Alternative investments are an area of growing interest in international financial markets, with the global alternative investments industry set to grow at impressive rates in the years and decades ahead.

The modern portfolio manager assesses the needs of each of its clients and designs the portfolio's risk and exposure based on a suitable strategy for the client's goals. Some are risk-averse, some are risk-takers, but there is a market – a product to trade for everyone.

As the name suggests, investments in this category comprise “alternatives” to the traditional, long-only portfolio. They are grouped based on risk, liquidity (i.e., how quickly they can be turned into cash), and investing horizon.

This article aims to cover the most important alternative investment types, starting with hedge funds and private equity companies and continuing with commodities like gold and other precious metals, infrastructure investments and collectibles, and real estate - not necessarily in this order.

Another goal of this article is not just to present alternative investments from a theoretical perspective but also to show the industry's potential, future growth rates and trends and some major players. The companies listed here, public or private, are only meant to offer a perspective of who is who in the industry and what it takes to manage alternative investments.

This is an industry known for its illiquid assets. Moreover, this is a highly leveraged industry, thus riskier than others, especially when considering hedge funds and private equity companies.

Furthermore, some alternative investments, such as commodities and collectibles, have served as protection against inflation for decades. This is a particularly important topic for the post-COVID-19 world, as the central bankers and governments around the world have delivered monetary and fiscal stimulus that will eventually inflate prices.

What Are Alternative Investments?

One of the reasons why alternative investments exist and why the industry is growing in the 21st century comes from the fact that they exploit inefficiencies in financial markets. An efficient market is supposed to have a strong, efficient form where all available information is priced in. However, that is not the case even in the developed markets, not to mention in the developing, emerging, or frontier ones.

Investments in this category focus on non-traditional assets and strategies, and they typically have a low correlation to the traditional financial markets. Also, the returns are primarily driven by active management rather than passive investment strategies, with a focus on inefficient markets.

Illiquidity is a major concern of alternative investments. Think of rare wine or fine art as part of an investment strategy in collectibles. While fine art may increase in value over time, finding the right buyer to sell the piece to at the right time and at the right price may be tricky. Depending on the liquidity needs, the premium return may be forgone.

Not all alternative investments are illiquid. Collectibles and real estate do have liquidity problems. However, as part of a long-term portfolio, the exit strategy may be designed in such a way as to benefit from the swings in the business cycle.

Liquid alternative investments do exist. We already covered one of them here in one of the other articles part of this trading academy – ETFs or Exchange Traded Funds. In fact, ETFs are one of the most liquid financial assets in general, representing a cheaper alternative to get exposure to a diversified portfolio. Besides diversification benefits, ETFs are used to provide downside protection in declining markets, especially those with a commodity focus.

Alternative Investments vs. Traditional Investments

Traditional investments, also known as long-only investments, are investments in assets in the public market. Passive investing means structuring the portfolio in such a way as to track the main market indices, altering the composition with the changes in the index’s constituents. This is the perfect example of traditional investment, when all investors want is a similar performance to the benchmark, typically an index like the S&P500, the Dow Jones or the Russel.

Traditional investments have a high correlation to markets, but that has become a theme recently in alternative investments too. Since central banks and governments flooded the system with cheap money in response to the COVID-19 pandemic, the correlations in financial markets tightened, leading to risk-on and risk-off moves.

Hedge funds, for example, follow different active strategies, from short- or long-only to short and long, quantitative directional and so on. The aim is to make the most of markets’ movements – to exploit the market inefficiencies.

Major Categories of Alternative Investments

Alternative investments have come a long way in recent years. Most people think of commodities only, but nowadays, alternative investments comprise 2 main types of investments.

One is formed out of investment in traditional assets but using non-traditional methods. This category is formed out of hedge funds and private equity companies, known for their use of short-selling and high leverage, respectively.

The other category is formed out of investments in non-traditional assets, such as infrastructure, collectibles, real estate, and commodities. Different financial products are used to get exposure on alternative investments, typically derivatives such as futures, forwards and options, which are highly leveraged products with complex structures.

