From the 70s to the present day, the foreign exchange market has changed dramatically, mainly due to technological breakthroughs. For a long period of time, the cost of exchanging currencies on the interbank market was extremely high – prohibitive for many.

After the drop of the gold standard, the world's fiat currencies (paper money) began to free-float in the market, gaining or losing value as their economies expanded or contracted. Investors and speculators quickly noticed the sharp change in currencies’ value occasionally and began placing speculative bets on macroeconomic themes.

A currency, any currency, is backed by its central bank's decisions. Therefore, it reacts to the changes in the interest rate level – higher interest rates lead to a currency's appreciation; lower interest rates lead to depreciation.

Also, currencies reflect a country or region's economic strength or weakness, rising and falling in value when the economy expands or contracts. The interpretation of foreign monetary policy and foreign economic activity quickly set the tone for macroeconomic speculation after the gold standard disappeared.

Large institutional players quickly opened offices in all three major markets (North America, Europe and Asia) and bought and sold currencies of different economies. Its high volatility quickly attracted interest because it was (and still is) a free-floating market. However, the huge transaction costs prohibited many participants from participating in this new and exciting market.

The foreign exchange market is huge, accounting for over six trillion dollars' worth of transactions every day – and rising. Players of all types buy and sell currencies based on the needs they have.

Some buy to purchase goods and services priced in a different currency. Some exchange currencies to fund international mergers and acquisitions. Finally, some invest available funds with the purpose of speculating (i.e., making a profit).

The Internet Era

Technology changed everything. Once the personal computer PC appeared, traders and speculators had an easier time following markets and began computing technical indicators. Moreover, the Internet allowed ordinary people to participate in the world's largest market – the currency market.

Because of the Internet, brokerage houses managed to cut transaction costs significantly. Technological advances brought concepts like Electronic Communication Networks ECNs and Straight-Through Processing STPs, further reducing the costs associated with trading.

Suddenly, anyone interested in financial markets could invest or trade from the comfort of home, having only a stable Internet connection. Online trading further revolutionized financial markets, with the currency market becoming the most popular of them all.

Forex market participants are more than just the retail traders that first come to mind. Central banks have their own trading departments, instructed to sell or buy certain financial assets as part of implementing the central bank's monetary policy.

Brokerage houses, depending on their type, might take positions on the market, too. For instance, market makers trade against their clients' direction, offering prices that mirror the actual market.

Sovereign funds, institutional players, and commercial banks' treasury departments are other examples of forex market participants. If anything, the technology brought by the Internet and online trading leveled the field, as nowadays, anyone can be part of the same market, albeit with different resources.

The Internet is also responsible for growing market participants among retail traders. As the Internet penetration rate grows from developed to developing, emerging, and frontier markets, so does the number of retail market participants. Therefore, the size of the forex market is expected to increase dramatically, almost doubling in the last decade.

Understanding Exchange Rates

The currency market is one of the most dynamic markets in the world – it reflects international trade flows and the ways they affect the value of a currency. Currencies are paired against one another, so a trader's job is to identify the currency that will rise or fall next and against what currency it will do that.

For instance, the euro (EUR) may rise against the Canadian dollar (CAD) but fall against the British pound (GBP). Therefore, picking the right currency pair to trade a currency is an important aspect of the forex market.

Currency pairs form the Forex dashboard. The dashboard represents all the markets available to traders and, in the 21st century, it does not have only currency pairs. Because financial markets are interconnected and correlated, forex brokerage houses include other markets in a regular forex account (e.g., gold, oil, indices, fixed income, etc.).

However, a forex broker account's dashboard mainly shows the various fiat currencies in the world paired against each other.

For example, consider the EURUSD pair. This is the most popular and liquid currency pair, formed by two of the most important currencies in the world – the EUR and the USD.

Suppose economic news out of Europe surprises the market positively. In that case, the EURUSD exchange rate rises – meaning the effect is negative for the USD (it declines) and positive for the EUR (it rises). In other words, forex trading is a zero-sum game, as one currency's gain is another currency's loss.

Each pair represents an exchange rate, and a pair's rise or fall differs from a currency's rise and fall. And so, the Forex dashboard pairs each currency against another, reflecting the exchange rates available to traders, investors, speculators, and any other party interested in finding out the value of a currency against another.

US Dollar – The World's Reserve Currency

After the Bretton Woods symposium, the USD became the world's de facto reserve currency. This means that other nations prefer to diversify some of their excess reserves into foreign currencies, with the USD being the default one.

