The FX market is the largest in the world. Every day, trillions and trillions of dollars and other currencies exchange hands in what has become the most volatile market, too.

Since online trading has increased in popularity in recent years, retail traders from all parts of the world have become speculators. Sure enough, the daily trading volume belonging to retail traders is very small compared to other entities.

A distinction should be made between other market participants and financial intermediaries. Financial intermediaries are a key part of the well-functioning of the entire financial system. Any market one can think of, such as the stock market or the FX market, needs an intermediary. That is an entity connecting buyers with sellers in exchange for a fee. Buyers and sellers benefit from trading due to financial intermediaries through their trade execution conditions.

Many categories of financial intermediaries exist, such as commercial, mortgage and investment banks; brokers and exchanges; credit card companies; insurance companies and so on. This article focuses only on a few categories, the most important ones given the content already covered in this trading academy.

As such, this article deals with the most important stock exchanges in the world: investment banks, broker-dealers and arbitrageurs.

Stock Exchanges

Shares are bought and sold on exchanges. Nowadays, all FX brokers offer access to other markets on top of the currency market. As such, most of the stocks traded on these exchanges are also part of an FX broker offering.

No less than 60 major stock exchanges exist worldwide, and about 16 have a market capitalization of over $1 trillion. Many of them regulate the issuers that list their securities on the exchange by requiring financial disclosures, and analysts evaluate the stock prices based on these disclosures.

Various valuation methods exist, such as the discounted cash flow method. Regardless of the method used, the analyst and any individual trader try to discover the intrinsic value of a stock. Depending on the current market price, the trader may decide whether the stock is undervalued or overvalued. As such, the trader may act by buying the stock in the first case or selling it short in the second one.

To sell short a stock, the trader needs to borrow shares from the broker and will profit if the stock price declines. If the stock price advances and the funds deposited with the broker are not enough to cover the margin needed, the broker will ask for more funds or will issue a margin call.

If the trader does not meet the call, the broker sells the shares in the open market. On the other hand, if the trader considers a stock to be undervalued, the logic decision is to go long the stock. Buying can take place in cash or cash and borrowed money. Brokers give the possibility to leverage a trade and lend money at an interest rate so that the trader or investor can buy more shares and thus benefit more if the stock price advances.

The example above shows the deep interconnection between various financial intermediaries and the benefits they provide to trading. In this case, stock exchanges regulate companies that list their shares, and brokers act as intermediaries.

United States

The United States equity market is the largest in the world. Every company in the world, when decides to go international and expand, plans to list its shares on the American stock exchanges and so, to access American capital. Two of the largest exchanges in the world are the New York Stock Exchange and the NASDAQ Stock Market.

New York Stock Exchange

The New York Stock Exchange or NYSE, is the largest stock exchange in the world. Founded in 1792, it is based in Lower Manhattan. Over 2,400 companies are listed on the NYSE.

Nasdaq

Also known as the stock exchange, where the biggest technology companies in the world are listed, Nasdaq is the second largest stock exchange in the world. In 2021, the market capitalization of all the stocks listed on Nasdaq was close to $20 trillion.

Top 10 Large-Cap Companies Listed on US Stock Exchanges

- Apple - $2.5 trillion

- Microsoft – $1.88 trillion

- Alphabet – $1.63 trillion

- Amazon - $1.29 trillion

- Tesla - $940.57 billion

- Berkshire Hathaway - $617.32 billion

- UnitedHealth Group - $481.12 billion

- Johnson & Johnson - $432.68 billion

- Visa - $413.55 billion

- Exxon Mobil - $408.84 billion

Canada

One of the biggest stock markets is in Canada. Out of all the stock exchanges that exist in Canada, the following three are the most relevant ones: Toronto Stock Exchange (TSX), TSX Venture Exchange and the Canadian Securities Exchange (CSE).

Toronto Stock Exchange

The Toronto Stock Exchange (TSX) had a market capitalization of over CAD3.1 billion at the end of 2020. It was founded in 1861, and it currently became the 9th largest stock exchange in the world.

Because Canada has abundant natural resources, it is no surprise that most of the companies listed on the TSX belong to the mining, gas and oil sectors. No other stock exchange in the world had so many listed companies belonging to these three sectors.

TSX Venture Exchange

TSX Venture Exchange is headquartered in Calgary, Alberta, Canada and trading is done electronically. The main difference between the Toronto Stock Exchange and the TSX Venture Exchange is the fact that the latter is a venture capital marketplace for emerging companies.

