Developed in the 1930s, the Elliott Waves Theory is one of the most popular trading theories in the world. It became part of any technical analysis course as traders quickly acknowledged its importance in forecasting future prices.

Like other trading theories, the Elliott Waves theory has suffered changes from the original version. This should come as no surprise because the markets always change and the complexity of the theory resulted in even Ralph Elliott, who wrote it first, changing it over a couple of years.

This trading academy features many articles treating the Elliott Waves theory. From impulsive to corrective waves, everything is covered.

But there is some more. The finesse of interpreting the waves lies not in knowing the rules of an impulsive or corrective wave but in knowing small details that make an Elliott Waves pattern valid or not.

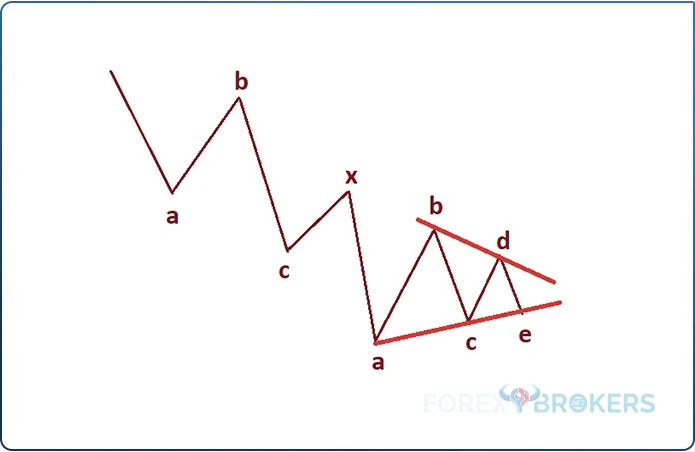

Such details are the channeling rules surrounding complex corrections with a small x-wave. The article on such corrections mentioned that these are the most common corrective waves to form, especially in the currency market. We talk here about double and triple combinations, but also about double and triple zigzags and double and triple flats.

Any trader flirting with the Elliott Waves trading knows about triangles, flats, and zigzags. But as simple corrections, they rarely appear on a chart.

For example, for a zigzag to be a simple correction, the price action to follow wave c, an impulsive wave, must fully retrace it in less or the same time it took wave c to form. In other words, the price action to follow must be more aggressive than the impulsive wave, which rarely happens.

What happens instead is that the market forms complex corrections. About 80% of the time, or even more, these corrections have a small x-wave and must follow the channeling rules explained in this article.

If not, the complex correction with a small x-wave is either misinterpreted or incomplete.

What Makes a Complex Correction with a Small X-Wave?

A complex correction is made of two or three simple corrections connected by one or two intervening waves. Whenever an intervening wave connects two corrections, the term "double" is used. For example, a double three, a double combination, or a double zigzag.

When two intervening waves connect three corrections, the term "triple" is used. For instance, a triple three, a triple combination, or a triple zigzag.

The intervening wave is called the x-wave. It is a corrective wave on its own and can be either a simple or a complex correction, too. This x-wave is used to distinguish between complex corrections. Two types of complex corrections exist – with a small or with a large x-wave.

Finding the right type is relatively simple. The thing to do is to measure the first correction from its starting point to the ending one and find the 61.8% retracement level. If the x-wave is smaller than 61.8% of the first correction, then the market forms a complex correction with a small x-wave.

In the case of a complex correction with three corrective waves, the second x-wave must respect the same rule as the first one. More precisely, the second x-wave must be smaller than 61.8% of the second corrective wave.

Complex corrections with a small x-wave are much more common than the ones with a large x-wave. Therefore, if interpreting a complex correction, the trader has about an 80% chance to work on a complex correction with a small x-wave.

How Many Such Corrections Exist?

Corrections with a small x-wave appear everywhere because most of the price action on a chart is corrective. However, while very common, only a few types exist:

- Double combinations

- Triple combinations

- Double zigzags

- Triple zigzags

- Double flats

- Triple flats

Out of the six types of corrections with a small x-wave, double combinations and double zigzags are the most common ones. Nevertheless, the others form, too, especially in the currency market.

An important part when interpreting complex corrections is the channeling component. It is unique for each type of complex correction, so the Elliott trader must be able first to identify the correction, and then use the correct channeling.

Before moving forward, one thing needs to be clear. Typically, channeling refers to the price action being contained by two parallel lines. But in this case, this is true only for the last four complex corrections on the list above. For the first two (i.e., double and triple combinations), channeling refers to something else, and parallelism, if any, is just coincidental.

