LISTEN TO THIS ARTICLE:

The Reserve Bank of Australia (RBA) is one of the most influential central banks in the world. Unlike the Federal Reserve in the United States (Fed) or the European Central Bank (ECB), the RBA must also consider commodity prices before setting its monetary policy.

For this reason, the local currency, the Australian dollar (AUD), is viewed as a commodity currency. Therefore, in periods of sharp appreciation or decline, the central bank will sharpen its reaction depending on the commodity prices as well. The perfect example comes from 2020 and how the RBA reacted to the COVID-19 pandemic and the subsequent strength in the AUD pairs. Because the price of gold and other commodities also increased, the rise took some pressure off the RBA’s shoulder as the currency’s appreciation was somehow offset by the rise in the commodity prices. Commodities, therefore, play an important role for the Australian economy and for the local currency.

In this article we will focus on the characteristics of the Australian economy and how its performance is closely linked to the AUD. Also, we will have a look at the roles and functions of the RBA, as well as at how the central bank responded to the global pandemic in 2020.

Moreover, this article will cover the process of setting the monetary policy in Australia and the growing role the country and the currency have in the Asia-Pacific region. Finally, the article will cover in detail how the transmission of monetary policy mechanism works in Australia and describe the mandate and what the central bank targets.

The previous section of this trading academy covered the most relevant things to consider when trading the Australian dollar. E.g., correlations between the AUD pairs, the role of commodities, what economic data to focus on, and it also briefly touched on aspects of monetary policy in Australia. This time, we will go deeper into the central bank’s role and functions, with the purpose of offering a clear understanding of what drives the value of the Australian dollar.

Key Characteristics of the Australian Economy

Before the COVID-19 pandemic, the Australian economy enjoyed one of the largest economic expansions on record. For decades, the continent “down under” did not know what a recession was and it was the envy of the world.

The uniqueness of the pandemic meant that all the world’s economies entered a recession at the same time. In some parts of the world the recessions were deeper, reaching contractionary levels and even turning into depressions, but in other parts the recessions remained mild.

Australia is one of the latter. Together with other countries in Asia-Pacific (e.g., China, New Zealand, Singapore), Australia handled the pandemic better by bringing together the private and public sectors and communicating properly. As such, economic output is almost back to pre-pandemic levels and the unemployment rate is in decline too.

This is in sharp contrast with what happened in other parts of the world. For example, the European Union suffered second and third waves of the pandemic, something not seen in Asia-Pacific. Major European economies are still in lockdown, and most of the Northern Hemisphere spent the winter months in lockdown as well.

To get an idea of the extent of the economic damage in Europe, Spain, one of the largest European economies, announced that its economy lost over 200k active jobs in January 2021 and over 70k were laid off in that month alone. Therefore, the two economies, the Australian and the European, will likely diverge in the future and the first place for such divergences to appear is on the currency market.

A Snapshot of the Australian Economy

With a population of 26 million people, Australia has a 1.3% annual demographic growth rate. As of January 2021, the employment to population ratio reached 62% and the western part of the country is responsible for most economic output.

Unlike most developed economies, the Australian economy is not service based. While services do account for 15% of its export share, resources account for 63% of exports. This tells us much about where the industry is concentrated and why commodity prices’ evolution is key for the monetary policy in the region.

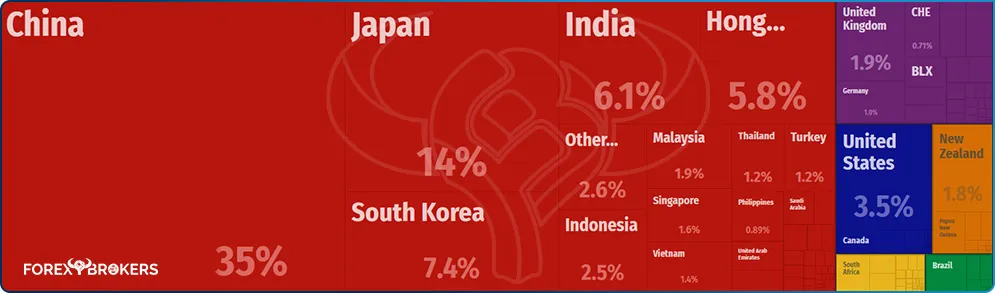

China remains the major economic partner. Most Australian resources are exported to China. For this reason, AUD traders and investors in the Australian economy closely monitor the economic performance of the Chinese economy.