The sections to follow focus on some of the main types of alternative investments:

- Commodities

- Hedge funds

- Private equity

- Real assets

- Real estate

- REIT

- Infrastructure

- Collectibles

Commodities

Commodities trading is mainly done via derivative contracts in the futures, forward, and options market. Derivatives have the great advantage of offering a cheaper alternative to directly investing in the underlying asset.

Think of oil trading or any other commodity, such as lumber. Not everyone can take delivery of the underlying asset, and thus, derivatives solve the storage problem.

Traditionally, commodities are used as a hedge against inflation. During the 70s, inflation gripped the developed economies and triggered a wave of commodity buying. We could say that something similar happened in 2021, right at the start of the trading year. The price of oil, for instance, had one of the best starts to a trading year in the last 3 decades, and lumber rose by more than 500% in the last twelve months alone.

Other commodities, such as minerals like copper, kept rising during the COVID-19 pandemic, on strong economic growth perspectives, but also fears of inflation. In the commodities category, precious metals occupy a special place, with gold and silver the most representative ones.

Precious Metals

Gold, silver, platinum, and palladium are known as precious metals. Investors can gain exposure to each of these markets in various ways.

One way is to trade derivatives that move with the underlying asset. Another way is to own the physical material, especially in the case of silver and gold. But in this case, investors may consider the storage costs and where the actual location is in order to transform the precious metal into liquidity when needed.

Another way is to own shares of mining companies listed on the public stock exchanges. The share prices of such companies move in a tight correlation with the price of the precious metals, and thus, investors gain exposure to the dynamics in the commodity markets without direct ownership of the physical material. This way, investors may also benefit from reinvesting potential dividends and from the inflation protection given by the rise in commodity prices, which would sustain the share price of the listed companies in the event of a recession.

Gold

Gold is the ultimate hedge against inflation. It acted as a store of value for thousands of years, and even in our lifetime, the price of gold has delivered impressive returns despite the fact that there was no inflation in the advanced economies.

Even before the 2008–2009 Great Financial Crisis, inflation was subdued in some parts of the world (e.g., Japan). After the housing crisis that started in America and quickly spread in the developed world, central banks took steps to ease their policies, and the inevitable outcome was to bring inflation close to its target of 2%.

Some central banks succeeded in their efforts (e.g., Federal Reserve of the United States), but some other ones did not (e.g., European Central Bank). Yet, despite low inflation and, in some cases, deflation, gold had its place in the professional investor’s portfolio.

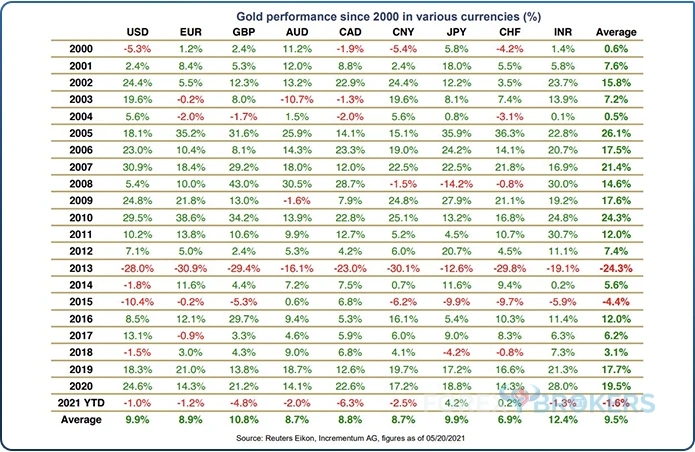

In the last 2 decades, gold delivered negative returns against the main fiat currencies only in 2 years – 2013 and 2015. A close look at the table above reveals that gold has returned on average 9.5% against fiat currencies such as the US dollar, the euro, the British pound, the Australian and Canadian dollars, the Chinese yuan, the Japanese yen, the Swiss franc and the Indian rupee.