Channeling in Complex Corrections

The first thing to consider is that many complex corrections end with a triangle. For instance, double and triple combinations almost always end with a triangular pattern. It means that the maximum or minimum point at the end of the correction is not necessarily the end of it. This is essential because channeling considers the end of each wave part of the correction.

Another relevant component of channeling with the Elliott waves is that it is different than what technical traders know and do. For example, channeling involves a straight line connecting two points and then projected on the right side of the chart. Also, a classical channel typically has two parallel lines. None of these points matter for the Elliott Waves theory in the interpretation of double and triple combinations. The triangle at the end of the patterns is the one responsible for that.

What matters for Elliott traders is the two points that define one edge of a channel and the price action between the points after the second one. Also, parallelism is only optional when interpreting double and triple combinations.

But enough with the theory, and let us look at some examples. After covering all complex corrections, you will see that it is not easy to find and interpret complex corrections with small x-waves because channeling excludes many of them from the start.

Double Combinations

Let's begin with a quick remembering of what a double combination is. Two types of double combinations exist – one that starts with a flat and one that starts with a zigzag. The most common arrangement is for the double combination to end with a triangle. Therefore, if it starts with a flat, it usually ends with a triangle. Or, if it starts with a zigzag, it also ends with a triangle most of the time.

However, sometimes, a triangle is not present at the end of the double combination. So, one double combination might, in fact, start with a flat and end with a zigzag. Or, start with a zigzag and end with a flat. These are all the possibilities, and all of the options listed above must respect the channeling component.

But a double combination ending with some other correction rather than a triangle should be considered a rare pattern. Therefore, if the reader ever finds one, it is most likely an error in interpreting a pattern of a larger degree.

It is critical to understand the channeling component of double combinations because of a simple argument. Double combinations are so common that they make about 80% of all the complex corrections with a small x-wave. In other words, every eight out of ten such patterns are double combinations; the rest are triple combinations, double or triple zigzags, or double or triple flats.

Double Combinations That Start with a Flat

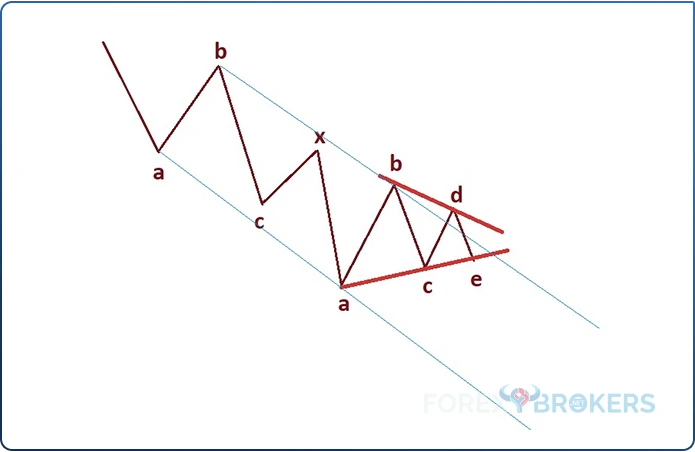

A typical double combination is one that starts with a flat and ends with a triangle. It looks like the one below.

This is a classic double combination, and probably many Elliott Waves traders have labeled this such price action. However, while it looks like a valid double combination, it is not because it does not respect the channeling component.

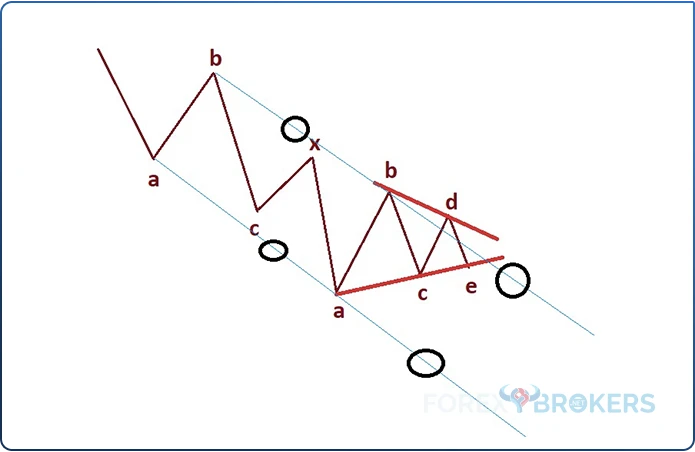

The channeling rule involving double combinations states that the pattern must channel between the a-a and the b-b trendlines. In other words, we have to draw two trendlines that connect the said points and project them on the right side of the chart.

The picture above shows the two trendlines. Before moving forward, keep in mind that parallelism is not mandatory. If the two trendlines end up being parallel, it is just a coincidence. The key here is to find the correct ending point for each of the a and b waves. But that is only the first phase of the analysis.

