If there is one commodity that has shaped the world as we know it, it is oil. Although oil has been known about for millennia, it has played a crucial role in modern society since the mid-1850s/beginning of the 1900s.

In less than a century, oil changed the shape of the world. Anywhere you look – automobiles, planes, clothing, infrastructure, petrochemicals – major industries were shaped by the global use of oil and oil-related products.

As a commodity, oil is the subject of a great deal of speculation in the financial markets. Throughout history, the price of oil has exceeded $100, but it has also printed negative values, as we learned in the 2020 global coronavirus crisis.

Like most commodities, oil trades on futures exchanges with clear rules and regulations. In the long history of the derivatives market, there was never a clearinghouse to miss payments to its clients. The 2020 drop of the WTI May futures contract below zero is a historical development in the commodities market. It comes as no surprise that it happened on the oil market, because of its implications for the overall global economy and modern economics.

The price of oil is a key driver for some currencies in the Forex market. Currencies belonging to oil-producing countries have a strong correlation with the price of oil.

Another important aspect regarding oil is its pivotal role in the way central banks set their monetary policy. For the currency market, it is all about what central banks do with interest rates. Because inflation is part of every central bank's mandate and oil is a key driver of inflation, central banks ultimately consider the price of oil in any of their economic forecasts. This article aims at building a complete understanding of the oil market, centered around currency trading and the financial world.

History of Oil

The new oil economy can be traced back to the Spindletop discovery in Texas in 1901. Colonel Drake discovered oil in Pennsylvania in 1859, much earlier than the Spindletop field in Texas, but it was only at the start of the new century that the production of oil increased due to its being a cheap alternative to coal oil and whale oil for fueling lamps.

Oil quickly became the preferred energy source. By 1919, the automobile industry and electricity had changed the oil market forever.

Oil proved to be a great asset during World War I as it fueled military planes, trucks, and ships, so world powers at that time strived to get their hands on as many reserves as possible.

Oil is responsible for creating some of the richest families in the world (e.g., the Rockefellers), and also for the appearance of one of the most iconic US corporations of all times – Standard Oil.

The oil fever that began in the United States quickly spread all over the world. Most of the 20th century saw the oil industry dominated by gigantic corporations that controlled the way oil was produced, moved, and sold – Standard Oil, Royal Dutch Shell, British Petroleum, Occidental, Texaco, and Chevron, to name a few.

But one of the most interesting developments in the oil industry appeared when oil was discovered in the Middle East. Due to the quick spread of oil products in all areas of our everyday lives, it was clear that the new, vast reserves discovered in the Middle East would change the world’s balance of power.

What followed in the region was nothing short of a miracle.

The Rise of the Middle East

During the 1930s, major oil producers were involved in prospecting the possible oil reserves in the Middle East. Libya, Saudi Arabia, and Kuwait were among the countries where most of the investment went – and it paid off.

From the moment oil was discovered in the Middle East, the region changed dramatically, becoming the largest oil producer in the world. As it turned out, the massive sand dunes hid impressive oil reserves, and suddenly the local governments had a source of revenue they had never dreamed of.

In time, the role of the region changed significantly. Today, the Middle East is a prosperous part of the world, with rich nations (e.g., United Arab Emirates, Kuwait, Qatar, Bahrain, Saudi Arabia) that built their wealth on the back of oil production.

In the 1960s, Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela formed a cartel called OPEC (Organization of the Petroleum Exporting Countries). Only Venezuela was not from the Middle East region, but its presence as one of the founding nations of OPEC should not surprise anyone due to the vast oil reserves it still has to this day.

The idea behind OPEC's formation was to have stronger negotiating power against the big oil companies when it came to future concessions rights, the price of oil, and other matters regarding oil production (e.g., production levels).

As the importance of oil quickly expanded globally, so did OPEC's influence. It accepted new members and today is viewed as one of the most influential worldwide organizations capable of influencing supply and demand and, thus, the price of oil. It became so important on the global stage that simple membership gives a country instant credibility on the oil market – an important asset to attract investors in domestic oil production.

The Petrodollar

The 1970s brought a spectacular macro-event that changed the entire financial system at the time. After decades of having the US dollar, the world’s reserve currency, pegged to the price of gold, the United States announced that it would no longer fix the value of the dollar to the value of gold. In other words, the gold standard, common in many economies around the world at that time, was scrapped by the one nation that was not affected by World War II – but which was struggling to finance its own war in Vietnam.

As it turned out, the move set the start of a new market – the free-floating currencies market, also known today as the foreign exchange market, or Forex. Nowadays, it makes sense to talk about monetary policy, sovereign currencies, free-floating exchange rates – but back in those days, the United States’ move sparked a lot of tensions.

