Canada has a highly developed economy and is one of the most successful democracies in the world. Bordering the United States, Canada is rich in natural resources and has some of the largest oil reserves in the world.

This makes the oil industry special, as a large portion of its population works in the industry, both upstream and downstream. For this reason, the Canadian dollar is difficult to trade and interpret on a stand-alone basis, as it fluctuates based on the oil price movements.

In this article, we will have a look at the particularities of the Canadian dollar and the Canadian economy, as well as the factors that influence the currency’s volatility. It is impossible to successfully trade its currency without a proper understanding of the Canadian economy.

The Bank of Canada plays an important role as well. This central bank often surprises market participants by delivering rate hikes or cuts that are not priced in the market. We will, therefore, explain its role and insist on its response to the COVID-19 pandemic.

The currency trader should also be aware of the economic data that moves the Canadian dollar. Besides the classic economic indicators, one needs to interpret the changes in supply and demand in the oil industry, the price of oil’s evolution, but also the overall developments in the commodity markets. Also, jobs data, while extremely volatile for the currency, is released at the same time as the US jobs data, thus, it requires special attention.

For the currency trader, the Canadian dollar pairs are unique in the sense that they require less margin to trade when compared to other pairs. On the flip side, they have a larger spread, especially during illiquid market times.

Distinctive Features of the Canadian Economy

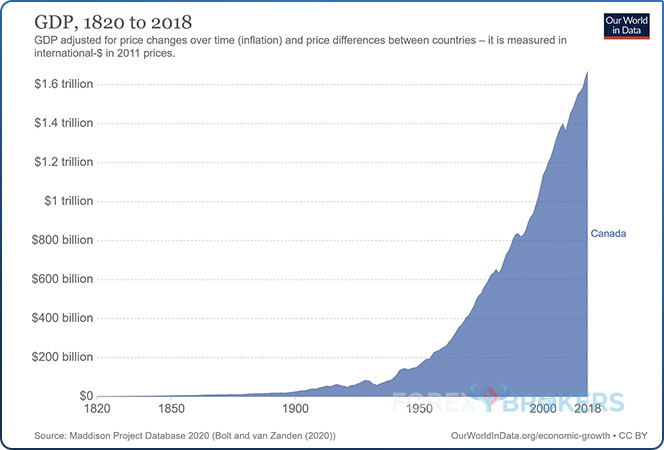

Canada has a relatively small population relative to the size of its land area. Only 37 million Canadians are responsible for the ninth-largest nominal GDP in the world.

The Canadian economy is a highly developed mixed economy, with about three-quarters of the population working in the services sector. However, it is not the services sector that is the most famous in Canada, but rather its natural resources.

The country is blessed with natural resources estimated at over $33 trillion in 2019. It is the world's fourth-largest petroleum and natural gas exporter and thus is considered an energy superpower.

While the services industry employs three-quarters of Canada’s population, other important industries are growing and expanding in the country. Relevant examples are chemicals, transportation, timber, paper products and fish. Also, besides oil and natural gas exploration, Canada is a leading producer of natural minerals such as aluminum, nickel, and gold.

Petroleum’s discovery over a century ago led to tectonic shifts in the global economy. Countries with no competitive products, such as many Middle Eastern countries, were suddenly flooded with revenues from oil production facilities.

The impact of oil exports on the Canadian economy is clearly seen in the chart above. It is not a coincidence that the GDP has increased exponentially since the discovery of Canada’s oil, as the country’s resources have contributed to its growing wealth.

The purpose of the image below is not to interpret the capacity utilization during the COVID-19 pandemic but to form a better picture of how the Canadian economy breaks down in sectors other than the services sector. As such, we see that oil and gas extraction, forestry and logging, mining, construction, food manufacturing, paper manufacturing, etc., make a large contribution to the Canadian GDP.

The Canadian Oil Industry

Any discussion about Canada and the Canadian dollar is incomplete without an analysis of the oil industry. Canada is the fourth-largest oil-exporting country in the world and the vast majority of its exports go to its southern neighbor – the United States.