Canadian Securities Exchange

Another stock exchange focusing on emerging companies is the Canadian Securities Exchange (CSE). It is the Canadian stock exchange with the fastest growth rate and besides emerging companies, it also supports micro-cap companies.

Top 10 Large-Cap Companies Listed on Canadian Stock Exchanges

- Royal Bank of Canada – CAD177.91 billion

- Toronto-Dominion Bank – CAD157.9 billion

- Enbridge – CAD112.01 billion

- Canadian National Railways – CAD108.44 billion

- Canadian Pacific Railways – CAD95 billion

- Bank of Nova Scotia – CAD85.90 billion

- Bank of Montreal – CAD84.73 billion

- Canadian Natural Resources – CAD83.29 billion

- Thomson-Reuters – CAD71.53 billion

- Nutrien - CAD63.58 billion

Australia

Australia is another country with vast natural resources. Its stock market is made of three main exchanges: Australian Securities Exchange (ASX), Sydney Stock Exchange (SSX), and National Stock Exchange (NSX).

Australian Securities Exchange

ASX, or the Australian Securities Exchange, is by far the largest stock market exchange in Australia. The market capitalization for the 2,200 listings exceeds AUD1.5 trillion.

Sydney Stock Exchange

Sydney Stock Exchange or the SSX was founded in 1997 and the AIMS Financial Group owns it.

National Stock Exchange

Based in Sydney, the National Stock Exchange or NSX is home to growth-style companies from Australia and abroad. NSX was founded in 1937.

Top 10 Large-Cap Companies Listed on Australian Stock Exchanges

- BHP Group – AUD199.05 billion

- Commonwealth Bank of Australia – AUD166.28 billion

- CSL – AUD142.30 billion

- RIO Tinto – AUD140.30 billion

- National Australia Bank – AUD95.52 billion

- Westpac Banking Corporation – AUD75.49 billion

- Australia and New Zealand Banking Group – AUD70.1 billion

- Macquarie Group – AUD67.59 billion

- Woodside Energy Group – AUD62.85 billion

- Fortescue Metals Group – AUD56.1 billion

Continental Europe

Europe is home to some of the world's largest stock market exchanges, such as the XETRA stock market in Germany or the Euronext in Paris. Many popular stock market indexes are from Europe, such as the Dax index in Germany, the CAC40 in France and the IBEX in Spain. Stock market indexes play a crucial role in passive investing.

Germany

Germany is the largest European economy and the engine of economic growth. German companies run businesses worldwide and investors may participate by taking ownership of world-renowned names such as Allianz, Siemens or Mercedes Benz.

The German economy is an export-oriented one. Because its products and services have global reach, many investors outside of Germany want to own shares of such companies.

The stock market is quite important and well-represented. Three stock exchanges are worth mentioning, such as the XETRA, which is the largest one, the Borse Stuttgart or the Stuttgart Stock Exchange, and the Frankfurt Stock Exchange.

Most blue chip companies are listed on the XETRA, while retail investors prefer the Stuttgart Stock Exchange.

Top 10 Large-Cap Companies Listed on German Stock Exchanges

- SAP – EUR101.42 billion

- Deutsche Telekom – EUR94.71 billion

- Volkswagen – EUR89.48 billion

- Siemens – EUR82.41 billion

- Merck – EUR74.71 billion

- Allianz – EUR70.26 billion

- Mercedes Benz Group – EUR61.78 billion

- Siemens – EUR53.05 billion

- Bayer – EUR52.78 billion

- Bayern Motoren Werke – EUR49.08 billion

France

One of the oldest stock market exchanges in the world is Euronext Paris. Founded in 1802, it is the largest exchange in continental Europe. Famous French companies are listed on the Euronext Paris, from big names such as LVMH to small ones such as Bonduelle or Fromageries Bel.

Top 10 Large-Cap Companies Listed on French Stock Exchanges

- LVMH – EUR326.93 billion

- L'Oreal – EUR185.84 billion

- Hermes – EUR135.88 billion

- Total Energies – EUR127.74 billion

- Christian Dior – EUR113.47 billion

- Sanofi – EUR102.60 billion

- Airbus – EUR76.76 billion

- Schneider Electric – EUR70.67 billion

- Essilor Luxottica – EUR68.29 billion

- Kering – EUR65.12 billion

Spain

The Spanish equity market is often the first choice for Latin American investors. The fourth biggest exchange operator by equity turnover in Europe is BME or Bolsas y Mercados Espanoles. It operates four stock exchanges, and the most important one is Bolsa de Madrid, home to companies such as Inditex or Telefonica.