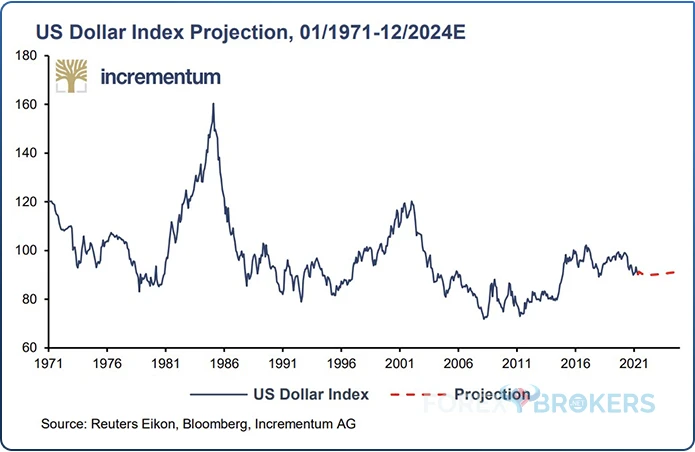

The US dollar index (DXY) declined significantly during the COVID-19 pandemic as the Federal Reserve flooded the international financial system with newly printed dollars. Over 20% or so of all the dollars ever created have been created since the start of the pandemic in 2020.

Inevitably, the DXY declined, but gold did not gain against the dollar in the first half of the year, as the table above shows. The explanation comes from competition from digital assets that claim to serve the same purpose as gold, and investors are still willing to take risks.

Silver

Also known as the “poor man’s gold,” silver has a much smaller market capitalization than gold. But it is used in various industries and thus has an intrinsic value – just like gold.

The prices of gold and silver are tightly correlated, and many investors in commodities monitor the so-called gold/silver ratio. When the price of silver deviates significantly from the price of gold, investors try to speculate from the market inefficiency based on the historical correlation between the 2 precious metals.

Hedge Funds

Hedge funds are alternative investment vehicles closely monitored by the financial media and the financial market participants. They are, for instance, much more popular than private equity firms, even though they both belong to alternative investments.

One of the explanations for the hedge funds' popularity is that many star investors run their own hedge fund or work for a famous hedge fund, and their returns fuel the imagination of retail and professional investors alike. Hedge funds are not transparent; they may suffer from the "survivorship" bias and are highly leveraged.

The lack of transparency refers to the fact that the strategies being used are not known to the public. Hence, by investing in a hedge fund, an investor does not know what goes behind the scenes, as the secrecy in the industry is quite elevated.

The survivorship bias refers to performance presentation. By choosing to present only the strategies that performed and the accounts that delivered results but ignoring those that did not perform, hedge funds present their performance with a bias, misleading the potential investor.

A high level of leverage is common in the hedge fund industry. These market players use all kinds of strategies to benefit from the market movements, from technical to quantitative strategies and to implementing complex derivative strategies.Global Hedge Fund Industry – Trends and Forecast

The global hedge fund industry is projected to grow by 3.14% CAGR by 2025, with North America being the fastest-growing market. It is not surprising, considering that North American capital markets are the most developed and largest globally.

The traditional fee structure for the hedge fund industry is 2-20, meaning that hedge funds charge a 2% management fee based on assets under management (AUM) and a 20% performance fee. Typically, the performance fee is calculated on a high-water mark principle. This means that investors will be charged only once for the performance and will be charged again only if the hedge fund delivers additional returns.

Also, many hedge funds use a hurdle rate in their performance fee calculation, typically the risk-free rate as represented by the US Treasury bond. In other words, the performance fee will be paid only in gains in excess of the US Treasury bond, should that be the hurdle rate used.

Pressures exist for the hedge funds’ fee structure to decrease. Star hedge funds use even higher performance fees, but the average is around 2-20. Variations exist, such as 0% for AUM and 30% performance fee, but most differences come from the hurdle rate.

Top Hedge Funds – 3-Year Annualized Weighted Return

Many new hedge funds are set up yearly, but most fail in about 3 years or so. This is a competitive industry that requires tremendous efforts to succeed, as well as financial resources. Running a hedge fund is expensive, and many new ones don't make the cut.

The big names in the industry are Bridgewater Associates, Renaissance Technologies of the famous Jim Simons, and Two Sigma Investments. However, that doesn't mean that they are the most profitable ones, as shown by the funds presented below that made the list of the top twenty hedge funds by 3-year annualized weighted return. The returns were calculated as of the beginning of Q2 2021.

