Every financial market participant is familiar with equity indexes, such as the Dow Jones and the S&P 500 in the United States, Xetra Dax in Germany, CAC-40 in France, or Nikkei 225 in Japan. Indexes are used to analyze the performance of an entire security market, and they were first introduced to reflect the performance of the U.S. stock market.

However, other indexes exist, too, such as fixed-income indexes or alternative investment indexes. This article covers everything there is to know about indexes, focusing on equity indexes.

Before discussing the different types of indexes, we will cover the basics of indexing, such as calculating a single-period return and the return over multiple periods. Moreover, the article will explain the different ways of weighing an index as well as introduce the concepts of index rebalancing and reconstitution. Indexes have many uses, but they are mainly known for acting as a gauge of market sentiment. For instance, if the S&P 500 index declines more than 20% from the top, the equity market is said to enter bearish territory. Thus, the index is viewed as the market, and financial market participants aiming to beat the market use the S&P 500 index as a benchmark.

Equity indexes are the most numerous, and many types exist within this category, such as style or sector indexes. However, fixed-income indexes and alternative investment indexes also exist although they are not so wildly followed. For example, commodity or real estate indexes are not as popular as equity indexes but play an essential role in financial markets.

Indexes are the basis for new investment products and offer a way of participating in the market. For instance, many exchange trading funds (ETFs) track indexes, thus offering a cheaper way to invest in the market.

What Is an Index?

An index is nothing but a portfolio of securities called constituents. Every index has a certain number of constituents that represent a market or just a market segment. For example, equity indexes have only equities as constituents, while fixed-income indexes are made of fixed-income securities. Also, the Dow Jones is an equity index formed out of 30 companies in the United States.

Securities are added to an index based on certain rules, such as profitability or the country of incorporation. Also, the size of a business may be one criterion to build an index.

An index serves various purposes, but the most important is its use as a benchmark for actively managed portfolios. Consider having a stock portfolio and wanting to compare its yearly performance with the overall market. In this case, the S&P 500 index is a benchmark for comparing the portfolio's returns. Also, indexes are used as proxies for modeling returns and systematic risk. A challenge is to decide what index to use as an appropriate benchmark because choosing the wrong index could lead to misleading performances.

Two versions of every index exist — price and total return index. The difference between the two is that the total return index considers interest, dividends and other distributions on top of the price appreciation. Therefore, when talking about an index performance, it is important to know what type of return is presented - price return only or total return.

Price Return vs. Total Return

As mentioned earlier, the price return of an index only considers the price appreciation or depreciation over a period. More precisely, let's consider an index with a value of 1,000. Suppose the index reaches 1,100 at the end of a period. In that case, the appreciation or price return is 10%, calculated as the price at the end of the period less the price at the start of the period and dividing the outcome by the initial index price: (1100-1000)/1000=10%.

In the same manner, we can calculate the price return of any security part of an index. For example, Tesla is part of the S&P 500 index, and if we want to calculate the price return over a period, we should follow the same procedure.

Tesla does not pay dividends at the time of writing, so the total return, which includes interest and dividends, would be equal to the price return. However, many companies do pay dividends. Therefore, when calculating the total return of either one index or a constituent of an index, dividends must be included. Because of that, the total return is always bigger than the price return when dividends are paid.

Single Period vs. Multiple Periods

In the paragraphs above, we discussed single-period returns. But how to calculate the return of an index over multiple periods? For example, let's assume the S&P 500 index delivered +14%, +16% and -10% in three consecutive years. What is the price return of the index over the period?

To solve it, we should multiply the index's initial value by the annual performance to find the ending value. In the example above, we should multiply the initial value by 1.14, 1.16, and 0.9, respectively.

Different Types of Index Weighting

Not all indexes are weighed the same. For this reason, it is important to distinguish between different weighting methods — price, market capitalization, fundamental and equal.

Price

Dow Jones is one index representative of the price-weighting method. Under this method, the weight of each constituent is calculated by dividing its price by the sum of the prices of all constituents. One of the issues with price weighting is that it creates arbitrary weights in the case of a stock split.

