Twitter has emerged as a mandatory tool for retail and professional traders. FinTwit is a vibrant financial community active on Twitter, a social media platform where information about financial markets is shared and interpreted.

On Twitter, anyone can create an account and follow other accounts based on their interests. The FinTwit community is perhaps the most valuable of all the communities on Twitter, judging by the names and institutions that have accounts there.

The Internet makes it possible to have all the information one could ever want with just a few clicks. Twitter goes a mile further, allowing users to filter the information they want to see and the accounts they want to follow.

On Twitter, you can interact with former central bankers, such as Vitor Constancio, the former ECB Vice President, and one of the accounts this article suggests for following. Or, you can simply follow accounts that present economic data in real-time, by the second, offering a competitive advantage when trading.

Economists worldwide have a Twitter account to share their views regarding monetary and fiscal policy, how they interpret past and current economic data, and so on. All these inputs from various individuals and organizations make Twitter a mandatory tool for the trader who wants to be up to date with how financial markets move or with what moves the markets.

This article intends to present Twitter, both the company and the social media platform, but focuses mostly on certain accounts a trader might want to follow. The selection of these accounts is from the writer's experience and interaction with Twitter, and it does not represent a suggestion to follow or anything else along those lines. They are only accounts that offer valuable information to the trading community.

What Is Twitter? An Introduction

Twitter is a relatively new company. Founded in 2006, it is active in the interactive media and services industry and the communication services sector. Twitter is based in San Francisco, California, and it runs one of the most influential social media platforms in the 21st century.

Presidents and CEOs run Twitter accounts that can easily influence public opinion and, why not, financial markets. The best examples are the former US President Donald Trump and the CEO of Tesla, Elon Musk.

President Trump used Twitter actively for the entire period he was in charge of the White House. His Twitter comments were controversial, to say the least, and he used the platform to campaign for re-election, too. His account was followed by tens of millions of people from around the world, as most of his tweets were personal, in the sense that the account was not run by his PR team. Therefore, if one wanted to have an idea about what the President of the United States was saying or thinking about any particular subject, Twitter was the place to be.

Elon Musk is one of the richest (if not the richest) people in the world. He runs Tesla and SpaceX and is also an advocate of cryptocurrencies. In early 2021, Tesla made a $1.5 billion investment in Bitcoin, increasing the price of Bitcoin. Any subsequent tweets from Mr. Musk were interpreted after that as either bullish or bearish for Bitcoin and the cryptocurrency market in general – clear evidence of the power of social media over financial markets.

Twitter also allows companies and individuals to promote their products and services by offering the possibility to promote their brands. Twitter is listed on the New York Stock Exchange (NYSE) under the ticker TWTR and employs over 5,500 people.

What Is FinTwit?

FinTwit is a community organized on Twitter where anyone with an interest in financial markets can contribute. It is not a special place on Twitter, like a chat room or something; it is simply the content provided by Twitter on the Twitter feed based on the accounts followed.

For instance, when someone opens a Twitter account, they will follow someone. Let’s say that a new account follows the European Central Bank’s Twitter account. From that moment, everything that the European Central Bank tweets will appear on the new account’s feed.

Moreover, the platform suggests new accounts you might have an interest in based on the accounts you follow. As such, it is easy to expand your horizons, find new accounts and opinions from the same area (i.e., financial markets, economics), and build a Twitter feed that helps with trading financial markets.

In other words, a new Twitter account can immediately access the FinTwit community by simply following a few accounts on monetary policy, economics, and trading. From that moment on, the platform starts suggesting new accounts from the same areas, and this is how one gets access to the FinTwit community.

The community is huge, and there are some people who follow thousands of other accounts. However, you should know that the more accounts you follow, the more you will see on your Twitter feed, and the more difficult it will be to stay in touch with what really matters. Therefore, to make the most of the FinTwit community, a trader should build their following list carefully.

Twitter does not force anyone to post something. As such, a Twitter account may solely be used as a tool to monitor developments in financial markets and to access and interact with bright minds from around the world.

Why Be on Twitter When Trading?

