The foreign exchange market, or FX market, is the largest in the world. The daily volume in the FX market exceeds the fixed-income market by some 15 times.

Any brokerage house now allows trading currencies besides other markets, such as fixed income, commodities, stocks, etc. Trading currencies is a complex subject, treated in this trading academy in various articles.

But not all currencies are tradeable, yet they are all exchangeable. Remember that in the FX market, an exchange rate or a currency pair expresses the value of one currency in terms of another. So, if you are bullish on one currency in a currency pair, you are automatically bearish on the other currency.

This article aims at bringing more light to the world of currencies. No less than 180 currencies exist worldwide, so it is quite daunting to talk about each of them.

Instead, this article will focus on global currency or exchange rate regimes. The reason to do so is that this way, we can group currencies of multiple nations or unions into one regime or another, thus making it easier to cover everything planned.

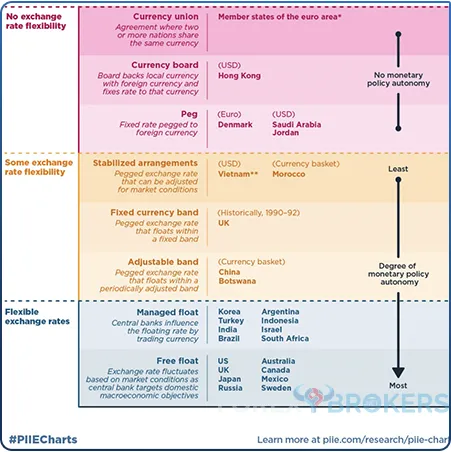

Exchange rate regimes tell a lot about a country and its monetary policies. For instance, an exchange rate regime can give countries different levels of monetary policy autonomy. In the world of trading currencies, central banks' autonomy does matter.

Moreover, the reader will find here the conditions for the ideal currency regime and what properties must be met for such a regime to be in place. Finally, the article will provide as many examples as possible to understand the complexity of the currency market.

To be clear from the start – this is NOT about cryptocurrencies.

World Currency List

As an FX trader, you will probably be familiar with most of the main currencies. The currency pairs are grouped into categories, such as majors (e.g., EUR/USD, or USD/CHF), minors (e.g., EUR/NZD, USD/SGD) or exotics (e.g., UR/HUF, EUR/TRY).

But there are more currencies in the world. Not all of them are available for trading due to various reasons, such as lack of liquidity. Because of that, they are not part of a brokerage house's offering.

Most countries have their own currencies, but not all of them. Here is a comprehensive list of all the currencies in the world and the countries that are using them (some countries use the currency issued by another country):

