If trading and investing were easy, everyone would be rich. Success in financial markets means making more money than at a regular job. Trading for a living means getting out of financial markets enough to make ends meet. But no matter how much one learns about markets, it is still not enough without mastering market psychology.

Market psychology is a vast subject. Is it about markets? Not really – it is more about the trader and the reactions in front of the unknown. Also, who is in front of a trade? Who is on the other side of a trade? That is another trader, another human being with ambitions and aspirations.

Therefore, mastering market psychology means mastering human behavior. Before saying that most of the trading in the 21st century is done by algorithms or robots, think of the fact that someone must program these robots to trade or know where to enter and exit the market. Feelings may not be involved. in the execution part, but there is always room for greed and fear on the programming part.

This article aims to cover the psychology of trading financial markets both from a theoretical perspective and by using some well-known examples. Sometimes, the simplest things are the most effective ones, so why not look back at what happened in the past and learn from other traders' and investors' mistakes?

Above all, this article should be a guide for what the investor should do. By using examples, the aim is to present situations from the past from which everyone should have learned something. And so, to use what is learned to master market psychology in the future.

Finally, knowing when the markets move is key to overcoming periods of market inactivity. In doing so, the trader better handles the temperament and the need to do something when there is nothing to be done in the financial markets.

The Case of Cryptocurrencies

Cryptocurrencies have appeared relative recently. However, the popularity of cryptocurrencies reached extreme levels in only a few years. Suddenly, everyone with the desire to get rich quickly has entered the cryptocurrency market. Some of the projects were legit, but the lack of regulation also brought many crooks into the market.

One can look at the cryptocurrency owners as belonging to different categories. First, there were early adopters – those who believed in the ecosystem and the promise of decentralized finance. They invested early and advocated for cryptocurrency adoption by institutional investors. The logic was that the more investors pile in, the higher the price will rise.

Second, there were the so-called holders, or investors, vowing never to sell their crypto assets. And then, speculators or people attracted by the cryptomarket's high volatility. Indeed, it happened – prices of cryptocurrencies began to rise. Bitcoin, the leading cryptocurrency, became the fastest asset ever to reach a market capitalization of $1 trillion. In comparison, it took Microsoft 44 years to reach a similar market capitalization, Apple 42 years, and Amazon 24 years. Bitcoin only needed 12 years to exceed a market capitalization of $1 trillion.

It speaks of the frenzy and excitement in the cryptocurrency market. Suddenly, retail traders saw it possible to amass fortunes with a small investment. Together with the cryptocurrencies' popularity, the industry evolved too. Cryptocurrency exchanges appeared literally overnight. Some of them grew so fast that they soon handled billions and billions in customers' funds. Unfortunately, as it turned out later, scams were unavoidable (e.g., the FTX saga).

The point here is that the quick rise in cryptocurrencies' popularity led to market behavior that hurt investors. And this brings us to the first example in this article – the laser eyes.

Laser Eyes

During the COVID-19 pandemic, online activity increased substantially. Forced into lockdowns, people consumed more online products and services than otherwise.

Naturally, the trading activity increased. More retail traders came to the cryptocurrency market, the US dollar was sold aggressively and stocks made a new all-time high almost on a daily basis. The laser eyes phenomenon created the fear or missing out sentiment. Bitcoin struggled with the $10k level for a while, and after it broke higher, it did not stop all the way to $30k.

And then, Tesla announced that it had invested $1 billion in Bitcoin. What followed was that Tesla fans started to buy cryptocurrencies, too, the company's CEO, Elon Musk, was actively involved in Bitcoin and Dogecoin, and the next thing you know, Bitcoin traded over $60k.

In any bubble, investors chase prices higher for fear of missing out on the next big move. Making money seems easy; everyone can do it, so why don't you?

And so the laser eyes saga began when cryptocurrency enthusiasts changed their profile pictures on social media with laser eyes. It was their way of saying that they are fans of cryptocurrencies, not necessarily of one particular currency. That moment coincided with the top. In hindsight, it looked silly, but the market behavior did not look so irrational at that point.

However, by the time it was obvious that everyone was into cryptocurrencies, the selling began. Bitcoin reached an all-time high above $69 and then kept sliding and sliding. By the time it fell below $30k, laser eyes had started to disappear from people's social profile pictures.