The role of the world's reserve currency is also viewed in the Forex dashboard's structure. There are two categories of currency pairs, depending on whether or not the USD is part of a pair. As such, any currency pair with the USD is called a major pair. The rest are cross-pairs.

Brokers try to further differentiate between different currency pairs, classifying them into minors, exotics, and so on. However, the main universal distinction is the one that reflects the role of the USD. To be clear, the USD is not the only reserve currency but the main one. EUR, GBP, and CHF are secondary reserve currencies.

Because it is the currency of the largest economy in the world, the USD influences everything in the financial markets. Just consider the fact that most of the world's debt is denominated in USD or that oil is mostly purchased and transacted in USD. It means the Federal Reserve's fund rate on the USD is the most important interest rate benchmark to watch on the currency market.

When the United States enters economic expansion, the Fed starts hiking the interest rate in response to higher pressure on wages, which leads to higher inflation. Suppose the rest of the world does not follow the path of economic expansion, and the central banks are not able to follow the Fed. In that case, the higher interest rates in the United States will further impoverish emerging markets’ economies that must pay more for the USD to service the USD debt.

As long as the USD remains the world's de facto reserve currency, everything in trading starts and ends with the US monetary policy and the federal funds rate. The flows out of or into the USD have the power to shift all areas of the international financial system.

What Is a Pip?

A currency pair's move is quantified in pips or pip points. A pip is the fourth digit in a quote for most currency pairs.

Right after online trading allowed brokers to cater to retail forex trading, the quotes in a trading account had only four digits. For instance, the EURUSD pair had a quotation of 1.0894.

Nowadays, due to technological advances, all forex brokers offer a five-digit quote. As such, the EURUSD quote would be 1.08945, for example. But a pip does not refer to the fifth digit – it refers to the fourth one.

Therefore, if the current EURUSD quote is 1.08945 and the pair jumps to 1.09000, it is said that the EURUSD pair rose 6.5 pips. For some pairs, like the USDJPY or other JPY pairs, there is a three-digit quotation standard, and the pip refers to the second digit. Therefore, if the USDJPY pair falls from 107.691 to 107.449, it is said the pair dropped 24.2 pips.

If you want, the pip is the measurement unit of a market move. Because each currency pair ultimately represents a market, the bigger the distance traveled by a currency pair, the more pips it moved.

For a trader, understanding the concept of a pip is key to money management and positioning in the market. Determining the value of a pip is part of each trader's plan and depends on the volume traded – the higher the volume, the bigger the risk and the possible reward.

Statistics of the Forex Industry

Online trading increased in popularity with the rise of computers and advanced brokerage technologies. However, it does not mean that trading in the forex market is profitable.

Money or risk management, or the art of managing money, is the pillar of making money. The money-making business always attracts people, but that does not mean they have success. In fact, only 37% of traders involved in the forex market are profitable, and profitability comes in time.

To this day, there is an aura of mystery surrounding people who are in the business of making money, and success comes only as a result of managing risk. Hence, money management and risk management are the same and are responsible for the increase in the profitability rate due to education, experience, and perseverance.

According to industry statistics, 47% of traders have not paid for any educational material whatsoever. This high rate explains the low rate of success. At the same time, it is encouraging for new traders to know that education is required for success, too. Just like one needs to graduate from law school to become a successful lawyer, the same is true in trading – the higher the investment in trading education, the higher the rate of return.

Many traders do not use a stop-loss for fear of seeing the market trigger it and then reverse it. This is one of the biggest mistakes rookie traders make and is responsible for the high rate of failure when trading the FX market. As 72% of traders have no experience before trading forex, it is no surprise that such mistakes lead to a high rate of people dropping trading after only a few years.

On average, almost 40% of traders are beginners – having between one and three years of experience. Moreover, 85% of them use the MT4 platform, the most popular trading platform for retail trading.

Here is a list of detailed statistics mentioned earlier and what to make from these numbers:

- 37% of traders are profitable

- The forex market is correlated with all other financial markets and has the highest volatility of them all.

- The fast-paced currency market is responsible for many traders' failure, as they need more understanding of Intermarket correlations and basic trading education concepts.

- 85% of traders use MT4

- MT4 or MetaTrader4 is the first choice offered by brokers to retail traders and a performant trading platform.

- Over 90% of forex brokers offer the possibility to trade via the MT4 platform, so its high usage ratio among traders is no surprise.