No one knew what to do – to trust the USD (after all, just fiat money if not backed by gold) or not? What the world would soon find out was that the so-called Kissinger deal, named after Henry Kissinger, arranged for all Saudi Arabian oil to be sold in USD. Moreover, excess amounts should be used to buy US dollar denominated debt (e.g. treasuries) – all these in excess of military protection in the region.

The move was quickly embraced by other Middle East countries, and the USD gained in credibility while the United States found a way to finance its own debt. The so-called petrodollar is responsible for much of the United States’ economic expansion and dominance in the world to this day.

In other words, dollars from oil sales are used for investment in the United States, thus creating growth in a non-inflationary way – a privilege other countries do not have and one of the advantages of having the world’s reserve currency status.

However, economists cannot agree if the world's reserve currency status is ultimately a blessing or a curse from an economic point of view.

Oil as a Commodity

Oil is a commodity. Like most commodities, oil is traded on the futures market, with clear rules regarding delivery, terms of the contract, daily price settlement, and so on.

But oil is more than a regular commodity. To understand this fully, imagine that financial markets include gold, silver, corn, and wheat in the same category – commodities. However, none of the other commodities have such a strong influence on the world as oil does.

Yes, one could argue that corn feeds people, and, as such, it exceeds the benefits of oil or petroleum. Or, that gold served its purpose through the millennia as it protected household savings. All of these are true.

However, no commodity changed the world as oil did. Moreover, no commodity changed the world as fast as oil did. If we think of the fact that only a century ago humankind figured out its importance, everything else pales in comparison.

At the start of the 1880s, humankind had no automobiles, planes, machines of all types, roads, etc. – all of which are derived from oil. The funny thing is that, when thinking of oil or petrol, most people associate it with the gasoline they use to fill up their cars.

But that is only one (small) part of what a barrel of oil is responsible for. A single barrel of oil is enough for asphalt to make about one gallon of tar, almost 70 kw hours of electricity, enough liquified gas to fill twelve cylinders for camping use, enough gasoline for a medium-sized car to drive more than 280 miles, about four pounds of charcoal briquettes, lubricants for motor oil, wax for candles, with plenty of petrochemicals left over to provide the base for producing 39 polyester shirts, 69 plastic drinking cups, and many other plastic-derived products.

Again – all those listed above are derived from a single barrel of oil! Perhaps it is now clearer why oil is considered the ultimate resource the Earth provides, and all other commodities pale in comparison with its influence on the way people live today.

Different Types of Oil

When talking about oil, investors refer to crude oil, and typically to one particular type of oil – WTI – West Texas Intermediate. This is a high-quality crude oil from the United States, highly valued due to the fact that more gasoline can be refined from it when compared to other types of oil available on the market.

Also called “sweet crude oil,” its nickname comes from the fact that it is lighter than water, with an API gravity of 39.6 degrees. Location is important as well because most of it is refined in the United States, the largest gasoline-consuming country in the world.

But WTI crude oil is not the only type of oil that exists. Brent oil, also called Brent blend, is a combination of different types of oil from the North Sea. Brent oil is also a sweet crude oil, but not as light as WTI. Financial markets price it differently, with many differences on the futures price market between the WTI price and the Brent oil price.

Besides WTI and Brent oil, there is yet another type of crude oil – the OPEC basket. Part of this basket is crude oil from Venezuela, Nigeria, the United Arab Emirates, and Saudi Arabia, among others. When compared with WTI and Brent oil, OPEC oil has a much higher percentage of sulfur. Because of that, the OPEC basket oil is not as light as WTI and Brent, and therefore its price is always lower than the other two. In the end, it is all about quality. But OPEC basket oil has another quality – it is viewed as a major market player because OPEC’s decisions to increase or decrease the quantity of its output affect the worldwide supply and demand for oil-related products.

Understanding the Futures Market

The futures market is a derivatives market where most commodities are traded. Unlike forwards, which are derivatives as well, futures trade on regulated exchanges, with clear rules regarding transparency of transactions and, more importantly, their safety.

Oil is traded in contracts, with two parties, the buyer and the seller, agreeing to enter the futures contract, and a clearinghouse sets a daily settlement price. Depending on how the price of oil moves, the long part makes a profit if oil is rising, while the short side books a loss. The clearinghouse makes sure that all positions are settled at the end of the trading day, with the profit credited to the winner and the loss to the loser. This happens daily until the contract expires.