Consider the 2020 pandemic-led recession. The Australian dollar emerged from the pandemic as one of the strongest currencies, and one of the main reasons for this was the fast recovery of the Chinese economy.

A study by the International Monetary Fund (IMF) released in January 2021, called the World Economic Outlook, shows that the Chinese economy is one of the few in the world that had positive growth in 2020 and will have one of the strongest economic growth rates in the world in 2021. Therefore, positive news for Chinese economic growth is positive news for the Australian economy and its currency.

Economic Output

A country with such a large share of its exports held by resources can only have a strong mining sector. In fact, the sector is responsible for 11% of the Australian output, slightly below the health and education sector (13%) and above the finance sector (9%).

If we add to mining the construction industry (8%) and manufacturing (6%), we see that over a quarter of the Australian economy is labor intensive. For this reason, three PMIs are released monthly in Australia – services, manufacturing, and construction.

Financial Stability in Australia

Perhaps the data presented in this paragraph is not that relevant for the Australian economy for a simple reason – it was taken during the pandemic in October 2020. As such, some levels may have been exacerbated by the pandemic, but nevertheless, the data helps to form an idea about the financial indicators and stability in Australia.

The country has about 7% loan repayment deferrals in housing loans and 11% of small and medium business loans. Remember that the construction sector and, thus, the housing market is one of the most developed sectors in the Australian economy, so the 7% should be taken with a grain of salt given the economic recession. Speaking of housing, the commercial property risks are viewed as high and, at the time of the data, the non-performing loans were low (1%) but expected to rise.

As mentioned earlier, the Australian economy recovered the lost ground quickly, mostly because as an island nation it had better control of its borders. Also, the warm summer season helped, so the unemployment rate dropped to 6.8% by October 2020. Since then, it has fallen even more, fueling speculations that the economy has come back on track much faster than many expected.

The main risk from a financial stability point of view is that the asset prices could fall without substantial policy support (fiscal, monetary, prudential) from the national central bank – the Reserve Bank of Australia.

Explaining the RBA’s Mandate

In a nutshell, the RBA is responsible for the monetary policy in Australia. Up until the COVID-19 pandemic the financial markets were mostly concerned with monetary policy changes that impacted the equity and currency markets. But the pandemic brought an active government, and the role of fiscal expansion influenced the economies as well. In other words, both fiscal and monetary policies should help the RBA reach its mandate.

Just like other central banks in the developed world, the RBA has an inflation-targeting mandate. The progressive adoption of inflation targeting by central banks started in 1989 with the Reserve Bank of New Zealand (RBNZ). Chile and Canada followed in 1990, and two years later, in 1992, the RBA.

In Australia, the Australian Federal Reserve’s target is to reach inflation between 2% and 3%. As you can see, there is quite a difference between, say, the ECB’s mandate of reaching inflation below but close to 2% and the RBA’s mandate. If you want, the RBA’s mandate since 1992 is closer to the recent average inflation targeting announced by the Fed. In the summer of 2020, the Fed used the Jackson Hole Symposium in August to signal a shift in its mandate. It now looks at averaging inflation of 2%, meaning that inflation close to 3% or higher will be tolerated by the Fed.

But why would any central bank be happy with rising inflation, and how come the RBA has a higher target than other banks? Consensus exists among economists that modest inflation is necessary for sustained economic growth. As for the 3% upper target, the explanation comes from the tight relationship with the precious metals market.