Top 10 Large-Cap Companies Listed on Spanish Stock Exchanges

- Inditex – EUR70.90 billion

- Iberdrola – EUR64.60 billion

- Banco Santander – EUR43.34 billion

- BBVA – EUR31.08 billion

- Caixabank – EUR26.92 billion

- Cellnex Telecom – EUR25.33 billion

- Naturgy Energy Group – EUR25.13 billion

- Amadeus IT Group – EUR23.42 billion

- Telefonica – EUR22.65 billion

- Ferrovial – EUR18.36 billion

Italy

Despite having one of the largest economies in continental Europe, Italy has only one stock exchange – Borsa Italiana or the Italian Stock Exchange. Nowadays, Borsa Italiana is part of the London Stock Exchange and home to names such as Unicredit or Ferrari.

Top 10 Large-Cap Companies Listed on Italian Stock Exchanges

- Enel – EUR49.99 billion

- Ferrari – EUR49.44 billion

- Stellantis – EUR42.96 billion

- ENI – EUR41.78 billion

- Intesa Sanpaolo – EUR36.53 billion

- Generali – EUR24.22 billion

- Unicredit – EUR21.78 billion

- Altantia – EUR18.71 billion

- Tenaris – EUR16.81 billion

- CNH Industrial – EUR16.55 billion

United Kingdom

London Stock Exchange is the largest stock market exchange in the United Kingdom. Large capitalization companies are included in the famous FTSE 100 index, while mid-cap companies are part of the FTSE 250 index.

The United Kingdom stock market is one of the largest in the world, having listed companies such as AstraZeneca or Diageo.

Top 10 Large-Cap Companies Listed on United Kingdom Stock Exchanges

- Shell – GBP168.96 billion

- AstraZeneca – GBP157.30 billion

- HSBC – GBP103.61 billion

- Unilever – GBP100.68 billion

- BP – GBP86.20 billion

- Diageo – GBP85.68 billion

- Rio Tinto – GBP80.21 billion

- British American Tobacco – GBP76.34 billion

- Glencore – GBP63.73 billion

- GSK – GBP53.86 billion

Japan

The largest stock exchange in Japan is the Tokyo Stock Exchange or TSE. Close to 4,000 companies are listed on the TSE and the Nikkei 225 is the most famous index.

Besides the TSE, three other stock market exchanges are worth mentioning: Nagoya Stock Exchange or NSE, Sapporo Securities Exchange or SSE and Fukuoka Stock Exchange or FSE. Nissan, Panasonic and Canon are only some of the global brands listed on the Japanese stock market exchanges.

Top 10 Large-Cap Companies Listed on Japanese Stock Exchanges

- Toyota – JPY28.22 trillion

- Nippon Tel & Tel – JPY13.73 trillion

- Sony – JPY12.86 trillion

- Keyence – JPY12.65 trillion

- KDDI – JPY9.68 trillion

- Mitshubishi – JPY9.08 trillion

- Softbank – JPY8.53 trillion

- Fast Retailing – JPY8.36 trillion

- Daichi Sankyo – JPY8.15 trillion

- Recruit Holdings – JPY7.3 trillion

China

One of the stock markets that has grown rapidly in the last few years is the Chinese stock market. The Shenzen Stock Exchange or SZSE, is one of Asia's largest stock market exchanges and lists nearly 2,000 names.

Top 10 Large-Cap Companies Listed on Chinese Stock Exchanges

- Kweichow Moutai – JPYCNY2.34 trillion

- Industrial and Commercial Bank of China – CNY1.47 trillion

- China Construction Bank - CNY1.05 trillion

- Contemporary Amper – CNY1.05 trillion

- Agricultural Bank of China – CNY977.22 billion

- Petrochina – CNY959.15 billion

- China Mobile – CNY937.49 billion

- China Merchants Bank – CNY879.39 billion

- Bank of China Limited – CNY846.54 billion

- Ping An Insurance – CNY783.79 billion

Saudi Arabia

The Tadawul is the only Saudi Stock Exchange. Middle East has become increasingly important in the context of the energy crisis in the aftermath of the COVID-19 pandemic and the Russia-Ukraine war.

