Technical analysis refers to interpreting data from past charts to forecast future market movements. It offers an educated guess about where the market might go next.

In contrast, fundamental analysis refers to interpreting economic data to make similar forecasts. Most traders prefer the latter between technical and fundamental data because it is usually grounded in what an economy (or company) does.

Technical analysis has a long history. For example, speculators have long tried to look for repetitive market behavior and document the resulting patterns.

This is how the Western, or classic, approach to technical analysis was born. In this category, we can find numerous patterns, such as the head and shoulders, rising and falling wedges, double and triple tops and bottoms, and so on.

With technical analysis gaining in popularity, trading theories were born. For example, the Elliott Waves theory has become one of the most famous.

But all these classic technical analysis patterns and the various trading theories have a significant drawdown. They are time-consuming.

To interpret a pattern, such as a double top or bottom, and to trade it, one needs to wait for the pattern to complete. Depending on the timeframe, the pattern may take a lot of time to form. Also, putting everything together in an Elliott Waves top/down analysis takes time, too.

And then Japanese candlesticks became famous. Steve Nison was the first to introduce bullish and bearish engulfing patterns or morning and evening stars.

Their advantage is the short time to form. Most of these patterns only have two or three candlesticks, far fewer than classic technical analysis patterns.

Some, like the Doji pattern, need only one candlestick to form.

This article covers everything there is to know about the Doji candlesticks – from identifying their different types to trading them.

What Is the Doji Pattern?

A Doji is a pattern made out of a single candlestick. According to the Japanese theory, in technical analysis, a candlestick has the following elements:

- A real body made out of the price action between the opening and closing levels.

- An upper shadow, as in the distance from the highest value in a candlestick to the opening level.

- A lower shadow or the distance between the lowest value in a candlestick and the closing level.

Sure enough, a variety of candlesticks exist. However, not all of them interest the trader using Japanese candlestick patterns.

A quick throwback to the articles part of this trading academy that discussed the morning and evening stars or the bullish and bearish engulfing patterns – candlesticks there had a big real body and short shadows.

The Doji differs. Here, the real body should not exist.

Indeed, the ideal Doji candlestick has identical opening and closing prices. In reality, one needs to be flexible with this rule, but more about it a bit later in the article.

For now, remember that this candlestick should have no or a very small real body. Also, it must have both an upper and a lower shadow.

As for the length of the two shadows can vary, depending on the type of the Doji candlestick. To sum up this part, a Doji pattern is one candlestick with no or a very small real body and with upper and lower shadows.

So, what is so special about this candlestick?

Doji Signals Uncertainty

Doji may present little or no interest to many traders. The explanation lies in its duality.

This pattern shows uncertainty and hesitation. More precisely, the market is directionless, trending conditions do not exist, and everybody is waiting for the next breakout, higher or lower.

Because of that, a Doji candlestick may act as both a continuation and a reversal pattern. It may form as part of a pennant, thus being part of the consolidation that eventually breaks in the same direction as the underlying trend.

Or, it may form at the top of a bullish or the bottom of a bearish trend, thus acting as a reversal pattern.

In both cases, when a Doji appears on a chart, it shows uncertainty. So, effectively, the market pauses before the next leg is higher or lower.

But this is precisely why Doji candlesticks are so interesting. In a way, they act like breakout points. In fact, they do signal a breakout – just like the price action breaks above the b-d trendline of a triangle, so does the price action break after a Doji candlestick.

Is it possible to have more than one Doji candlestick in the same area? Certainly, it is.

Also, is it possible to have two, three, or more consecutive Doji candlesticks? Sure it is.

Just remember that the market looks for direction. Therefore, it should be no surprise that Doji candlesticks form when the market is least active.

More precisely, the FX market is mostly quiet in the Asian session. As such, look for Doji candlesticks and a breakout during the London session.

Also, the FX market takes its time to consolidate before a major event, such as the European Central Bank interest rate decision or the Non-Farm Payrolls report in the United States. Therefore, look for Doji candlesticks before and a breakout after that.

The chart below is the most recent EUR/USD 4h timeframe. The market has been in a continuous ascending trend for several weeks, and the blue arrows show different Doji candlestick patterns.