The second phase calls for the price action between and after the two points to reach and pierce the trendlines. In other words, we can talk about four distinct areas.

One is the area between the a-a points. Another is the area following the second a point. The third one is the area between the two b points. Finally, the last area is the one following the second b point. There should be at least one contact point on each trendline. In the example above, no trendline is pierced in the four mentioned areas. Hence, the channeling component invalidates the potential double combination.

So, what would a correct double combination look like?

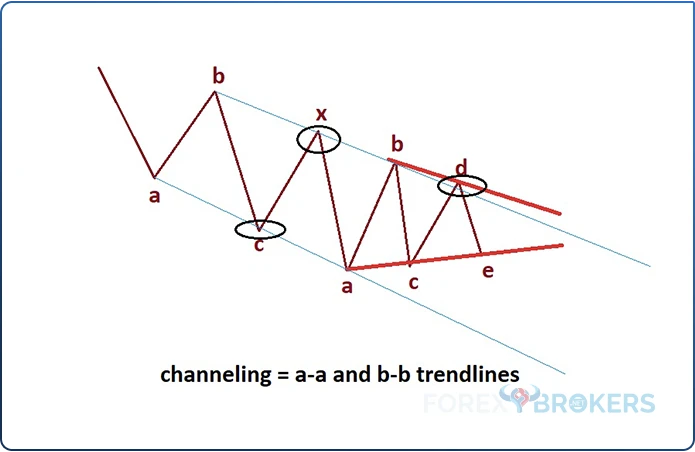

It would look like the above. First, note that the two trendlines are not parallel – they rarely are.

Second, note that the first c-wave pierces the a-a trendline – that is a confirmation of channeling. Finally, note that the x-wave and the d-wave pierce the b-b trendline – another confirmation of channeling.

Hence, a double combination channels along the a-a and b-b trendlines, with piercing being mandatory between and after the two points on each trendline.

Double Combinations That Start with a Zigzag

Another possibility for a double combination is one that starts with a zigzag. As mentioned earlier in the article, if a double combination starts with a zigzag, it almost always ends with a triangle. The channeling rule for a double combination that starts with a zigzag is a bit different than in the previous case. More precisely, the channeling should occur between the 0-x and the a-a trendlines.

Take a look at the double combination illustrated below. It appears to respect all the rules listed so far in any article dedicated to the Elliott Waves Theory in this trading academy.

Let's review those rules. A double combination that starts with a zigzag should have the first b-wave shorter than 61.8% than the length of wave a.

Also, the c-wave should take approximately the same time as wave a. Both rules are respected.

Moreover, the x-wave should not retrace more than 61.8% of the first a-b-c (i.e., the zigzag). It does not.

Finally, the market should form a triangle at the end of the pattern. By the time the price breaks above the b-d trendline, the triangle is completed.

Next, traders should focus on what type of double combination the market formed. Two types exist – one that is fully retraced by the following price action and one that is not fully retraced. But that is a different analysis to consider. First, the Elliott Waves trader must be sure that the interpretation of the double combination is correct.

In this case, it is not. The reason is that the double combination does not respect the channeling rules.

Correct Interpretation of a Double Combination That Starts With a ZigZag

Channeling is an important component of the Elliott Waves analysis. If the pattern does not respect it, it means that either the pattern is incomplete or the market forms something else.

If we draw the 0-x and the a-a trendlines on the example above, there is no channeling.

When using the term 0, this is not labeling the pattern. Instead, 0 refers to the starting point of a pattern.

Hence, for the 0-x trendline, all we have to do is connect the start of the pattern with the end of the x-wave. Next, draw the trendline further on the right side of the chart.

Channeling should occur in two areas. First, between the 0 and x, and second, beyond the x point. More precisely, the first b-wave should end near or at the 0-x trendline and the b or d points. In our example, there is no piercing along the entire 0-x trendline, so the channeling conditions are not satisfied.

As for the a-a trendline, the trader can draw it by connecting the first wave a, the one belonging to the zigzag, with the second wave a, the one belonging to the triangle. Channeling can occur in two instances.

First, the c-wave of the zigzag should pierce the a-a trendline. Second, it could be that the c-wave of the triangle and the e-wave will make two lower lows, thus piercing the projection of the a-a trendline.

In our example, we do have the channeling component on the a-a trendline respected. However, because it is not respected on the 0-x trendline, we cannot validate the double combination.

So, what should the correct one look like?

It should look like the above – both the 0-x and the a-a trendlines are pierced, confirming the channeling component. Therefore, this double combination would be correct.

