LISTEN TO THIS ARTICLE:

The wide spread of the Internet in the past two decades and the emergence of smartphones resulted in people spending more time online. New industries were born, and some other ones adapted to make the most of the online industry.

One such industry is the brokerage industry. Of course, brokers existed well before the Internet was invented, but trading took place on a different scale.

For instance, there was a considerable delay between sending an order to a broker (usually via wire or telephone) and the execution date. As such, the trade was filled at a different price than the one intended, but this is how things functioned, and traders considered all the factors in their analyses.

The Internet changed everything—both for the brokerage industry and the trader. Online trading spread so fast that hordes of retail traders opened online retail trading accounts.

Moreover, online trading brought stiff competition among brokers. As a result, commissions and fees declined, making trading available to the masses. Another benefit brought by competition was the continuous improvement of services and technological improvements in the industry.

Nowadays, online trading has revolutionized the trading industry, and retail and professional traders have embraced it. However, the retail trader is often uneducated, lacks experience, and is therefore prone to errors.

One of the biggest mistakes a retail trader makes is not knowing what moves financial markets. More precisely, there is the tendency to believe that the prices of financial assets move because of people buying or selling.

Buying and selling are responsible for market movements, indeed. However, most trades are made by computers or robots, not humans. In other words, algorithmic trading dominates the trading industry, and the better the retail trader understands the concept, the more chances are to be profitable.

What Is Algorithmic Trading?

Algorithmic trading refers to trades opened and closed by computers. Computer programs are instructed to automatically open and close positions depending on various factors.

One such factor is a technical breakout. For example, suppose the market price action moves in a certain direction and breaks resistance or support. In that case, the program is instructed to buy or sell, or if the daily price closes above or below a certain level, a new position is initiated. These are just a couple of examples illustrating two possibilities, but the list can extend indefinitely.

In theory, any trading strategy may be written in a computer program with clear entry and exit level instructions. The phenomenon is widespread because algorithmic trading has numerous advantages over manual trading, such as the constant monitoring of the market price action.

While it may sound complex, algorithmic trading increased in popularity among retail traders, too. Nowadays, any serious trading platform must be able to host algorithmic trading strategies; otherwise, the broker will lose a large portion of trading fees.

Speaking of trading fees and commissions, the brokerage industry loves algorithmic trading. The constant monitoring of market developments leads to more fees and commissions than manual trading does. After all, humans need to rest, but robots or computers don’t. Hence, by ensuring that algorithmic trading is facilitated, brokers adapt to traders’ needs in the 21st century.

In short, algorithmic trading is nothing but automation. Just like automation transformed many industries (e.g., auto industry), it transformed security trading, too.

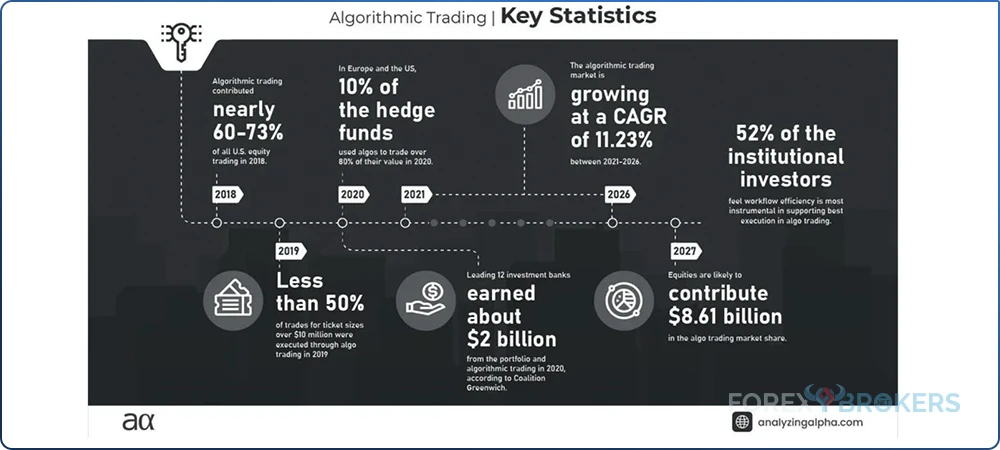

Nowadays, algorithmic trading takes place in literally all financial markets, from currencies to fixed-income and equities. The industry is so large that it generates billions in fees and commissions, and it is forecast to grow at a compounded annual growth rate (CAGR) of 11.23% by 2026.