Market Capitalization

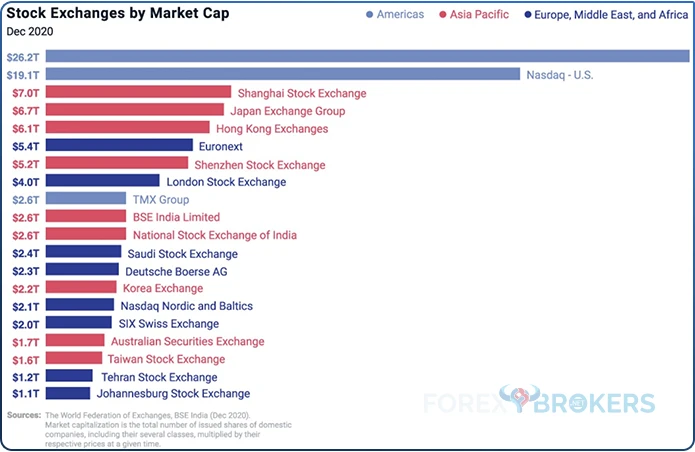

Also called value weighting, market capitalization weighting is extremely popular. The weight in the index is determined by dividing the security's market capitalization by the entire market capitalization of all the constituents. On a side note, market capitalization is calculated by multiplying the number of shares by the price/share. The problem with this method is that securities with the biggest price jump would weigh more in the index.

Fundamental

Fundamental weighting uses a company's metric to attribute weights to the securities in the index. Popular metrics are number of employees, revenues, or cash flows.

Equal

As the name suggests, equal weighting means that each constituent has an equal weight. An advantage is the method's simplicity, but maintaining equal weights is time-consuming, and regular adjustments are needed.

Rebalancing

Whenever the weights in an index are adjusted, it is said that the index is rebalanced. Rebalancing takes place on a regular basis, and price-weighted indexes are not rebalanced.

Reconstitution

Whenever the names of the securities in an index are changed, the index is said to be reconstituted. For instance, the last changes in the Dow Jones index components took place on August 31, 2020—Amgen, Honeywell International and Salesforce were added, while Exxon Mobil, Pfizer, and Raytheon were dropped.

Equity Indexes

Equity indexes are the most numerous ones. Multiple types of equity indexes exist, such as broad-market or multimarket indexes and each of them is useful for different types of investors.

To illustrate, consider the Russell 3000 index. This index is made of the largest 3,000 companies in the United States by market capitalization. As such, it covers almost the entire U.S. stock market, and thus, it is a broad-market index. Other examples of broad-market indexes are the Shanghai Stock Exchange Composite Index (SSE) and the Wilshire 5000 Total Market Index.

Multimarket indexes represent the entire world or only a specific region or country. One example is the MSCI international equity index. MSCI stands for Morgan Stanley Capital International, a research firm providing stock indexes and performance analytics, among others, and it calculates indexes for developed, emerging, and frontier markets.

Examples of Equity Indexes

Many equity indexes exist in the world, and a different article from this trading academy will cover more about the most important indexes in the world. At this point, the intention is to list some of the most famous indexes and introduce them to the reader.

The next section of this article comprises some of the most relevant indexes in the world and, in some cases, the list of their constituents and the sectors they are active in. Such a comparison is useful for a comprehensive understanding of how indexes are composed and how the constituents represent different sectors.

MSCI Indexes

The simplest way to explain the concept of an index is to use MSCI indexes as an example. The problem for many investors in a global economy is the large number of securities worldwide—close to 30,000. Because of that, indexes help filter the securities based on certain criteria.

MSCI stands for Morgan Stanley Capital International, an investment firm that provides stock indexes. To construct an index, MSCI starts by defining the securities that are eligible for an index. Out of all the investable securities, only some are eligible—ordinary and some preferred shares, share equivalents such as American depository receipts (ADRs) and real estate investment trusts (REITs). ETFs, mutual funds, or equity derivatives such as options and futures contracts are not eligible.

Moving forward, the company applies investability screens based on three requirements. First, the company tries to assess the share capital available for investors. In doing so, it analyzes both the free-float and full market capitalization to also consider the value of shares provided through stock issuance plans. Second, the shares must be accessible to international investors. Finally, stocks must have sufficient liquidity.

The MSCI calculates indexes covering countries, sectors, and regions and even ones that focus on the size of a company. To exemplify, to assign a company to one specific sector, the MSCI classification uses the Global Industry Classification Standard (GSCI). This is made of 11 sectors and 24 industry groups from 69 industries and 158 subindustries. Because the world's equity universe is constantly changing, there is a need for an objective and transparent process.