Finally, note the two trendlines that make the channeling – they are not parallel.

Triple Combinations

Triple combinations have one more degree of complexity. As the name suggests, the market forms yet another small x-wave, plus one more correction. A good question at this point would be the following: how do we know that the market makes a triple combination and not only a double combination?

The answer comes from the triangle that typically forms at the end of a double combination. Also, a triangle is not possible to form as the second corrective wave part of a triple combination.

Therefore, if you ever see a double combination that starts with a flat and ends with a zigzag, or starts with a zigzag and ends with a flat, the chances are quite big that the market will form a triple combination.

As a review of the above, a triple combination:

- It is labeled with letters: a-b-c-x-a-b-c-x-a-b-c-d-e

- Has a triangle as the last correction

- Ends when the price breaks the b-d trendline

- Has two intervening waves, labeled with the letter x

- The two x-waves can be triangles

- Appear most often as the c-wave of a flat

Triple Combinations That Start with a Flat

Like double combinations, a triple combination may start with a flat or a zigzag. It should never start with a triangle. Most commonly, a triple combination has a flat as the first correction. In other words, triple combinations that begin with a flat are more common than the ones that start with a zigzag.

A triple combination is a series of consecutive corrective waves that appear difficult to interpret. Almost every segment is reversed at least 50%, meaning that most of the market moves are false.