Besides energy companies, some other sectors of the top 10 companies listed on the Saudi Arabia Tadawul exchange are banking and telecommunication.

Top 10 Large-Cap Companies Listed on Saudi Arabia Stock Exchanges

- Saudi Arabian Oil – SAR8.13 trillion

- Al Rajhi Bank - SAR354 billion

- The Saudi National Bank – SAR294.09 billion

- Saudi Basic Industries – SAR286.5 billion

- Saudi Telecom - SAR198.88 billion

- Saudi Arabian Mining – SAR164.89 billion

- Acwa Power – SAR116.39 billion

- Saudi Electricity – SAR105.62 billion

- Riyad Bank – SAR99.15 billion

- Saudi British Bank – SAR80.85 billion

Investment Banks

Investment banks are in the business of offering financial advice to their clients. Also, they act as one of the major active players in the financial markets, with services extending from mergers and acquisitions to the issuance of securities and much more.

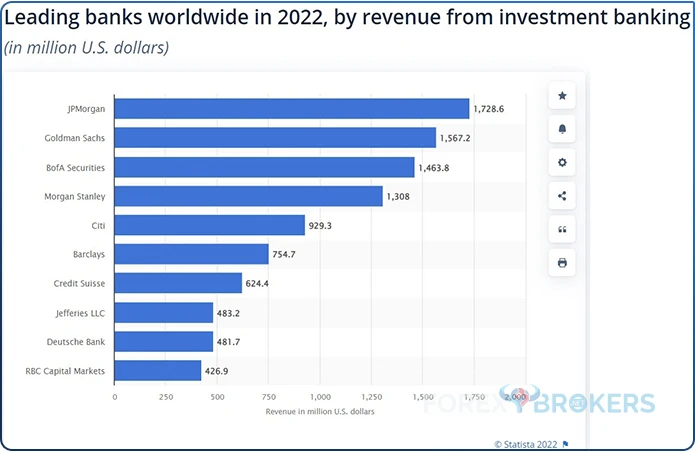

Top 10 Largest Investment Banks by Revenue

Here are the top 10 largest investment banks by revenue at the time of writing this article.

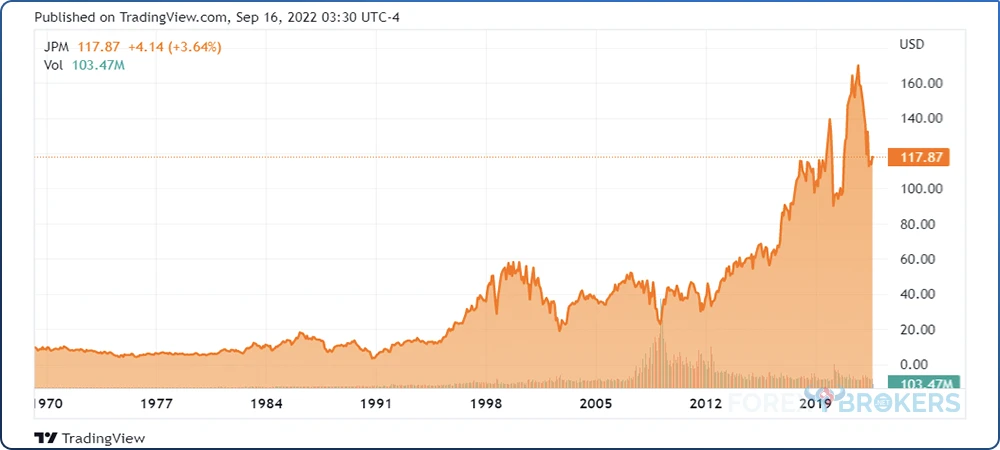

J.P. Morgan

JP Morgan needs no introduction, as it is one of the largest investment houses in the world. This is one company that was involved in all major US financial crises and will probably have something to say about future ones as well.

Founded in 1799, JP Morgan Chase evolved into a conglomerate these days – it employs close to 300k people and has a global presence. It pays a quarterly dividend, which it has managed to increase for the past seven years despite the 2020 COVID-19 pandemic.

It ranks as the number one corporate and investment bank in the world and generated $21 billion of net income on record revenue of $52 billion in 2021. Also, it is the number one underwriter of green bonds and ESG-labeled bonds.