Dow Jones

Dow Jones is one of the most famous equity indexes in the world and the oldest. First introduced in 1884 by Charles Dow and Edward Jones, it includes 30 large, blue-chip American companies.

The companies have different weights based on the price of the stock. In other words, this is a price index, and the weight of one constituent is calculated by dividing the price of its stock by the sum of the prices of the other constituents' stocks.

For instance, at the time of writing, Microsoft is in fourth place in terms of the Dow's weight, following UnitedHealth Group Incorporated, Home Depot, and Goldman Sachs. Its weight in the index is double that of American Express, another Dow constituent, and so the index will fluctuate more with changes in the price of Microsoft shares than with changes in the price of American Express shares.

Here's a list of the 30 Dow Jones constituents ranked by their weights at the time of writing:

- UnitedHealth Group – ticker: UNH

- Home Depot – ticker: HD

- Goldman Sachs – ticker: GS

- Microsoft – ticker: MSFT

- Salesforce – ticker: CRM

- McDonald's – ticker: MCD

- Amgen – ticker: AMGN

- Visa – ticker: V

- Honeywell International – ticker: HON

- Caterpillar – ticker: CAT

- Boeing – ticker: BA

- Apple – ticker: AAPL

- 3M – ticker: MMM

- Johnson & Johnson – ticker: JNJ

- Nike – ticker: NKE

- American Express – ticker: AXP

- JPMorgan Chase – ticker: JPM

- Procter & Gamble – ticker: PG

- Travelers Companies – ticker: TRV

- Walt Disney – ticker: DIS

- Walmart – ticker: WMT

- International Business Machines – ticker: IBM

- Chevron – ticker: CVX

- Merck & Co. – ticker: MRK

- Cisco Systems – ticker: CSCO

- Coca-Cola Company – ticker: KO

- Dow – ticker: DOW

- Verizon Communications – ticker: VZ

- Intel – ticker: INTC

- Walgreens Boot Alliance – ticker: WBA

S&P 500

The S&P 500 is one of the American indexes mostly used as benchmarks for the overall market. This is because it has 500 constituents from many sectors, basically representing the market. Many companies are part of more indexes. For example, Microsoft is also part of the Dow Jones index. Another example is Amazon, part of both the S&P 500 index and the NASDAQ 100 index.

Other representative companies in the S&P 500 index are Bank of America, Pfizer, Adobe, Netflix, and PepsiCo.

Russel 3000

The Russel 3000 index is another wildly monitored index. It measures the performance of the largest 3,000 companies in the United States and covers about 97% of the equity investable universe in the country.

One thing to consider about Russel indexes is that their name might be misleading. For example, the Russel 2000 index does not measure the performance of the largest 2,000 companies in the United States. Instead, it tracks 2,000 small-cap companies or companies that have a market capitalization smaller than $2 billion.

Wilshire 5000

The Wilshire 5000 is a market capitalization-weighted index established by Wilshire Associates in 1974. It measures the performance of the most publicly traded companies in the United States and for many years, was under the administration of Dow Jones. During that time, the index's name was Dow Jones Wilshire 5000, but the partnership ended in 2009.

It was named after the number of securities in its componence, but in time, it has grown to include over 5,000 constituents. Apple, Microsoft and Amazon are members of the Wilshire 5000 index.

TOPIX

TOPIX, or the Tokyo Stock Price Index, is a Japanese index covering an extensive proportion of the Japanese stock market. The start of calculation for the index was July 1969, and the initial value was 100 points. This float-adjusted market capitalization index represents over 90% of the market value of all Japanese equities.

It is made of two sections: a first section containing the largest companies in the index and a second section containing the smaller ones. It is made of roughly 2,000 stocks and is regarded as the benchmark index for the Japanese stock market.

An interesting fact about TOPIX is that the top 20 stocks in the index are approximately 25% of the total weighting. Among the top constituents are Toyota Motor, Mitsubishi, Telephone and Sumitomo Mitsui.

Nikkei 225

The Nikkei 225 is another representative Japanese index calculated by the Nihon Keizai Shimbun newspaper since 1950. As the name suggests, the Nikkei 225 index has 225 constituents and represents the largest blue-chip companies in Japan.

Nikkei 225 is a price-weighted index of the first 225 Japanese companies listed in the first section of the Japanese stock exchange. Among the top constituents are Fast Retailing, Softbank, FANUC Corporation, Tokyo Electron, and Kyocera Corporation.