Beware of the FX Market

Let us go back to the original definition of a Doji candlestick and focus on the real body. The rule says that the Doji should have identical opening and closing levels; hence, no real body, just a line, should be there.

This worked very well back in the old FX days. Still works on the stock market, where spreads are bigger.

But in the 21st century FX market trading, the increased competition between brokerage houses benefited the customer – the retail trader. New technologies made it possible for the broker to offer a five-digit quotation instead of a four-digit one that had been in place for years.

Effectively, it means that for the EUR/USD, a broker will show an exchange rate of 1.09686 with five digits today. Back in the day, the quotation would have looked like 1.0968 – with four digits.

It may not seem a big deal, but it is when dealing with Doji candlesticks. With a four-digit quote, the Doji candlesticks were more frequent on a chart.

Because of the five-digit quotation, it is very unlikely to have identical opening and closing prices for any candlestick in any timeframe. Therefore, the trader should be flexible and allow for a small range.

This is why, on the earlier chart, you'll see that not all real bodies are the same. However, they have one thing in common – they are small, close to the original definition of a real body belonging to a Doji pattern.

Beware of the Daily Chart

The daily chart deserves special mention. When using a strategy based on Doji candlesticks or simply looking for Doji candlesticks, the trader should know the technical details of the trading platforms.

Some trading platforms can be customized regarding how the data on charts is displayed, but most cannot. Instead, they will show the data as it comes from where the broker's servers are located.

Let us imagine two brokers – one with servers in Eastern Europe and one in London. They both market the same thing, targeting retail FX traders.

If you put the daily chart on the two platforms, you will notice that the daily candlestick closes at different times. If there is a one or two hours difference, that difference will matter for the shape of the candlestick.

In other words, on one broker's platform, you may end up seeing a Doji candlestick, while on the other one, the Doji candlestick does not appear.

Beware of the Sunday Candlestick

Another thing to know about your brokerage house is whether it displays the Sunday candlestick. Trading begins in New Zealand when there is still Sunday in Europe or the United States.

Hence, the broker's terminal should have a candlestick that reflects the trading that occurred. However, not all brokers have such a candlestick. Some decided it was useless since there was little or no market activity during those hours – so they simply eliminated it from the daily chart.

If your broker shows the Sunday candlestick on the daily chart, it will be quite small. In fact, for every six candlesticks, you'll notice one that is small, reflecting the market activity on Sunday.

Therefore, this candlestick has a big chance of looking like a Doji candlestick. Only it isn't, for at least two reasons. First, it shows the trading activity for only a few hours. Third, it differs from a regular, 24h candlestick.

As such, it should be ignored if the trading strategy is based on a Doji candlestick.

Different Types of Doji Candlesticks

A Doji candlestick has a very small real body (ideally, it should have equal opening and closing prices). Also, it has both an upper and a lower shadow.

A classic Doji candlestick has a real body and two equal shadows. Also, the entire Doji candlestick is relatively small.

But other types of Doji candlesticks exist, depending on the real body's location as well as the length of the two shadows. Here is a comprehensive list of the most common types of Doji candlesticks:

- Dragonfly Doji

- Rickshaw man

- Gravestone Doji

- Doji after a bullish candlestick

- Northern Doji

- Southern Doji

Each type of Doji candlestick discussed here has a specific meaning beyond the fact that it shows uncertainty in the market.

Dragonfly Doji

A Dragonfly Doji is bullish. It forms before a strong upside movement, and its main characteristic is that it has no upper shadow.

More precisely, the real body forms at the top of the Doji candlestick. However, for all the reasons mentioned earlier in the article, one needs to be flexible regarding the real body of a Doji candlestick.

For a Dragonfly Doji to form, the market should have no higher value than the opening price of the candlestick. Then, the market is weak enough to decline, but buyers emerge and reverse the losses just before the candlestick closes. In other words, the bullish pressure is present towards the end of the Dragonfly Doji, which is why a strong upside movement follows it.

The chart below is the USD/JPY 4h timeframe, and the Dragonfly Doji forms right before the strong upside move. Please note that the real body is not ideal, but there is no upper shadow. Hence, the conditions for a Dragonfly Doji are met.