- Afghanistan – Afghan Afghani - AFN

- Albania - Lek – ALL

- Algeria - Algerian Dinar – DZD

- American Samoa - US Dollar – USD

- Andorra – Euro - EUR

- Angola - Kwanza – AOA

- Anguilla – East Caribbean Dollar - XCD

- Arab Emirates - Arab Emirates Dirham – AED

- Antigua and Barbuda – East Caribbean Dollar - XCD

- Argentina - Argentine Peso – ARS

- Armenia – Armenia Dram - AMD

- Aruba - Aruban Florin – AWG

- Australia - Australian Dollar – AUD

- Austria - Euro – EUR

- Azerbaijan - Azerbaijani Manat – AZM

- Bahrain - Bahraini Dinar – BHD

- Bangladesh - Bangladeshi Taka – BDT

- Barbados – Barbados Dollar - BBD

- Belarus – Belarusian Ruble - BHD

- Belgium - Euro – EUR

- Belize – Belize Dollar - BZD

- Benin - Central African CFA Franc – XAF

- Bermuda – Bermudian Dollar - BMD

- Bhutan – Bhutanese Ngultrum - BTN

- Bolivia - Bolivian Boliviano – BOB

- Bosnia and Herzegovina - Bosnian Marco – BAM

- Botswana – Botswana Pula - BWP

- Bouvet Island – Norwegian Krone - NOK

- Brazil - Brazilian Real – BRL

- British Indian Ocean Territory - US Dollar – USD

- British Virgin Islands - US Dollar – USD

- Brunei Darussalam – Brunei Dollar - BND

- Bulgaria - Bulgarian Lev – BGN

- Burkina Faso - Central African CFA Franc – XAF

- Burundi – Burundian Franc - BIF

- Cambodia – Cambodian Riel - KHR

- Cameroon - Central African CFA Franc – XAF

- Canada - Canadian Dollar – CAD

- Cape Verde – Cape Verde Escudo - CVE

- Cayman Islands – Cayman Islands Dollar - KYD

- Central African Republic - Central African CFA Franc – XAF

- Chad - Central African CFA Franc – XAF

- Chile - Chilean Peso – CLP

- China - Chinese Yuan – CNY

- Christmas Island - Australian Dollar – AUD

- Cocos Island - Australian Dollar – AUD

- Colombia - Colombian Peso – COP

- Comoros – Comoro Franc - KMF

- Congo - CFA Franc BEAC - XAF

- Cook Islands – New Zealand Dollar - NZD

- Costa Rica - Costa Rican Colon – CRC

- Croatia - Croatian Kuna – HRK

- Cuba – Cuban Convertible Peso - CUC

- Cyprus - Euro – EUR

- Czech Republic - Czech Koruna – CZK

- Denmark - Danish Krone – DKK

- Djibouti – Djiboutian Franc - DJF

- Dominica – East Caribbean Dollar - XCD

- Dominican Republic - Dominican Peso – DOP

- East Timor - US Dollar – USD

- Ecuador - US Dollar – USD

- Egypt - Egyptian Pound – EGP

- Equatorial Guinea - Central African CFA Franc – XAF

- Eritrea – Eritrean Nakfa - ERN

- Estonia - Euro

- Ethiopia – Ethiopian Birr - ETB

- Falkland Islands – Falkland Islands Pound - FKP

- Faroe Islands – Danish Krone - DKK

- Fiji – Fiji Dollar - FJD

- Finland - Euro – EUR

- France - Euro – EUR

- Gabon – Central African CFA Franc – XAF

- Gambia - Gambian Dalasi – GMD

- Germany - Euro – EUR

- Ghana – Ghanaian Cedi - GHS

- Gibraltar – Gibraltar Pound - GIP

- Great Britain - British Pound – GBP

- Greece - Euro - EUR

- Greenland – Danish Krone - DKK

- Grenada – East Caribbean Dollar - XCD

- Guadaloupe - Euro

- Guam - US Dollar - USD

- Guatemala - Guatemalan Quetzal – GTQ

- Guinea – Guinean Franc - GNF

- Guinea Bissau - Central African CFA Franc – XAF

- Guyana – Guyanese Dollar - GYD

- Haiti – Haitian Gourde - HTG

- Heard and Mc Donald Islands - Australian Dollar – AUD

- Honduras – Honduran Lempira - HNL

- Holland - Euro – EUR

- Hong Kong - Hong Kong Dollar – HKD

- Hungary - Forint – HUF

- Iceland - Icelandic Krona – ISK

- India - Indian Rupee – INR

- Indonesia - Indonesian Rupiah – IDR

- Iran – Iranian Rial - IRR

- Iraq – Iraqi Dinar - IQD

- Ireland - Euro – EUR

- Isle of Man – Manx Pound - IMP

- Israel - Israeli New Shekel – ILS

- Italy - Euro – EUR

- Ivory Coast - Central African CFA Franc – XAF

- Jamaica - Jamaican Dollar – JMD

- Japan - Yen – JPY

- Jordan - Jordanian Dinar – JOD

- Kazakhstan – Kazakhstani Tenge - KZT

- Kenya - Kenyan Shilling – KES

- Kiribati - Australian Dollar – AUD