The simplest answer to this question is that being on Twitter helps traders understand what is going on in the markets. Imagine that the euro makes a sudden movement during the opening market hours and there is no economic data to be released that day. What triggered the move? Should the trader be worried about the long-term implications of such a move, or it was simply the breakout of a technical level?

If there is an explanation for the move, the chances are that Twitter has an answer. You may end up reading a tweet on your Twitter feed saying, “ECB sources: The ECB Governing Council did not discuss tapering of its asset-purchases at the previous meeting.”

Such a headline is enough to move markets, and the FinTwit community will re-tweet it so many times that it would be impossible not to hit your Twitter feed. Therefore, being on Twitter helps us understand what is happening in the markets.

Another reason for being on Twitter is to connect with great minds and people with the same interests. Twitter has direct messaging and private accounts, meaning that you can interact with people with the same interests, learning and accumulating information that helps when trading financial markets.

Finally, Twitter helps with understanding and digesting economic data. Think of one of the most important economic releases in the United States: the Non-Farm Payrolls (NFP). The NFP is released on the first Friday of every month, and the jobs report presents the state of the labor market from the prior month.

If the US economy creates more jobs than the market expects, that is bullish for the US dollar. However, the US dollar might react differently, and Twitter explains why – it may be because of previous revisions or that the unemployment rate ticked in the opposite direction. If there is a logical explanation, the chances are it will appear on your Twitter feed.

Introducing the Tweetdeck

Twitter offers multiple options to gain access to the social media platform. First, there is the desktop version at twitter.com.

Second, there is the app for both Android and iOS, where the user can log into their trading account and set up notifications and everything else according to the desired privacy policy.

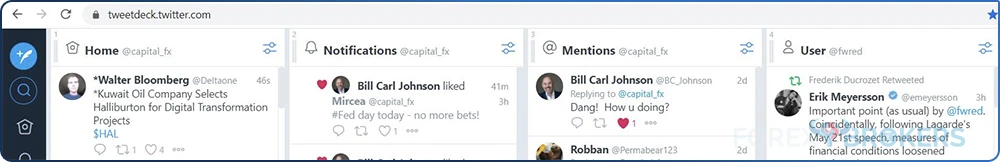

Finally, there is also the Tweetdeck, which can be downloaded at tweetdeck.twitter.com. Tweetdeck has multiple advantages for the retail trader; examples are shown below.

It is a customizable platform that allows sorting and viewing of different columns based on your interests. Depending on how big the computer screen is, more columns will appear on the Tweetdeck.

In other words, instead of monitoring just one Twitter feed, traders monitor multiple Twitter feeds, particularly some Twitter accounts. For example, if I am interested in a Twitter account, I might want to set up a special column on the Tweetdeck platform where I can see all the tweets from that account.

Therefore, Tweetdeck makes it easier to follow your interests and the market. Also, the user has an easier time reacting to market news or even posting something in reaction to a market event or to a reply or message from a different account.

Twitter Accounts to Follow When Trading International Financial Markets

The rest of the article is dedicated to providing a listing of Twitter accounts considered useful for the retail trader. The accounts in this article are either individuals involved in the economics and financial space or institutions, such as central banks. Some of the accounts may be traders, but the point here is not to look for financial advice but resources that may help the trader gain a competitive advantage over the markets.

Blue Checkmark

Some of the Twitter accounts are accompanied by a blue checkmark. These accounts are verified by Twitter and the blue checkmark certifies that the account is real and not a scam.

Typically, blue checkmarks are given to people working in financial publications, such as Bloomberg, or to personalities so the user knows the account is real. For example, no one would have followed the former President of the United States on Twitter without the account having a blue checkmark. Effectively, Twitter confirms the authenticity of the people behind the accounts.

Having a blue checkmark is aleatory – one cannot ask for it. Twitter runs various checks on the accounts that are open and, at some point, may ask for proof of identity in order for the account to be verified. Hence, a Twitter user cannot ask for the blue checkmark – it is given at some point if Twitter considers it necessary.

Moreover, it is not about the number of followers one user has. For example, many Twitter accounts with a huge number of followers, close to half a million, have no blue checkmark. On the other hand, there are accounts with only a few thousand followers that have it. Hence, while the blue checkmark does confirm the account's authenticity, it does not mean that accounts without the checkmark are not authentic.