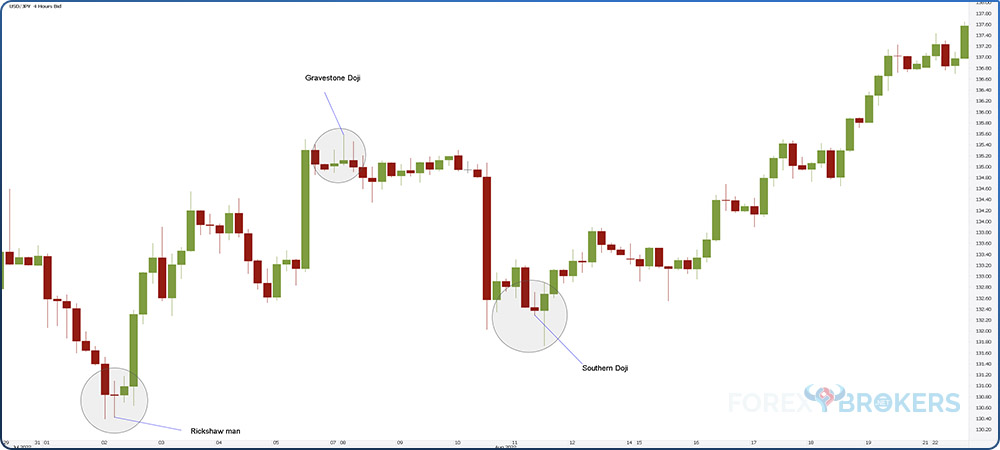

Rickshaw Man

The Rickshaw man looks like a typical Doji candlestick because the real body is in the middle of the pattern. What distinguishes it is the length of the two shadows – they are longer than normal.

The longer the two shadows, the more powerful the pattern is.

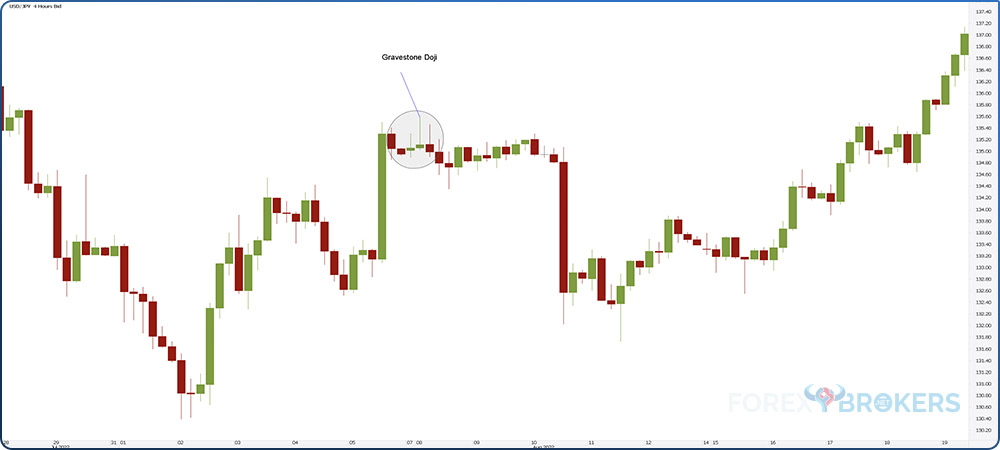

Gravestone Doji

The Gravestone Doji is the opposite of the Dragonfly Doji. As such, if the Dragonfly Doji is a bullish pattern, this one is bearish. Therefore, it forms at the end of bullish trends and signals a reversal.

The main characteristic of the Gravestone Doji is that the real body forms right at the bottom of the pattern. In other words, there is no lower shadow. Thus, as the name suggests, the pattern indicates bearish pressure.