For this reason, whenever the US crude oil inventories data is published, the Canadian dollar moves based on how the actual data compares to the forecast. Lower oil inventories in the United States suggest potentially higher demand for oil in the period ahead, thus increasing imports from Canada. Hence, the Canadian dollar will tend to appreciate on lower oil inventories and depreciate when oil inventories in the United States are rising.

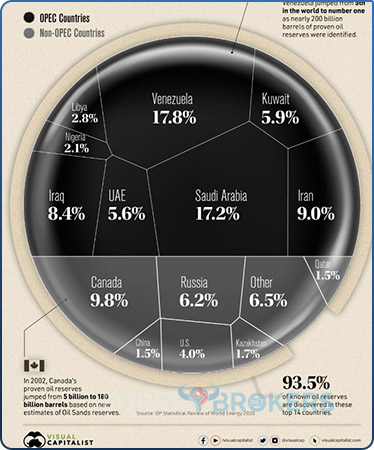

While Canada was known for having large oil reserves of about 5 billion barrels, the proven reserves number ballooned in 2002 with the oil sands discovery. The estimated oil sands reserves are nearly 175 billion barrels, propelling Canada to one of the top oil-rich countries. It now has official or proven oil reserves of about 10% of the world’s known oil.

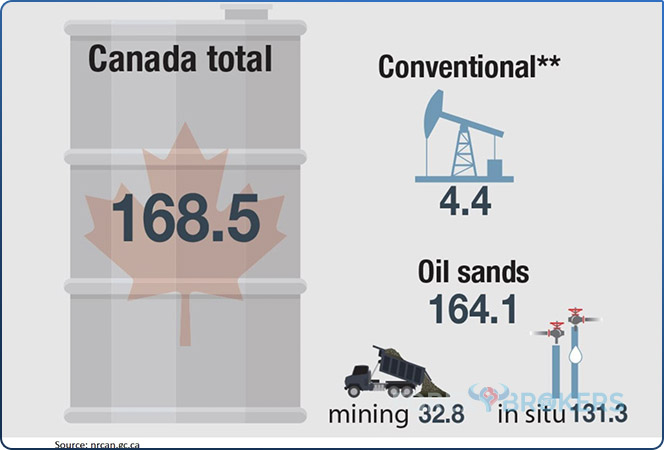

Below is a more accurate breakdown of the oil industry in Canada. Out of the total of 168.5 billion barrels, only 4.4 billion belong to the conventional reserves, while the rest belong to the oil sands.

Canadian Oil Sands – The Third-Largest Proven Oil Reserve in the World

Oil sands exploration is an important part of the Canadian economy. In 2019, oil sands accounted for 63% of Canada’s oil production, with investments of over $325 billion in the industry up to that year.

Challenges to the Canadian oil sands industry do exist. For instance, the industry is responsible for greenhouse gases – some 12% of all the gases produced in Canada result from oil sands exploration.

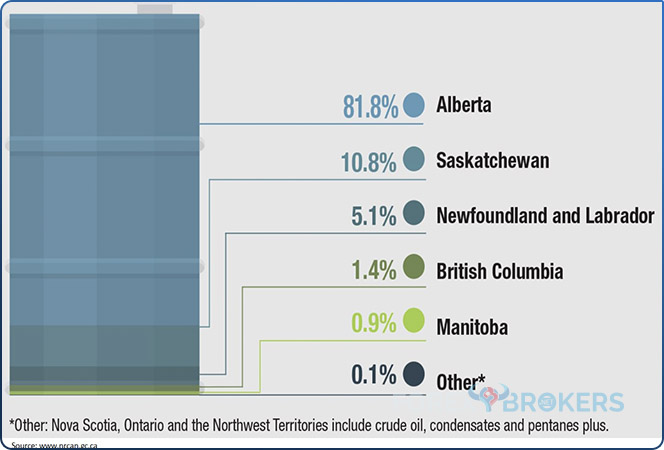

Alberta is the Canadian region with the most reserves, accounting for over 80% of them. In total, the area of oil sands resources exceeds 142,000 square kilometers, while the total Canadian land area is about 10,000,000 square kilometers.