Algorithmic Trading Statistics

The algorithmic trading industry has grown exponentially in the last decade and is predicted to do so in the future. As mentioned earlier, the double-digit CAGR rate of 11.23% by 2026 speaks for itself on the growth trend.

To have an idea about algorithmic trading’s impact on financial markets, imagine that four years ago, in 2018, algorithmic trading was responsible for almost 75% of U.S. equity trading. Surely, considering the CAGR number discussed above, the share of algorithmic trading in the equity markets increased significantly in the four years that followed.

Moreover, it is estimated that by 2027, the algorithmic trading market share in equities will be close to $9 billion. What is the reason for this significant increase in equity share? As it turns out, more than half of institutional investors favor the best execution, and that is one feature where algorithmic trading excels.

Furthermore, Morgan Stanley, one of the largest investment banks in the world, acknowledged that 80% of its corporate bond tickets and 20% of all its trading volume come from algorithmic trading. This is just one investment bank and, thus, one example meant to illustrate the impact of algorithmic trading in today’s financial markets.

But it would be a mistake to think of algorithmic trading as made of only complex computer programs buying and selling. Indeed, most of it is made of such things. Still, algorithmic trading also consists of pending orders used by all traders, retail or professional, to protect the trading account, book profits, or simply enter the market at the desired future level.

A quick examination of asset classes shows that algorithmic trading is the most common in the equity, futures, and options markets, followed by the FX (foreign exchange – forex) and fixed-income markets. Advances in computer processing and improvements in connectivity are two factors that will contribute to the increased use of algorithmic trading.

High-Frequency Trading

High-frequency trading (HFT) is just another form of algorithmic trading. While algorithmic trading refers to the opening and closing of a position by a computer program or robot, HFT goes one step further.

As the name suggests, HFT is high-speed algorithmic trading. As a retail trader, you are probably familiar with the quotes a broker offers for an exchange rate. For instance, the EUR/USD pair at the time of writing this article traded at 1.13184. This is a 5-digit quotation, and the fourth digit represents 1 pip.

Therefore, if the EUR/USD pair moves to 1.13205, the pair advanced 2.1 pips. Five-digit quotes are the norm in the industry, but the HFT industry goes beyond that.

HFT is made of robots conducting thousands of trades per second. As such, they do not interpret the fifth digit in one quote but often trade based on the changes on the eighth or ninth digit. This is why the HFT industry rarely impacts a currency pair’s volatility because they simply trade at a different, granular level.

The HFT industry has evolved exponentially in the last few years. Mathematicians and other brilliant quants are hired by hedge funds aiming to beat the market. The quant industry comprises algorithmic trading companies and individuals running robots to beat financial markets. It is worth noting that HFT is nothing but more frequent algorithmic trading.

In HFT, it is all about speed and technology. Because thousands of trades are performed every second, any delay has a tremendous impact, no matter how small it appears. It is estimated that 1 millisecond alone in latency can cost an HFT firm some $100 million a year.

In other words, in the algorithmic trading industry and thus in the HFT industry, too, humans have a different role than in regular trading. Humans do not trade but program and supervise machines responsible for trading.

How Does Algorithmic Trading Impact Price Action?

In the 21st century, algorithmic trading is the one that moves financial markets. We already provided some statistics on the subject, and many more exist, but it is important for the trader to realize that manual trading is not as common in the industry as it appears.

Sure enough, retail traders are attracted by brokerage houses’ commercials showing how easy it is to “operate” in financial markets. Buy here, sell there, make a profit.

But the reality is different. As a trader, you must understand whom you are facing. Any buy position for you means a sell position for someone else. When you’re buying in the market, someone else is willing to take the other side of the trade. Hence, understanding who is on the other side of the market is as important as understanding your trading strategy.

This is not to say that manual trading won’t work. In fact, some of the best traders out there still use manual entries just to make sure they get in after the dust settles.

Why is that?

When a robot or computer program monitors the market, ready to take a trade, it does so continuously. The robot may not be aware of upcoming events that might lead to an increase in volatility. Therefore, if the signal to buy or sell comes during or right after such an event, the entry may suffer a slippage in execution, affecting the bottom line.

One may say that slippage of a few pips does not matter, but it depends on the strategy and the time frame monitored. As a rule of thumb, algorithmic trading is typically used on lower timeframes; therefore, the take-profit is set very tight. If a trader has a take-profit level of 10 pips, but the slippage costs 3 pips, there is a 30% less profit. This is just an example explaining why some traders prefer manual instead of algorithmic trading.