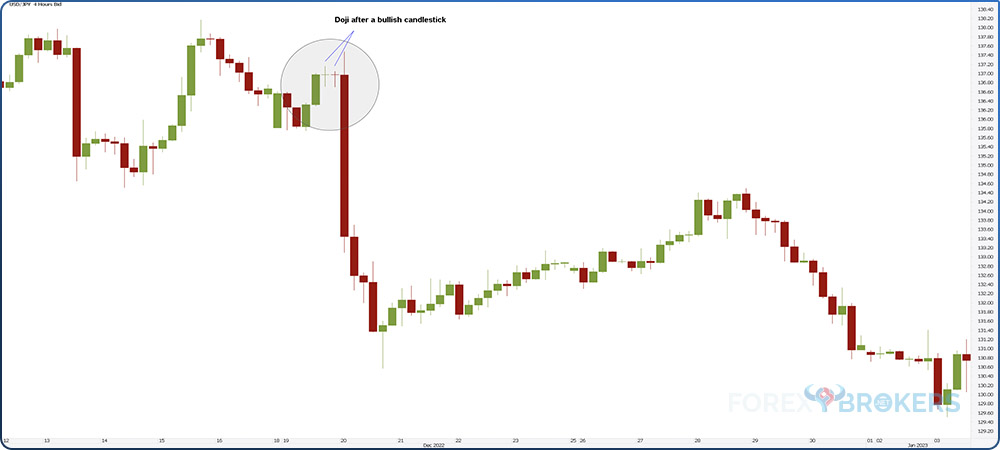

Doji after a Bullish Candlestick

This is a particular pattern in the sense that it involves two candlesticks. One is a bullish candlestick with a strong real body and, ideally, with a small or no upper shadow. The second candlestick is a Doji.

When a Doji forms after a bullish candlestick, it signals a reversal. In the example seen on the chart below, two Doji candlesticks follow a bullish candlestick. What followed was a massive selloff.

Northern Doji

The Northern Doji is a bearish pattern, signaling a bearish reversal. This Doji has both upper and lower shadows, but the real body forms in the upper half of the candlestick, indicative of its name.

Southern Doji

The Southern Doji is a bullish pattern forming in the lower half of the candlestick. The Doji should have a small shadow, and the following price action is typically bullish.

Doji Acting as a Reversal Pattern

Doji candlesticks show uncertainty. They may signal a reversal or a continuation of the underlying trend.

Whenever a Doji candlestick forms, it is wise to wait for the price action to unfold. More precisely, wait for the market to break and close above or below the upper or lower points in the Doji candlestick.

It is important to remember that the breakout and the closing above or below mean something. Therefore, whenever the Doji acts as a reversal pattern, wait for the price action to break below the lowest point and close there.

One can find Doji candlesticks in all kinds of reversal patterns, such as:

- Head and shoulders and inverse head and shoulders.

- Double and triple tops.

- Double and triple bottoms.

- Rising and falling wedges.

- Morning and evening stars.

Doji Acting as a Continuation Pattern

Whenever acting as a continuation pattern, the Doji candlestick shows the market hesitating or taking a breather before the main trend resumes.

Once again, the trader should wait for the price action to break and close above or below the upper, respectively, the lower, point in the candlestick. It means that the consolidation ended, and the trend resumed.

Doji as a Pattern within a Pattern

Later in the article, we will cover the different ways to trade a Doji candlestick. Until then, it is worth reviewing patterns where a Doji candlestick may appear.

Each pattern described in this section has been treated in detail in a stand-alone article. Therefore, the description here is meant to simply remind the reader of the basics of these patterns and are not accompanied by many examples.

The Doji candlestick reinforces the continuation or reversal pattern when acting as a pattern within a pattern.

Doji Acting as a Reinforcement

The Doji candlestick acts as a reinforcement for a continuation or reversal pattern. Sure enough, one can simply trade the Doji alone.

But when combined with a bigger pattern, the trader has the opportunity to trade the market from multiple perspectives while maintaining a rigorous money management system.

Head and Shoulders

The head and shoulders pattern is one of the most famous reversal patterns. Every technical trader should know how to recognize it.

It marks the top of a bullish trend. Because of that, the first phase of the pattern, the left shoulder, is unrecognizable at first.

It means that the market consolidates, typically in a triangular pattern, during a rising trend. Therefore, nothing unusual.

Moreover, the bullish breakout is so violent that no one suspects what is about to follow – a reversal. This reversal is the first clue that a head and shoulders pattern might form.

The second clue is another consolidation area appearing on the right side of the pattern. This is called the right shoulder, and by the time it is completed, the pattern ends.

One might summarize the basic elements of a head and shoulders pattern as:

- Left shoulder

- Head

- Right shoulder

- Neckline

- Measured move

The neckline is a line drawn below the left and right shoulders. It connects the lowest points in the two areas and is not mandatory to be horizontal. In fact, in the FX market, the neckline is rarely horizontal.