Averaging Inflation – The New Theme in Monetary Policy

As mentioned earlier, the RBA’s mandate was to keep inflation between 2% and 3%. In other words, levels of 2.1% or 2.9% were considered normal and desirable. The explanation comes from the power that it offers the central bank – ammunition to act in times of crisis.

Let me give you an example. When the COVID-19 pandemic became obvious, central banks around the world started cutting interest rates. The Fed, for instance, slashed the rates from around 2% to zero. However, the ECB in Europe did not have that luxury. It had already had the interest rates below zero for quite some time, and the most it could do was offer special conditions on its TLTROs (Targeted Long-Term Refinancing Operations) packages to support businesses and households. On top of this, inflation in Europe was close to zero and declining.

If the central bank manages to create inflation, by the time the inflation reaches the target or comes closer to it, the central bank has already raised the interest rates substantially. Therefore, on the next downturn, higher inflation offers ammunition to react by cutting the rates already raised due to the rise in inflation.

RBA Copying the Fed

The RBA switched its target from inflation between 2% and 3% to reaching inflation in that area, on average, over the medium term. The problem here, just like in the case of the Fed, comes from the period the inflation is averaged. How many months back in time does the RBA look to average inflation? The more months considered, the longer the RBA is willing to let inflation fly above the target.

Because central banks in the developed world had such a hard time creating inflation in past years, the belief is that they can handle higher inflation just like they handled lower inflation. History has offered us some brutal examples showing that this is no longer the case, and not only in developing economies, but in developed ones as well (e.g., United States).

Roles and Functions of the RBA

Besides targeting certain inflation levels, the RBA seeks price stability (i.e., the stability of its currency). Also, full employment and economic prosperity are secondary targets of the RBA. This is the role of the RBA and it is similar to the role of other central banks in the developed world.

Like any central bank, the RBA acts as a bank to the government. It operates both in the domestic and international financial markets and takes care of or manages Australia’s foreign exchange reserves. This is an important endeavor for any country, especially one as export-oriented as the Australian economy is.

The stability of the financial system is a responsibility of the RBA too. The bank provides liquidity to the system, namely to financial institutions. In March/April 2020, in response to the COVID-19 pandemic, the Federal Reserve of the United States opened US dollar swap lines with major central banks in the world – one of them was the RBA. Because the US dollar is the world’s reserve currency (i.e., most nations keep their foreign reserves in American dollars), it is often looked for as a safe haven in times of crisis. As such, because everyone in the world was looking to buy dollars, a dollar shortage led to an abrupt appreciation at the start of the crisis. When the Fed intervened, the international financial system stabilized, as each central bank acted locally with the help of the liquidity provided by the Fed.

The RBA is also responsible for handling the production and issuance of the country’s banknotes. Even though the use of digital money is on the rise in the developed world, cash payments are still part of almost all economies. As the central bank, one of the RBA’s tasks is to produce banknotes that people can have trust in as being safe as well as offering a store of value.

How the RBA Sets the Monetary Policy

The RBA is one of the few central banks left in the developed world that still have a monthly monetary policy decision. The ECB and the Bank of England (BOE) had a similar framework, but they switched in recent years to follow the model set by the Fed in the United States – they hold one meeting every six weeks.

The RBA holds twelve Reserve Bank Board meetings a year and has four statements on monetary policy throughout the year. Also, two financial stability reviews complement the RBA’s agenda of delivering its monetary policy message.

If that is not enough, as it was often the case in the past, the RBA is not shy about speaking its targets and intentions out loud. For example, back in the day when the AUDUSD rate was around 0.90, the then governor of the RBA, Stevens, said that a fair value for the AUDUSD exchange rate would be somewhere around 0.70. Needless to say, the interview sparked a selling on the AUD pairs and, eventually, the RBA got what it wanted.