Crosslink Capital

Crosslink Capital is run by Seymour Kaufman and has AUM close to $550 million. It posted a 3-year performance of 186.27%.

Hudson Bay Capital Management

Hudson Bay Capital Management is an asset management firm that employs close to one hundred people. Sander Gerber is the CIO and Managing Partner. A member of the Economic Club of New York, Gerber delivered 128.02% in returns to the fund’s investors in the past 3 years with over $7 billion in AUM.

Crestwood Capital Management

Crestwood Capital delivered 121.07% in the past 3 years to its investors and is run by Michael Weisberg. The fund has only about $200 million in AUM and a relatively small number of holdings in its portfolio, with names such as Shopify, Five and Synopsys.

Whale Rock Capital Management

Whale Rock Capital delivered 197.48% in returns to its investors in the last 3 years and is run by Alex Sacerdote. The fund has over $12 billion in AUM and spreads its investments over a portfolio of about 50 holdings.

Coatue Management

Philippe Laffont runs Coatue Management and has over $18 billion in AUM. The fund delivered 124.50% to its investors in the last 3 years.

Private Equity

Private equity companies use leverage to buy other companies they consider attractive. They use debt and buy a company intending to exit via an IPO (Initial Public Offering) or by selling it to a competitor.

Companies attractive to private equity investors typically have many assets and promising future cash flow. Leveraged Buyouts (LBO) are the norm in the industry, and they can take place either with or without the current management team.

Private equity is a risky business. The committed capital is at risk as the turnaround often fails. However, out of several attempts, if only 1 or 2 are successful, the transactions tend to compensate for the rest.

Private Equity Market – Trends and Forecast

The private equity market is expected to grow at a Compounded Annual Growth Rate (CAGR) of 11% by 2026, with Asia being the fastest growing market and North America the largest one. Recently, many private equity investors used the SPAC (Special Purpose Acquisition Companies) IPO for a faster exit from their investments, a trend likely to continue in the years ahead.

Leading Private Equity Firms

The following section of this article comprises short descriptions of major private equity firms with operations around the world. The idea behind this list is to show how big the industry is and how competition drives innovation in this area of alternative investments.

Blackstone

Blackstone is an American company based in New York, one of the world's largest alternative asset management firms. Its private equity arm is involved in various transactions around the world, from large buyouts to mid-cap buyouts, typically with multiple acquisitions under a single management team. Blackstone was founded in 1985 and has over 3,000 employees.

KKR

A private equity and real estate investment firm, KKR specializes in buyouts (leverage and management) as well as lower middle market and middle market investments. It invests globally, with a strong foot in Asia, in particular in countries such as Japan, Malaysia, Vietnam and China. Headquartered in the United States, KKR is an asset management and custody banks industry leader.

The Carlyle Group

Another American company, The Carlyle Group is an active player in equity private placements, divestitures, leveraged buyouts, and also venture and growth capital financing. It runs buyout deals between $20 million and $1 billion and seeks an exit from its investment in a time horizon of 3 to 6 years.

Apollo Global Management

Apollo is another company from the United States which runs a major business in the private equity sector. It has an enterprise value between $200 million and $2.5 billion and invests between $10 million and $1.5 billion in any single project. It also manages real estate and private equity funds for its clients.

Ares Management

Ares runs a diversified business in the asset management and custody bank industry and its private equity group segment prefers investments in under-capitalized companies. It was founded in 1990 and is headquartered in Los Angeles, California.

Goldman Sachs

The private equity business run by Goldman Sachs is only one of its many separate segments. Goldman needs no introduction as it is one of the largest investment bankers in the world. One of its areas of expertise is private equity. Goldman Sachs was founded over one hundred years ago and is one of the leaders in the financial sector.

Brookfield Asset Management

As a global alternative investments manager, Brookfield Asset Management specializes in managing private equity assets as well as real estate, renewable power, and infrastructure projects. Brookfield is headquartered in Canada and was founded in 1997.