The measured move is calculated as the distance between the highest point in the head and shoulders pattern (i.e., the top of the head) and the neckline. By projecting this distance to the downside and from the neckline, traders find out the minimum distance that the market should travel or the measured move.

One important point to make here is that the measured move is only the minimum distance, meaning that it confirms the reversal pattern. The market often continues to fall, forming a series of lower lows and lower highs, typically found in bearish trends.

Doji candlesticks may appear everywhere in a head and shoulders pattern, but they are most valuable when found at the top of the head or on the right shoulder.

Because the head and shoulders pattern is a bearish reversal, look for the price action to break below the lowest point in the Doji candlestick and close there.

Everything mentioned in the case of the head and shoulders pattern is valid for an inverse head and shoulders. The only distinction is that the latter is a bullish reversal pattern and forms at the bottom of a bearish trend.

Wedges

Wedges are of two types – falling and rising. A falling wedge is a bullish pattern, while a rising wedge is bearish.

During a wedge formation, the price action lacks momentum. Let's focus on a rising wedge forming at the top of a bullish trend.

In its latest stages, the market forms higher and lower highs without advancing much. To spot the wedge pattern, traders connect the higher lows to find out the trendline that needs to be broken when the wedge completes.

Wedges are present in trading theories such as the Elliott Waves theory. When a first wave is extended waveforms, it has the look of a wedge pattern. Also, terminal impulsive waves with a first wave extension look like wedges.

It is difficult to trade a Doji candlestick during a wedge's formation. Therefore, a Doji may only act as a reinforcement.

The thing to do is to wait for the price action to break below the lower edge of the pattern and check for Doji candlesticks at the top. If one or more could be found, they reinforce the reversal pattern.

The minimum distance the market should travel after the wedge ends is half the entire price distance covered during the wedge's formation. Most of the time, it completely retraces the entire pattern.

Support and Resistance

During bullish and bearish trends, the market sometimes has difficulty breaking through different areas. These are called support or resistance areas, depending on the market's direction.

Support and resistance may be horizontal or dynamic.

Horizontal support and resistance areas are more common. A support area is an area where the bearish price action stalls. The market may or may not be strong enough to break through it. A resistance area is an area where the bullish price action stalls.

The apex of a contracting triangle is one area that typically acts as support or resistance.

Dynamic support and resistance areas follow the price action. They form surrounding rising or falling trendlines and are more powerful than the horizontal ones.

The important thing about support and resistance levels is the interchangeability principle. According to it, once the market breaks a support area, the area changes polarity and becomes resistant. Also, when the price action breaks above a resistance area, the area changes polarity and becomes support.

At support or resistance areas, the market forms continuation or reversal patterns. Therefore, the trader should look for Doji candlesticks during such patterns, as they indicate the future market direction. More precisely, the Doji candlesticks are used to form an educated guess about the market's strength and ability to break support or resistance.

Double and Triple Tops and Bottoms

Double and triple tops and bottoms are reversal patterns. As the names suggest, they appear at the top of bullish trends, respectively the bottom of bearish ones.

A double top or bottom is made of two reversals from approximately the same place. A triple top or bottom has three attempts to break an area, all three failing.

Doji candlesticks are valuable if they form at one or more tops or bottoms. They are even more valuable if they are part of a triangle or a morning or evening star pattern.

Triangles

Triangles are the most common patterns in technical analysis. Multiple types of triangles exist; the classic ones are ascending or descending.

Ralph Elliott discovered many types of triangles when he documented the Elliott Waves theory. Here is a quick taxonomy of such triangles:

- Contracting and expanding

- Limiting and non-limiting

- Irregular

- Symmetrical

- Running

- Triangles with a-e baseline

Triangles are nothing but consolidation areas. They may act as continuation or reversal patterns and they typically form ahead of important economic releases, such as the Non-Farm Payrolls in the United States or a central bank's interest rate decision and press conference.

The chart above shows a descending triangle. A descending triangle's main feature is a horizontal support area.

The market keeps bouncing from support, but any bounce is met with selling. Moreover, the price action is not strong enough to break the series of lower highs. This is a sign of weakness and eventually, the market breaks the support area, a moment that marks the end of the descending triangle.