- 66% use swing trading (daily timeframe)

- Swing traders look at timeframes starting with the hourly and ending with the daily, and they have a bigger time horizon for their trades. A trade may take a few hours or even a few weeks, and the reason to open or close a trade may be fundamental and technical. Swing traders like to have a reason for a trade. Whether technical or fundamental, the reason gives the logic behind a trade a sense of understanding the market.

- Because most retail traders do not trade for a living, they use higher timeframes in their technical or fundamental analyses. This makes it easier to cope with the lack of time spent in front of the trading screen while still having a chance to outperform the market.

- 47% have not paid for any trading education material

- There are two ways to be successful in trading:

- pay for educational trading materials

- books

- courses

- mentors

- learn on your own

- pay for educational trading materials

- While learning on your own is preferred due to lower costs, in the long run, the capital lost makes up for the initial investment in trading education.

- There are two ways to be successful in trading:

- 39% of traders have 1–3 years of experience

- Because the Internet is still not available in all countries, many people still need to be able to participate in financial markets trading.

- Online trading is responsible for improving this ratio and explains the need for more experience due to the constant arrival of newcomers.

- 72% of traders had no experience before trading forex

- As a retail trader, it is difficult to have any experience related to trading.

- Some traders have a finance or economics background that may help understand and interpret economic news, but the actual experience of actively trading is lacking for most retail traders.

- An average of 3 hours per day are spent on trading

- This is a relatively high number, considering that most retail traders participate in their free time (i.e., outside their regular work hours).

- It also shows that more and more people are able to make the leap from trading as a hobby to trading for a living.

Bid and Ask Prices

Brokers quote two prices for each currency pair – the bid and the ask prices. Selling is possible only from the bid price while buying takes place only from the ask price.

To explain, let us use the EURUSD pair again as an example. If a trader believes the pair is set to move lower (i.e., EUR depreciates and USD appreciates), the appropriate way to take advantage of the move is to sell the pair. As mentioned earlier, selling can be done only from the bid price.

On the other hand, if the trader believes that the EURUSD pair will rise, taking advantage of it means buying the pair. Again, buying is done only from the ask price.

When the trader closes the position, it is said that the position is squared. Depending on the initial trade and the direction the market moved, the position may show a profit or loss or break-even. In all cases, the net result is the one that matters, meaning that all adjacent trading costs are included in the net result.

The higher the difference between the bid and ask prices, the higher the transaction cost is. As the next section of this topic shows, the spreads are an important factor to consider when choosing a broker to trade with.

Bid and ask prices are not the same for all brokers. Moreover, different account types have different quotes for the currency pairs part of the forex dashboard.

If the trading account offers fixed bid and ask prices, it means that the spread (the difference between the two quotes) remains stable during the trading hours. However, look for the bid and ask prices to act differently during illiquid trading times, such as when positions are rolled over to the next trading day.

At this point, just remember the essential factor regarding the bid and ask prices – selling is possible only from the bid quote while buying takes place only from the ask quote. Also, to close a short position, the trader must use the ask price (squares the short by using the ask price). Naturally, to close a long position, the trader must use the bid price (squares the long by using the bid price).

Spreads

Every broker has different bid and ask prices. The difference between the two prices called a spread, represents a fee for the brokerage house.

If one buys the EURUSD at 1.08909 and wants to close the position right away, the closing or squaring price will always be smaller than the ask price. Assuming the market does not move, the closing price, the bid price, reflects how much the broker charges as a spread on the EURUSD pair.

Spreads also differ from currency pair to currency pair. Factors like liquidity, volatility, popularity among traders, whether the USD is present or not, if the pair is a major or cross, etc., dictate the size of a spread.

From a trader's point of view, the tighter the spreads, the better – the cost of trading is reduced. However, this is not always the case – forex brokers have different spreads on different accounts based on the general trading conditions offered to their traders.

However, we can generalize some factors regarding spreads. First, the most popular pairs have the tightest spreads. For example, the EURUSD, GBPUSD, USDJPY, and so on.

Second, major pairs always have better spreads than cross pairs. Even though the spreads may widen sometimes during the trading day, and this rule does not stand, in general, majors have better trading conditions from a spread point of view.

Second, brokers offer different types of trading accounts – some with variable spreads and some with fixed spreads. Accounts with variable spreads have tighter ones on average, but they increase significantly when important economic news comes out or when positions roll over to the next day. Accounts with fixed spreads guarantee an unchanged spread regardless of the trading time and pending news, but for that privilege, the trader must accept wider spreads than usual.