Joe Weisenthal - @TheStalwart

Joe is the heart and soul of the FinTwit community. He is credited as being one of the Twitter accounts that started the community and helped grow it to the size and influence it has today.

He is a co-host of the Odd Lots podcast on Bloomberg and also writes a daily column for Bloomberg on all-market stuff. One can expect anything from Joe when it comes to financial markets topics – from interest rates and monetary policy to main cryptocurrencies or from lumber prices to inflation; Joe has an opinion about everything and is a must-follow in the FinTwit world.

One of the best things about this account is that Joe always brings arguments to a story. If he disagrees with something, he tells why. Another great thing is that the topics he covers go beyond traditional financial markets. If there is one account that covers the fundamental aspects of markets, then @TheStalwart is that account.

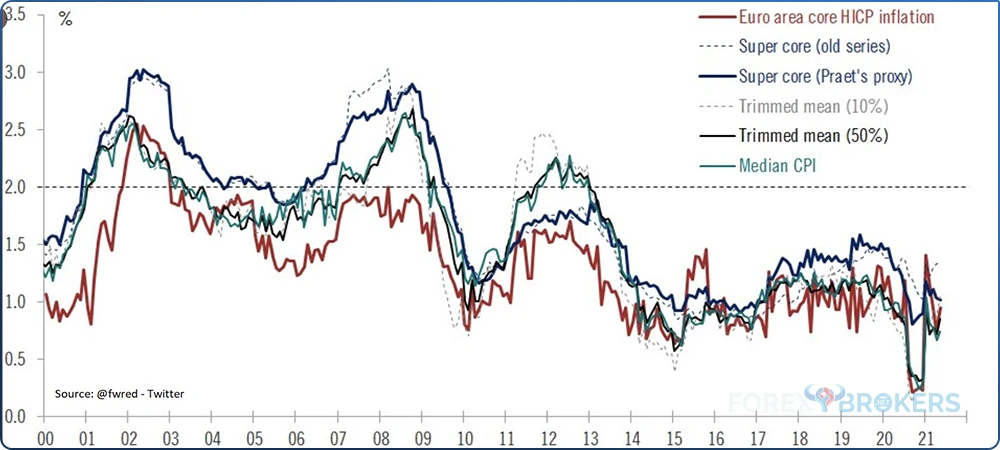

Frederik Ducrozet - @fwred

Frederik is the must-follow account when it comes to the European Central Bank (ECB) and its decisions. Fred is one of the so-called ECB “watchers”, monitoring every signal and message from the ECB and putting them into the overall context.

Frederik is an economist and global macro strategist at Pictet Wealth Management in Switzerland. His account is highly regarded by those willing to understand the ECB message, how to interpret inflation, and what to expect next.

Ahead of every ECB meeting, which takes place every 6 weeks, Frederik makes public his views about what is expected from the ECB and the scenarios that lie ahead. His comments on Twitter are more than pertinent, and his Twitter account is followed by prestigious names in economics from all over the world.

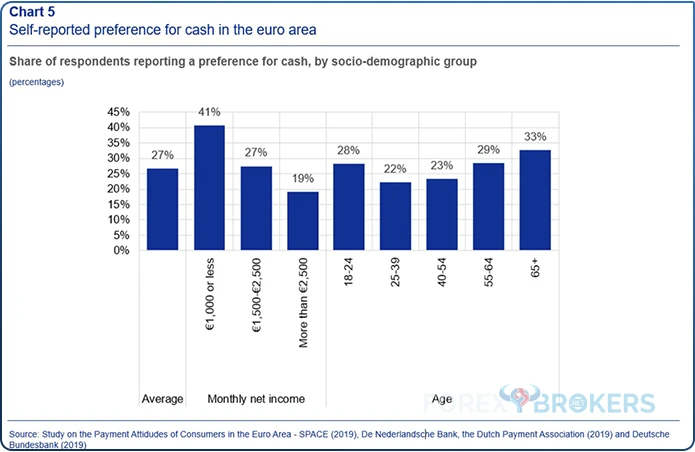

Frederik’s charts can be expected to show, for example, in the chart above, how the euro area core HICP inflation evolved over time (in this case, over the last 2 decades), and there will also be an interpretation of each chart. Followers will definitely learn a lot from this account, as the intricacies of central banking language and monetary policy decisions are difficult to understand without proper training.