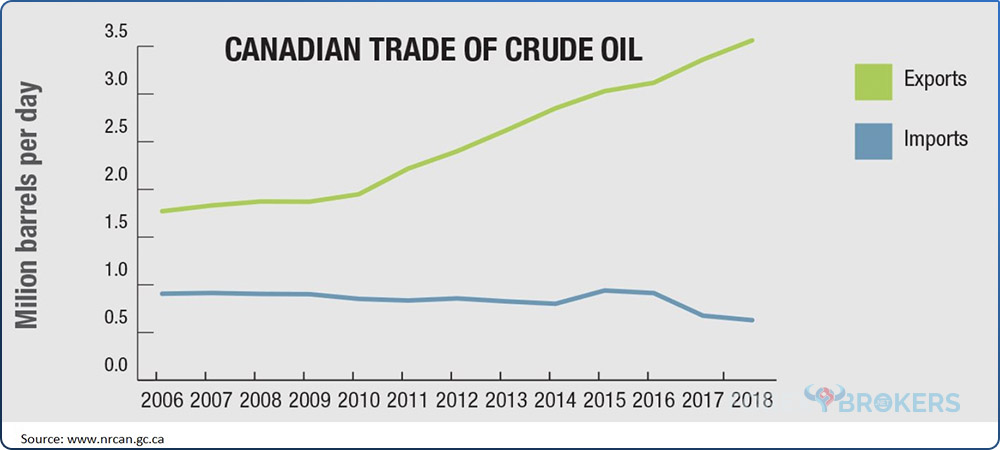

Canada is a net exporter of crude oil – it exports more than it imports. In 2019, it was the largest exporter of oil to the United States, with about 4 million barrels of oil per day crossing the border.

Once again, traders should never underestimate the influence of oil prices and industry on the Canadian dollar. Most recently, there has been a tendency to fight climate change and thus, oil may be used less in industries such as the global auto industry. Nevertheless, oil is a big part of the energy mix, and projections for the decades ahead show that it will remain dominant.

History of the Canadian Dollar

The Canadian dollar has pre-colonial origins. “Wampum” was Canada's first form of money, as described by the early Europeans in the mid-seventeenth century. A combination of small bones, shales or cockles served as money in that era.

Fast forward to the present day, and the Canadian dollar is the country’s official currency. It was introduced in 1858 and as of 1871, it had replaced the currencies of different Canadian provinces under one single Canadian dollar.

The picture above shows the various banknotes in circulation in Canada and abroad, and coins of 1, 5, 10, 25, and 50 cents exist too. Coins of 1 and 2 Canadian dollars circulate as well.

The currency trader might want to know that the Canadian dollar is also called a “loonie.” Often, traders refer to being bearish or bullish about the Canadian dollar when they want to sell or buy the loonie.

Loonies are aquatic birds, an image of which appears on the back of the 1 dollar coin. This led to it being quickly adopted as a nickname for the Canadian currency.

The Canadian Dollar’s Exchange Rate versus the US Dollar

The USDCAD currency pair is the most important of all the Canadian crosses. On the one hand, it reflects the differences between the 2 neighboring economies – the United States and Canada. On the other hand, it reflects the differences in the monetary policies run by the 2 central banks – the Federal Reserve of the United States and the Bank of Canada.

