Best Forex Trading App – Access Markets Anytime and Trade On the Go

The Internet completely changed the way traders access financial markets. It made it simpler for brokerage houses to offer their services to more customers. Smartphones took it one step further. They have become part of everyone’s life since their invention more than two decades ago.

For traders, the smartphone’s invention unlocked some fantastic features and opportunities. First, it is easier to check the market from anywhere, as long as there is a 3G connection (minimum) and Internet coverage.

Second, the smartphone enables quick checks of market activity, prices, and recent movements. Finally, it allows traders to make quick decisions on the go without the need to be in front of the screens all the time. It is essential in the currency market, where currency pairs move 24/5.

As such, brokers have invested a lot in developing the “perfect” forex trading app. While such a thing may not exist (yet), some good apps exist. This article will cover what we believe to be the best apps available to traders right now.

Best Forex Trading Apps

A forex trading app connects the investor with the market all the time. It enables mobility for traders, something that was not an option before. Here is the best forex trading app list based on our research:

- XM

- AvaTrade

- XTB

- Forex.com

XM

XM is a broker with a vast experience in the forex market. Founded in 2009, it is well known for its low withdrawal fees and comprehensive educational content, among other things.

Its trading app gives you access to over 1000 instruments and features more than 90 trading indicators. Besides the latest news and market research, a trader can access super-fast execution and account customization options in-app. Moreover, there are no re-quotes.

AvaTrade

AvaTrade is a forex and CFD broker offering tight spreads, low commission, instant execution, and up to 30:1 leverage. Its trading app was voted nr. 1 Best Forex Trading App by the Global Forex Awards.

Traders can choose from over 1000 instruments to trade, from forex pairs to stocks, cryptocurrencies, or commodities.

XTB

XTB‘s trading app is modern and intuitive. It brings all markets into one place, together with daily market news. Traders have rewarded the app with good scores on reviews in App Store and Google Play. As such, the app scores 4.5/5 in AppStore and 4.5/5 in Google Play.

Forex.com

Forex.com’s app enables trading on the go with features like advanced charts, news, and analysis. It boasts a straightforward interface, market analysis, and alerts, making managing the trading account’s activity easier. On top of that, traders can build multiple personalized watchlists and customize the screen for each trading style.

eToro

eToro is best known for its CopyTrader service. It allows users to replicate traders’ actions in real time. Its trading app makes monitoring personal trades and those replicated through CopyTrader services easier. It is intuitive and innovative, and one can easily alternate between tablet or mobile devices.

Methodology of How We Chose the Best Apps

Moreover, the broker’s asset coverage and educational resources offered to users were essential in determining the best apps. Furthermore, we considered other areas, such as security measures or additional services that can be accessed through the app.

How to Download and Install a Forex Trading App

Installing a forex trading app is a simple process and follows the steps needed to install any other app.

- First, go to the store where you can download the app. In most cases, we talk about the App Store and Google Play.

- Second, download the app on your mobile device. Third, use your login credentials to access the trading account.

Keep in mind that the app is the mirror of your trading account. While it offers fewer resources, it does allow you to monitor and take action on your active trading positions.

Trading App Features and Tools

While a trading app offers limited resources to traders and investors, it has some valuable features. One is trading and order execution. One can place different orders, such as take-profit, stop-loss, limit, or market orders.

Also, it uses real-time market data and essential charting tools, such as interactive charts, trading alerts, and risk management tools.

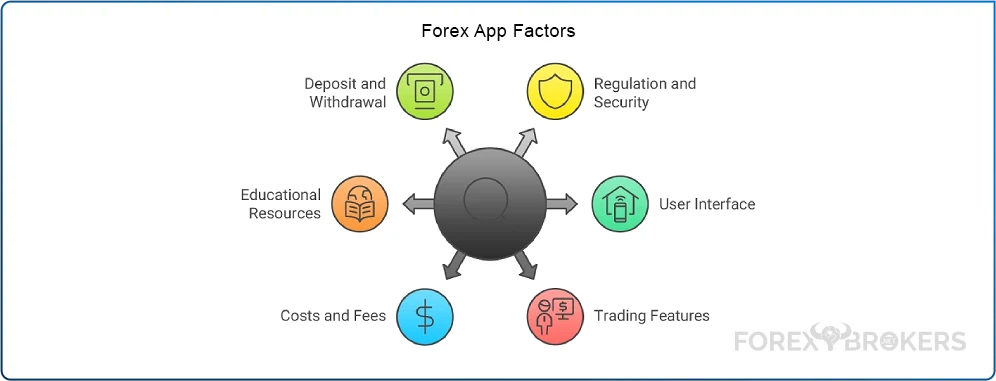

Factors to Consider When Choosing a Forex App

One should remember that no matter how good a forex trading app is, it is just the extension of the brokerage house’s products and services. As such, when choosing a forex app, besides the app’s features, one should analyze the broker, too.