A so-called "crypto winter" started in November 2021, and a bearish market led the price of Bitcoin all the way down to below 16k. Even the most fervent investors, the ones who vowed never to sell their Bitcoins, had doubts.

The moral of the story – collective behavior influences market activity and retail traders usually pay the bill.

Bitcoin – Buying the Dip?

One of the most interesting phenomena linked to market psychology is the plan to "buy the dip". Human nature is, once again, playing a trick with investors' heads, as very few are the ones that buy the dip when they see one.

The phenomenon is particularly visible in the stock market but frequently occurs in other markets, too. The idea behind it is that investors fear buying a top. As such, they plan to buy the next serious dip, thus profiting from the market decline in order to get a better entry price. But faced with a rapidly declining market, most of the traders fail to buy the dip.

How come? Simply put, they get scared.

Bearish markets decline fast, and pulling the trigger on a rapidly declining market is not easy. Also, it may be very costly.

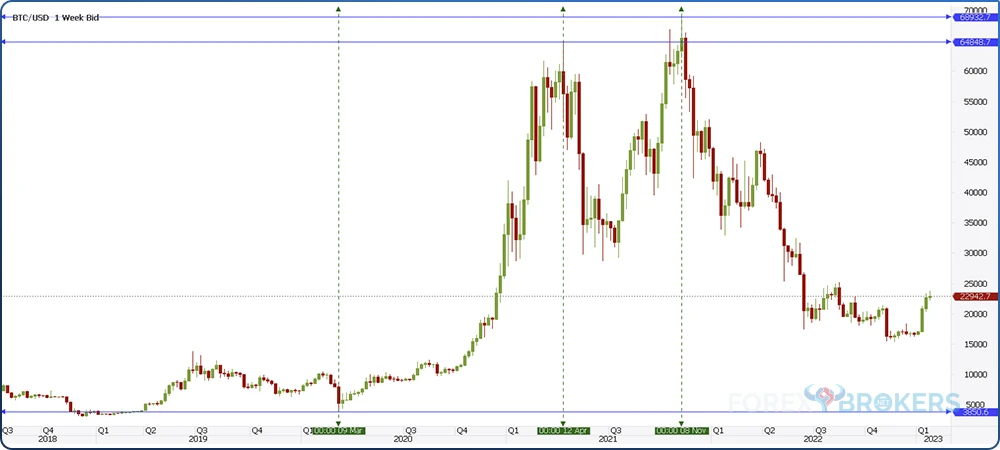

Below is the Bitcoin weekly chart. It shows the price action in the last few years with the rally that characterized the cryptocurrency market frenzy.

During the COVID-19 pandemic of 2020, Bitcoin prices surged. By mid-2021 it traded as high as $65k before correcting. From $65k, Bitcoin fell aggressively to $30k. It erased more than half of its market capitalization. Was a "buying the dip" strategy worthwhile?

It depends on the time to hold the horizon. Those who bought the dip and sold on a new all-time high probably did well. But those who bought the dip and held to it are sitting now on a massive loss. The "buying the dip" idea comes from the technical setup of a bullish trend. Bullish trends have a series of higher highs and higher lows, the traders try to buy the dip while the higher lows are still in place.

The panic comes when the higher lows series is broken because it is implied that the bullish trend has ended. As such, many traders get scared to buy the dip as the price action comes closer to the previous higher low.

Another tricky decision comes when and if the market makes a new higher high – as Bitcoin did. Is the bullish trend re-established now that the price action has reached a new higher high? Therefore, should you buy the dip?

The idea behind this market behavior is that traders plan to buy the dip, but they often get scared by the velocity of market declines. As such, buying the dip strategy rarely works alone.

NFTs Mania

One final example connected to the cryptocurrency market involves NFTs or Non-Fungible Tokens. An NFT is a digital identifier recorded in a blockchain – it cannot be copied or subdivided.

In other words, once you have one, it is yours.

But the sheer reality punished NFT investors. At the height of the NFT bubble, people spent millions on one single JPEG image of a monkey. Is it of any use? Is it worthless? No one knows for sure, but the ones purchasing NFTs did so, hoping that they would find someone else later down the road to pay a higher price for it.

Only that what happened is that the market for NFTs collapsed, and with it, the NFTs value. Just because the price of an asset, be it even a digital one, keeps rising, it does not mean that it will do so forever. The lesson here is not new because it happened in the past (e.g., Tulip mania) and will probably happen again.