The RBA sets the cash rate. In each country the interest rate that matters for the central bank has a different name – official cash rate, policy rate, federal funds rate, key interest rate, etc. Basically, it represents the policy interest rate the central bank uses to either stimulate the economy when it is contracting or to cool it down when it is expanding too fast.

In response to the COVID-19 crisis, the RBA’s response was to cut the cash rate to the current 0.1%. Cutting the rate close to the zero boundary means that the central bank reached the extent of its conventional measures. However, after the 2008-2009 Great Financial Crisis, the Fed in the United States introduced the concept of quantitative easing (i.e., the central bank buys its own government debt). The model was quickly copied in the developed world, and so central banks have a new set of tools in their arsenal – unconventional tools.

Unconventional Monetary Policy in Australia as a Result of the COVID-19 Pandemic

Joining other banks in advanced economies, the RBA acted decisively. As mentioned earlier, it first cut the cash rate to 0.25% – and then further lowered it to the actual 0.1%. The aim here was to boost the cash flow of Australian households and businesses and to hurt the exchange rate.

One of the immediate competitive advantages of an export-driven economy such as the Australian one is being able to sustain the economy via a lower exchange rate. Thus, the products sold in Australian dollars become more attractive to foreigners.

However, the problem during the COVID-19 pandemic in 2020 was that all central banks did the same. Everyone had cut the interest rate to zero as the pandemic created a global recession. As such, the RBA was forced to engage in unconventional monetary policy.

Even so, some other central banks, such as the ECB, had been using unconventional measures since the 2012 sovereign crisis in Europe. Therefore, even if the RBA started in 2020, a huge gap remained between different policies around the world. Ultimately, such a difference is visible on the exchange rate.

Asset Purchases to Support Australian Households and Businesses

The first step in the unconventional monetary policy was to start purchasing Australian Government Securities, also known as AGSs. Remember, the aim was to create inflation to the sustainable 2%-3% level, and thus to help the economy bounce back. Also, by providing low funding across the business spectrum and the economy and by keeping a lower exchange rate, the RBA ensured that it would cut the accommodative monetary policy for a sustained period of time. Effectively, this process is called forward guidance.

Other Unconventional Monetary Policy Decisions Undertook by the RBA

The full extent of the measures that the RBA undertook shows its decisiveness to act. Also, it shows that it has the ability to adapt swiftly to changes in economic developments. Many voices argued that since Australia had not experienced a recession in a long time, the central bank would react with a lag. This was not the case, however, once again proving that the RBA had learned a lot from the Western and bigger central banks.

Another thing that the RBA did was to open a so-called Term Funding Facility, or TFF. Literally, the RBA gave banks the possibility to borrow funding at extremely favorable rates and use it to lend to businesses and households. This is a measure introduced on a large scale across the advanced economies, albeit with a different name.

One smart move that the RBA made was to directly help the banking system. More precisely, the central bank operates a policy interest rate corridor around the cash rate. The RBA increased the interest rate that the commercial banks received to ten basis points, or 0.1%, to help promote lending at low cost of credit across the Australian economy.

The Australian Dollar and Its Role on the FX Dashboard

Making a profit is the ultimate goal when investing or speculating. To do that, it is not only about buying or selling, but all the factors that facilitate trading.

Liquidity, for instance, is one important factor that enables trading of large volumes. The FX market is the largest market in the world, and because of that, buyers and sellers can literally trade large volumes without damaging the prices.

In smaller markets, trading big is not possible without distorting the prices. For example, imagine the stock market and think of any particular stock that comes to mind. In a bearish trend, the market’s velocity increases and traders that bought shares on margin are receiving margin calls from their brokers. If they cannot come up with additional funds in due time, the broker will sell the shares. The selling will put further pressure on the share price, fueling the downward move.

In the FX market, the increased liquidity levels make it impossible for market squeezes to survive for long. It could be that at some points in time, especially on Friday afternoons or during a bank holiday, the liquidity will shrink a bit, but it will be back to normal on the next regular business day.