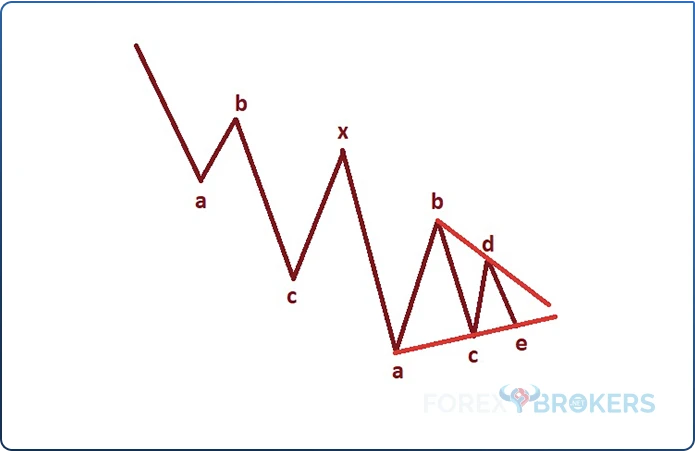

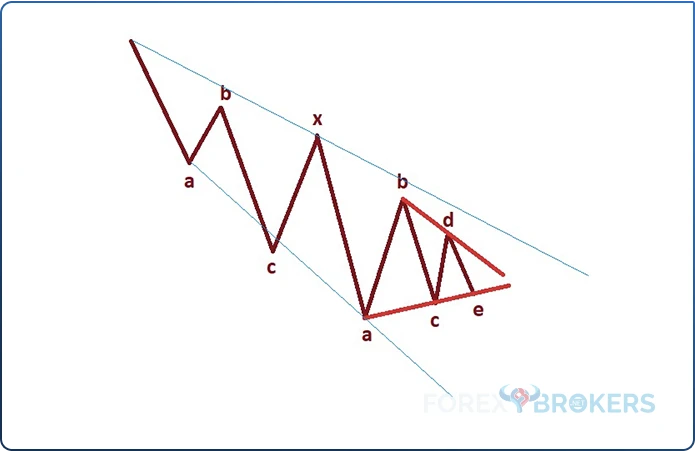

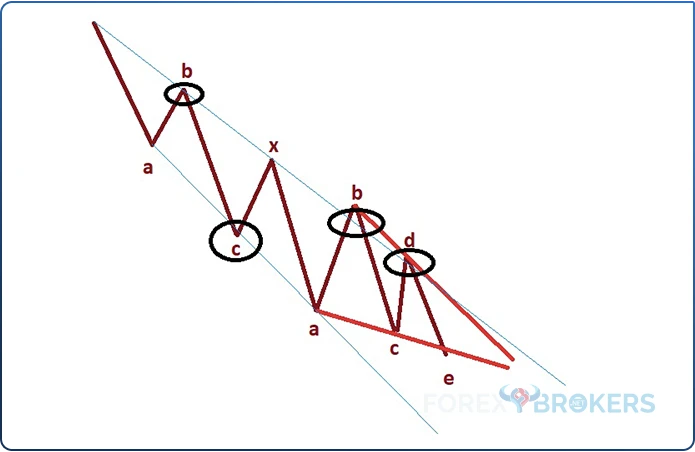

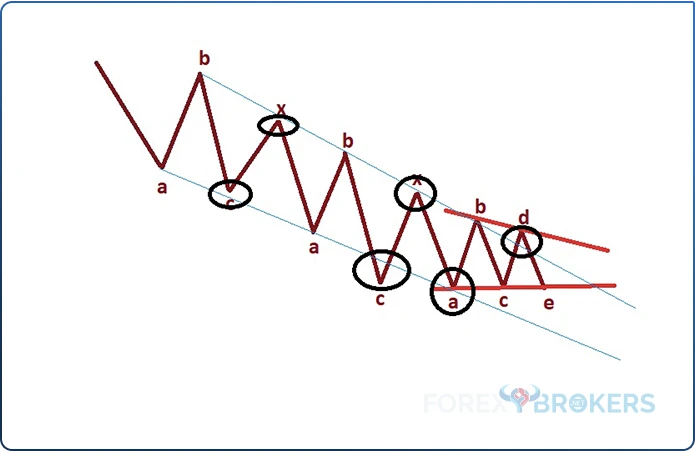

Here is what a triple combination might look like:

Note the triangle at the end of it, as it is the biggest unknown in any combination. The problem with it is that it can virtually take any triangular shape.

Is the structure above a valid triple combination? Judging by everything we know about triple combinations, all the rules are respected, except the channeling one.

We note the first a-b-c followed by an x-wave that is smaller than 61.8% correction. Also, the first x-wave connects the first a-b-c with the second one. Many similar structures can be found on any chart, but it does not mean they are triple combinations. For the pattern to be a triple combination, the channeling rules say that we should draw two trendlines: the b-b-b trendline and one formed by the first two a's.

The two trendlines should be pierced by the price action in between the points or after the last one. In this case, the price action exceeds the a-a trendline by far, thus invalidating the channeling principle.

A triple combination respecting the channeling principle should look like below. Note the fact that the two trendlines are not parallel.

Triple Combinations That Start with a Zigzag

The Elliott Waves Theory's complexity leaves room for error when interpreting the possible patterns. Double and triple combinations that start with a flat are more common than the ones starting with a zigzag, but the channeling component is more or less the same.

Channeling is more or less the same when interpreting a triple combination that starts with a zigzag. However, there is one more possibility to consider, on top of the channeling rules for a triple combination that starts with a flat.

A few things are worth mentioning here.

First, whenever a triple combination starts with a zigzag, the chances are that the zigzag is an elongated one. This is very important information for the Elliott trader because elongated patterns, such as an elongated flat or zigzag, almost always appear as part of a triangle. More precisely, an elongated zigzag is either the entire leg or segment of a triangle or part of it.

As a reminder, an elongated zigzag is one that has the c-wave longer than 161.8% of wave a.

Second, whenever a triple combination begins with a zigzag, it is common that the second correction is a flat, rather than a zigzag. Sure enough, one can find two zigzags connected by an x-wave, and then a triangle to complete the triple combination. However, that is a rare possibility.

Third, channeling is the same as for the triple combinations that start with a flat. However, there is one more possibility, given that the first zigzag might elongate. Instead of using the first two a's for channeling, the Elliott trader should use the second and the third one.

More precisely, another possibility for channeling with triple combinations that start with a zigzag is to use the b-b-b trendline and an a-a trendline that begins with the second wave a.

Double Zigzags

As the name suggests, a double zigzag is a complex correction with one x-wave that connects two zigzags. Before going into more details, let's briefly review what a zigzag is.

While a corrective pattern, a zigzag has two impulsive waves. For this reason, it is often mistaken with one impulsive wave of a larger degree. The secret to correctly interpreting a zigzag is the b-wave. It should not retrace more than 61.8% of wave a; it often retraces less than 23.6%.

But the time element is the main thing that differentiates a zigzag from some other pattern. The two impulsive waves, part of a zigzag wave a and c, must take about the same time to form.

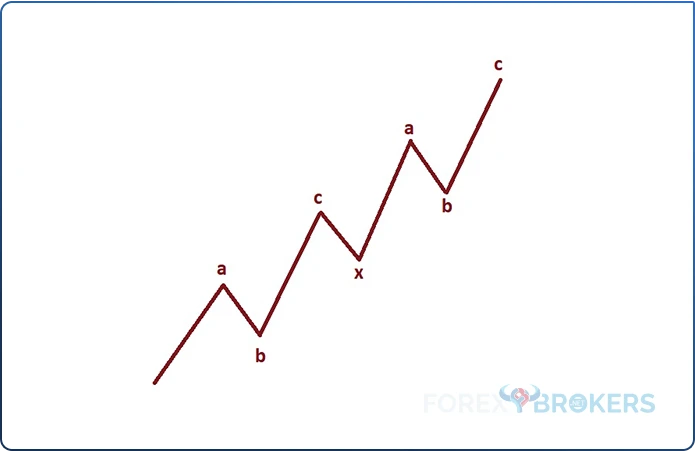

Having said that, it means that a double zigzag has the following count: a-b-c-x-a-b-c. Out of the seven waves part of the double zigzag, four are impulsive (waves a and c) and three are corrective (waves b and x).