Using examples is the best way to illustrate the impact of algorithmic trading in today’s financial markets. Here are two: the nonfarm payrolls (NFP) release and the Federal Open Market Committee (FOMC) statement.

Nonfarm Payrolls

The NFP is one of the most important economic data releases. It shows the number of jobs created by the U.S. economy and is typically released on the first Friday of each month.

Together with the NFP, the unemployment rate indicator is released as well. Because of that, traders prefer the Friday when the NFP is released as the day when the jobs data is out.

Jobs are important for the equity, FX, and fixed-income markets because the United States Federal Reserve has a dual mandate—to ensure price stability and create jobs. Therefore, if the central bank intends to change the interest rate level, it will do so based on inflation and jobs data.

As such, whenever the NFP is due, market participants listen. The impact of algorithmic trading on financial markets is best seen when watching the FX market react to the NFP release.

Trading algorithms or robots are programmed based on what the market expects from the release. Let’s say that the market expects the U.S. economy to add 400k new jobs. A number bigger than the forecast would be good for the currency, the U.S. dollar, while a lower number would hurt the dollar.

This is why, right on the release, the U.S. dollar pairs move aggressively at that very second. In the blink of an eye, the EUR/USD exchange rate may be up 100 pips or down 100 pips. This is the result of algorithmic trading because all robots are instructed to take the same trade at the same time—they buy or sell the U.S. dollar based on the NFP missing or exceeding expectations.

FOMC Statement

Central banks meet regularly to assess the economy and to set the monetary policy for the period ahead. They used to meet once a month, but that changed several years ago, and now most central banks in advanced economies meet every six weeks.

A central bank meeting usually takes more than a single day. However, for financial market participants, the message of a specific meeting or what the central bank decided matters.

In the United States, the FOMC decides on the level of interest rates and other monetary policy changes. The committee releases a statement, called the FOMC statement, and half an hour after the statement is published, a press conference starts where the Fed’s chair reads the statement again and then answers questions from the financial press representatives.

The text in the FOMC statement is subject to algorithmic trading.

Algorithms Search the FOMC Statement to Spot Changes in Language

Just like some trading algorithms are instructed to buy or sell when the market reaches certain levels or when various indicators signal something, some other trading algos are instructed to trade based on changes in a text.

Programmers use the previous FOMC statement and instruct the algos to buy or sell if a change in wording occurs. For example, suppose the previous FOMC statement contained a reference to inflation risks being tilted to the downside, and the new one refers to inflation risks as “broadly balanced.” In that case, this is interpreted as a hawkish twist in the FOMC language and the algorithms will buy the U.S. dollar.

As always, when it comes to algorithmic trading, the execution is so fast that it triggers sharp moves in the market. Also, because all algos trade in the same direction, the impact on the market prices is exacerbated.

This is why central banks take extra care when communicating monetary policy changes so as not to trigger sharp market movements. Forward guidance was introduced exactly for this reason—to let the market participants know well in advance what the central bank will do.

Nowadays, social media raised the communication game to a new level. Twitter, in particular, is responsible for much of algorithmic trading, as algos are instructed to “read” snippets from central banks’ official Twitter channels.

The amount of data and information grows exponentially, and so does the ability of trading algorithms to scan the news channels to find out potentially profitable trades. Therefore, one may say that algorithmic trading and big data are responsible for the increase in market efficiency, thus making it difficult for traders to find profitable trades.

Algorithmic Trading and the Retail Trader

Algorithmic trading may seem like an advanced topic for retail traders, but it is widespread among the retail community. While HFT took the speed of execution to a new level, algorithmic trading at the retail level is used for different purposes, such as scanning the market 24/5.

All trading platforms incorporate an algorithm to automate a trading strategy. Moreover, some offer the possibility to test the trading strategy automatically on past data and check its profitability.

Before discussing more about expert advisors (EAs) and how they are used, it is worth remembering that trading platforms come with automated features, such as pending orders. The following pending orders exist:

- Buy stop;

- Buy limit;

- Sell stop;

- Sell limit;

- One-cancels-other;

- Good-till-canceled.

Trading with Pending Orders

A pending order is an instruction given to the broker to buy or sell a certain market. In other words, the trading platform acts as a tool to place an order with the broker. The broker will execute the order regardless of whether the trading platform is open or closed—this is an important distinction between trading with pending orders and trading with an EA, which we will discuss later in the article.