Jeroen Blokland - @jsblokland

Jeroen is the former head of multi-asset at Robeco, a Dutch asset management firm established in 1929 with close to $200 billion in assets under management. Jeroen recently decided to start out on his own, building a new investment research platform. This is exactly why his Twitter account is followed – for the research over multiple asset classes and the insights he provides.

Jeroen covers multiple markets, from FX to crypto, fixed-income, and equity indices. His charts help traders visualize current market trends and they show potential changes in the market conditions.

Here is one of the charts you may find on Jeroen’s account. This is the 10-year US Treasury yield, which has arisen in the aftermath of the Federal Reserve of the United States’ June decision to signal the removal of the accommodative measures.

When a central bank like the Fed buys bonds, the price of bonds increases while the yield decreases.

The Fed’s announcement led to the market’s interpretation that the tapering of the asset purchases conducted by the Fed is close. As such, the yields have risen in anticipation and Jeroen was quick to point out the change in the market. Hence, you don’t need to follow the moves in the fixed-income markets, as Twitter will let you know on the spot of the important changes that you might need to know about.

Walter Bloomberg - @Deltaone

Walter’s Twitter account is one of the most popular among retail and professional traders and investors. What Walter does is relatively simple yet complicated.

This account tweets major headlines as events happen in the world. For example, if it is the ECB day, Walter tweets something like “ECB Decides To Leave Interest Rates Unchanged.” Most of the time, he just copies headlines and posts them on Twitter, but so quickly that the news provides value to investors so they can quickly react to the market movements.

You won’t find any fancy analysis from Walter, such as fundamental or technical, or the interpretation of the news he posts. Instead, you’ll be “hit” with fresh news all the time, without links to the source, but with relevant information, sometimes unavailable from other sources.

Such a simple approach made Walter’s account extremely popular among traders, as sometimes simple things work best.

Federal Reserve - @federalreserve

This is one account that is mandatory to follow. Anyone having the slightest interest in financial markets, not just in the FX markets, must follow the Federal Reserve’s Twitter account.

One may wonder why they should follow such an account when the Fed publishes all the information on the official website, federalreserve.gov anyway? The answer is that sometimes you have it easier on Twitter as the Fed posts the information as it comes. Hence, instead of searching the website for what is new and how the Fed is dealing with this or that challenge, the easiest way is to simply follow the Twitter account.

Whenever the Fed has something important to say, it will do it on Twitter, too. Therefore, by following the Fed’s Twitter account, traders can be sure that nothing important is missing from their analysis.

Above is a screenshot of what might appear on the Fed’s Twitter feed. It is an image with the Fed’s building in the background and an invitation to watch live the June 16 FOMC Statement, Staff Projections, and the Press Conference. The viewer is redirected to the Fed’s website where the economic events can be watched by clicking on the link provided.

European Central Bank - @ecb

The European Central Bank (ECB) is the second most important central bank in the developed world. The ECB is a central bank like no other in the sense that it sets the monetary policy over the euro area economies despite those economies being different.

On Twitter, the ECB is very active. It often publishes links to various articles about monetary policy that are posted in the blog section of the ECB’s website.

From time to time, central bankers hold speeches between 2 meetings to ensure that the market participants have fully understood their message. Twitter is just another channel used by central banks to communicate with the “outside” world. Thus, it is an integral part of the toolbox.

For example, the United States Federal Reserve delivered a hawkish statement to the markets at its June 2021 meeting. Effectively, the hawkish surprise took markets by surprise, and the US dollar rallied.

The ECB had a hard time in the few months prior to the Fed’s decision, as it did not welcome the higher EURUSD exchange rate. The Fed’s decision sent the pair lower by over 2 big figures (two hundred pips), to the ECB’s delight.