What is important for a trader to understand at this point is that spreads are a fee paid to the broker for access to the market. The lower the spreads, the better for the trading account.

Currency Pair Nicknames

Most currency pairs that are part of the forex dashboard have a nickname. Naturally, there is a logic behind these nicknames, but that is not important. What matters is that as a trader, when reading about a currency or a currency pair or talking about trading currencies with other traders, nicknames are part of the jargon.

Here are some of the most used nicknames for currencies or currency pairs:

- GBPUSD – also called "Cable," after the physical cable that connected London and New York

- AUDUSD – Aussie pair

- USDCAD – Loonie pair

- EURUSD – Fiber

- CAD – Loonie – from the solitary loon on the backside of the Canadian dollar coin

- AUD – Aussie

- NZD - Kiwi

When referring to their position in the market or the overall stance (bullish or bearish), traders often use nicknames. For example, one may say that he's bullish on Cable in the short term and dovish the Loonie pair. Effectively, it means that the trader expects the GBPUSD pair to move to the upside and the USDCAD pair to fall. Or that the USD will fall against the GBP and against the CAD, too.

Keep in mind that the exchange rate reflects the value of a currency in terms of another, and the appreciation of one currency always means the depreciation of another. Naturally, the other way around is also true.

Most Important Correlations to Consider When Trading the Currency Market

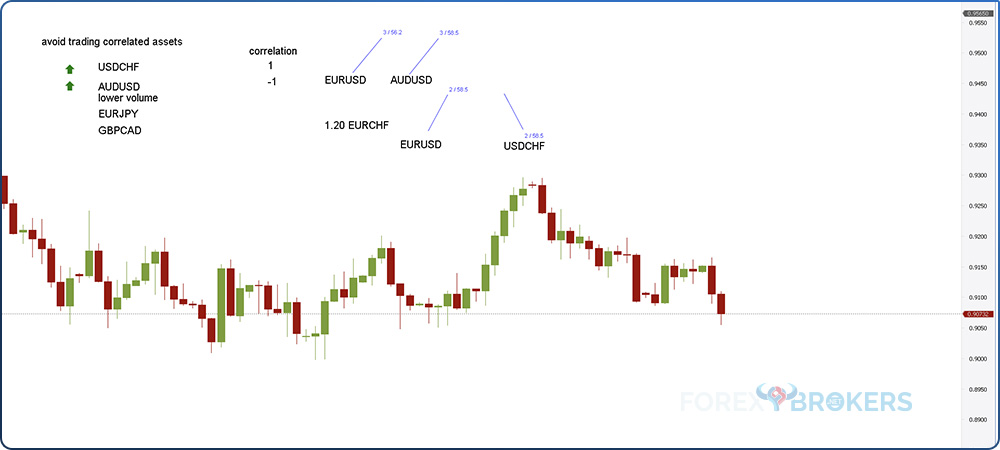

Now that we have reviewed the currency market generalities, we can move on to the most relevant currencies to consider when trading forex. The name of the game here is to avoid correlated trades or correlated markets, as overtrading has a big impact on the profitability of the trading account.

Correlated assets move together. In other words, other markets follow when one market moves in a certain direction. For example, if the EURUSD rises 1%, the USDCHF falls 1% if the cross (EURCHF) remains flat. This is a correlation valid for all major and cross pairs, something we have covered in a part of this trading academy.

A move higher in the EURUSD that triggers a move lower in the USDCHF reflects two correlated assets. Because one asset (i.e., EURUSD) rises and the other one (i.e., USDCHF) falls, it is said that the correlation is negative.

A positive correlation reflects assets or markets that move in the same direction. For example, when the market is in a risk-on move, the EURUSD, AUDUSD, GBPUSD, NZDUSD, and the US stock market (e.g., Dow Jones) move to the upside, while the USDCAD, USDCHF, and USDJPY move to the downside. In other words, the EURUSD, AUDSD, GBPUSD, NZDUSD, and the Dow Jones have a positive correlation, while the EURUSD and USDCAD, for example, have a negative correlation.

Naturally, the degree of correlation differs from asset to asset. For instance, the EURUSD and USDCHF negative correlation may be closer to -1 than the EURUSD and AUDUSD positive correlation is to +1. Generally, when two assets have a 100% correlation, the maximum level is +1 (positive) or -1 (negative).

Check out our video about the Correlations in the currency market:

The Role of the USD

The forex dashboard is made up of USD and non-USD pairs or majors (those with the USD in their components) and crosses (those without the USD).