Double zigzags are very common. They may appear virtually in any pattern of a larger degree, but they do have one interesting characteristic. That is, a wave of the same degree never retraces a double zigzag.

Channeling with Double ZigZags

Zigzags typically channel, given the time element that must be respected. If the time taken for the c-wave equals the time taken for wave a, then the channeling is almost guaranteed.

The time rule almost always guarantees channeling. However, in some cases, such as in the case of an elongated zigzag, it does not. Therefore, it makes sense to adjust the channeling rules in order to interpret a triple combination that starts with a zigzag correctly.

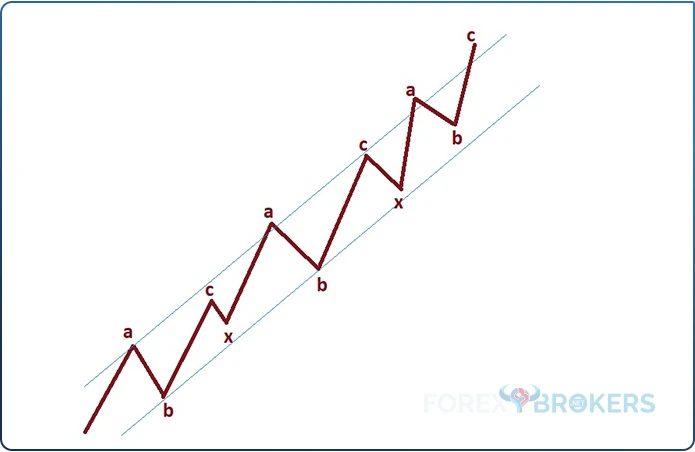

However, the Elliott Waves rules provide an ideal channeling environment in the case of a double and a triple zigzag. Effectively, the channeling component of the pattern means that the two lines are parallel and contain the entire price action.

The entire price action of a double zigzag must be contained by two trendlines – the a-a and the b-b ones. What differs from a double or a triple combination is the fact that the two trendlines must be parallel. If parallelism is not present, then the double zigzag pattern must be invalidated.

One could interpret a double zigzag starting with the rules of a simple one. The only difference is that the pattern has one intervening or connecting eave – the x-wave.

Given the time rule, it is impossible for a double zigzag not to channel perfectly. This is not the case with a triple zigzag, but this is something to explore later in this article.

For now, remember that the time rule says that the c-waves should take about the same time as the previous a-wave. Also, the b-waves are corrective waves, and the x-wave is often a triangle.

As the image above shows, the channel contains the price action in a double zigzag. It does so in the case of a triple zigzag, too, albeit with a few differences.