Moreover, the next day, the ECB’s Phillip Lane appeared in an interview and said that the ECB has no plans to remove the accommodative measures. The euro took another dive, and the Twitter account was one of the first places to learn about Lane’s speech.

Here is an example of a recent chart the ECB posted on its Twitter feed. It has a reference to a post on the central bank’s website, and those willing to dive into more details are free to click on the link that appears on the ECB’s Twitter feed and learn more about the recent developments.

#AskECB

One of the most interesting events hosted by the ECB happens only on Twitter. Like many other social networks, Twitter uses hashtags or #. Basically, if you tweet a word with an official hashtag, the post will be attached to all posts using that hashtag, making it easier for people to find the information they want.

For example, if one tweets something about the EURUSD, it is one thing. But if the tweet contains #EURUSD, the chances are that everyone with an interest in that hashtag will see the post.

The ECB has an official hashtag called #AskECB. Every now and again, one of the ECB Governing Council members holds an hourly session answering questions posted under this hashtag.

Effectively, anyone on Twitter may post a question and the ECB might answer it. These sessions are very powerful and transparent tools for the central bank that lead to an easier task to fulfil the mandate. Moreover, central banks have a chance to find out what people really believe and their concerns regarding monetary policy, and they can reply accordingly.

Naturally, the volatility in the euro pairs increases exponentially when an #AskECB event takes place. The more difficult the questions answered, the greater the euro’s volatility.

David Andolfatto - @dandolfa

David is the Senior Vice President of the Federal Reserve Bank of Saint Louis. The Fed has local banks that act as its arms, responsible for implementing the national monetary policy locally. Also, they provide research and local economic data for the Federal Open Market Committee (FOMC) to consider and interpret.

David has a PhD in Economics and his tweets are from a personal perspective. Yet, as is often the case, David discusses monetary policy, answers difficult questions posted by others, and provides valuable insights into how monetary policy functions and how central bankers view the economy as a whole.

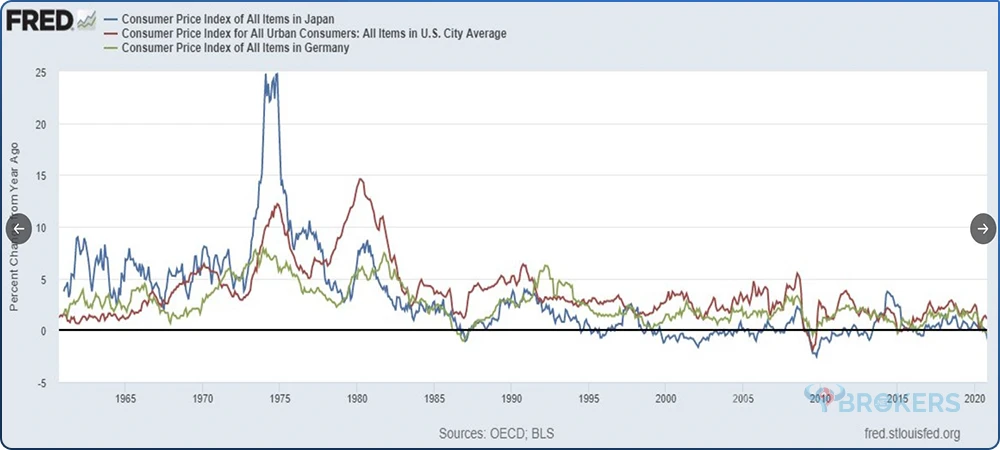

For example, this is a chart posted by David showing the change in Consumer Price Index (CPI) or inflation in Japan, Germany, and the United States since 1965. Inflation is debated strongly in the United States, as the prices of goods and services have risen to their highest point since 1981 due to fiscal and monetary expansion.

David may post such a chart to support his view regarding inflation, offering a clear picture of what matters and what does not. Also, David’s Twitter account is closely watched by cryptocurrency traders. David’s views about Bitcoin, blockchain, and the role of central banks’ digital currencies are more than interesting.

Vitor Constancio - @VMRConstancio

Vitor Constancio needs no introduction to currency market traders. He is the former ECB Vice President and its Twitter activity has increased since his mandate at the ECB expired.