- Kuwait - Kuwaiti Dinar – KWD

- Kyrgyz Republic - Kyrgyzstani Som - KGS

- Laos – Lao Kip - LAK

- Latvia - Euro

- Lebanon – Lebanese Pound - LBP

- Lesotho – Lesotho Loti - LSL

- Liberia – Liberian Dollar - LRD

- Libya – Libyan Dinar - LYD

- Lichtenstein – Swiss Franc - CHF

- Lithuania - Lithuanian Lita – LTL

- Luxembourg - Euro – EUR

- Macedonia – Macedonian Denar - MKD

- Madagascar – Malagasy Ariary - MGA

- Malawi – Malawian Kwacha - MWK

- Malaysia - Malaysian Ringgit – MYR

- Maldives – Maldivian Rufiyaa - MVR

- Mali - Central African CFA Franc – XAF

- Malta - Euro – EUR

- Marshal Islands - US Dollar – USD

- Martinique - Euro

- Mauritania – Mauritanian Ouguiya - MRU

- Mauricio - Mauritian Rupee – MUR

- Mayotte - Euro

- Mexico - Mexican Peso – MXN

- Micronesia, Federated States of - US Dollar – USD

- Moldova – Moldovan Leu - MDL

- Monaco - Euro

- Mongolia – Mongolian Tugrik - MNT

- Montenegro - Euro – EUR

- Montserrat – East Caribbean Dollar - XCD

- Morocco - Moroccan Dirham – MAD

- Mozambique – Mozambican Metical - MZN

- Myanmar – Myanma Kyat - MMK

- Namibia – Namibian Dollar - NAD

- Nauru - Australian Dollar – AUD

- Netherlands Antilles - Netherlands Antilles Florin – ANG

- New Caledonia – French Pacific Franc - XPF

- New Zealand - New Zealand Dollar – NZD

- Nicaragua - Nicaraguan Cordoba – NIO

- Niger - Central African CFA Franc – XAF

- Nigeria – Nigerian Naira - NGN

- Niue – New Zealand Dollar - NZD

- Norfolk island - Australian Dollar – AUD

- Northern Mariana Islands - US Dollar – USD

- Norway - Norwegian Krone – NOK

- Oman – Omani Rial – OMR

- Pakistan – Pakistani Rupee - PKR

- Palau - US Dollar – USD

- Panama – Panamanian Balboa - PAB

- Paraguay - Paraguayan Guarani – PYG

- Peru - Peruvian Nuevo Sol – PEN

- Philippines - Philippine Peso – PHP

- Poland - Polish Zloty – PLN

- Portugal - Euro – EUR

- Puerto Rico - US Dollar – USD

- Qatar - Qatari Rial – QAR

- Reunion - Euro

- Romania - Romanian Leu – RON

- Russia - Russian Ruble – RUB

- Santa Lucia – East Caribbean Dollar - XCD

- Santa Elena - British Pound – GBP

- Saudi Arabia - Saudi Rial – SAR

- Scotland - Scottish Pound – SCP

- Senegal – Central African CFA Franc – XAF

- Serbia - Serbian Dinar – RSD

- Seychelles – Seychelles Rupee - SCR

- Sierra Leone – Sierra Leonean Leone - SLE

- Singapore - Singapore Dollar – SGD

- Slovakia - Euro – EUR

- Slovenia - Euro – EUR

- Solomon Islands – Solomon Islands Dollar - SBD

- Somalia – Somali Shilling - SOS

- South Africa - South African Rand – ZAR

- South Georgia and The South Sandwich Islands - British Pound – GBP

- South Korea - South Korean Won – KRW

- South Sudan – South Sudanese Pound - SSP

- Spain - Euro – EUR

- Sri Lanka – Sri Lankan Rupee - LKR

- St. Helena – Saint Helena Pound - SHP

- St. Tome an Principe – Sao Tome Dobra - STN

- St. Vincent and Grenadines – East Caribbean Dollar - XCD

- Sudan – Sudanese Pound - SDG

- Surinam – Surinamese Dollar - SRD

- Swaziland – Swazi Lilangeni - SZL

- Sweden - Swedish Krona – SEK

- Switzerland and Liechtenstein - Swiss Franc – CHF

- Syria – Syrian Pound - SYP

- Taiwan - Taiwan Dollar – TWD

- Tajikistan – Tajikistani Somoni - TJS

- Tanzania – Tanzanian Shilling - TZS

- Thailand - Thai Baht – THB

- Timor – US Dollar - USD

- Togo – Central African CFA Franc – XAF

- Tonga – Tongan Pa’anga - TOP

- Trinidad and Tobago - Trinidad and Tobago Dollar – TTD

- Tunisia - Tunisian Dinar – TND

- Turkey - Turkish Lira – TRY

- Turkmenistan – Turkmenistani New Manat - TMT

- Turks and Caicos Islands - US Dollar – USD

- Tuvalu - Australian Dollar – AUD

- Uganda – Ugandan Shilling - UGX

- Ukraine - Ukrainian Hryvnia – UAH

- United Kingdom - British Pound – GBP

- United States Minor Outlying Islands - US Dollar – USD

- United States of America - US Dollar – USD

- United States Virgin Islands - US Dollar – USD