Blackrock

Blackrock is a New York City-based publicly owned investment manager with operations in various areas such as public equity, real estate and other alternative markets around the world. Blackrock was founded in 1988 and employs over 16,000 people.

Real Assets

Besides hedge funds and private equity companies, alternative investments include real assets, too. Here, the 2 biggest types of real assets are real estate and infrastructure projects.

Real Estate

Everyone is familiar with real estate in one way or another. Real estate is further divided into commercial and residential real estate. Shopping malls are most representative of the first category. In the second category, consider the house you live in – owned or rented.

Real estate is an alternative investment favored by long-term investors, such as endowments. An example of an endowment is a fund run by a university, as their investment horizon is large enough to include alternative investments and they do not need immediate liquidity. Most endowments are invested in real estate, but institutional and retail investors also favor real estate.

The problem with real estate is that it is expensive. Also, it is illiquid. Many individuals invest everything they have in a house to live or a property, and this property is typically bought with a loan. Two types of mortgage loans exist – recourse and non-recourse.

The recourse loan allows the bank to come after the individual’s other income sources to cover the difference between the original loan and the proceeds obtained from selling the house or property if the client defaults.

Non-recourse loans, very popular in the United States, are different. In the case of a default, the bank sells the property, and whatever amount it can recover, that's all there is. While it seems that non-recourse loans are more appealing, the truth is somewhere in the middle. A default on a mortgage loan in the United States lowers the individual's credit score, leading to difficulties in accessing other financial products in the future.

Investing in real estate became much easier and cheaper through the use of REITs or Real Estate Investment Trusts. These are publicly listed companies that own and operate income-producing real estate such as commercial and residential properties – e.g., hotels, apartment buildings, etc.

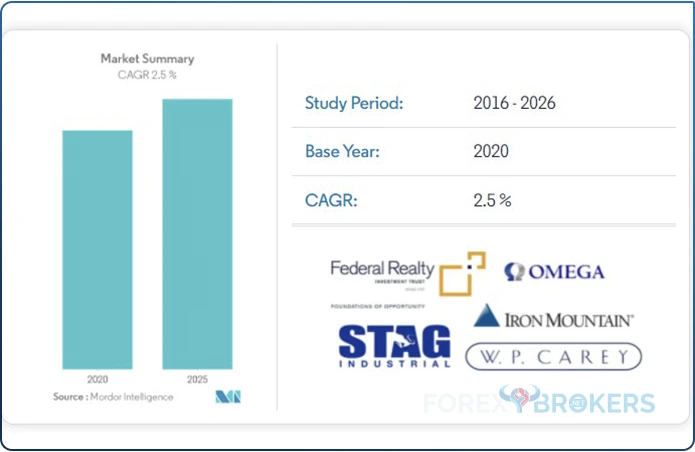

North American REIT Industry – Trends and Forecast

The North American REIT industry is the most developed in the world. Basically, REITs are vehicles that pool investments in the real estate industry and then sell the shares in the form of participation in the fund. Investors are paid from the proceeds collected from the income-producing properties.

REITs pay a hefty dividend and have a long history of growing the dividend. The industry is expected to grow by 2.5% on a CAGR rate, not something that many investors will favor. Still, dividend-seeking investors will always favor a lower CAGR rate with a strong ability to pay dividends.

Leading REIT Companies

The following companies listed in the next part of the article represent some of the leaders in the industry. The idea is not to offer an investment recommendation but to show how publicly-listed REITs performed in recent years, their dividend history, and some particularities of each name.

Iron Mountain

Iron Mountain Incorporated is a leader in the specialized REITs sector and was founded in 1951. The company is listed on the New York Stock Exchange (NYSE) under the ticker IRM and its share price performance in the last twelve months at the time of writing this article was +58.15%.

If we add to the stock price appreciating the dividend, which investors mostly use to reinvest in the company’s stock, then the total return for the period is even higher. Iron Mountain has a 7.52% 4-year average dividend yield and a growth rate of 0.61% in the last twelve months as of May 2021.

Iron Mountain was founded in 1951 and is headquartered in Boston, Massachusetts. It employs close to 24,000 people.