It offers a wide range of services in consumer and community banking, corporate and investment banking, commercial banking or asset and wealth management.

JP Morgan is one of the world's oldest and most famous financial firms.

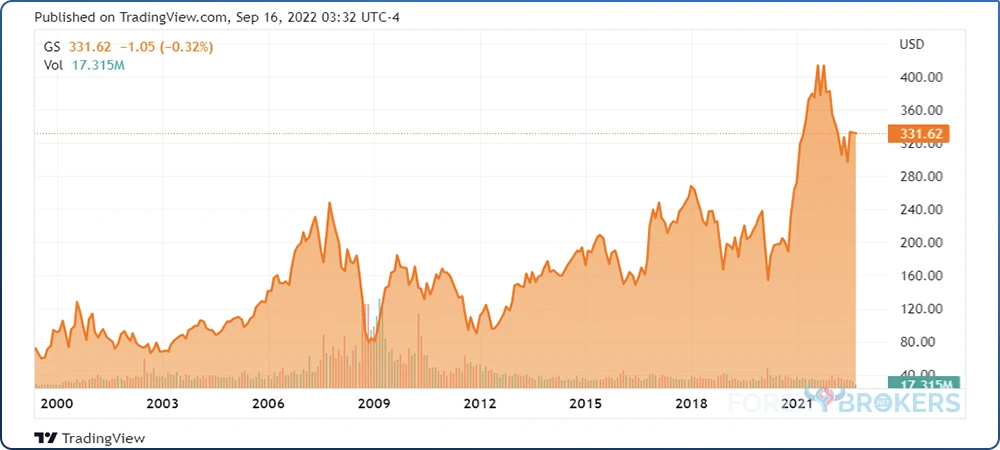

Goldman Sachs

Goldman Sachs is one of the largest investment banking and brokerage companies. It employs over 45,000 people and was founded in 1869. It offers a wide range of services to its various clients, such as:

- Asset management

- Personal financial management

- Solutions for non-profit organizations

- Global investment research

- Investment banking

- Liquidity investing

- Access to global markets

- Transaction banking

Goldman pays a quarterly dividend, and it has increased the amount paid to shareholders for the past 10 consecutive years. The stock price reached an all-time high during the COVID-19 pandemic, trading at above $400/share.

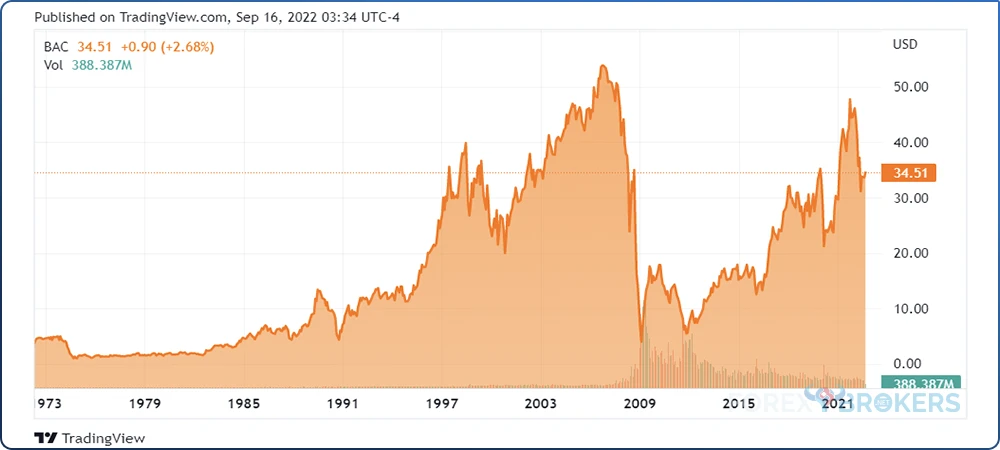

BofA Securities

Bank of America Securities is another large investment bank in the United States. It works with over 90% of the US Fortune 1,000 companies and over 75% of the Global Fortune 500 companies. Also, it serves close to 70 million consumers and small businesses.