- Uruguay - Uruguayan Peso – UYU

- Uzbekistan – Uzbekistan Som - UZS

- Vanuatu – Vanuatu Vatu - VUV

- Venezuela - Venezuelan Bolívar – VES

- Vietnam - Vietnamese Dong – VND

- West Africa - West African CFA Franc – XOF

- Yemen – Yemeni Rial - YER

- Zambia – Zambian Kwacha - ZMW

- Zimbabwe – Zimbabwe Dollar – ZWL

Types of Currency Regimes

A currency regime, also known as an exchange rate regime, dictates the country's ability to exercise independent monetary policy. Monetary policy decisions move financial markets; therefore, a trader needs to know today's advantages and disadvantages of various currency regimes.

Nine types of currency regimes exist:

- Exchange arrangements with no separate legal tender

- Currency board

- Fixed parity

- Target zone

- Crawling peg

- Crawling band

- Managed float

- Monetary union

- Independent float

One can group them into three main categories based on the exchange rate flexibility:

- No exchange rate flexibility:

- Peg

- Currency union

- Currency board

- Dollarization

- Some exchange rate flexibility:

- Stabilized arrangements

- Fixed currency band

- Crawling band

- Flexible exchange rates

- Managed float

- Independent float

Exchange Arrangements with No Separate Legal Tender

When a country uses another country's currency, the currency regime is called dollarization. Basically, the country gives up the ability to conduct monetary policy.

Why would a country choose to do so?

For various reasons, the main one is to import another currency's stability and qualities. For example, imagine a country where inflation is rampant and out of control. In this case, dollarization might be a solution because it brings fiscal and monetary discipline.

But dollarization does not mean that all the countries adopted the US dollar. Instead, it means that a country adopts another country's currency. Hence, some countries that adopted dollarization may use the euro, for example.

Examples of countries that use dollarization (USD):

- Ecuador

- El Salvador

- Marshall Islands

- Palau

- Panama

- Timor-Leste

- Zimbabwe

Examples of countries that use dollarization (EUR):

- Montenegro

- San Marino

- Tuvalu

Currency Board

A currency board agreement is based on a country's commitment to exchange domestic currency for a specified currency at a fixed exchange rate. It works like the classic gold standard.

It has one big advantage over dollarization, and that is called seigniorage. The central bank obtains this profit from earning a market rate on its assets and paying little interest on its liabilities. The difference is seigniorage, and, in the case of dollarization, it goes to the monetary authority whose currency is used.

Basically, the currency has an explicit commitment to exchange local currency for a foreign currency at a specific rate.

Examples of countries that adopted a currency board regime:

- Bosnia and Herzegovina

- Bulgaria

- Hong Kong

- Djibouti

- Antigua and Barbuda

- Brunei Darussalam

Bulgaria

Bulgaria is part of the European Union but not a euro area member. Hence, it has its own currency – the lev.

Since the launch of the common currency, the euro, the lev has been pegged to it at a rate of 1.95583 by the currency board. Before the creation of the euro, the lev was pegged to the German Mark.

It is not to say that all European countries that are part of the European Union but not the euro area have adopted a similar currency regime. For instance, Romania has a free float currency regime, while it is part of the European Union but not part of the euro area.

Hong Kong

Since 1983, Hong Kong has had a currency board regime. The Hong Kong dollar (HKD) is pegged at 7.8 to the US dollar. However, it is allowed to move in a tight band, between 7.75 and 7.85, and the central bank must intervene to protect the peg.