Omega Healthcare Investors

As the name suggests, Omega Healthcare Investors is a REIT with investments in the healthcare industry focusing on assisted living facilities, among others. It uses a triple-net lease structure operated by various healthcare companies.

Omega Healthcare Investors has activities in the United States and the United Kingdom and it has a dividend payout ratio of 79.97%. The 5-year dividend growth rate is 3.47% and has a dividend payment history of seventeen years.

Infrastructure

Another type of real asset investment is infrastructure. While the capital needed to invest in infrastructure deals is significant, they have the big advantage of offering stable and predictable free cash flows. Moreover, infrastructure investments are not cyclical, meaning that even during recessionary times, the cash flows keep pouring in.

Infrastructure investments refer to highways, bridges, sewage systems, etc. They are capital intensive and do bear risks to investors.

For example, one risk is that the government will intervene in the project and unilaterally change the conditions. Emerging and frontier markets pose a much bigger political risk than developed markets, so investors must be very careful when deciding where to invest in infrastructure and how much.

Two types of infrastructure investments exist – greenfield and brownfield. Judging by their names only, greenfield infrastructure investing means investing in an infrastructure project from its incipient phases. There are high risks involved in greenfield infrastructure investments, such as regulatory and construction risks.

Brownfield investing refers to investing in assets that are already producing revenue. Think of a bridge or a hospital where the government, at some point, decides to let the private sector take control – fully or partially. Risks still exist at this stage, albeit not in greenfield investments.

An important thing to consider before deciding to invest in infrastructure projects is the valuation. How do investors value infrastructure projects? Just like in any investment, the projected cash flows are key. In this regard, the discounted cash flow method and unlevered free cash flow are often used.

Collectibles

This category of alternative investments is a very special one. Most people are familiar with fine art, rare wine collectors, and rare stamps or baseball card collectors.

As it turns out, they tend to keep their value over time, acting as a true store of value when everything else around falls, such as traditional investments. Think of a recession, when the traditional stock market declines abruptly – but the market value of a Picasso, a Modigliani, or a bottle of a fine Chateau Laffite remains relatively stable.

Also, in periods of high inflation, alternative investments such as collectibles tend to preserve their value, reflecting the true market price updated with the inflation rate. However, some things need to be considered before investing considerably in collectibles.

One is liquidity. For example, investing in fine art is great, but if there comes a point in the future when you want to sell a part of the art collection due to liquidity constraints, exiting the investment may come at a high cost.

Modern times have led to the rise of new categories of collectibles. For example, 2021 saw the rise of Non-Fungible Tokens or digital art. It is just another form of art, with pieces selling for millions of dollars, sought after by investors believing that at some point in the future, these investments will be worth more or at least preserve their value.

Conclusion

Alternative investments are investments other than the traditional long-only portfolio. They are usually used to diversify the portfolio, as clients seek diversification benefits to protect against inflation.

When we talk about portfolios, we don’t talk about just the professional investing managers, but also about the day to day families that seek to protect their wealth. For example, gold plays an important role in many Middle East countries, as traditionally, families have protected their wealth from inflation and governments debasing currencies. Therefore, even households seek alternative investments, such as collectibles and precious metals, to spread the risk of an overnight devaluation of the local currency.

When asked about alternative investments, the first answer is gold and silver (i.e., precious metals). Yet, as this article showed, there is much more to alternative investments than just precious metals.

Real estate, infrastructure, hedge funds and private equities – these were covered in detail in this article. However, other sub-categories exist, such as lumber and farmland.

While precious metals mostly serve as protection against inflation, other alternative investments are used to speculate on market inefficiencies. Hedge funds, for example, base most of their strategies on actively managing a portfolio, often using strategies that involve quantitative, technical and fundamental analyses.

Private equity companies look for distressed investments and take a company private using high leverage. The next step is to restructure its activities and turn the business around, and after a number of years, typically 5 to ten years, the business is sold and the private equity company makes an exit.

To sum up, alternative investments are used to diversify the portfolio or wealth and to profit from inefficiencies in financial markets. The global alternative investments market is rising fast, creating plenty of opportunities for retail and institutional investors.