Therefore, the USD splits the forex dashboard into two parts. Effectively, it means that the USD pairs have a high correlation degree, a correlation that also differs from crosses.

When trading the currency market, some principles resemble those used in portfolio management. The basic rule in portfolio management is that the manager focuses on finding uncorrelated assets to add to the current portfolio mix.

In other words, the lower the correlation degree, the better. However, because of the two extremes (-1 and +1) that define negative correlations and positive correlations, the perfectly uncorrelated asset has a 0 correlation. As a rule of thumb, any asset with a correlation degree bigger than -0.5 or smaller than 0.5 when compared to the assets in the portfolio is attractive. The closer the correlation reaches zero, the more attractive the asset is.

But how to define correlations in the forex market? As mentioned earlier, the USD is the starting point. If one is short the EURUSD, the first question to answer is – what is the reason for being short? Is it that the trader expects a weaker EUR or a stronger USD? If the trader is bearish on the EUR, it makes sense to short other EUR pairs, too – EURJPY, EURAUD, EURGBP. However, if the trader is bullish on the USD, adding shorts on the EURJPY, EURAUD, or EURGBP should come from a different analysis.

In the first case, we may say that the trades are positively correlated, while in the second case, the correlation degree declines significantly. The point here is that the correlation degrees in the forex market vary occasionally. In other markets, correlations are fixed and barely change.

Commodity Currencies

We mentioned earlier that the US dollar is the most important currency on the Forex dashboard. Because it is the world's reserve currency, the greenback's volatility influences the forex market's volatility.

Besides the American dollar and the correlations it brings to various pairs, some other currencies trade in a correlated manner – commodity currencies.

Many commodities exist, but oil and gold affect the forex market. As such, countries whose Gross Domestic Product (GDP) depends on the price of oil and gold also have their currencies correlated to the commodities’ price changes.

Let's consider Canada as an example. Canada is a country with vast natural resources. One of them, and perhaps the most important one, is oil.

Judging by the impact of the oil industry on the Canadian GDP, oil is the most important natural resource Canada has today. Because of that, the local currency, the Canadian dollar, is positively related to the price of oil. More precisely, when oil prices rise, so does the Canadian dollar. Therefore, the Canadian dollar is also called a "commodity currency" because of its tight correlation to the price of oil.

Obviously, the more the Canadian economy depends on oil, the tighter (i.e., closer to +1) the correlation will become. Or, the less the economy depends on oil, the more the correlation between the price of oil and the Canadian dollar declines. In the same category, we can include other currencies – the Russian ruble (RUB) or the Mexican peso (MXN). However, the Canadian dollar is the only currency of a developed economy that depends on the price of oil. Hence, when trading the CAD pairs, think of the price of oil and the positive correlation with the CAD. Also, if traders want to increase their exposure to the oil market, the emerging markets' currencies like the RUB or MXN offer this possibility. As always, avoiding correlations works best.

How to Avoid Correlated Trades

We have mentioned oil as the main commodity influencing the currency market, but gold has a saying in the value of the Australian dollar, too. Hence, the AUD is also considered a commodity currency.

However, the correlation between the Australian dollar and the price of gold is not as strong as between the Canadian dollar and oil prices. Nevertheless, traders should consider AUD and gold to move hand in hand, although they have a lower correlation than CAD and oil.

How to avoid correlated trades? The best way is to always look for something different than the open position in a portfolio. For example, if a short EURUSD is opened, it makes no sense to sell EURJPY, too. Instead, if the trader is bearish, the best way to express that is to add to the EURUSD short. Or to add an uncorrelated trade, like any position on a commodity cross – AUDCAD, NZDCAD, AUDJPY, etc.

Conclusion

Many of you may wonder why we discussed FX generalities in an article dedicated to the market's correlations. Also, why repeat some things already said in the first part of this trading academy?

The answer to this question comes from the statistics section of this article. Forex trading is tough, and the numbers do not look good. Many retail traders fail precisely because they do not understand the basics of forex trading and how correlated the forex assets are.

Unlike other markets, forex correlations break from time to time. Also, their level changes. For example, the EURUSD and the USDCHF correlated close to -1 all the time; the Swiss National Bank kept the EURCHF exchange rate pegged to 1.20 and the rate traded close to the level. The more the EURCHF distanced from the level, the weaker the negative correlation.

To sum up, this article highlighted the direct and indirect positive and negative correlations. The better the trader understands them, the easier it becomes to grow a trading account.