In this case, the Hong Kong Monetary Authority (i.e., the central bank) is forced to maintain 100% foreign currency reserves against its monetary base. Modest fluctuations around the 7.8 parity level are allowed.

Fixed Parity

Under the fixed parity regime or peg, the fixed rate is pegged to a foreign currency or to a basket of currencies. Two bands around the parity exist, allowing the exchange rate to fluctuate between -1/+1 percent, and the monetary authority is forced to intervene to maintain the peg.

An important aspect of fixed parity is that the central bank can still act as a lender of last resort.

Examples of countries with a fixed parity currency regime (USD):

- Venezuela

- United Arab Emirates

- Saudi Arabia

- Aruba

- Bahamas

- Curacao and Saint Maarten

- Barbados

- Jordan

- Oman

- South Sudan

- Turkmenistan

- Belize

Examples of countries with a fixed parity currency regime (EUR):

- Denmark

- Benin

- Mali

- Cameroon

- Chad

- Equatorial Guinea

- Gabon

- Sao Tome and Principe

- Burkina Faso

Denmark

Denmark has a fixed exchange rate policy against the euro. Effectively, it means that the value of the local currency, the Danish krone, is stable against the euro.

While in the European Union, Denmark is not part of the euro area. By choosing a fixed exchange rate against the euro, Denmark aligns with the 2% inflation framework in the euro area.

One of the reasons why Denmark chose the fixed parity regime in 1982 was precisely high inflation coupled with high unemployment, a phenomenon called stagflation. Before the euro, Denmark kept a fixed parity between the Danish krone and the German Mark.

Denmark currently keeps the local currency in a band of +/-2.25% of a central rate of 7.46 krone to the euro. That's the theory, but in reality, the band did not exceed +/-0.5%.

CFA Franc Region

The Central African franc (CFA) is a common currency in two African regions. One is West Africa, where it is used in eight countries ( Togo, Senegal, Benin, Burkina Faso, Guinea-Bissau, Ivory Coast, Maly, Niger). Another is Central Africa, where it is used in six countries (Gabon, Equatorial Guinea, Chad, Republic of Congo, Central African Republic, and Cameroon).

Under the symbol XOF, the CFA franc is pegged to the euro at the rate of 655.957.

The two francs are interchangeable and guaranteed by the French treasury.

Oman

Oman's currency has been pegged to the US dollar at the rate of 0.3849 since 1986.

United Arab Emirates

Even though the dirham (AED) was officially pegged to the US dollar only in 2002, it has been trading at around 3.6725 since 1997.

Marocco

Marocco is an interesting case because fixed parity works against a basket of currencies. In this case, it is a euro-US dollar basket and the proportions are 60% and 40% for the euro, respectively, the US dollar.

Kuwait

Kuwait's currency regime is even more curious. The local currency, the dinar (KWD), is pegged to a basket of currencies, only the composition of the basket is unknown. It is thought that the currencies belong to the country's major financial and trading partners. In any case, the central bank declares a daily exchange rate against the US dollar.

Saudi Arabia

The riyal (SAR) is pegged to the US dollar at a rate of 3.75. The choice of the US dollar is not by chance, given that Saudi Arabia is one of the largest oil exporters in the world.

Target Zone

A target zone is similar to the fixed parity only that the horizontal bands are wider, up to +/-2% around the parity level. The Slovak Republic and Syria are two countries that use a target zone currency regime.

Crawling Peg

A crawling peg is one where the exchange rate is quickly adjusted to the changes in the inflation rate. It had huge success in Latin America, in countries such as Argentina and Chile, and it can be active or passive.

An active crawling peg has the exchange rate pre-announced for the next week. On the contrary, a passive crawling peg has the exchange rate adjusted weekly or even daily.

Crawling pegs imposes constraints on monetary policy, either backward-looking (passive) or forward-looking (active). Nicaragua and Botswana are examples of countries using a crawling peg, the first against the US dollar and the second against a basket of currencies.

