Wide Range of Trading Assets

AvaTrade is a broker and a global brand that allows traders to trade several assets on an extensive selection of trading platforms. It was founded in 2006 by Negev Shekel Nosatzki and is now regulated by numerous regulatory institutions, including the Central Bank of Ireland.

AvaTrade forex broker is known for its versatility, as it provides numerous trading platforms for traders beyond the traditional MT4 and MT5 platforms. AvaTrade’s fees are considered lower than most brokers’, as they have low CFD fees and do not charge deposit fees. While using this platform, it’s important to note that, while there are many tradable instruments offered, the inactivity fees are quite high. In this AvaTrade review, we will discuss all the features, pros, and cons of AvaTrade.

- Highly regulated by three tier-1 institutions

- Low CFD fee

- No deposit or withdrawal fees

- Offers a proprietary trading platform

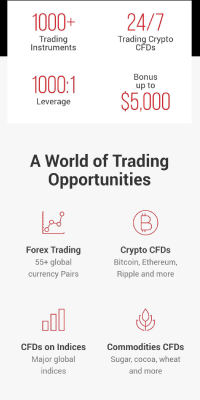

- Variety of tradable instruments, up to 1200 CFDs

Licenses

AvaTrade is regulated by several regulators, including The Central Bank of Ireland, The B.V.I Financial Services Commission on the British Virgin Islands, and The Australian Securities and Investments Commission.

Plarforms

AvaTrade provides web, mobile, and desktop trading platforms. These trading platforms are user-friendly and allow traders to access and trade the financial markets with ease.

Privacy and Security

AvaTrade strives to secure users' funds and safeguard their private information. The broker also provides negative balance protection in all countries it operates in.

Spreads/Fees

AvaTrade's spreads are considered close to the industry average. The broker charges no deposit and withdrawal fees, but there are inactivity fees for dormant accounts.

Mobile

AvaTradeGo Is AvaTrade's mobile trading platform. The platform is easy to use and has several features to help traders access the financial markets with ease.

Customer Care

AvaTrade provides customer service and support in many local languages. Users can access phone support, live chat, and email support.

AvaTrade Regulatory Compliance

Investor protection is a primary concern for most traders when choosing a broker. AvaTrade is regulated in several financial centers around the world, providing reassurance that your money is safe and secure.

In addition to being regulated by some of the top financial authorities in the world, AvaTrade offers Negative Balance Protection (NBP), meaning that you will never lose more than your account balance. AvaTrade provides traders with a high level of security.

When it comes to the safety of your trades and deals, AvaTrade is a reliable broker. All orders are executed fairly and promptly. You can be confident that you will never be subjected to hidden fees or commissions with this broker.

The assets in AvaTrade are constantly being updated. New assets are added to the platform regularly, which keeps traders’ options open and allows them to take advantage of new opportunities as they arise.

Over 250 assets can be traded on the AvaTrade platform, including major, minor, and exotic currency pairs, commodities, indices, and shares. This allows traders to find the right assets for their trading strategies and objectives. Most of the CFDs can be traded on the MT5 platform. AvaTrade also allows traders trade CFDs, including Apple, Amazon, Microsoft, Netflix, and Tesla. Note that the number of tradable instruments can vary based on your jurisdiction.

AvaOptions is a new platform designed for trading options. This is a very innovative product that allows traders to trade options on a wide range of assets, including currency pairs, commodities, indices, and shares. The AvaOptions platform offers a variety of unique features that make it an ideal choice for traders looking for a more advanced way to trade.

Popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple can be traded on AvaTrade.

Overall, AvaTrade offers a wide range of tradable assets, which gives the trader a great deal of flexibility. However, the tradable assets on AvaTrade are somewhat similar to those offered by their competitors.

AvaTrade's Spreads and Fees

When we talk about the costs of forex trading with AvaTrade, we need to consider three things: commissions, spreads, and fees.

Commissions

Commissions are fees charged by the broker for each trade that is executed. AvaTrade does not charge any commissions on trades. This is good for traders, because it means they won’t have to pay AvaTrade any fees for executing buy and sell orders.

Spreads

The spread is the difference between the bid and ask price of a currency pair. AvaTrade offers competitive spreads, starting from 0.8 pips on major currency pairs. Spreads vary widely across asset classes, with some assets having spreads as low as 0.1 pips and others having spreads as high as three pips. Here is a list of popular instruments and their fees on AvaTrade.