To benefit his followers, Vitor often posts short threads about all things markets, particularly the euro, the ECB, and the Federal Reserve. He offers the central banker’s perspective on the markets and, thus, a valuable point of view for anyone to consider.

Vitor also discusses cryptocurrencies, often presenting what a currency stands for and why cryptocurrencies are actually digital assets and not currencies. He offers interesting comparisons and examples from the past so that followers better understand what is happening in today’s financial markets.

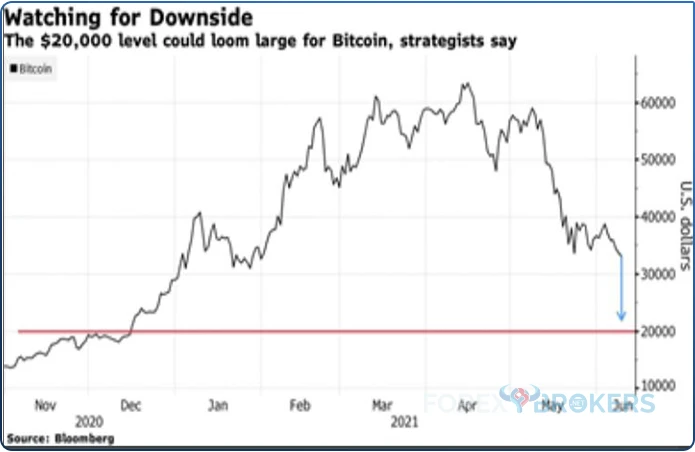

In this particular example, Vitor made a strong point arguing that Bitcoin’s volatility does not allow it to act as a store of value. The main cryptocurrency dropped from over $60,000 to close to $30,000 in just a few days.

Andreas Steno Larsen - @AndreasSteno

Andreas is the Global Chief Strategist at Nordea – a European investment bank targeting international corporations and institutional customers. Andreas has an opinion about everything markets related, from Nordic economies to emerging ones, from the Fed to the ECB and from the euro to the dollar.

His Twitter account is pretty active because he tweets daily and offers the "pulse" of the market. But his account is mostly valuable for the fact that it is one of the few accounts on Twitter that offers forward guidance on what to actually expect ahead of major economic events, such as central bank meetings.

For example, ahead of the Fed’s June 2021 meeting, Andreas was one of the few analysts calling for a possible hawkish surprise from the Fed. He even hinted that the Fed might raise the Interest On Excess Reserves (IOER) – guess what the Fed did? It raised the rate by 5 basis points.

One delight of this Twitter account is that Andreas and the team from Nordea publish at least 1 research letter weekly. The letter covers the most important topics in the financial markets for the period ahead and an analysis of what to expect.

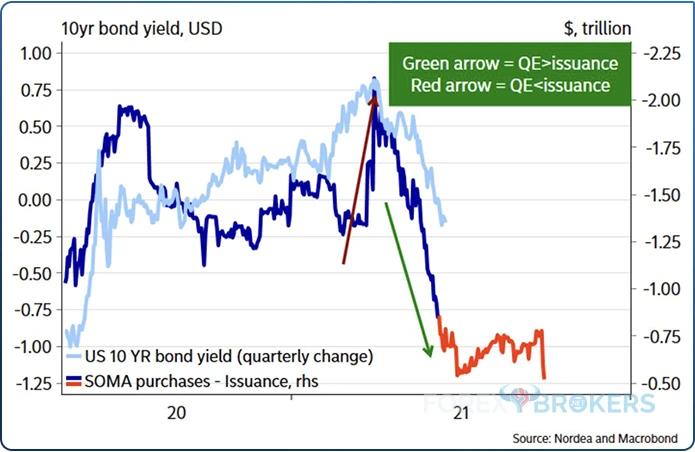

Charts like the one above are Andreas’s specialty, as he often brings interesting correlations to the market’s attention. All in all, it is a great account to follow, full of subtleties and valuable information.

Jens Nordvig - @jnordvig

Jens is an economist and the founder of Exante Data. He is currently based in New York, and the research firm he built is highly regarded in the industry.