It is especially important to understand the futures market and the implications for the price of oil because crude oil is a commodity like no other. For instance, it is overly complicated to shut down oil production just because the price of an oil contract with various expiration declines more than predicted.

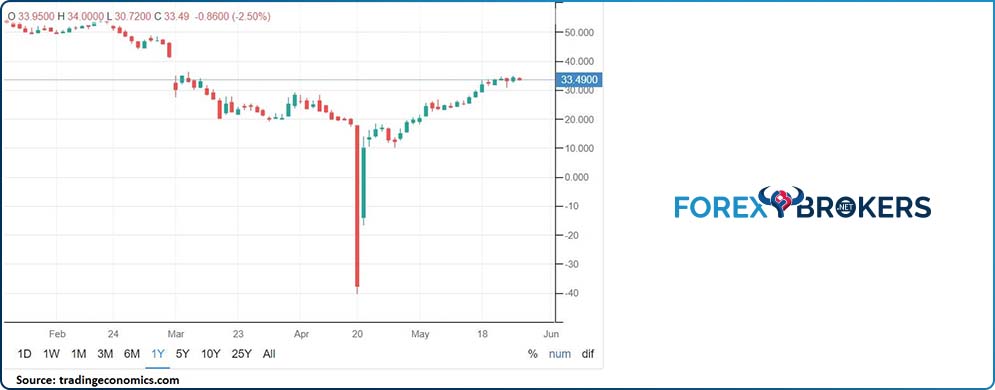

Also, because oil is traded on the futures market and not on a cash market, it is possible to see events like those in April 2020, when the price of oil turned negative. How can it be that a commodity has a negative price?

Negative Oil Prices Becoming a Reality During the Coronavirus Pandemic

April 2020 will remain in history as the first time the price of WTI oil settled into negative territory. The contracts were due to expire in May, but all of a sudden there were no interested buyers because the delivery date was approaching. As most oil contracts settle in cash and not for physical delivery, producers had a big problem finding storage for the oil they had produced and could not find buyers for.

The pandemic created a sudden stop in demand, as most of the industries were in lockdown – the aviation industry kept planes on the ground, people were in lockdown mode (hence no gasoline consumption), and most manufacturing stopped as well. As such, oil demand decreased sharply, and producers were forced to store their output.

As the price of the WTI May 2020 contract kept falling towards the zero level, many traders wondered if it could go below the zero level. The clearinghouse, CME, quickly stated that it would allow negative oil prices, and that was the moment when WTI collapsed. It closed the day at -$37, an unprecedented level, and a value that will remain in the history of the oil market.

Effectively, it meant that producers found it cheaper to pay buyers to take the oil than to shut down or slow down production. Just like in the aftermath of the 2008-2009 financial crisis when we saw negative interest rates in many developed countries, the coronavirus crisis created a precedent in the oil market – negative futures prices.

Oil and Inflation

For traders, this is the most important part of this article. Oil, or the price of it, has a big influence on inflation – it creates upward pressure when the price of oil rises, and downward pressure when it falls.

Perhaps this is a great time to revisit the article dedicated to different inflation types – deflation, disinflation, hyperinflation. It helps to understand the logic behind changes in prices.

In general, inflation refers to changes in the price of goods or services over a certain period. If the prices rise, it is said that inflation rises too. If they fall, inflation falls.

When inflation rises too fast, or when too much money chases fewer goods, hyperinflation appears. As a consequence, money quickly loses its value.

If inflation falls but remains positive, it is said that disinflation appears. For as long as inflation does not turn negative, the process remains disinflationary. By the time inflation turns negative, it is said that deflation appears.

Deflation is a huge problem for central banks. In fact, it is a much bigger problem to tackle than inflation or disinflation, because it increases the real debt levels, consumer spending grows painfully slowly, and prices continue to decline as consumers delay purchases.

Oil plays a major role in all these changes in inflation. Consider the price of oil at $100. Suddenly, it will cost more to travel by plane or by car, and to ship goods from one part of the world to another. In general, higher oil prices affect all aspects of our lives, as explained earlier in this article. Naturally, the prices of goods and services in general will rise, creating positive inflation.

The opposite is true when the price of oil falls – depending on how much it falls and how much was priced in by the market and policymakers, lower oil prices create disinflation. Worse, extremely low oil prices (negative oil prices?) can easily send developed economies in deflationary territory.

Central Banks’ Mandate

Because most central banks in the developed world have an inflation-targeting approach when running their monetary policy, the interest rates change based on how inflation evolves – higher or lower. Oil, therefore, directly influences the interest rates in an economy, creating volatility in the currency market and other financial markets as well.