The leverage and spread varies depending on the instrument being traded. For example, as a crypto trader, you should evaluate the AvaTrade Bitcoin leverage and spread independently, as this differs from the leverage and spread for currency pairs.

| Instrument | Leverage | Average Spread |

|---|---|---|

| APPLE | 10:1 | 0.13% |

| AMAZON | 10:1 | 0.13% |

| MICROSOFT | 10:1 | 0.13% |

| NETFLIX | 10:1 | 0.13% |

| EUR/USD | 400:1 | 0.9 |

| GBP/USD | 400:1 | 1.5 |

| AUD/USD | 400:1 | 1.1 |

| Gold | 200:1 | 0.29 |

| BTC/USD | 25:1 | 0.20% over-market |

Fees

There are three types of fees we should consider when it comes to forex brokers: withdrawal fees, deposit fees, and inactivity fees.

- Withdrawal Fees

Withdrawal fees are the fees the broker charges for each withdrawal made from the account. AvaTrade does not charge any withdrawal fees.

- Deposit Fees

Deposit fees are the fees the broker charges for each deposit made into the account. AvaTrade does not charge any deposit fees.

- Inactivity Fees

Inactivity fees are the fees the broker charges if the account is inactive for a certain period of time. AvaTrade charges a fee of $50 after three months of inactivity and a $100 administration fee after one year of inactivity.

Pros:

- No commissions

- No deposit fees

- No withdrawal fees

Cons:

- Charges Inactivity fees

- Relatively high spread

Account Types and Account Opening on AvaTrade

AvaTrade offers five different types of trading accounts to its clients.

- Retail Accounts

The retail account is the most basic account type offered by AvaTrade. It requires a minimum deposit of $100 and offers leverage up to 30:1. The account comes with negative balance protection, dispute settlement, and daily market updates. You can open a real account or a demo account by following the AvaTrade demo registration procedure.

- Professional Accounts

AvaTrade’s professional accounts are designed for experienced traders who are looking for higher leverage and lower spreads. You can upgrade your retail account to a professional account once you have met certain requirements. This increases the account leverage to 400:1.

- Islamic Accounts

An Islamic account is a swap-free account available to Muslim traders. This account type follows Sharia law, which prohibits the earning or paying of interest.

- MAM Accounts

AvaTrade’s MAM accounts are designed for money managers who trade on behalf of their clients. The accounts come with many special features, such as custom lot sizes. This account type is only available to professional account holders.

- AvaTrade Standard Accounts

This type of account is available to traders who are not from the EU. A standard account has a leverage of up to 400:1 for international users.

AvaTrade ECN accounts are unavailable, as the broker is a market maker.

Payment Options at AvaTrade

The minimum deposit for a new account is $100, and there are no deposit fees. The following methods can be used to make a deposit:

- Credit/debit card – Cards accepted include Visa, Mastercard, and American Express.

- Skrill – There is no fee for using this e-wallet to deposit funds.

- Bank wire transfer – Any deposit made via bank wire transfer is free of charge but can take up to 10 working days to reach your account.

- NETELLER – This is another e-wallet that can be used to make free deposits.

- PayPal – This is a convenient option for most traders but isn’t available in all countries.

- PerfectMoney – Deposits made with this payment processor are also fee-free.

Clients from the EU or Australia are not permitted to make deposits via e-wallets. However, they can deposit via bank transfer or credit/debit card.

| Deposit Method | Deposit Processing Times | Min Deposit | Withdrawal Procesing Times | Min Withdrawal |

|---|---|---|---|---|

| Credit / Debit cards | Instant 24/7 | $100 | 1-2 working days | N/A |

| eWallets | Instant 24/7 | $100 | 1-2 working days | N/A |

| Bank Wire | Up to7 business days | $100 | 1-10 working days | N/A |

Withdrawal Options and Fees

AvaTrade ensures that withdrawals can only be sent via payment methods with which you funded your account. There are no withdrawal fees, and the withdrawal methods available to you depend on your country. These include bank wires, credit cards, and e-wallets. You will be required to verify your identity before making withdrawals.

Privacy, Security, and Funds Protection on AvaTrade

AvaTrade is committed to protecting the privacy of its clients and their personal information. We have implemented physical, electronic, and procedural safeguards to protect client information. All client money is held in segregated accounts with leading banks, in accordance with international banking standards.

AvaTrade takes data protection seriously and has implemented measures to ensure that all client information is kept safe and confidential. Client information is used only for the purpose of providing services to clients and is not shared with any third parties.

The platform aims to provide a secure and safe trading environment for all clients.

Web Trading Platform

AvaTrade’s web trading platform lets users trade online by signing in to the web trading interface. The web trader provides access to AvaTrade’s tradable assets and has several functionalities to help traders have the best possible experience. These include:

User Friendly Interface:

The web-trading platform has a user-friendly interface. This helps traders analyze the market and trade simultaneously. The market feed is continuously updated to help users make real-time technical decisions. This platform is available for users with demo and live accounts. If you have a demo account, simply input your demo account login.

Search Feature:

The search feature can be used to easily access the tradable instruments on the platform. This can help traders save time and increase the efficiency of their trading processes.

Easy Trade Execution:

The web trading platform lets traders execute orders quickly by choosing the specific asset to trade and inputting the risk management parameters.