Jens is featured in many financial publications and frequently contributes to TV shows on financial topics. He tweets about the currency market, the bond market, central banking and monetary policy, but also about topics of interest to everyone, such as the COVID-19 pandemic and its impact on financial markets and consumer behavior.

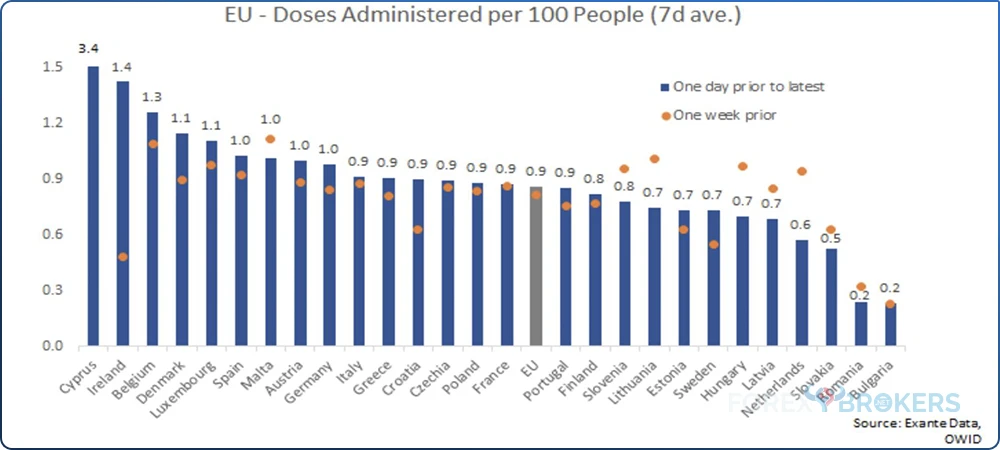

This is an example of a chart posted by Jens, analyzing the COVID-19 vaccination campaign in the European Union, highlighting the differences between countries and the evolution over time. From the same account, one can find out how volatile markets are and how the Japanese yen’s safe-haven status changes, as shown by Exante Data and other insights that are useful when trading financial markets.

Other Twitter Accounts to Consider

The Twitter accounts mentioned in this article are just some considered useful for the currency trader. Many others exist, depending on what your interests are.

There are different types of traders, from commodity traders to stock market traders, from scalpers to fundamental traders, from day traders to swing traders, and so on. But rest assured that the FinTwit community always has interesting accounts to follow, no matter the trading interest.

For those interested in macroeconomics and the global economy, Olivier Blanchard (@ojblanchard1) is a great account to follow. For those with an interest in China and how the Chinese economic landscape changes, GaveKal (@Gavekal) is the account to follow.

Grant Williams (@ttmygh) is an account to consider if you like financial podcasts. Grant has interviewed financial personalities from around the world, including successful traders and investors.

Other Twitter accounts are equally interesting; one only needs to type in the name of a person to find suggested accounts. Daniel Loeb and Gavin Bakers have great Twitter accounts dedicated to the investing world; John Turek is a must-follow when it comes to Fed policy, and so on.

Conclusion

Twitter is a social trading platform connecting individuals with similar interests. The FinTwit community is huge, so it’s impossible to follow all the Twitter accounts that offer great insights into the industry.

However, by starting with some accounts, Twitter recommends some other ones, and so on. The best part? It is free, as Twitter does not charge for being a member. Also, one can participate and share opinions, or simply check what other people say.

Like in any public space, many of the accounts are copied and spammed. Twitter fights daily with fake accounts, and the best way to make sure you are following the right account is to look for the blue checkmark. If an account does not have a blue checkmark, focus on the number of followers it has. Typically, a fake account has a small number of followers. Therefore, if you intend to follow a personality in economics, that account should have a big following.

Perhaps you are wondering why the FinTwit article is included in this section of the trading academy. Also, why should we have an article like this one here?

The answer is that times change and investors must adapt to new challenges. Twitter makes it easier to access valuable information and interact with people with similar interests; thus, the trader benefits from the new technology.

To sum up, a Twitter presence makes it easier for traders to stay in touch with everything that happens in the financial markets. Because the markets move so fast, having access to the right and timely information is critical for success when trading the financial markets.