Doji candlesticks offer valuable insight if they form at the lower highs. The chart above shows such examples and reflects the fact that the Doji candlesticks showed uncertainty and hesitation each time the price action attempted to break the lower highs series.

Morning and Evening Stars

Stars are patterns belonging to the Japanese approach to technical analysis. Morning and evening stars have three candlesticks and they form at the bottom of a bearish trend, respectively, at the top of a bullish one.

A Morning star begins with a bearish candlestick having a big, real body. Nothing suggests that a reversal pattern might form.

But the second candlestick might offer a clue. This candlestick typically has a small real body and shadows, and it is not mandatory to be a Doji.

Yet, if it is a Doji, it reinforces the pattern. The breakout that follows with the third candlestick, a bullish one, is suggestive of the power of the morning star.

For an evening star, everything is the same except for the fact that the first candlestick is bullish and the last one is bearish. Again, the one in the middle is not mandatory to be a Doji, but if it is, it gives more confidence that a reversal is close.

How to Trade the Doji Pattern

The last part of the article deals with how to actually trade the Doji pattern. Because the Doji is only one candlestick and a small one compared to others, it might be difficult to trade it. However, if combined with money management, Doji patterns can offer great technical setups.

On the chart below, there are seven Doji candlesticks. This is the most recent EUR/USD price action showing the bullish trend in place in the last part of 2022 and the start of 2023.

Remember that a Doji candlestick shows uncertainty and hesitation. Also, they may act as both reversal and continuation patterns.

Therefore, the trader does not know in advance what the market might do next. Because of that, the trading should begin after the moves. In other words, the trader should wait for the market to move first and then to trade.

Technical Setup to Use When Trading a Doji Pattern

From left to right, we will illustrate how to trade the Doji pattern starting with the Doji marked with the number 1. Several steps are needed for the technical setup.

Before starting, any technical setup must have an entry point, an exit or target, and a stop-loss order. Also, the risk-reward ratio should exceed 1:1, meaning that the distance between the entry and the exit should exceed the one between the entry and the stop loss order. The bigger the difference between the two, the better.

First, mark the top and the bottom of the Doji candlestick. In this case, they are marked with two horizontal lines.

Second, monitor the market activity and wait for one candlestick that breaks above or below the two edges. At the close of that candlestick, enter the market. In this case, the entry comes seven candlesticks later.

Third, measure the distance between the maximum and the minimum values of the Doji candlestick and project it twice to the upside. This way, the risk-reward ratio is 1:2.

Finally, set a stop-loss order at the lowest point in the Doji candlestick. Eight candlesticks later, the market has hit the take-profit level, 44 pips points higher.

A similar setup works for the Doji candlesticks numbers 2, 3, and 5, but ideally, one should wait for a setup to complete before trading another one.

Our next example is the Doji candlestick marked with the number four. The very next candlestick is strong enough to close above the upper edge of the Doji candlestick. Hence, we have a bullish breakout. At the close of this candlestick is the entry.

However, the entry-level exceeds the entire distance of the original Doji candlestick. Because of that, it makes no sense to put the stop-loss order at the lowest point in the Doji candlestick, as the risk-reward ratio would be altered.

To solve this, place the stop-loss order at the upper point in the Doji candlestick. This way, a risk-reward ratio of a minimum of 1:2 is locked.

Check out our video about the Doji Candlesticks:

Conclusion

Doji candlesticks are unique patterns. They are made of one single candlestick and may act as both reversal and continuation patterns.

The Doji candlesticks shows hesitation. Many types of Doji exist, but they all signal the same thing.

Because of the nature of the pattern, trading Doji candlesticks is tricky. Daily timeframes and above should be avoided; the 4h timeframe is the proper one.

A Doji candlestick may reinforce a continuation or a reversal pattern. They should offer the trader the confidence needed to execute a trade whenever they are part of such patterns.

Trading a Doji candlestick is straightforward and needs a minimum 1:2 risk-reward ratio. This way, the trading account may grow even if losing trades exist.

In any case, trading a Doij candlestick is less important than understanding the Doji's message – uncertainty, hesitation, and an upcoming breakout.