The Case of the Swiss National Bank

A classic example of how market psychology plays a trick on investors is the case of the Swiss National Bank. This is one central bank like no other in that it has public shares, and it makes no secret that it often intervenes in the FX market to support or sell the Swiss franc (CHF).

The EUR/CHF peg was introduced in 2011. It established a floor under the EUR/CHF exchange rate, as the SNB vowed to keep it above 1.20.

It was scared that the Swiss franc's strength would hurt the economy, so the SNB was willing to sell all the francs and buy all the necessary euros to keep the exchange rate above 1.20. It did so for years and was quite an effective matter. During particular periods in the years that followed its decision, the SNB managed to lift the exchange rate above 1.21 and even more.

However, it inevitably returned to pressure on the 1.20 floor. The answer came from the euro area and the European Central Bank's plans.

Under Mario Draghi, the former ECB President, the central bank planned to cut the rates in the euro area into negative territory. In doing so it was the first major central bank to do so, and it would hurt the euro.

But the SNB has vowed to buy euros and sell Swiss francs to protect the EUR/CHF floor. Therefore, something had to give and the one that one was the Swiss National Bank.

In January 2015, years after it protected the 1.20 EUR/CHF floor, the SNB gave up. The announcement was a shocker one for the financial markets.

EUR/CHF literally collapsed, with no bids seen for minutes. Traders believed what the SNB promised and bought the EUR/CHF with stops at 1.20. But when the SNB was no longer there, the stops were useless because there was no market available below 0.90.

Yet, some traders did take the other side of the SNB's bet. Some were actually betting against the SNB's ability to keep the floor, and the rewards were impressive.

The moral here is that doing what central banks suggest and what other traders do is not necessarily the right approach to successful trading. Market participants were too focused on the SNB and put their guard down instead of monitoring the price action and remaining vigilant.

George Soros and the Bank of England

Diversification is one of the ways to reduce risk when investing. The secret is to find the right diversification level that allows a portfolio to grow. For instance, the 60/40 portfolio. This basic diversification strategy requires investing 60% of a portfolio in equities and 40% in bonds.

But not everyone is a fan of diversification. Sure enough, it brings the investor peace of mind, but the higher the diversification level, the lower the return. Some investors advocate going "all in" when you find the right trade. Such was the case of the legendary investor George Soros, who brought the Bank of England to its knees and took an opposite bet than the rest of the market participants.

If you want, what Soros did with the British pound and the Bank of England is similar to the investors that stood against the Swiss National Bank when it dropped the EUR/CHF peg.

In 1992, on a Wednesday, Soros made $1 billion in profit from betting against the Bank of England. More precisely, it bet that the Bank of England will exit the European Exchange Rate Mechanism.

It did, as the central bank was forced to let the local currency, the British pound, be revaluated at more appropriate levels by the free market. In building such a position, Soros understood the market psychology better than anyone because his bet was that market speculators would not believe that the British government could contain the short selling.

Investing – A Combination of Intellect and Temperament

It is said that an investor or trader should plan first and execute second. But investing can be extremely boring. Planning is one thing, but executing is another. The investor's temperament will define an investment's success, not the strategy.

More often than not, emotions scream at the investor to do the wrong thing. Imagine any investment in a stock, bond, currency or currency pair, and then a major exogenous event appears. The temperament is key – it can ruin an investment, but it can also do the opposite. Many famous investors trade aggressively, going all in if they are convinced of their judgment. The secret source is not their resources and capital but their willingness to stick with the trade unless the picture changes and until the exit point is reached.

Such investors use risk-reward ratios of 1-40. Effectively, it means that for every unit of risk, they stand to gain forty times more reward.

Are they successful every time? Definitely not.

Very often, they are wrong, like all traders and investors. But when they are right, the defining winning trait is that they stick to their guns and hold on to the gains.

Let the profits run!

Sitting on Your Hands

One of traders' biggest mistakes is acting when they don't have to. Financial markets are always open; therefore, the trader feels the need to do something because the markets are moving. But that is not always the recipe for success. In fact, it is often the recipe for failure.

Having no position in the markets is a position. It means that the trader awaits a better entry-level or that the market is in a consolidation, which it often is.