The convention among central banks that use an inflation-targeting approach is that for sustainable growth, the 2% inflation target is appropriate. It is considered far enough from the zero level that any possible decline would not create a deflationary spiral, and low enough from the danger of having rampant inflation.

Therefore, the 2% inflation target well serves central banks that have price stability in their mandate. The European Central Bank (ECB), the Bank of England (BOE), the Reserve Bank of New Zealand (RBNZ), etc., are just some of the major central banks targeting inflation below, but close to, two percent. The United States Fed, while having a dual mandate, still considers inflation as key to the price stability part of its mandate.

Earlier in this article it was mentioned that the price of oil dropped into negative territory as a result of the coronavirus pandemic. The strong connection between supply and demand means that the lack of demand for oil comes from a lack of demand for goods and services on consumers’ part.

This becomes a vicious circle, because businesses are forced to cut new orders and lay off employees. Furthermore, to sell inventory and in the hope of attracting new clients, businesses will lower prices.

Declining prices and lack of consumer demand lead to deflation – a phenomenon amplified by lower oil prices. As such, central banks intervene by easing the monetary policy, and governments also often react by loosening the fiscal stance.

The Price of Oil and Its Influence on the Currency Market

By now, you should have an idea about how the price of oil influences the currency market. Because it dictates changes in inflation, it causes changes in interest rate levels and overall monetary policy. Or, for the currency market, interest rates are the main volatility driver.

As oil is a global commodity, a rise in the oil price affects all countries, albeit to various degrees. When faced with strong trends in the price of oil, traders and investors often position in advance of the central banks’ reaction in adapting the monetary policy.

After all, trading the currency market is a game of expectations, as the current price often incorporates all the available information. If the notion of market efficiency is ever tested in terms of how fast the market incorporates all the available information, the currency market is the place to test the theory.

Sharp declines in the price of oil send commodity currencies lower because of the direct correlation between the two asset classes. In contrast, a steady rise in the price of oil sends commodity currencies higher, as oil-producing nations earn more by selling more expensive oil products.

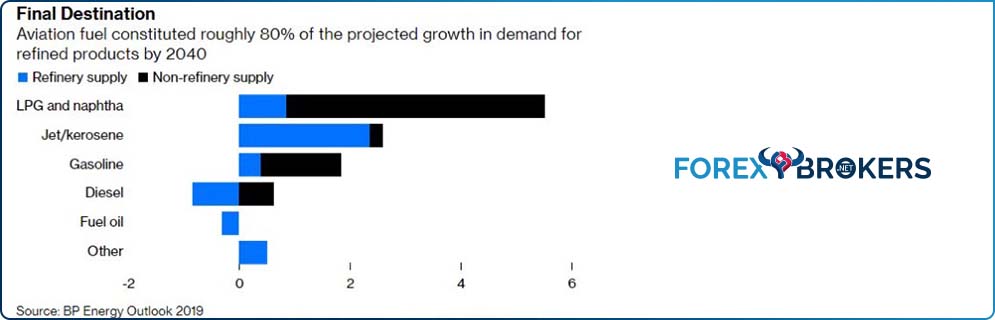

Talking about products derived from oil, this article already covered what a barrel of oil is responsible for. The image below shows the final destination of oil-derived products from an industry point of view.

By 2040, the aviation fuel industry will represent about 80% of the projected growth, with diesel products declining, as well as fuel oil. This shows that, despite the concern of many that electric cars will take over the world, the demand for oil will remain intact moving forward, and there are plenty of resources available to tackle.

Oil and the Canadian Dollar

Canada is a major oil producer – and a developed economy. A vast proportion of its exports are oil-related products, and most of them go to the United States. Therefore, the values of both the Canadian dollar (CAD) and, to a lesser extent, the USD, are influenced by oil market fluctuations.

The Canadian dollar closely follows the price of oil in the international markets. For example, when the WTI futures contract dipped below zero in April 2020, a similar bearish move happened on the CAD pairs on the Forex market. The USDCAD, for example, rose dramatically, a move suggesting a correlation between the CAD and oil. This is just an example that illustrates the direct correlation between the two and why the CAD is considered a commodity currency.

Other currencies of oil-producing countries have a similar relationship with the price of oil. For instance, the Mexican peso and the Russian ruble. But even here, one cannot compare USDCAD volatility and market reaction to the changes in the oil price to the Mexican and Russian currencies, for the simple reason that Canada is a developed economy and the other two are not.

In other words, the exchange rate also reflects the overall economic stance and grading, besides direct or indirect correlations with other financial markets.