FTSE 100

FTSE stands for the Financial Times Stock Exchange, and 100 indicates the number of its constituents. These are companies listed on the London Stock Exchange, and the index is maintained by the FTSE Group.

It measures the performance of the first 100 companies with the highest market capitalization listed on the London Stock Exchange. It reached record values in May 2018, when it closed at all-time highs of 7,877.45 points, and the index began in 1984 with a value of 1,000 points. Representative companies are Barclays, Burberry, International Airline Group and Ocado Group.

An interesting fact about the FTSE is that its constituents are reviewed every quarter. As such, the index looks very different today compared to how it looked in the 1980s.

Xetra Dax

The Xetra Dax is the German index. It tracks the performance of the 40 largest and most liquid companies in Germany and was launched in 1988. Dax stands for Deutscher Aktien Index or the German Stock Index, and it underwent some important changes this year.

Until September 2021, the index had tracked only 30 companies. Here is a list of the constituents, ranked based on their index weighting as of September 2020:

- Linde – ticker: LIN.DE – sector: basic materials

- SAP – ticker: SAP.DE – sector: technology

- Siemens – ticker: SIE.DE – sector: industrials

- Allianz – ticker: ALV.DE – sector: financial services

- Bayer – ticker: BAYN.DE – sector: healthcare

- Deutsche Telekom – ticker: DTE.DE – sector: communication services

- Adidas – ticker: ADS.DE – sector: footwear

- BASF – ticker: BAS.DE – sector: basic materials

- Deutsche Post – ticker: DPW.DE – sector: industrials

- Daimler – ticker: DAI.DE – sector: automobile

- Munich Re – ticker: MUV2.DE – sector: financial services

- Vonovia – ticker: VNA.DE – sector: real estate

- Infineon Technologies – ticker: IFX.DE – sector: technology

- Deutsche Borse – ticker: DB1.DE – sector: financial services

- Volkswagen Group – ticker: VOW3.DE – sector: automobile

- E.ON – ticker: EOAN.DE – sector: utilities

- BMW – ticker: BMW.DE – sector: automobile

- RWE – ticker: RWE.DE – sector: utilities

- Fresenius – ticker: FRE.DE – sector: healthcare

- Merck – ticker: MRK.DE – sector: healthcare

- Deutsche Bank – ticker: DBK.DE – sector: financial services

- Henkel – ticker: HEN3.DE – sector: consumer goods

- Fresenius Medical Care – ticker: FME.DE – sector: healthcare

- Deutsche Wohnen – ticker: DWNI.DE – sector: real estate

- Delivery Hero – ticker: DHER.DE – sector: online food ordering

- Continental – ticker: CON.DE – sector: automotive

- Covestro – ticker: 1COV.DE – sector: basic materials

- MTU Aero Engines – ticker: MTX.DE – sector: industrials

- HeidelbergCement – ticker: HEI.DE – sector: basic materials

- Siemens Energy – ticker: ENR.DE – sector: energy technology

Dax Expansion in September 2021

As of September 2021, 10 new companies have been added to the Dax index in an effort to reform it. Besides the increase in the number of constituents, other rules have been introduced, such as future Dax candidates must have positive earnings before interest, taxes, depreciation and amortization (EBITDA) in the last two annual financial statements.

Moreover, the index base universe was extended, and there is a regular Dax review in March. Here are the names of the 10 new companies introduced in the Dax index in September 2021:

- Airbus

- Qiagen

- Sartorius

- Siemens Healthineers

- Brenntag

- Hello Fresh

- Porsche

- Puma

- Symrise

- Zalando

IBEX

IBEX is a market capitalization-weighted index inaugurated in 1992. It is formed out of the 35 most liquid Spanish stocks, and its composition is reviewed twice per year, in June and December.