Liquidity, therefore, is the ability to sell or buy in large volumes without affecting the price. High liquidity levels also lead to improved execution, as it reduces slippage to the extent that it doesn’t represent an additional trading cost for swing traders or investors – only scalpers may want to consider it, depending on the profit they aim for with each trade.

The Aussie dollar is known for its trending characteristics. This is a currency that correlates strongly with the price of commodities, and that is where the focus of every trader and investor should be.

Gold and Its Influence on the RBA’s Decisions and the Australian Dollar

As mentioned earlier in the article, the mining industry is responsible for a big chunk of Australian exports. In the mining industry, the gold industry stands out from the crowd – it employs many people, and it thus it further weighs on the value of the Australian dollar in multiple ways.

First, the Australian dollar moves in direct correlation with gold due to the increased exposure of the mining sector in the Australian Gross Domestic Product (GDP). Let us expand this idea a bit – the more the price of gold rises, the more profitable mining is, and thus positive for the Australian economy. As such, higher gold prices are positive for the local currency, too.

Second, for the FX world, the AUD and gold price correlation changes from time to time. However, it has always been tighter on higher gold prices and eased when the price of gold falls.

For example, the price of gold dropped from $1,800 several years ago to $1,000 and consolidated in that area for a few years. All that time, the direct correlation between the price of gold and the Australian dollar decreased. Therefore, for traders involved in the FX market, the Australian dollar moved more based on the changes in the monetary policy of the RBA than on the price of gold’s evolution.

However, by the time the price of gold broke higher from the consolidation, it kept moving, eventually reaching a new all-time high above the $2,000 level in August 2020. On its way up, it triggered a sharp move higher on the AUD as well against the US dollar – the higher the gold went, the more the AUD gained against the dollar.

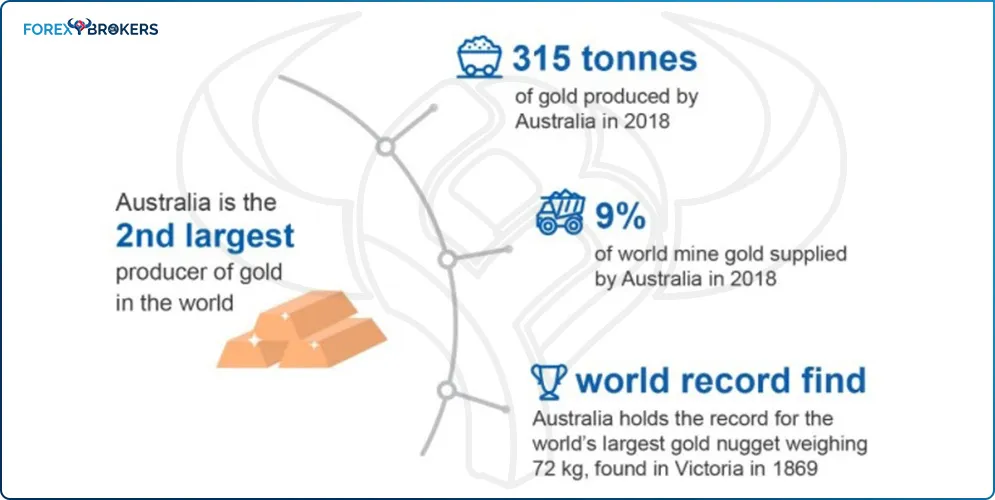

The Australian Gold Mining Industry

The second-largest gold producer in the world, desert covers most of Australia’s 7.69 million square kilometers. The Melbourne-Brisbane-Sydney corridor is where most of the population lives and the continent is home to twenty of the largest gold mines in the world. Two of these mines account for 2.9% of global goldmine production – and now you have a clear picture of why gold is important for the Australian economy and the Australian dollar. Moreover, before setting the monetary policy for the month ahead, the RBA always checks the commodity price index and how it may weigh or not on the local currency.