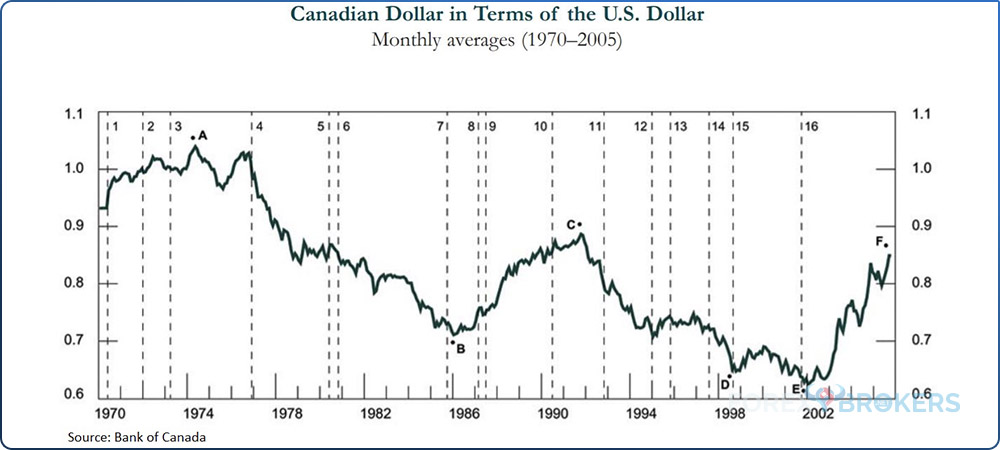

If we add to this the impact of the oil prices, we have the perfect picture of how complicated it is to trade the USDCAD pair. The chart below shows the Canadian dollar's performance against the US dollar since the 1970s when the Nixon shock led to the creation of the free-floating fiat currencies.

This is the inversed USDCAD chart, basically showing how much 1 Canadian dollar was worth in terms of 1 US dollar since the 1970s. It has sixteen vertical lines corresponding to various fundamental events in the history of the Canadian dollar and 5 dates, labeled with letters (A, B, C, D, E), that mark lows or highs during various cycles.

All-Time Canadian Dollar Low

The lowest value ever reached by the Canadian dollar against the US dollar was registered on the 21st of January 2002. At that time, one Canadian dollar was worth $0.6179 (marked with the letter E on the chart above).

For the first time in this article, we will make the connection between the price of oil and its impact on the Canadian dollar. At that time, at the start of 2002, the WTI crude oil price was around $20. It should be mentioned that there are many types of crude oil around the world, each trading at a different price. For this reason, the correct reference to oil price is to use plural and not singular.

The WTI crude oil price is the most popular of them all. The acronym WTI stands for West Texas Intermediate and is a benchmark for North American crudes. Basically, it is the reference price for light crude oil delivered at Cushing, Oklahoma, the United States – a pipeline hub. Therefore, the WTI price is more relevant for the Canadian dollar than other oil prices, such as the Brent or Maya prices. Also relevant are the Canadian Light Sweet and the Western Canada Select prices.

We see that when the USDCAD reached its highest point, and thus the Canadian dollar was at its lowest against the US dollar, the WTI crude oil price started a bullish trend. In less than a decade, the WTI crude oil price increased 7-fold, triggering one of the strongest trends seen in the currency market that decade.

Important Events That Shaped the Canadian Dollar’s History

All currencies from the developed economies were affected by what happened in the 1970s. In the case of the Canadian dollar, the 31st of May, 1970, marked the official date when it started to float.

Fast forward to March 1973, when the Bretton Woods system collapsed. Basically, the new financial order that held until today started in the early beginnings of the 1970s. At that point, the value of 1 Canadian dollar was roughly the same as that of 1 US dollar, which changed significantly over time. Only in 2008 did the 2 currencies trade again at parity.

Once again, all vertical lines on the chart showing the monthly averages of the Canadian dollar in terms of the US dollar between the 1970s and 2005 represent important events in the world financial markets. Here are some examples:

- September 1985 – the Plaza Accord marked a major bottom in the US dollar.

- October 1995 – the Quebec referendum.

- July 1997 – the Asian crisis.

- September 2001 – the terrorist attacks in the United States.

Bank of Canada and the Impact of Its Monetary Policy

The Bank of Canada (BOC) sets the monetary policy for the Canadian economy and its mandate centers around price stability. Price stability in Canada is viewed as ensuring that inflation is neither too low nor too high to stimulate economic growth while preserving purchasing power.

In Canada, the central bank has an inflation-controlled target framework. All central banks in the developed world have an inflation-targeting framework, but their targets differ from one central bank to another.

For example, the European Central Bank defines price stability as keeping inflation below but close to 2%. Or the Federal Reserve of the United States has used an Average Inflation Targeting (AIT) framework since 2020, one that replaced the previous 2% target. And so on.

