Overview of This Plus500 Forex Review

As we go into detail about each service that forex Plus500 provides, you will determine if this broker is a good fit for your trading style or your investing preferences. We will cover the areas that are essential to an investor. How is your deposit protected, and to what level? What are the bonus conditions, spread range, trading platforms quality, etc.? Finally, we will give a verdict after using the broker's services, coupled with deep research and testing.

Review of Plus500.com Regulation

Contract for difference (CFD) trading offered through the plus500.com web platform is managed by Plus500CY Ltd from Cyprus, regulated by the Cyprus Securities and Exchange Commission (CySEC). Several other subsidiaries are regulated by different authorities, namely, the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, the Financial Sector Conduct Authority (FSCA) in South Africa, and the Monetary Authority in Singapore. Client funds are segregated in line with CySEC guidelines. Plus500 is a market-maker type broker and uses hedging methods to offset positions.

Finally, Plus500 has a fund compensation program under the Investor Compensation Fund (ICF) governed by CySEC. Additional details can be found in the provided legal documents. A comprehensive discussion on ICF is also presented in this review.

- UK's FCA (Financial Reference Number [FRN] 509909); CySEC (License No. 250/14)

- AFSL #417727 issued by ASIC. Financial services provider license no. 486026 issued by the Financial Markets Authority (FMA) in New Zealand and Authorized Financial Services Provider license #47546 issued by FSCA in South Africa

- Seychelles Financial Services Authority (License #SD039)

- Estonian Financial Supervision and Resolution Authority (License #4.1-1/18)

- Monetary Authority of Singapore authorization for dealing in capital markets products (license #CMS100648)

- Dubai Financial Services Authority (license #F005651)

The Plus500 app review is rated and reviewed on Google Playstore and Apple App Store; but, in our opinion, this rating and review is of little worth in terms of credibility. The ratings are not flawless. The same goes for the "Objectives & Vision" section, which is a part of marketing and is therefore not important for any serious investor.

The primary goal of Plus500 marketing is to attract clients and capture market share. Potential clients should probably place extra focus on investor relations because Plus500 is a public broker listed on the London Stock Exchange Main Market (PLUS).

Pros

- Segregated account

- Highly capitalized broker

Cons

- VPS is available only if you qualify

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Plus500 Forex Broker Registration – A Rather Hassle-Free Process

We always highly prioritize a website's security. Plus500.com is SSL encrypted and equipped with recognition measures. Upon accessing the site, your country is immediately detected, and, accordingly, you are redirected to an appropriate website version. Clients from the UK, for example, will see a website that is slightly different from that of another country and will fall under FCA regulations.

The Plus500 open account process remains the same in different countries.

Step 1:

The first step requires selecting a demo or a real account, with the option to also choose a smartphone version.

Step 2:

The next step of the Plus500 create account procedure requires you to type in your email and password. You also have the option to utilize your Facebook, Google account, or Apple ID. Upon completion, your account is created and the Plus500 forex platform is accessible. Compared to other brokers, the sign-up process and Plus500 account review is rather quick.

Step 3:

Once you are on the platform, you can switch between a demo and a real account. You have access to both. Naturally, to trade with real money on Plus500 forex trading, you need to complete the verification process first. You will be asked about your ID information, residence, "Assessment of Appropriateness," phone verification, etc. The verification process with Plus500 is somewhat more demanding compared to the same process in other brokers.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

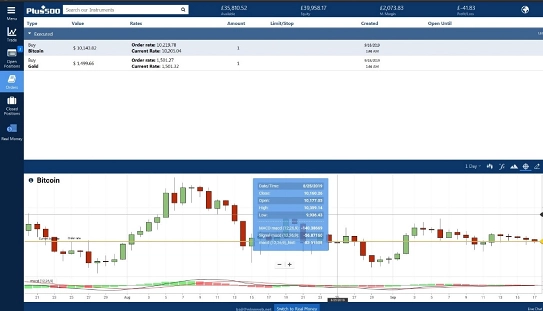

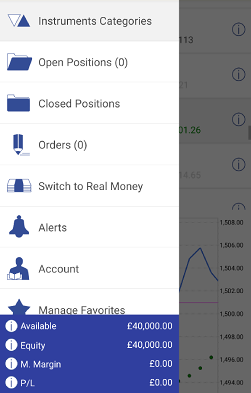

Plus500 Broker Mobile App Features

If you are wondering whether is Plus500 a good broker, the answer is yes because it has mobile trading available for Android and iPhone. After the same login process, the home screen presents both the chart and the instruments list in a clean and simple layout. As with the web platform, information is easy to read, while statistics, sentiment, trading conditions, etc., are neatly organized. You can also set up alerts that can be delivered through SMS, push notifications, or email.

The addition of the economic calendar within the platform is great, featuring the same superior Dow Jones website tools section.

The chart features some indicators, but most of them cannot be displayed: there is a pop-up notification that says, "the screen is too small." However, simpler ones like Parabolic SAR work. Overall, the chart features have not been developed to TradingView levels.

The Account Snapshot feature is handy, offering a good but simple way to display your equity composition, leverage, margin, and open positions in the form of charts and numbers. This feature is useful for quickly glancing at your exposure.

Plus500 broker's mobile app shares the same concept as the web platform, but it falls short in comparison to its competitors in terms of quality. The app appears to be designed for checking positions occasionally when traders are away from their computers. In this regard, it is responsive and executions are fast.

Pros

- Clean and beginner-friendly

- Good overview and alerts function

Cons

- Not suitable for advanced traders

- Frequently logs out

Other Key Points About Plus500

In this Plus500 broker review, it is important to point out that the broker has a proprietary platform and a dealing desk. Different regulations and rules regulate the platform. The FCA regulations are the most rigid, and they cover the Plus500 UK Ltd platform and the plus500.co.uk website. Bonuses for other jurisdictions are available under specific terms and conditions. For additional information on global coverage and differences between regions, refer to the provided table.

For traders who want to receive Plus500 com review and information on how the group is performing, a subscription to company announcements is also available.

One key point that may shock traders is the fine Plus500 had to pay in October 2012 to the FSA. The broker had inadequate controls and did not report some financial transactions and had no relevant staff training. A total of £205,128 was paid.

Plus500 is available in the following languages:

Conclusion

Plus500 forex is a large and popular market-maker broker, which exclusively uses its proprietary platforms. It gathers a lot of information from clients for marketing. Our impression is that this is a broker that exercises great control and has a right to do so because traders make a profit. Numerous reports and low ratings make investors very cautious.

Traders may look at the Plus500 demo account as easy-to-use, serving as a testing ground and affording useful tools for risk management and alerts. Some may even appreciate that there is no market research or gimmicks, just pure and free trading.

See more from “Forex Brokers”