The company offers a wide range of services to its customers, such as:

- Business banking designed to serve companies with a revenue between $5 million and $50 million

- Global commercial banking

- Companies with $50 million to $2 billion in revenue

- Global corporate and investment banking

- Serves companies with $2 billion or more in revenue, such as corporations and other large institutions

- Access to global markets

- Global research

- Wholesale credit

- Global transaction services

- Retirement and personal wealth solutions

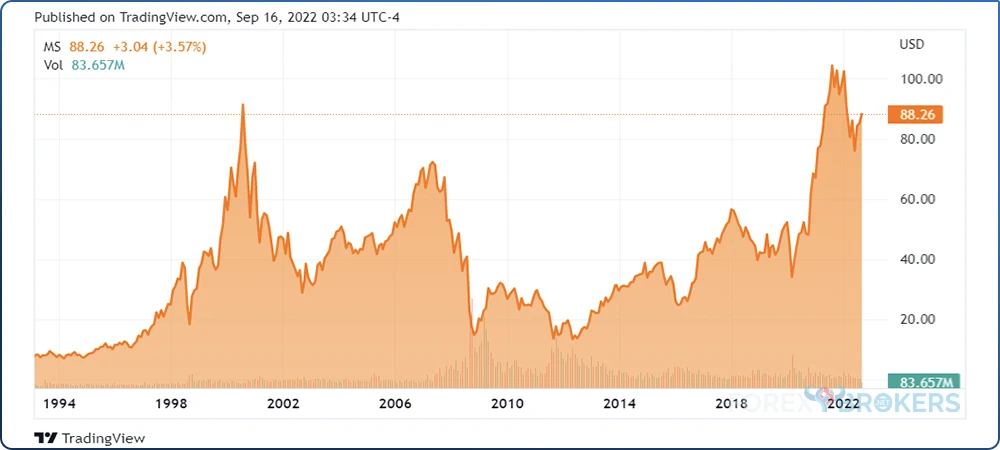

Morgan Stanley

As a financial holding company based in New York, Morgan Stanley employs nearly 80,000 people. It is doing business worldwide, and it is a global leader in financial services.

Among the products and services offered to its customers, the following are worth mentioning:

- Investment banking

- Access to capital markets

- Services in market-making, sales, and trading

- Cash equities

- Equity derivatives

- Prime brokerage

- Electronic trading

- Commodities

- Macro products

- Global research

- Investment management

- Private credit and equity

- Private equity investing and multi-manager strategies, among others

- Solutions and Multi-Asset

- Alpha-oriented investment strategies

- Real assets

- Strategies for spanning public and private markets

- Global fixed income

- Actively managed strategies

- Active fundamental equity

- Private credit and equity

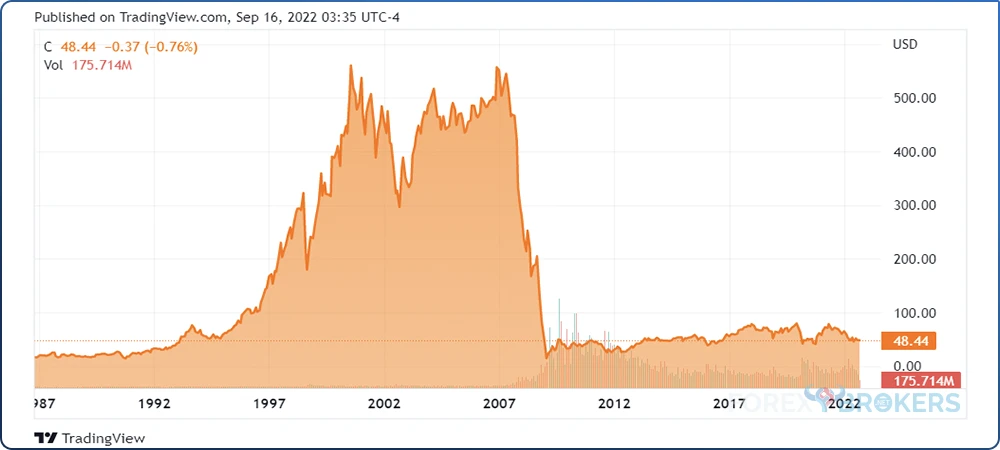

Citigroup

Citigroup, or simply Citi, is a global investment bank offering its financial services to customers worldwide. Headquartered in New York, it offers a wide range of products and services to its customers, such as:

- Financial services for institutional clients

- Physical presence in 95 countries and local trading desks in 77 markets

- Banking, capital markets, and advisory

- Customized financial strategies

- Commercial banking

- Access to global markets

- Equities

- Rates

- Currencies

- Commodities

- Spread products

- Securities services

- Custody

- Clearing

- Asset servicing

- Fund administration

- Exchange Trading Funds (ETFs) services

- Middle office

- Agency securities

- Securities lending

- Collateral management

- Transfer agency

- Fiduciary services

- Treasury and trade solutions for public sector organizations, financial institutions, and multinational corporations

- Trade finance solutions

- Integrated cash management solutions

- Working capital solutions

Barclays

Barclays' investment division has a global reach. It offers a wide range of products and services to its customers in areas such as:

- Mergers and acquisitions

- Defense/activism

- Divestitures

- Exclusive sales

- Fairness opinions

- Joint ventures

- Leveraged buyouts

- Mergers

- Restructuring

- Special committee assignments

- Spin-offs

- Debt capital markets

- Loans

- Securitized products

- Bonds

- Liability management

- Equity capital markets

- Block trades

- Private placements

- Share repurchases

- Follow-on offerings

- Initial public offerings

- Leveraged finance

- Debt issuance

- Debt origination

- Debt structuring

- Debt syndication

- Bridge financing

- Mezzanine debt products

- High yield bonds

- Leveraged loans

- Risk solutions

- Rates

- FX

Credit Suisse

Credit Suisse is a global investment bank that offers financial services and is headquartered in Zurich, Switzerland. In 2020 alone, it reported revenues of CHF22.7 billion, and one year earlier, the assets under management exceeded CHF1.5 trillion.

By the end of 2021, AUM have reached CHF1.6 trillion, and the number of employees exceeds 50,000. It serves financial institutions, governments, institutional investors, ultra-high-net-worth individuals, pension funds, hedge funds and so on.

Credit Suisse is organized into four divisions:

- Wealth management

- Investment solutions

- Tailored financing services

- Advisory services

- Investment banking

- Trading and execution services

- Capital raising services

- Global securities sales

- Swiss bank

- Consumer finance services

- Asset management

- Active and passive solutions in traditional and alternative investments

Jefferies

Jefferies is an investment company offering financial services and headquartered in New York, United States. It offers products and services to customers worldwide in areas such as:

- Investment banking

- Mergers and acquisitions

- Private capital advisory

- Debt advisory

- Debt restructuring

- Equity capital markets

- Equities

- Prime services

- Corporate access

- Cash equities

- Market maker services

- High execution quality

- Equity derivatives

- Convertibles

- Electronic trading

- Fixed income

- Securitized markets

- Leveraged finance

- Access to global capital markets

- Asset management

- Wealth management

- Insurance planning

- Hedging

- Structured product offerings

- Custom lending solutions

- Wealth and estate planning

- Corporate and executive services

- Family office services

- Institutional trading and execution

- Asset allocation

- Investment advisory

- Research and strategy

- Equity research

- Fixed income strategy

- Global macrostrategy and economics

Deutsche Bank

Based in Germany, Deutsche Bank is one of the largest investment banks in the world. It offers products and services through various divisions, such as:

- Corporate bank

- Corporate treasury services

- Institutional clients services

- Business banking

- Asset management

- Active

- Passive

- Alternatives

- Sustainable products and investment strategies

- Investment banking

- Fixed income

- Foreign exchange

- Origination and advisory

- Private banking

- International private bank

- Sustainable finance

RBC Capital Markets

RBC Capital Markets is a financial services company from Toronto, Canada. It serves governments, corporations, private equity firms, as well as institutional investors from around the world.

This is a global investment bank ranking in the top 10 and had reported revenue of CAD10.2 billion. RBC Capital Markets serves over 15,000 clients in 100 countries and in 2021 alone, it advised on 202 mergers and acquisition transactions. It is active in over 140 markets, exchanges, and electronic trading platforms and offers its customers expertise in:

- Global investment banking

- Industry coverage

- Mergers and acquisitions

- Equity capital markets

- Debt capital markets

- Leveraged finance

- Corporate banking

- Global markets

- Commodities

- Debt origination

- Electronic trading

- Equities

- Equity-linked products

- Foreign exchange

- Fixed income

- Global ETF services

- Prime brokerage

- Corporate banking

- Industry coverage

- Mergers and acquisitions

- Equity capital markets

- Debt capital markets

- Leveraged finance

- Sustainable finance

- Structured investment solutions integrating ESG factors and themes

- Best practices in ESG

- ESG due diligence

- ESG advisory

- Sustainability-linked financial products

- Equity research services

Dealers

FX traders are aware of the different types of forex brokers that exist. Some of the brokerages take the opposite direction of their clients' trades, raising an ethical issue regarding their professionality. But dealers are something else, and any trader needs to understand the dealers' role in the FX market. Dealers effectively trade with their clients.