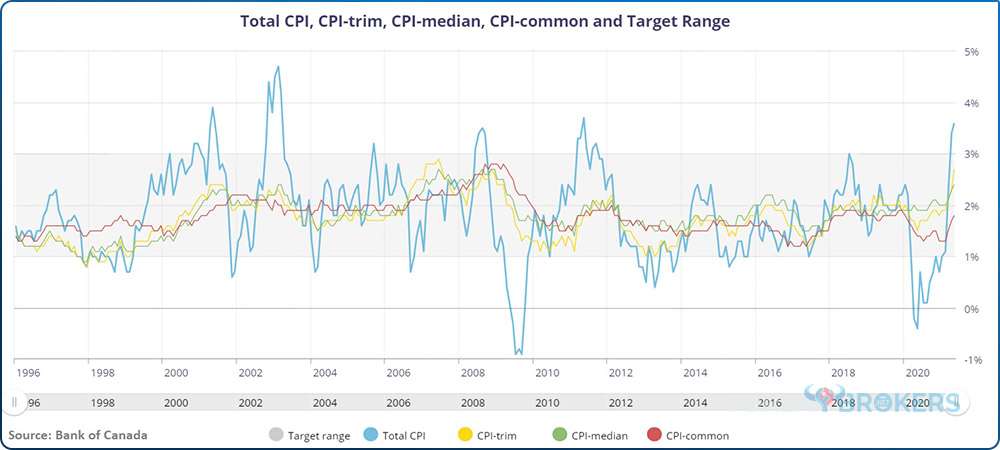

In Canada, price stability is defined as letting inflation fluctuate within a 1% to 3% target range. The range was first introduced in 1991 and ever since, it has guided the Bank of Canada's decisions and is the base for setting the monetary policy. The range, however, is reviewed every 5 years, and the next date that the Governing Council will re-assess it is in 2021.

The Bank of Canada sets its monetary policy 8 times a year, basically every 6 weeks. Every 2 meetings, the central bank also releases a Monetary Policy Report. Therefore, the interest rate decisions accompanied by a Monetary Policy Report generate more volatility in the Canadian dollar pairs than the other ones.

At the time of writing this article, the total CPI or total inflation in Canada rose beyond the upward band of the Bank of Canada’s inflation range. Effectively, it means that the central bank will start removing some or all of the stimulus delivered during the COVID-19 pandemic and maybe even start normalizing policy by starting a new tightening cycle.

Bank of Canada’s Monetary Policy During the COVID-19 Pandemic

The Bank of Canada meets every 6 weeks on a Wednesday. However, in challenging times, it may communicate its decisions at other times, depending on the urgency.

For example, the COVID-19 pandemic led to all the world's economies falling into outright recessions. Economies literally have shut down.

Therefore, central banks have cut interest rates to their lowest boundary. In some cases, the lower boundary is in negative territory, such as in the euro area and Switzerland. In some other cases, the lower boundary is close to zero, such as in the United States and Canada.

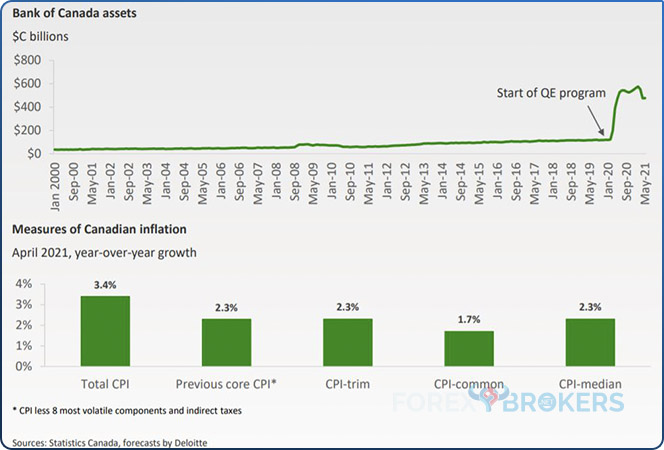

After interest rates were cut to their lowest possible level, central banks engaged in unconventional measures. More precisely, they started various programs designed to ease the monetary policy further.