The recent upside move in the price of gold, in both USD terms, and AUD terms is expected to continue for the years ahead. According to a recent study, the trend is expected to continue well into 2024, meaning that the Australian dollar and the gold correlation is here to stay.

The Australian Gold Refining Industry

The gold refining industry has also grown in recent years. Australia is home to a refining industry that imports over 112 tons of gold every year. In other words, not only is Australia a big gold producer, but it is one of the leading countries in gold refining in the Asia-Pacific region.

Perth is the city where most of the minting takes place, and the refining industry plays a critical role in the economic development in the area. For the Australian dollar, therefore, the abrupt declines or rises in the value of gold are immediately seen in the exchange rate.

In a way, we may say that the Australian economy is perfectly hedged against inflation. We know that portfolio managers add gold to their portfolios to protect against inflation. Long-term investment portfolio managers typically add a few percentages (mostly up to 5%) of their portfolio to gold. As such, should inflation reach higher levels, the price of gold will rise and thus protect the portfolio, as gold acts as a hedge.

For a country like Australia, gold may act as a hedge against economic fluctuations. In times of higher inflation, the price of gold rises and thus supports the economy via the indirect connections with the gold mining and refining industries. Both will have spillover effects on economic growth. All these aspects are well known by the RBA and priced in its monetary policy decisions.

Australia – A Great Place to Store Gold

Australia’s experience in the gold industry makes it a great place to store gold. Investing in gold may take various forms, and investing in the physical stuff is one of them.

For instance, an investor may decide to own paper gold. This is referred to when owning (trading) ETFs or Exchange Traded Funds. ETFs are open-ended funds traded on the secondary market and one of their main advantages is that they offer cheap access to the underlying assets in the fund. Various ETFs exist that are directly linked to the gold market and the gold industry, and thus the investor may choose to gain exposure to the price of gold (and thus to the Australian dollar) by owning some of these ETFs. This trading academy will have a dedicated article about ETFs and open and closed funds in another part of a more advanced section.

Another way to gain exposure to gold is to own shares in gold mining companies. By owning shares in Australian gold mining companies, the investor also gains exposure to the local currency – the Australian dollar. Hence, all of the RBA’s decisions are tightly correlated to the value of the AUD and the price of gold.

Finally, another way of gaining exposure to the gold market is, as mentioned earlier, to own the physical stuff. Effectively, it means buying physical gold and storing it. Because of the sheer scale of the business, Australia has a state-of-the-art infrastructure for storing gold and there are no less than 80 bullion facilities that enable the buying, vaulting, and trading of physical gold.

Conclusion

This article made it clear why the RBA is one of the central banks in the world with a delicate mission. Not only does it have a mandate that revolves around inflation averaging between 2% and 3%, but also it must consider the crucial importance of the gold industry in the economic output and the value of the local currency.

Despite not having much experience with economic recessions, the RBA managed to successfully guide the economy during the COVID-19 pandemic. So far, as the pandemic is still not over at the time of writing this article, Australia has been a model for other countries for the way it handled the health crisis. It could not do so without the help and support of its central bank – the Reserve Bank of Australia.

Because the central banking community is closely knit, all the actions applied in the past by other central banks in times of crisis were known by the RBA as well. As such, its reaction to the economic crisis did not come as a surprise to anyone familiar to the world of central banking – it had cut the cash rate close to zero, engaged in quantitative easing, and launched forward guidance.

Besides the active role of the RBA in economic developments in Australia and thus in the value of the Australian dollar, the price of gold has a primary role in determining the AUD exchange rates. For this reason, this article covered concepts related to the gold market that were not covered in other parts of this academy that dealt with the gold market.

All in all, the RBA is part of a select club of central banks in the developed world that ties up its monetary policy considering commodities. The Bank of Canada is another one, although it considers a different commodity – oil.