Crawling Band

The bands can crawl, too. Such a regime is called fixed parity with crawling bands or exchange rates with crawling bands. It allows flexibility in that if the country decides to exit the peg, it might increase the bands at a slower pace to earn credibility in the international scene.

Examples of countries with a crawling band regime:

- China

- Ethiopia

- Tunisia

- Switzerland

- Haiti

- Guatemala

- Argentina

- Dominican Republic

- Uzbekistan

- Jamaica

- Honduras

Except for the last two on the list, the rest have the peg against a basket of currencies. The wider the bandwidth, the larger the degree of exchange rate flexibility.

Managed Float

A managed float is also called "dirty floating." The country actively intervenes in the exchange rate directly or indirectly, with no explicit exchange rate target.

Examples of countries with a managed float regime:

- Pakistan

- Myanmar

- Nigeria

- Rwanda

- Mauritania

- Vanuatu

- Algeria

- Iran

- Cambodia

- Liberia

- Turkey

- India

- Brazil

- Korea

Monetary Union

A monetary union is made by several countries adopting the same currency. The perfect example here is the EMU or the European Monetary Union.

Launched in 1992, the EMU is a cornerstone for European unity and integration. Its pillars are the coordination of economic and fiscal policies, a common monetary policy, and a common currency – the euro.

All are building blocks of a currency regime, and Europe decided to integrate its economies to gain international competitiveness. By integrating various economies, Europe has created a single market of five hundred million people.

Corporations worldwide want to sell their products and services in a single market, but with one voice, Europe stands a better chance to negate. A monetary union has an independent float currency regime.

The European Central Bank (ECB) was born as a result. It has one of the most daunting tasks in the world – to set the monetary policy for different countries in different parts of Europe.

One may argue that the Federal Reserve of the United States does the same – sets the monetary policy for all the states, regardless of the local unemployment rate in each state. However, unlike in Europe, the United States has a common fiscal framework. In Europe, the nations part of the euro maintain their fiscal independence, making it extremely difficult for the ECB to set the right monetary policy.

The following countries are part of the EMU, with Croatia joining in January 2023:

- Spain

- Austria

- Belgium

- Germany

- France

- Greece

- Ireland

- Italy

- Croatia

- Malta

- Cyprus

- Finland

- Estonia

- Netherlands

- Luxembourg

- Latvia

- Lithuania

- Portugal

- Slovak Republic

- Slovenia

Independent Float

The independent float currency regime is the pillar of the FX market. Traders from all over the world speculate on the future market movement of different currencies. Still, if those currencies are not allowed to move freely, then the market conditions are flawed.

We talk about flexible exchange rates in the case of independent or free float. More precisely, the exchange rates fluctuate based on market conditions and changes in the central banks' monetary policies.

Examples of countries that have adopted an independent float:

- Albania

- Philippines

- Romania

- Serbia

- Colombia

- Brazil

- Chile

- Canada

- Japan

- Colombia

- Georgia

- South Africa

- Thailand

- Turkey

- Uganda

- Ghana

- Hungary

- Iceland

- Mexico

- Norway

- Poland

- Sweden

- United Kingdom

- United States

- Somalia

- Indonesia

- Israel

- Korea

- Moldova

- Peru

- Paraguay

- New Zealand

Markets determine the exchange rates, and the central banks (usually) do not intervene. However, in extreme cases, they do intervene, mostly to draw attention to the market participants of specific dynamics that hurt the monetary policy.

The Swiss National Bank in Switzerland is known for actively intervening in the FX market to support the Swiss franc or to weaken it. Also, the Bank of Japan is known for intervening. It did so two times in 2022 when extreme Japanese yen weakness triggered worries that things would go out of hand. As such, the central bank intervened by selling US dollars and buying Japanese yen. The trick worked because at the time of writing this article, the USD/JPY exchange rate dropped by more than two thousand pips from the levels of the central bank's intervention.

In other words, central banks do intervene, but not to establish a level for the exchange rate, if not to prevent wild fluctuations.