The most popular of them all is quantitative easing, a program where the central bank buys its own government bonds in order to increase the money supply and credit availability in the economy.

Despite inflation being above the upper limit of the CPI range, the Bank of Canada continues its quantitative easing program. However, it has signaled its tapering and is also confident that inflation will return to 2% in the next 2 months.

Interest rates in the developed world tend to move together. As the chart below shows, there was a tight correlation between interest rates in Canada, the United Kingdom and the United States in the last century.

However, the Bank of Canada remains one of the most unpredictable central banks in the world. It has often taken market participants by surprise, thus generating increased volatility in the Canadian dollar pairs.

Economic Data and Events That Impact the Canadian Dollar

The following part of this article will focus on the economic data that influences the Canadian dollar, other than the Bank of Canada's monetary policy decision. Throughout the trading month, various economic releases reveal the evolution of the Canadian economy, thus influencing the probability that the Bank of Canada might react at its next meeting. Data and events from the oil industry must be considered, too.

Here is a list of what data and events matter the most for the Canadian dollar, presented in random order:

- Building permits

- Trade balance

- Bank of Canada Business Outlook Survey

- Housing starts

- Ivey PMI

- Crude oil inventories

- Employment change and the unemployment rate

- Consumer Price Index

- Retail sales

- Gross domestic product

Building Permits

The Building Permits data in Canada (and usually in other countries as well) is released every month. It shows the change in the total value of new building permits issued over a period and it is among the most important second-tier economic data.

The economic calendar signals economic data as being important when the release is marked in red or written in bold characters. This is not the case for Building Permits, and yet it is a leading indicator because of the future implications for the construction industry and economic developments.

This economic data is released about thirty-five days after the month ends and offers an educated guess about future construction activity.

Trade Balance

The Trade Balance data shows the difference between exports and imports over a period, typically 1 month. If exports exceed imports, there is a surplus.

On the contrary, when imports exceed exports, there is a deficit. Thus, a positive number for the Trade Balance means that Canada’s exports are greater than the imports for the month.

An interesting take here is that roughly 75% of Canadian exports are purchased by the United States, so the Trade Balance data tends to impact the USDCAD exchange rate. The Trade Balance data is a monthly release and comes out about thirty-five days after the end of the month.

Bank of Canada Business Outlook Survey

This is a survey that should be on top of the list of Canadian dollar traders. The survey takes place 4 times a year when the regional offices of the Bank of Canada interview business leaders from about a hundred Canadian companies.

Based on the responses, the Bank of Canada builds and releases the business outlook. The survey serves to guide the central bank in setting its monetary policy, thus, it has a strong impact on the exchange rate. The Bank of Canada Business Outlook Survey is a leading indicator of economic health and investors scrutinize it for clues to what the central bank will do at the next meeting.

Housing Starts

Another economic indicator from the housing sector, Housing Starts, shows the number of residential buildings that began construction during the month. Interpreted in conjunction with the Building Permits release, the Housing Starts indicator offers further details about the state of the housing sector in Canada.

Just like the Building Permits indicator, Housing Starts is a leading indicator of economic health. The bigger the number, the more positive the implications for the Canadian economy. Also, the bigger the difference between the actual and the forecast data, the stronger the impact on the Canadian currency.

This indicator is presented annually, in the sense that the monthly data is multiplied by twelve to arrive at the annualized one. Housings Starts is released about 9 days after the month ends.

Ivey Purchasing Managers Indices PMI

The Purchasing Managers Indices, or the PMIs, are calculated for every economy in the world. Depending on the size of the economy and its importance for global growth, some PMIs are more important than others.

Typically, the PMIs are broken down into multiple releases for different sectors. As such, in many countries, the PMI is released separately for the services, manufacturing, or even construction sectors.

But in Canada, one single PMI comprises all the sectors. The report is compiled by the Ivey Business School, hence its name – the Ivey PMI. It has predictive power in forecasting Canadian macroeconomic activity and is a survey of about 175 purchasing managers. The report comes out every month, about 5 days after the month ends.