Patience is critical in trading; waiting for the right moment to trade is the key to success. Most importantly, no one can have only winning trades. Also, no one can take all the trades the market offers.

Consider a technical trading setup in the currency market. It is based solely on technical analysis and has nothing to do with fundamentals.

If it works on one currency pair, it should work on all. However, any regular brokerage house is offering tens of currency pairs nowadays. Is it possible to scan and monitor all these markets? As a manual trader, that is not the case. It is, however, possible to do so when trading with the help of a robot or an expert advisor. But even in this case, the trader must always be involved in managing the positions' size and be ready to intervene at any time.

In other words, one should never feel like missing an opportunity in the market. Opportunities always exist, but it matters how they are approached.

Know When the Markets Move

Some traders are frustrated when the markets move without them being present. Depending on the market and the time zone the trader lives in, it may be useful to change trading habits.

Not all markets move at the same time and to the same extent. Therefore, knowing when the markets move should be part of the trading process.

There are three trading sessions every day when financial markets move: the Asian, European, and North American sessions. Out of the three, the Asian session is the slowest one, followed by the European trading session. Obviously, the North American trading session is the most volatile.

How come?

The answer comes from the US having the largest equity market in the world. Also, it has the largest economy in the world. Finally, American investors are nothing like investors from other parts of the world, as the investing culture is widespread.

So, if you are an investor or trader living in Asia, there are a few things to do to adapt to the lack of market volatility. One is to change the trading time to adjust to the time when the markets do move. This is recommended only in the case of day traders or scalpers.

The rest might use the larger timeframes to analyze the market. Also, pending orders help too. But in any case, investors should be aware of the times when markets move and when they don't. It makes no sense to prepare for a big market movement when, in fact, the market may be closed.

For example, most of the US holidays are on a Monday. The US stock market is closed as a result, and the US banks too.

It means that the volatility in all other markets will decrease significantly on such a day. Therefore, the trader might use the time to do something else – research, taking a day off, etc. – because the markets will not move.

Forex

The forex market is the largest one in the world. There is no other big market in terms of the number of market participants or the amounts exchanging hands daily.

One of the most interesting things about the currency market is that it is open around the clock, five days a week. Also, it is the most liquid in the world, meaning that at any one point, a trader should have no difficulty selling or buying large quantities in the market. Sure enough, some currency pairs are more liquid than others, but there is enough liquidity for retail traders to satisfy all needs.

Even if the currency market is open five days a week, there are some things to consider when making a trading plan. First, the trader should look at the calendar ahead and spot if there is a holiday during the week. As mentioned earlier in the article, holidays can drain liquidity from the market and lead to no movements. Hence, no opportunities exist for the speculative trader.

Second, the trader should be aware of any significant event that might impact the market. In particular, central banks are the ones that move the FX market. Therefore, any significant interest rate decision from the main central banks, such as the Federal Reserve of the United States, the European Central Bank or the Bank of Japan, may affect trading conditions.

For example, the Federal Reserve interest rate decisions are on a Wednesday afternoon in the United States. Because of that, there is little or no price action in the prior two trading days of the week, so opening a big position ahead of such an important event is not recommended.

Stocks

Stocks are open during the trading week for limited hours. In the United States, the New York Stock Exchange (NYSE) and NASDAQ are open from Monday to Friday from 09:30 AM to 04:00 PM.

But some stocks trade after hours, too. Also, the main stock market indexes are traded on futures exchanges, making it easier to track the stock market movements even after the closing hours.

Greed and Fear

Greed and fear are often responsible for losses in a trading account. It sounds so simple to overcome them, but in reality, they are the cause of wrong trading decisions. Statistically, chances are not in the trader's favor. Even brokerage houses have the percentage of traders that lose money with that broker on their front page and the percentage is not small at all.

Also, because of the spread, any trade starts with a handicap. Nowadays, the spreads are not as big as they used to be, but they still matter. The spread and the commission for trade are typically deducted from the trading account once a trade is initiated. Therefore, they account as losses right from the start.

Moreover, most of the time, the market goes against a trade in the incipient phases of a trade. It is extremely improbable that all entries are perfect and a position will show a gain immediately after a trade is executed.

So there it is – fear intervenes when the market goes against your position. That is, the fear that it will not reverse. Another type of fear is that the market will reach your stop-loss only to reverse and go in the original direction. This is the fear of missing out, or FOMO, and leads to traders widening their stop, hoping the market will reverse.