Therefore, trading with pending orders is a form of algorithmic trading because the broker automatically opens and closes the trades. It is also a money management feature because the presence of a pending order signals a trading plan in place.

Buy Stop Orders

A buy stop order is useful when the trader intends to enter the market at a higher level than the current price. For example, if the EUR/JPY cross pair trades at 129.25 and a move above 130 might signal a bullish breakout, the trader may use a pending buy stop order.

After placing it, the broker will execute the order if and when the market moves to 130. A pending buy stop order is useful when trading bullish continuation patterns, such as a bullish flag, a contracting triangle, an ascending triangle, a pennant, or an inverse head and shoulders.

Buy Limit Orders

A buy limit order is the equivalent of a buy stop order, only this time, the trader wants to enter the market from lower levels than the current market price. Using the same EUR/JPY example, if the current price is 129.25, the trader may want to buy a move to 128.50. If the market falls that far, the broker will automatically fill the buy limit order.

Such an order is useful when trading with the Elliott waves theory. For example, when trading a bullish flat pattern, the c-wave of a flat is an impulsive wave that must retrace a certain distance into the territory of the previous b-wave. As such, the trader may place a pending buy limit order to make sure that the trading platform will take the trade whenever the market declines to that level.

Sell Stop Orders

A sell stop order is useful when betting on a market breaking a support level or when trading bearish continuation patterns. Such patterns are bearish triangles, such as a descending triangle, bearish flags, or head and shoulders.

In the case of a head and shoulders, the market tends to consolidate on the right shoulder for some time before breaking below the neckline. Therefore, the trader may use a sell stop order and place it right below the neckline. This way, the trader makes sure that the broker will execute the order automatically on such a move, and the take-profit level may be set at the pattern’s measured move.

Sell Limit Orders

A sell limit order is placed by traders who want to enter a short position higher than the current market price. Such an order is useful when trading, following Elliott waves theory rules.

For example, Elliott waves are full of patterns that must respect certain Fibonacci levels. Therefore, if the trader has any reason to believe that the market forms a bullish flat pattern and the a-wave is completed, it may want to place a sell limit order at a 61.8% retracement of the a-wave. This is the minimum distance the b-wave should travel; thus, the trader wants to shorten the market if and when the price reaches the level.

One-Cancels-Other

One-cancels-other orders are not part of all trading platforms. However, they can be imported into most trading platforms as indicators.

Using this type of order, the trader places two orders, typically one above and one below the current market price. The trading platform automatically cancels the other order if the price reaches one level.

What are these orders useful for? The answer is that they are perfect tools to trade market ranges. Long-term consolidations are common even in the FX market, and a one-cancels-other order is a perfect solution to trade a breakout—bullish or bearish.

Good-Till-Canceled

Some trading platforms allow traders to set a time limit for their pending orders. As the name suggests, a good-till-canceled (GTC) order is always active unless the trader decides to cancel it anytime in the future. Some other pending orders have a validity of only one day or even a few hours.

To sum up this part of the article, pending orders are a form of automated trading. They show a disciplined trader and are used to ensure that the trade gets filled regardless of whether or not the trading platform is open.

Expert Advisors

EAs are the retail trader’s algorithmic trading tools. An EA is a robot or program built upon a strategy that opens and closes trades automatically.

Most trading platforms offer the possibility to trade with an EA, but not all of them provide the possibility to create one. The most popular one is the MetaTrader platform, used by most retail brokers, as it incorporates the MetaEditor, which allows traders to build their own EA.

The MetaEditor is the platform used to build the EA. The only problem with it is that the trader needs to have programming skills to build the EA. Assuming the EA is built, the platform allows you to export the file and save it on your computer to be uploaded in the MetaTrader.

What if the trader does not have programming skills? A solution to this problem is hiring a programmer, but the downside is that the trading strategy is shared.

Another option is to buy one already built, but the real question a trader wants to ask here is—why would anyone sell a robot designed to make profitable trades? Therefore, this option should be out of the question for all serious traders.

How to Trade with an Expert Advisor?

This is a topic worthy of consideration. The easiest way is to simply build it using the MetaEditor platform or some other one, save it on your computer, and then load it into the MetaTrader.

MetaTrader has its own folder created automatically during the installation process. There is a subfolder for EAs that contains some demo ones. This is the place to paste the newly created EA.

Moving forward, the next step is to close the MetaTrader if it is already open. Otherwise, the EA would not appear on the platform.