Mobile Trading on AvaTrade

AvaTrade offers two main types of mobile trading platforms: AvaTradeGO and MetaTrader 4 (MT4). Both are available for download on iOS and Android devices and can be used to trade various instruments, including forex, shares, indices, cryptocurrencies, and commodities.

- Android

- iOS

AvaTrade Go

AvaTradeGO is AvaTrade’s proprietary mobile trading platform. You can download the app and access mobile trading by following the AvaTrade login procedure. This simply requires your email address and password. If you don’t have an account, you must follow the AvaTrade registration procedure, as explained earlier. Once you have registered, you can login with your AvaTrade account information. For example, if you have a demo account, you can login with your AvaTrade demo account login information.

It is a simple yet effective app that provides traders with all the features they need to trade on the go, including real-time quotes, live charts, market news and analysis, price alerts, and more.

MetaTrader4

MetaTrader 4 (MT4) is one of the most popular third-party trading platforms in the world. It is widely used by traders, due to its advanced charting tools, extensive back-testing environment, and automated trading capabilities.

AvaTradeGO vs. MetaTrader 4 (MT4)

When choosing a mobile trading platform, it is essential to consider your own trading needs and preferences. If you are looking for a simple and user-friendly app with all the features you need to trade effectively, then AvaTradeGO may be the right platform for you.

However, if you are a more experienced trader who requires advanced charting tools and analytical features, then MetaTrader 4 (MT4) may be a better option.

AvaOptions is a proprietary platform for AvaTrade options trading. It is a powerful, user-friendly platform that offers traders a wide range of features, including live quotes, real-time charts, and market news and analysis to help users trade options. To use the app, download it for free and follow the AvaTrade sign in process by inputting your email address and password.

AvaTrade's Features

AvaTrade offers a selection of over 50 currency pairs and CFDs on popular financial instruments, including indices, commodities, stocks, and ETFs. You can trade these assets with a leverage of up to 400:1.

AvaTrade offers its clients negative balance protection, meaning that you will never lose more than your initial investment. The platform also provides a trailing stop loss feature, which allows you to automatically exit a trade when it reaches a certain level of loss. This helps you protect your profits and limit your losses.

Finally, AvaTrade allows you to hedge your positions, which means you can take two opposite positions on the same asset to offset your risk.

Customer Support

AvaTrade’s customer support team is available 24/5 in various languages, assisting traders worldwide.

The customer support team can be reached by phone, email, or live chat. In addition, the AvaTrade website has an extensive FAQ section that covers a wide range of topics related to trading.

Phone support is available in several languages, including English, French, Spanish, Italian, Portuguese, Russian, Arabic, Turkish, and Japanese.

E-mail support typically responds in 24 hours or fewer, making it a good option for less urgent inquiries.

Live chat support is available in several languages, including English, French, Spanish, Italian, Portuguese, Russian, Arabic, and Japanese.

What languages does AvaTrade support?

English

Japanese

German

Spanish

Pros:

- Extensive FAQ section

- Live chat and quick response are available

Cons:

- No 24/7 live support

Additional Benefits of AvaTrade

AvaTrade provides many benefits for traders to maximize their potential. The platform provides an extensive selection of educational content, giving new and experienced traders opportunities to learn about technical and fundamental analysis concepts. These resources include high-quality educational blogs, webinars, and platform tutorial videos.

AvaTrade supports several copy trading platforms, including ZuluTrade and AvaSocial, AvaTrade’s proprietary social trading technology.

AvaTrade's Awards and Recognitions

- The Most Trusted Trading Platform Europe 2022

- International Business Magazine

- The Best Educational Broker United Kingdom

- World Business Stars Magazine

Conclusion

AvaTrade is a regulated platform that offers traders excellent trading conditions with moderate fees. Traders can access various instruments, including stocks, metals, currencies, bonds, and CFDs. Overall, this AvaTrade forex review shows that the platform has an above-average rating, though the inactivity fees and minimum deposit could be improved.

Whether you’re a new or experienced trader, you can take advantage of the AvaTrade platform and start executing your trades today.

FAQ

Yes, AvaTrade is regulated by several authorities that allow AvaTrade register. These include The Central Bank of Ireland, The B.V.I Financial Services Commission on the British Virgin Islands, and The Australian Securities and Investments Commission. These agencies ensure that the broker adheres to the best practices while dealing with clients.

Yes, AvaTrade allows you to trade crypto. Over 250 assets can be traded on the AvaTrade platform, including major, minor and exotic currency pairs, commodities, indices, and shares. This allows the trader to find the right asset for their trading strategy and objectives.

AvaTrade doesn’t charge commissions on their trades. This means you won’t have to pay AvaTrade any fees for executing buy and sell orders. However, there are spreads on all assets on the platform. These spreads vary and are readily available to view on the website.