Crude Oil Inventories

The Crude Oil Inventories release is a weekly report showing the fluctuations in oil inventories in the United States. While the data refers to the United States, it impacts the Canadian currency due to the large Canadian oil exports.

A rise in the crude oil inventories in the United States typically leads to a decline in the Canadian dollar for the simple reason that the market participants assume that the economic activity in America is slowing down and thus won’t import that much oil anymore.

Employment Change and Unemployment Rate

The 2 releases are part of the Canadian monthly labor reports and are often very difficult to interpret. The jobs data in Canada is always released on a Friday – just like the Non-Farm Payrolls and the unemployment rate in the United States.

For traders, the problem arises when the jobs data from both Canada and the United States is released on the same Friday. When that happens, which is often, the timings coincide as well. Hence, trading the USDCAD on a day when both reports are due is very difficult due to the confusing signals.

Consumer Price Index CPI

The Consumer Price Index, or simply the CPI, is a measure of inflation. Because the Bank of Canada has a mandate focused on price stability, inflation is the key metric that determines the changes in the interest rate.

The CPI in Canada is released monthly, about twenty days after the month ends. It shows the changes in the prices of goods and services of the month, and Canada has different versions. For example, the Trimmed CPI excludes the most volatile 40% of items.

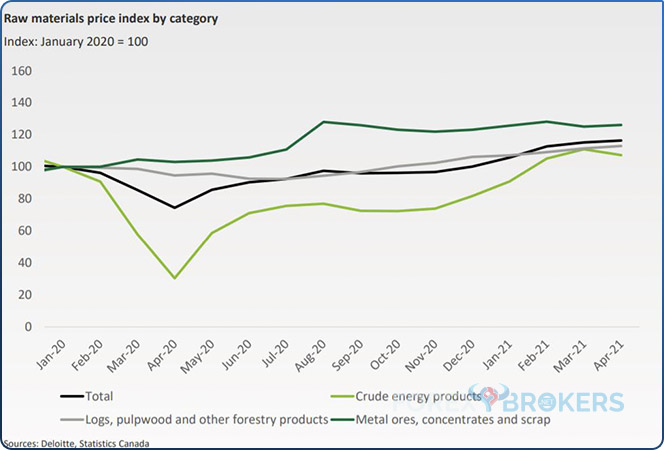

The chart below shows that commodity prices play a crucial role in inflation. The COVID-19 pandemic triggered a bullish move in commodity prices, led by energy prices. Eventually, the CPI increased worldwide, so inflation came close to, or even exceeded, the central banks’ targets.

Retail Sales

The Retail Sales indicator reflects the state of the Canadian consumer. The consumer is the engine of every developed economy and consumer spending is an indicator of economic health.

For example, a consumer who postpones spending due to falling prices triggers a deflationary spiral that the central bank wants to avoid by all means. Hence, Canadian dollar traders monitor the Retail Sales indicator closely to anticipate the Bank of Canada’s decisions.

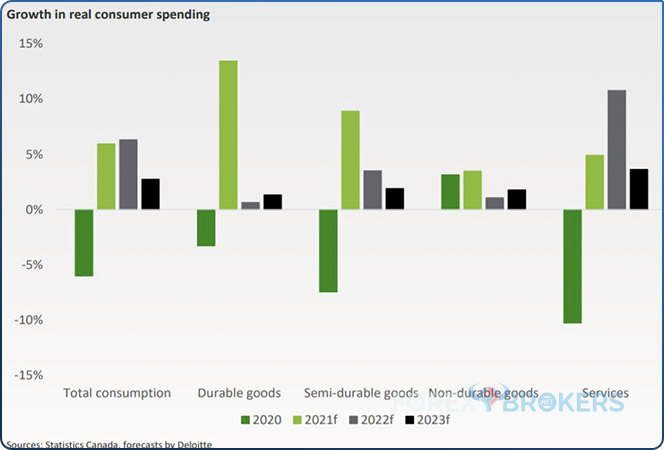

The Retail Sales data comes out every month and the more the number deviates from the forecast, the better for the Canadian dollar. Thus, traders monitor changes in the growth in real consumer spending in order to anticipate future economic growth trends.