The trader must then open the Navigator tab by pressing CTRL+N or by ticking the yellow box in the MetaTrader platform. A vertical window opens on the left side of the screen where a tab called Expert Advisors can be found. By pressing it, a list with all the available EAs opens.

The next challenge is to test if the EA is working properly—more precisely if it takes the trades when it is supposed to and closes them when instructed. The Strategy Tester option in the MetaTrader platform is the tool to use.

When the trader is sure that everything is in place, the next thing to do is to attach the EA to a market. First, the trader must open the currency pair or market to trade and carefully choose the time frame. The EA may be attached by using the click-and-drag option. Finally, by pushing the Live button, the EA turns a smiley face on the top right of the screen, meaning that all is set and the EA is monitoring the market for trades.

Virtual Private Servers

A big headache when trading with EAs is that they will stop taking new trades or closing the open ones if the trading platform is closed. In other words, the EAs become inactive when the MetaTrader is not running.

The trader needs a virtual private server (VPS) to solve this issue. By using a VPS, the trader “rents” a computer in a PC farm located somewhere in the world, and the farm owner guarantees that the PC will always run. If there is some maintenance, it will always happen outside market hours and will be announced days or even weeks in advance.

Setting up the EA on the VPS is similar. After accessing the VPS, the trader downloads the MetaTrader and uploads the EA. To make sure that everything functions properly, do not close the MetaTrader on the VPS—it needs to run all the time.

The downside is that a VPS costs a monthly subscription. Nowadays, some FX brokerage houses offer free VPS with certain trading accounts, but free VPS is not a regular feature in a broker’s offering.

Pay Attention When Changing Brokers

EAs are very popular among retail traders. Some traders completely give up manual trading and run multiple EAs on various platforms. Basically, they are in charge of monitoring the robots so that the automated trading works as planned.

But there is a catch when using the same EA on different brokers. It will not function properly unless the brokers have identical trading conditions—which is almost impossible given the five-digit quotation system.

Also, imagine that the brokers may have the servers set in different time zones. As such, the daily candlestick may close at different times, and if the EA is instructed to open or close a trade at the end of a trading day, the results would differ from broker to broker regardless if the EA used is the same.

As such, having one EA performing on one broker and delivering negative results on another is not unusual. Because of that, the trader needs to update the settings and change the EA accordingly so that the original trading strategy is adapted to and matches the broker’s trading conditions.

Pros and Cons of Algorithmic Trading

Algorithmic trading allows for the complete monitoring of market conditions 24/5 and sometimes 24/7 in markets like the cryptocurrency market, which is also open over the weekend. Therefore, this is the major advantage of algorithmic trading—taking all possible trades without exceptions.

Another pro of algorithmic trading comes from the psychological component. The trader knows that the robot follows a trading strategy, and if a signal was triggered, the robot knows the conditions for closing a trade. Therefore, emotions are eliminated from the trading process—a big improvement when compared to manual trading.

Finally, another pro comes from the execution part. Manual trading often results in delayed entries and exits, affecting profitability. However, this may act as both a blessing and a curse.

It is a disadvantage because automated trading also could create slippage. This is particularly the case when the market moves aggressively as a result of a news release or some central bank announcing a change in monetary policy.

Another negative aspect of automated trading is that the trading process becomes less personal. More precisely, the trader detaches from market-moving events and the overall trading process. This may result in delayed reactions should the EA fail to perform as programmed.

Conclusion

Algorithmic trading is responsible for a big chunk of today’s trading activity. Both professional and retail trading communities have embraced algorithmic trading, and the trend moving forward is that the share of algorithmic trading will rise in the future.

Algorithmic trading improves market efficiency, as robots discover inefficiencies much faster and in areas where human beings can’t do so. Meanwhile, some forms of algorithmic trading, such as HFT, barely move market prices because trading takes place at a deeper, granular level.

The idea of continuously monitoring the market in search of potentially profitable trades has also appealed to retail traders. For this reason, most trading platforms are built to incorporate algorithmic trading.

Algorithmic trading is profitable for brokers because it typically results in a larger number of trades. Therefore, commissioning improves when compared to manual trading. Also, because algorithmic trading typically takes place on lower time frames, such as the 1-minute or 5-minute charts, the number of trades is greater when compared with manual trading, which is often swing trading.

Altogether, algorithmic trading is responsible for the most violent market moves, and nowadays, traders monitor robots. Expect the trend to intensify in the years ahead.