Regulation and Security

The first thing to consider when trading with a broker is regulation and security. A regulated broker guarantees that the funds are in safe hands and, no matter what happens, the investor does not risk the loss of the invested funds due to the broker’s fault.

User Interface and Experience

Not all forex trading apps are the same. Some brokers may have sophisticated trading platforms and yet poor apps. Therefore, one criterion to use when choosing a forex app is the friendly user interface and experience with the app.

Costs and Fees

The costs and fees of trading financial markets differ from broker to trader. No one loves to pay commissions, but one should view it as the price of accessing financial markets.

Brokers offer an intermediation service and charge fees for that service.

Trading Features

Like all apps, a forex trading app has limited features compared to the desktop version. However, technology has made it possible to extend the trading features offered by brokers through apps.

Educational Resources

To retain their existing clients and to attract new ones, brokerage houses have invested in building educational resources available to investors. These can be webinars, videos, academies, etc.

A knowledgeable investor improves its chances of success when trading the forex market. This is also in the broker’s interest because active traders bring more commission, thus income, for the broker.

Deposit and Withdrawal Options

Further differentiation is made via the deposit and withdrawal options available.

Depositing funds is usually easier than withdrawing them. Once a client opens a new trading account, depositing funds is the next step after verifying and approving documentation. The most common way of depositing funds is bank transfer, but credit card payments are also popular. Nowadays, payment via other entities, such as PayPal or NETELLER, is also possible on some brokers.

Withdrawal of funds should be fairly easy, but sometimes brokers make things difficult. This is understandable, on the one hand, because any funds that leave the broker mean fewer commissions in the future. On the other hand, traders must have 100% access to their funds and are free to do whatever they like with them. Withdrawal is made using the same method used for the depositing. The commission varies depending on what method was used.

Which Is the Best Trading App for Beginners, and Why

The best trading app for beginners should have as many features as possible. It should connect rapidly with the market and allow quick action when needed. Moreover, such an app should boast some technical analysis setups. It should offer basic indicators, such as the ability to use the Relative Strength Index (RSI) or other oscillators and trend indicators. This way, traders may want to act when the market is reaching overbought or oversold territory directly from the trading app.

A trading app is an extension of the broker’s products and services. Effectively, it is just another way of accessing the trading account.

Therefore, it is of paramount importance that such an app belongs to a secure broker, a regulated one. The regulation comes with costs for the broker, but it means the safety of funds for investors. In most countries, regulation is mandatory for the broker to offer products and services to residents in that area. A trading app should mirror the trading account as much as possible. Traders must be able to close current positions and open new ones with the same ease. Also, the app must allow the use of pending orders and basic risk management strategies.

Trading on Your Phone vs Trading on a Desktop

Trading the forex market is a difficult task. Such a complex market is hard to master. Therefore, it requires plenty of time and dedication until success is achieved. Before smartphones, traders were glued to their desks all day. Trading was limited to the times when the investor could trade, either from home or from an office.

But smartphones changed that. They brought mobility to the trading world and peace of mind for traders to monitor positions even if they were not in front of the screens.

Sure enough, one can secure open positions using protective orders, such as stop-loss or take-profit orders to book profits. But sometimes, the market goes so close to a target without reaching it, and the opportunity vanishes if not in front of the screens. On the other hand, having access to the trading account via the trading app enables easy acting on open trades and other opportunities.

Nowadays, most trading is done from the app. That is, the opening and closing of trades are more accessible from the app.

However, all the analysis and strategy behind a trade is done from the desktop. The desktop trading platforms are far more performant than the apps. Traders can use a plethora of resources to prepare for a trade, from technical to fundamental analysis, and then, when ready, they can act on it by buying or selling via the app.

In other words, trading on a desktop and trading on your phone complement each other to give traders the best of both worlds. The first is mostly used in planning a strategy, while the second is used to execute it.

Expert Tip – Trading Apps

The process of selecting the right forex trading app for you starts with you and your trading style. If you are a swing trader and long-term investor, then any trading app is suitable as its main use would be to monitor open trades and open new ones. On such a time horizon, the entry price is not of the essence.

For scalpers and traders who want to benefit from quick market moves, the app should have other features on top of the ones mentioned above. For example, it must always be responsive, offer technical analysis tools, and open and close trades easily.

Finally, the app must belong to a trustful and regulated broker. The importance of regulation cannot be overstated, as it protects the traders from wrongdoing and other events that might damage the broker’s financial position.

FAQ

Yes, you can trade only using your phone. Any forex trading app acts as an extension of the trading account.

Such an app must belong to a regulated broker. Then, it should be easy to use. Moreover, it should allow basic risk management tools, such as placing pending orders.

Nothing is for free. Brokers charge a commission and/or a fee for any trade opened or closed, regardless if it was made on the desktop trading platform or via the app.

information about trades and even use copy and mirroring trading.

You can do that, but not directly from the app. Namely, you can access your broker’s page, log in to the user interface, and make payments.

Once arrived in the trading account, the funds are also instantly visible on the trading app.