How about greed?

Traders are often encouraged to add to a winning position and avoid adding to a losing one. But what do you do when you add to a winning position only to see the market suddenly moving in the opposite direction? Basically, you doubled your bet just before the market reversed just because of greed to make more than the initial plan.

Don't Fall in Love with a Trade

Successful traders avoid making decisions based on emotional biases. That is easier said and done, as no one is perfect.

A more accurate statement would be that successful traders understand that emotional biases usually lead to losses and try to overcome them as much as possible. With time comes experience and with experience, the trader learns what to do in certain situations when it may look like the market is cornering you.

Sometimes, illusions are more comfortable than reality. For example, one may have a bias that the EUR/USD exchange rate will move above 1.25 from the current 1.06. Sure enough, the trader would prefer the bullish setups and ignore or trade the bearish ones differently. This is a classic mistake because speculating in financial markets should work both ways, long or short, without any particular preference.

There is no such thing as a perfect track record in trading. Also, there is no such thing as only winning trades.

This should be the starting point when working on improving trading psychology and understanding the psychology of markets. Success in trading is the sum of both winning and losing trades, with the former ones' outcome being bigger.

Negativity and Status Quo Biases

Some biases help us understand more about market psychology. Two of the more representative ones are negativity and status quo biases.

The negativity bias is when you are influenced by negative events that have a stronger impact on your reasoning than positive ones. Because of that, one is inclined to give up on a trading strategy instead of just making some small adjustments.

The status quo bias refers to situations when the trader assumes that conditions from the past will work in the current market environment. Such a bias is common among technical traders.

With so many technical indicators around, it is difficult to imagine that no single combination of indicators provides the perfect forecast. As such, many technical traders look for such a combination and often, their strategy works for some periods of time. However, there is no guarantee that if they did work in the past, they would do so in the future, as the markets always adapt.

How to Improve Trading Psychology?

To improve trading psychology means dedicating time and passion to financial markets. Two of the must-do things are planning and executing.

Plan Your Next Steps and Execute the Plan

Planning is critical. This article stressed the importance of knowing when the markets move, which is part of the planning process. Researching in advance helps overcome fear and greed. For example, consider that you trade on the first Friday of any given month. Typically, this is the time when the Non-Farm Payrolls report is released in the United States.

Now, assume that the report triggered a market move opposite to what you wished. Instead of panicking, you should know what might move markets the following week. The events scheduled for next week are often more important than the current ones and impact markets more. If the Federal Reserve meeting is due next week, the market will focus on that and ignore the Non-Farm Payrolls report.

Build a Trading Strategy and Execute It

Technical traders like to believe that by finding a technical trading setup, emotions do not play a role in trading. That is correct to some extent, but there is always the fear of markets changing.

Algorithmic trading made it possible to program robots to take all the trading setups as long as markets are open. But even so, traders must intervene ahead of events that may trigger increased volatility.

Nevertheless, technical setups result in improved trading psychology; thus, it is worth building a trading strategy and executing it according to the plan.

Conclusion

Market psychology has a lot to do with the psychology of the crowds as well as with knowing your traits as a trader, strengths, and weaknesses. To master the trading game, one must understand the rules of the game, but also what drives market participants.

Fear and greed are two of the main reasons why investors fail in the long run. Greed leads to overexposure, thus an increase in risk, while fear leads to missing opportunities when opportunities present themselves.

Throughout history, there are plenty of examples when successful investors mastered market psychology and they realized significant returns. In this article, we covered some of the most famous ones, such as when George Soros bet against the British pound or the Swiss National Bank gave up the 1.20 exchange floor in place for years on the EUR/CHF exchange rate.

As an investor, one must look for an edge. For some investors, technical analysis is the focus, and a trading strategy well-executed represents their edge over others. For some other investors, understanding the crowds and their behavior is enough for placing successful trades.

Trading psychology impacts the way the trader acts, with a secondary impact on the performance displayed by the trading account. To improve it, traders should focus on their personality traits, overcoming biases, and understanding the market they are active in.

Trading financial markets lead to an emotional rollercoaster that is challenging to overcome. For many traders, this is the most difficult process that stands in the way of their success. But the path to success becomes clearer through discipline, planning, and awareness of how markets function and when they move.