What News to Consider When Trading Oil

The price of oil fluctuates on regular supply and demand news. When trading commodities, understanding the supply/demand balance is key.

For a currency trader, it is important to always know what the price of oil is. Even if not trading the market, sharp moves in the price of oil trigger correlated moves in all financial markets.

The oil market moves not just on changes in production levels. Other factors, likes the lack of storage space or the discovery of new reserves, may send the price higher or lower.

Moreover, sometimes the supply and demand ratio does not even matter for the price of oil to rise or fall. As the coronavirus shock revealed, when economic activity shrinks, the demand for oil and oil-related products shrinks too, sending the price of oil lower. Conversely, when economic activity picks up, demand for oil picks up too, and this tends to send prices higher.

China, as one of the fastest-growing economies in the world, is used as a bellwether for oil demand and consumption. As long as it continues to grow, the demand for oil will remain constant. Also, India and other Asian economies become more energy-dependent as they grow, so economic global trends also influence the price of oil.

The appearance of new technologies also influences the price of oil. Fracking is one example that revolutionized the American oil industry. Because of the relatively higher production costs (due to both labor and geographical conditions), the American oil industry has lost its influence over the years. However, after fracking was discovered, the so-called shale oil industry exploded in the sense that this new technological breakthrough lowered production costs dramatically. As such, the United States became a net oil exporter in 2019 for the first time in decades.

US Oil Inventories – EIA

The United States US crude oil inventories is a weekly report that shows the changes in the oil stored in America. The data, overlooked by currency traders, is closely watched by oil traders for various reasons.

First, a decline in inventories suggests a pickup in economic activity and implies that more oil is needed. As such, the immediate impact is that the price of oil will rise, and the commodity currencies will rise too (e.g., the Canadian dollar). Conversely, a rise in inventories will have the opposite effect – causing a decline in the price of oil followed by a decline in the commodity currencies too.

Baker Hughes Rig Count

Baker Hughes counts the number of oil rigs in the United States and internationally. The report is closely watched because a decline in the number of producing rigs implies lower demand for oil – hence it is bearish for the price of oil and commodity currencies. On the other hand, when the number of rigs increases, it shows demand picking up, and the price of oil will begin rising, followed closely by the commodity currencies.

A particularly important use of the Baker Hughes count comes from interpreting the regional differences between oil-producing countries. Considering that many oil-producing countries subsidize the oil industry, the number of producing rigs may be artificially kept up, despite a decline in oil demand. As such, traders focus most on what happens with the rigs in the United States, more precisely in the Permian Basin.

OPEC Meetings

OPEC and, nowadays, its allies are responsible for changes in oil supply and demand levels. Various deals across nations regarding oil production output make oil an economic “weapon” often used and deployed to punish other states.

For example, at the start of 2020, Russia and Saudi Arabia did not agree to cut production levels; this news, coming out on a Saturday, created a gap lower in the price of oil on the next Monday. The impact on the financial markets and the oil industry was huge, as the lower oil price that followed sent many shale oil producers in the United States into bankruptcy.

OPEC meetings take place regularly in Vienna, Austria, and the decisions there are closely watched by market participants. For currency traders, whenever an OPEC meeting is due, the CAD pairs are the ones that react the most to the decision, often disregarding any other economic news from Canada.

Conclusion

Oil is more than a commodity. Gold is a store of value and has multiple industrial applications. The same is true for silver. Other commodities serve various purposes, like providing food for global populations. But none have changed the way we live like oil has and continues to do.

International travel as we know it today would not be possible without oil. Technological advances in all industries would not be possible either. For instance, the petrochemical industry expanded so much in the last decades that it is responsible for much of the societal transformation we have witnessed.

The shale oil industry is another example of how humankind gets oil out of the ground. It revolutionized the industry because it revealed a cheaper way to extract oil, allowing the United States to compete again with the Russian and Saudi oil industries, both of which are massively subsidized by their local governments.

Above all, oil is responsible for civilization advances. Think of how the world looked a couple of hundred years ago, compared to how it looks now. From horse carriages to fancy automobiles, from no planes to various flying vehicles, from whale oil lamps to electricity – all these changes are due to the discovery and use of oil. An important point to remember is that these are just a few examples of oil’s impact on the way we live today.

For currency traders, the tight relationship between the price of oil and inflation dictates the positioning over the medium and long term. Because most central banks follow an inflation-targeting approach, they use inflation expectations two years from now to set the present monetary policy. This way, the transmission mechanism allows for the changes in monetary policy to make their way into the real economy.

When the price of oil changes today, it influences inflation expectations two years from now. And that changes everything for a currency trader with a medium and long-term horizon for its investments.