What is interesting is that more than 40% of the index is owned by international funds from countries such as Norway or the United States. Here is the list of its constituents ranked based on their weights as of June 2021:

- Iberdrola – ticker: IBE – sector: electricity

- Inditex – ticker: ITX – sector: clothing

- Santander – ticker: SAN – sector: financial services

- BBVA – ticker: BBVA – sector: financial services

- Amadeus IT Group – ticker: AMS – sector: tourism

- Telefonica – ticker: TEF – sector: telecommunications

- Cellnex Telecom – ticker: CLNX – sector: telecommunications

- Aena – ticker: AENA – sector: airports

- Repsol – ticker: REP – sector: oil and gas

- Ferrovial – ticker: FER – sector: infrastructure management

- CaixaBank – ticker: CABK – sector: financial services

- IAG – ticker: IAG – sector: aviation

- Endesa – ticker: ELE – sector: electricity

- Grifols – ticker: GRF – sector: pharmaceuticals

- ACS – ticker: ACS – sector: construction

- Naturgy – ticker: NTGY – sector: natural gas

- Red Electrica – ticker: REE – sector: electricity

- Siemens Gamesa – ticker: SGRE – sector: wind power

- ArcelorMittal – ticker: MTS – sector: steel

- Bankinter – ticker: BKT – sector: financial services

- Enagas – ticker: ENG – sector: natural gas

- Acciona – ticker: ANA – sector: construction

- Merlin Properties – ticker: MRL – sector: real estate

- Mapfre – ticker: MAP – sector: insurance

- Acerinox – ticker: ACX – sector: steel

- Banco Sabadell – ticker: SAB – sector: financial services

- Viscofan – ticker: VIS – sector: meat casings

- Inmobiliaria Colonial – ticker: COL– sector: real estate

- CIE Automotive – ticker: CIE – sector: automotive

- Solaria – ticker: SLR – sector: photovoltaic

- PharmaMar – ticker: PHM – pharmaceuticals

- Almiral – ticker: ALM – pharmaceuticals

- Indra – ticker: IDR – sector: IT services

- Melia Hotels – ticker: MEL – sector: tourism

- Fluidra – ticker: FDR – sector: industrials

CAC40

CAC40 is one of the most representative indexes in Europe, and it takes its name from the former early automation system of the Paris Bourse: Cotation Assistée en Continu or Continuous Assisted Quotation. It is formed out of the most significant 40 stocks in France and is a market capitalization-weighted index.

Here is the list of its constituents as of November 2021, a month when the index reached record-high levels:

- Air Liquide – ticker: AI.PA – sector: basic materials – GICS subindustry: industrial gases

- Airbus – ticker: AIR.PA – sector: industrials – GICS subindustry: aerospace and defense

- Alstom – ticker: ALO.PA – sector: industrials – GICS subindustry: rail transport

- ArcelorMittal – ticker: MT.AS – sector: steel – GICS subindustry: steel

- AXA – ticker: CS.PA – sector: financial services – GICS subindustry: life and health insurance

- BNP Paribas – ticker: BNP.PA – sector: financial services – GICS subindustry: diversified banks

- Bouygues – ticker: EN.PA – sector: industrials – GICS subindustry: construction and engineering

- Capgemini – ticker: CAP.PA – sector: technology – GICS subindustry: IT consulting and other services

- Carrefour – ticker: CA.PA – sector: consumer defensive – GICS subindustry: hypermarkets and super centers

- Credit Agricole – ticker: ACA.PA – sector: financial services – GICS subindustry: regional banks

- Danone – ticker: BN.PA – sector: consumer defensive – GICS subindustry: packaged foods and meats

- Dassault Systemes – ticker: DSY.PA – sector: technology – GICS subindustry: application software

- Engie – ticker: ENGI.PA – sector: utilities – GICS subindustry: gas utilities

- Essilor Luxottica – ticker: EL.PA – sector: healthcare – GICS subindustry: apparel, accessories, and luxury goods

- Eurofins Scientific – ticker: ERF.PA – sector: healthcare – GICS subindustry: biotechnology

- Hermes – ticker: RMS.PA – sector: consumer cyclical – GICS subindustry: apparel, accessories, and luxury goods

- Kering – ticker: KER.PA – sector: consumer cyclical – GICS subindustry: apparel, accessories, and luxury goods

- L'Oreal– ticker: OR.PA – sector: consumer defensive – GICS subindustry: personal products

- Legrand – ticker: LR.PA – sector: industrials- GICS subindustry: electrical components and equipment

- LVMH – ticker: MC.PA – sector: consumer cyclical – GICS subindustry: apparel, accessories, and luxury goods

- Michelin – ticker: BNP.PA – sector: industrials – GICS subindustry: tires and rubber

- Orange – ticker: ORA.PA – sector: communication services – GICS subindustry: integrated telecommunication services

- Pernod Ricard – ticker: RI.PA – sector: consumer defensive – GICS subindustry: distillers and vintners

- Publicis – ticker: PUB.PA – sector: communication services – GICS subindustry: advertising