Gross Domestic Product GDP

The Gross Domestic Product, or the GDP, reflects the value of all Canadian goods and services produced in a month. Changes in the GDP have a strong impact on the currency market, but they tend to be anticipated by market participants.

Therefore, there seems to be a stronger impact of GDP revisions and forward guidance by the Bank of Canada in terms of future GDP growth.

The Canadian Dollar and the Price of Oil – A Direct Correlation

This article would be incomplete without an example of how the oil price affects the Canadian dollar's value. Sometimes, oil price changes are the only thing worth watching, as the market participants often ignore the rest of the Canadian economic data.

Crude oil prices made history in 2020. The pandemic triggered economic lockdowns all over the world, and so the oil demand declined significantly. Moreover, it declined so quickly that the market participants did not have time to adjust – nor did the price.

Oil trades on futures exchanges and, for the first time ever, the price of oil was allowed to settle in negative territory in April 2020. It ended the trading day close to -$40, even though not all trading charts and platforms reflect that move.

But once it bounced, it never looked back. Today, more than 1 year after the price of oil fell below zero, it is trading comfortably above $70. It bounced back strongly on the back of effective vaccines against COVID-19 and the reopening of economic activity.

How did the Canadian dollar react to the changes in the price of oil?

The direct correlation between the Canadian currency and the price of oil is reflected in the chart above. Effectively, this is one of the strongest trends that formed during the pandemic, as the USDCAD pair kept forming a new lower low followed by a new lower high – typical series in a bearish trend.

Naturally, the Bank of Canada’s decisions and the economic data out of Canada over the last year have impacted the Canadian currency. But one cannot ignore the impact of the crude oil price as the key driver in the value of the Canadian dollar.

Tips to Consider When Trading the Canadian Dollar

The Canadian currency pairs do not require that much margin in most brokerage houses. Because of that, traders prefer them to the detriment of other pairs, such as the British pound pairs.

One thing to consider when trading the Canadian dollar is the relative illiquidity of most Canadian pairs. The most-traded one, and thus with decent levels of liquidity, is the USDCAD. But even the USDCAD has been widespread during illiquid times. For example, when the positions are about to be rolled over to the next trading day, the USDCAD spreads increase in most brokerage houses.

This is important because trading with a tight stop-loss is not recommended. But if the trader follows a scalping strategy based on tight stops, that strategy will not perform when used on Canadian dollar pairs.

Sharp moves in the Canadian dollar often accompany the Bank of Canada’s announcements. The market participants are well aware of the fact that the Bank of Canada likes to surprise the market from time to time, and it is not shy about changing the monetary policy in unexpected ways. In other words, slippage tends to be larger when actively trading Canadian dollar pairs during the Bank of Canada’s decisions.

Conclusion

The Canadian economy is one of the most advanced in the world. It is diverse enough to keep growing and the country is rich in mineral resources. Human capital, mineral resources, and democracy have led to Canada having one of the highest standards of living in the world.

The Canadian economy is energy-intensive because of the oil industry's crucial role in the country's GDP. Oil production and exports account for much of the GDP and, thus, for the wealth of the country's citizens.

Canada borders the United States and most of its exports are destined for the United States. Therefore, the 2 economies should be interpreted together when trading the Canadian dollar pairs. For example, if the United States enters a recession, it will have negative spillover effects on its main trading partners. Alternatively, it will have positive effects on a strong economic recovery.

Oil and the Canadian dollar have a direct correlation. Rarely has the Canadian dollar moved in a divergent way from the oil price. When it did so, it resulted from the monetary policy of the central bank, the Bank of Canada.

The loonie dollar is viewed by traders as a commodity currency, just like the Australian dollar. Thus, a change in commodity prices has a strong impact on the value of the Canadian dollar.

To sum up, when trading the Canadian dollar, think of the price of oil, the Bank of Canada’s decisions, the state of the United States economy, the evolution of the Canadian economy, and the changes in the price of commodities.

But above all, think of the price of oil as the main driver for the Canadian economy and its currency.