More precisely, dealers buy what the clients have to offer. They hope to reverse the transaction by trading with someone else. For example, if a client wants to buy shares, the dealer offers them as it owns them from other transactions. Effectively, they connect various buyers and sellers that arrive in the market at any one point in time.

Nomura Securities from Japan, Deutsche Bank from Germany or RBC Capital Markets from Canada are some of the largest dealers in the world. Some dealers, quite many, in fact, also broker orders.

Top 10 Broker-Dealers by Pre-Tax Earnings (2020)

Here are the first ten broker-dealers based on their pre-tax earnings posted in 2020.

LPL Financial

LPL Financial is based in San Diego, California, and was founded in 1968. It is one of the top five custodians and focuses on the retail financial advice market. With over $750 billion in assets under management (AUM), LPL Financial offers services such as wealth management or retirement planning.

Advisor Group

One of the largest independent wealth management firms in the United States, Advisor Group is made of several companies, such as Securities Service Network, SagePoint Financial or FSC Securities Corporation. In 2020, total AUM was close to $300 billion.

Commonwealth Equity Services

Commonwealth Equity Services reported revenues for the year 2020 in excess of $1.6 billion. It addresses financial advisors by offering a range of services, such as tailored business strategies, holistic investment solutions and powerful technology.

Northwestern Mutual Investment Services

Northwestern Mutual Investment Services is based in Milwaukee, Wisconsin, and it is a subsidiary of The Northwestern Mutual Life Insurance Company. Total revenues exceeded $1.5 billion in 2020.

The company serves close to 5 million clients and its team comprises of over 6,000 financial advisors. Ranked in the top 10 financial advisors among US independent broker-dealer companies, Northwestern Mutual Investment Services offers a wide range of products and services, such as:

- Financial planning

- Retirement planning

- College savings plans

- Private wealth management

- Estate planning

- Insurance services

- Investment products and services

- Brokerage accounts and services

- Private wealth management

- Investment advisory services

- Fixed and variable annuities

- Private client services

- Market commentary

Ameriprise Financial Services

Ameriprise Financial Services is a subsidiary of Ameriprise Financial, and it was founded in 1894. Over 7,700 advisors are part of its network, and total revenues exceeded $5 billion in 2020.

Arete Wealth

Arete Wealth is an independent broker-dealer, RIA (Registered Investment Advisor), and insurance firm. As of July 2022, Arete Wealth has $8.5 billion in AUM and it offers a wide range of services such as wealth planning and management, investment banking, capital markets services, or art and wine advisory.

JW Cole Financial

JW Cole Financial offers a range of advisory services and solutions, such as business planning and strategy, teaming and staffing, marketing or financial planning. It also has expertise in regulatory compliance.

Royal Alliance Associates

Royal Alliance Associates serves premier financial professionals. It offers investment advisory solutions, insurance consulting services, retirement plan consulting services, dual clearing and other specialized services and financial planning tools.

Equitable Advisors

Equitable Advisors is an American company based in New York. It offers services in areas such as financial planning and advice, life insurance, retirement, or employee benefits.

Cambridge Investment Research

Cambridge Investment Research has been in business for more than 40 years, helping financial professionals serve their clients. It offers expertise in innovative technology, outsourcing, simplified transactions, peer networking, compliance, succession and acquisitions, practice management, and investment products.

Arbitrageurs

While dealers connect buyers and sellers in the same market, arbitrageurs connect buyers and sellers in different markets. For instance, an arbitrageur may buy and sell the same instrument in different markets.

This way, they provide liquidity to markets.

Conclusion

Financial intermediaries provide individuals and entities to reach their financial goals. Without them, the financial system as we know it would not function properly.

This article covered some of the most relevant categories of financial intermediaries, such as stock exchanges, dealers, investment banks or arbitrageurs. Many other ones exist, but the aim was to reveal their importance and understand the nature of their products and services and how they influence markets and market participants.

By understanding who are the forces in the investment industry and who is moving the financial resources from one part to another, the trader and investor gain valuable insight into the global financial industry – a must for everyone interested in trading financial markets.