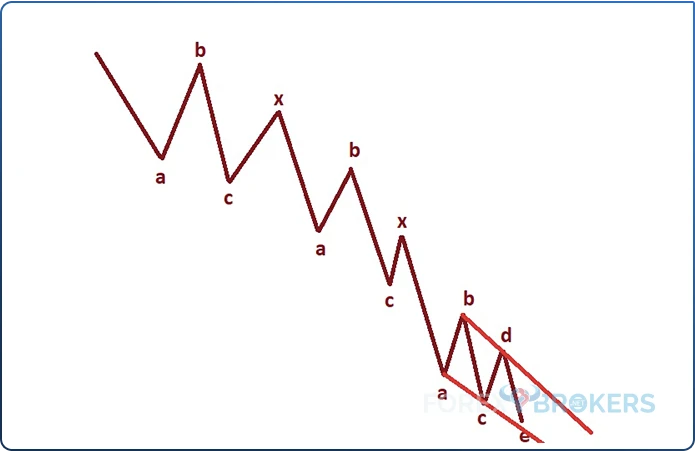

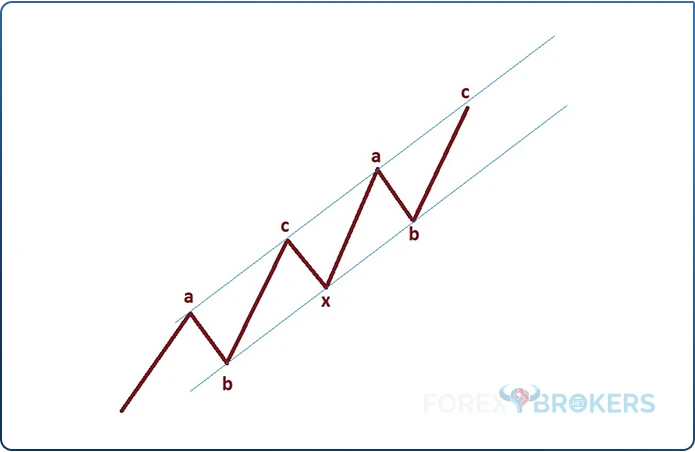

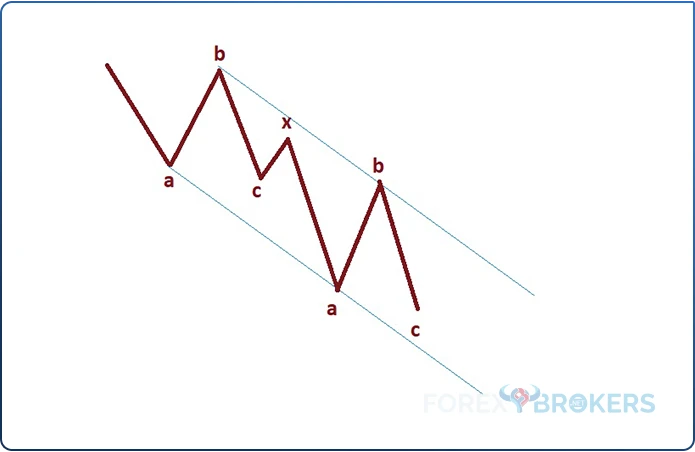

Triple Zigzags

A triple zigzag has three individual zigzag patterns connected by two x-waves. All the rules described earlier regarding a zigzag must be respected – each zigzag has two impulsive waves, and the time rule is a must. A triple zigzag is truly a misleading pattern. It is very difficult for the Elliott trader to identify the pattern during its formation correctly.

The issue with a triple zigzag is that the price action may exceed the upper or lower edges of the channel. Also, there is no specific rule on the points from which the trendlines are derived.

In other words, look for the price action to remain, more or less, in a channel. Because of the pattern's complexity, many channeling possibilities exist.

Here is one of them.

As you can see, parts of the pattern extend out of the channel. Nevertheless, this is how triple combinations channel and the above representation is one of the most common ones.

Double Flats

Ralph Elliott has identified three simple corrective waves – a flat, a zigzag, and a triangle. Combining them leads to complex corrections, such as double or triple combinations or double or triple zigzags, already mentioned in this article.

Besides that, double and triple flat patterns do exist. However, they are rare patterns, forming far less often than double or triple combinations or double or triple flats.

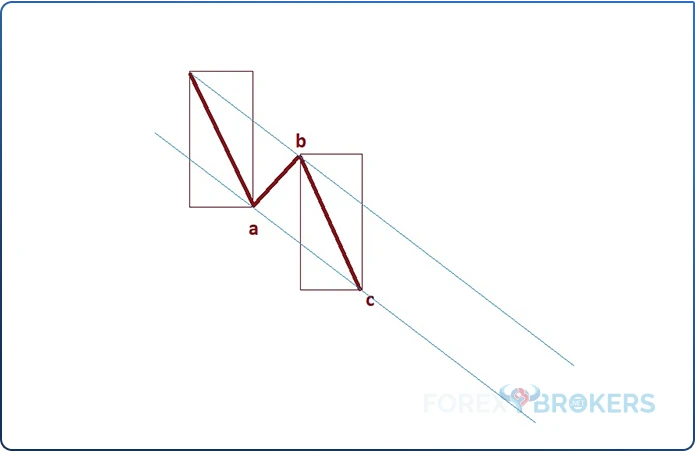

Double and triple flats share the same parallelism rule regarding channeling. Therefore, a double flat pattern has two flats connected by a small x-wave, and the two trendlines are the b-b and the a-a ones.

The perfect channeling looks like the one below, but the reader should know that slight variations do exist.

Double flats experience variations due to the multiple types of flat patterns. For instance, the image above shows two different flat patterns connected by an x-wave – the first one is a common flat, and the second one looks like a flat with a b-failure.

But any combination is possible. Considering that nine types of flat patterns exist, then the resulting possibilities might end up altering the channeling perspective presented in this article.