- Renault – ticker: RNO.PA – sector: consumer cyclical – GICS subindustry: automobile manufacturers

- Safran – ticker: SAF.PA – sector: industrials – GICS subindustry: aerospace and defense

- Saint-Gobain – ticker: SGO.PA – sector: industrials – GICS subindustry: building products

- Sanofi – ticker: SAN.PA – sector: healthcare – GICS subindustry: pharmaceuticals

- Schneider Electric – ticker: SU.PA – sector: industrials – GICS subindustry: electrical components and equipment

- Societe Generale – ticker: GLE.PA – sector: financial services – GICS subindustry: diversified banks

- Stellantis – ticker: STLA.PA – sector: consumer cyclical – GICS subindustry: automobile manufacturers

- STMicroelectronics – ticker: STM.PA – sector: technology – GICS subindustry: semiconductors

- Teleperformance – ticker: TEP.PA – sector: communication services – GICS subindustry: outsourcing

- Thales – ticker: HO.PA – sector: industrials – GICS subindustry: aerospace and defense

- TotalEnergies – ticker: TTE.PA – sector: energy – GICS subindustry: integrated oil and gas

- Unibail-Rodamco-Westfield – ticker: URW.PA – sector: real estate – GICS subindustry: retail REITs

- Veolia – ticker: VIE.PA – sector: industrials – GICS subindustry: multiutilities

- Vinci – ticker: DG.PA – sector: industrials – GICS subindustry: construction and engineering

- Vivendi – ticker: VIV.PA – sector: communication services – GICS subindustry: movies and entertainment

- Worldline – ticker: WLN.PA – sector: technology – GICS subindustry: data processing and outsourced services

Fixed-Income Indexes

While equity indexes are widely known and common, fixed-income indexes are not. Various problems make it difficult to group fixed-income products into an index, such as the huge number of securities in the fixed-income universe, the liquidity of such products, and the availability of pricing data.

The first fixed-income index was created by Barclays and was called the Barclays Capital Aggregate Bond Index. This is a one-country aggregate index comprising over 9,000 securities that represent the U.S. fixed-income market. Various types of fixed-income indexes exist, as they can be categorized by maturity or currency of payments, for example.

Commodity Indexes

Alternative investments are other investments besides stocks and fixed income. In the universe of alternative investments, commodity indexes are the most common ones.

Typically, commodity indexes are made of futures contracts on various commodities, such as gold, natural gas or sugar. Commodity indexes may use a different weighting method, so it is difficult to compare returns. Also, another thing to consider is the components of these indexes. More precisely, they are made of futures contracts, not the underlying commodity. Therefore, the actual performance of a commodity index may differ sharply from the actual performance of the underlying commodity.

Real Estate Investment Trust Indexes

Real estate indexes are of various types, such as appraisal, repeat sales, and REITs. A REIT is a company that owns and operates real estate that produces income. Real estate is a highly illiquid market and an expensive one to be exposed to. As such, REIT indexes are a way to get exposure to the sector and benefit from the industry's high dividend payments.

The value of REIT indexes is calculated continuously, and one example of such an index is the FTSE EPRA/NAREIT—a global real estate index. This is a float-adjusted market capitalization index made of REITs traded on public stock exchanges.

Hedge Fund Indexes

Hedge fund indexes are meant to reflect the returns on hedge funds — a tricky thing. The problem comes from the fact that hedge funds are unregulated entities; thus, no one knows if their reported performance is real and free of bias. Because of that, different hedge fund indexes may report different performances.

Conclusion

Indexes are a great way of tracking the performance of a country, industry, sector, and so on. They serve as benchmarks for financial market participants, and equity indexes are the most common ones.

However, the equities universe is not as big as the fixed-income universe. Because of that, it is more difficult to group fixed-income securities into an index. Nevertheless, some great fixed-income securities do exist.

Furthermore, alternative investment indexes exist, too, but they are the trickiest to analyze and interpret. For example, commodity indexes may have different performances than the underlying assets because they are typically based on futures contracts.

This article focused on equity market indexes, but this trading academy will go into further detail regarding the most important indexes in the world. At this point, it is important to remember that indexes serve various purposes, such as being a gauge of market sentiment, a proxy for modeling returns, a profit for asset classes, or a benchmark for actively managed portfolios. Passive investing is typically based on tracking indexes, and it challenges the notion of active investing.