The most important central banks to watch when trading currencies with an independent float regime:

- Federal Reserve of the United States

- European Central Bank

- Bank of England

- Bank of Canada

- Reserve Bank of Australia

- Reserve Bank of New Zealand

- Bank of Japan

Different Monetary Policy Frameworks

It should be clear by now that a currency regime is tight to the ability to conduct monetary policy. Depending on the type of currency regime, one country may give up its ability to set monetary policy, keep some tools available, or conduct a full range of monetary policy actions.

Each currency regime has a monetary policy framework. Five monetary policy frameworks exist:

- Exchange rate anchor

- Monetary aggregate anchor

- Inflation targeting framework

- Fund-supporting framework

- Other frameworks

Exchange Rate Anchor

In an exchange rate anchor, the central bank stands ready to intervene in such a way as to maintain a pre-announced exchange rate level or range. Currency board arrangements, crawling pegs, fixed pegs, and exchange rate regimes with no separate legal tender fall into this category.

Monetary aggregate anchor

In this case, the monetary authority wants to achieve a specific target for reserve money, M1, M2, or some other monetary aggregate. China, Tunisia, Moldova, and Uruguay are some countries that use a monetary aggregate anchor.

Inflation Targeting Framework

An inflation-targeting framework is well-known for currency traders. This framework is used by most free float currency regimes and was introduced by the Reserve Bank of New Zealand.

Under such a monetary policy framework, the central bank announces an inflation target and commits to achieving it through its actions.

All central banks listed earlier in this article have an inflation-targeting framework. However, each has a different notion of what that level is.

For example, the Federal Reserve of the United States aims at averaging inflation around 2%. When inflation is well above two percent, the monetary policy becomes restrictive. Conversely, the monetary policy becomes expansive when it drops below 2%.

Central banks' inflation levels may differ in other parts of the world. However, all central banks have one thing in common. That is, inflation targeting is done way above the zero level. This way, central banks have room to maneuver, and the consensus is that 2% inflation is healthy for stimulating economic growth.

Fund-Supporting Framework

Such a framework works in accordance with what the IMF (International Monetary Fund) suggests. Accordingly, floors and ceilings for international reserves, respectively, net domestic assets, are agreed upon and set.

Other Frameworks

In this case, there is no stated nominal anchor. Instead, the monetary authority monitors different indicators and sets the monetary policy accordingly.

The Ideal Currency Regime

The last thing to cover in this article is the concept of the ideal currency regime. All the currency regimes that exist have some advantages and disadvantages, but no one is perfect.

As such, as a rule of thumb, the ideal currency regime does not exist. It must have three properties, but fulfilling them all at once is impossible.

First, an ideal currency regime needs a credible exchange rate. Second, the currencies must be fully convertible. Finally, monetary policy should be independent in each country.

So why a currency regime can't have all three properties? Because by fulfilling the first two of them, then it means that there would be only one currency in the world.

Conclusion

The currency market is huge, with trillions worth of dollars changing hands daily. Brokers offer access to numerous currencies for traders to speculate on their movements, but many other ones exist.

Currencies move based on central banks' actions and economic performance. A currency regime may or may not consider economic developments before setting the monetary policy.

However, anchoring inflation is one of the main reasons why some nations gave up their ability to conduct monetary authority. By pegging their currency to another one, more stable, they gain credibility and control inflation.

An inflation-targeting framework is most popular among free-floating currency regimes. Central banks target inflation around 2%, a level that gives them the flexibility to set the proper interest rates during times of economic expansion and contraction.

Knowing the currency regime in one country helps investors understand what to expect from that respective currency. If, for instance, the central bank must intervene to keep the exchange rate in a corridor, it makes no sense to expect the corridor to be broken anytime soon.

For currency traders, the free float currency regime is the core of the FX market. Anything else is just speculation that the monetary authority will adopt a new currency regime or it will be forced to do so.

No currency regime is perfect. Each has flows, but for different countries, some are better than others. It also has to do with the political regime of a country. The reader might notice that some countries that have long struggled to deliver economic growth and prosperity to their population have specific currency regimes.

Or, some other countries, more powerful from an economic point of view, have adopted a different currency regime. In any case, knowing them all, with their flaws and qualities, is useful to the modern trader and investor.