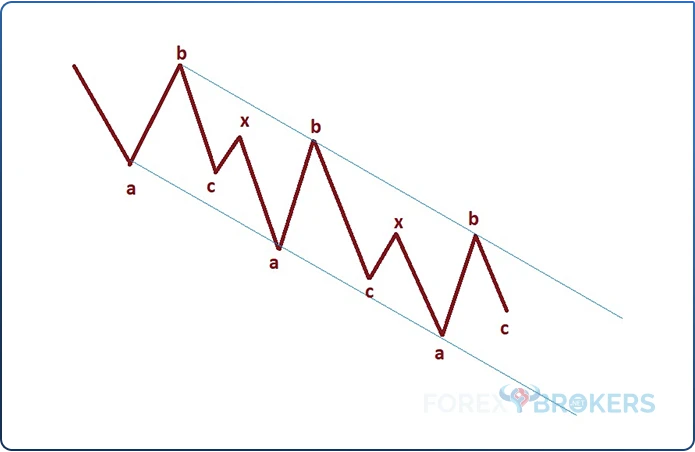

Triple Flats

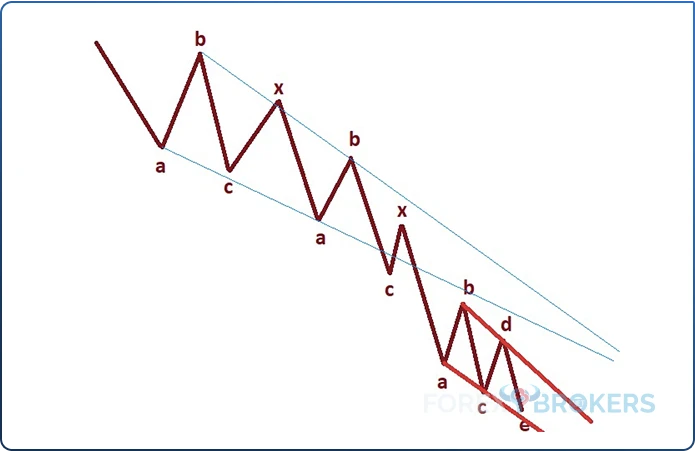

A triple flat is one of the most complex Elliott Waves patterns. The two intervening x-waves connect three distinct flats, which may or may not be the same.

For example, all three flats may end up being common flats. Or, all three may be irregular ones. Or, all three may be different than the other ones.

Let us put it this way – a triple flat pattern is a rare one, but when it appears, two things must happen. One is the channeling component. Another is the price action that follows. In other words, a triple flat pattern channels along the b-b-b and the a-a-a trendlines. Also, the price action that follows a triple flat pattern only fully retrace it if it is part of a wave of a larger degree.

Channeling with Triple Flats

The b-b-b and the a-a-a trendlines must contain the price action part of a triple flat pattern. Having said that, it means that there is no exception to the rule. Therefore, if no perfect channeling is present during a possible triple flat pattern, then the pattern should be discarded.

The image above shows a tripple flat pattern that acts as a bearish movement following a bullish one. Imagine a bullish trend prior to the triple flat pattern, such as a bullish impulsive wave or the wave a of a flat of a larger degree, but there are also other possibilities to consider.

In this case, the first flat pattern is a common flat. The second looks like an irregular one. Finally, the third one is a flat with a c-failure.

The failure indicates countertrend strength. Therefore, if a flat with a c-failure, a b-failure, or a double failure forms at the end of any pattern, the Elliott trader should expect a strong countertrend move.

Conclusion

Due to the many variational possibilities with complex corrections, creating a process that works for all is difficult. However, the rules of channeling presented in this article are good enough to confirm such patterns.

The channeling component is used to confirm Elliott Waves patterns, particularly complex corrections with a small x-wave. The small x-wave refers to the length of the intervening wave, which must not exceed 61.8% of the previous a-b-c structure. Not many patterns fit into this category, but the ones that do must respect the channeling component. Channeling differs for each pattern.

For instance, in the case of double and triple combinations, channeling refers to the ability of price to pierce certain trendlines. Also, channeling with double and triple combinations does not mean that the two trendlines in the discussion are parallel. In fact, they rarely are, and if the reader finds parallelism, it will likely be just a coincidence.

However, parallelism is mandatory when discussing channeling with double and triple zigzags and with double and triple flats. Two parallel lines contain the entire price action, making the patterns unique.

To sum up, without the price action respecting the channeling component, the patterns would not be valid, regardless if all the other rules are respected. This article focused on the theoretical aspect of channeling because the correct interpretation and Elliott count of a market is only possible with a top/down analysis. In other words, when the waves of a larger degree require the interpretation of a corrective pattern, one must first look at complex corrections with a small x-wave and then at other possibilities.

This article is one of many treating the Elliott Waves Theory. It shows that using Elliott to count waves and interpret financial markets is tedious and requires knowledge and attention to the smallest detail.