LISTEN TO THIS ARTICLE:

The Federal Reserve of the United States, also known as the Fed, is the world’s most influential central bank. It supervises the economic activity in the largest economy in the world and sets the interest rate for the world’s reserve currency – the U.S. dollar.

All of the Fed’s actions are paramount for currency traders. However, it’s not just currency traders that closely monitor what the Fed says and does, but also investors in all kinds of markets – real estate, alternative investments, fixed income, and equity market.

For the world’s financial markets, the interest rate level is key for investors looking for higher yields. Interest rates differ around the world, as economic conditions are different too. Some economies may be in recession, some in a different phase of the business cycle, and others may be more resilient to similar factors. But no matter where in the world, every trader, investor, and monetary policy decision-maker looks at the Fed’s actions for guidance.

As an institution, the Fed is unique in every way. The European Central Bank (ECB) copied the Fed structure in many respects, as there are many similarities between the two institutions. However, the Fed has more history behind it, and it is responsible for supervising a larger economy than that of the Eurozone.

This article covers all of the aspects related to the Fed – its structure, monetary policy, implementations, transmission mechanism, mandate, inflation targeting, and much more. Monetary policy is of crucial importance when trading financial markets, and this trading academy has already covered the role of central banks in the financial system. This time we’ll have a look at the world’s most prestigious central bank, one that is responsible for the health of the financial system as we know it today.

The Federal Reserve System – The U.S. Central Bank

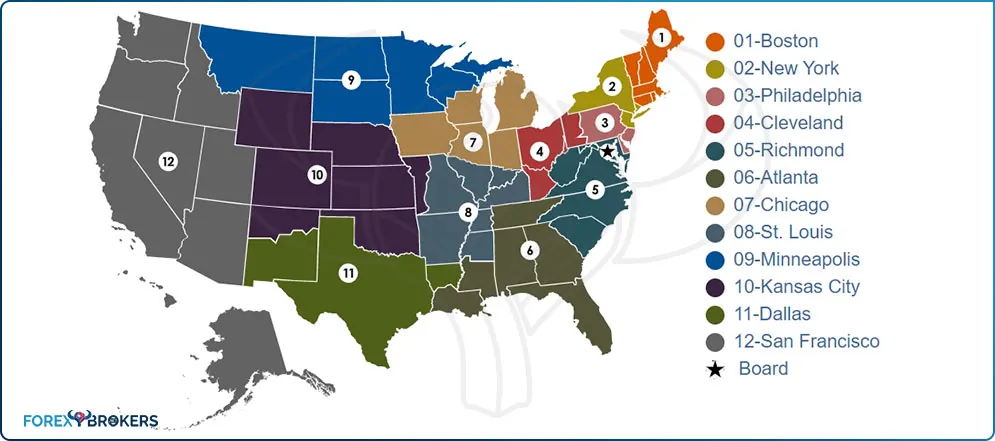

Created in 1913 through the Federal Reserve Act, the Federal Reserve System (de facto central bank in the United States) is a thirteen-body entity. It has one board (Board of Governors) headquartered in Washington, D.C, and twelve regional banks spread in various cities throughout the United States.

It is worth highlighting the ECB structure and why it resembles the Fed’s. The ECB is headquartered in Frankfurt, Germany, and the national banks act as regional banks in each member country of the Eurozone.

Coming back to the Federal Reserve System, it has multiple roles, as most central banks do. It is a bank to the government, it maintains the stability of the financial system, and it regulates banking institutions. However, for the currency trader and the general investor, the most important role of the Federal Reserve System is that it sets the monetary policy for the entire nation.

Before President Wilson signed the Federal Reserve Act into law, the United States made a few attempts to manage the money supply and regulate banks. Starting in 1791, when Hamilton set up the First Bank of the United States, and ending with the 1910 meeting at Jekyll Island, the events during this period laid the foundation for what was to become the Federal Reserve System.

Shortly after its creation, the Great Depression that started in 1929 showed how important a central bank is and why it was much needed for the country’s economic progress. To date, the Federal Reserve System has survived the Great Depression, two World Wars, the Treasury-Fed accord in the mid-1950s, the great inflation in the ’70s and the great moderation that followed in the next decade, and even the 2008 financial meltdown.

Federal Reserve System’s Structure

To start with, the United States Congress oversees the Federal Reserve System. The system is based on three entities, each with a distinct role in the overall Federal Reserve System: the Federal Reserve Board of Governors, the Federal Reserve Banks, and the Federal Open Market Committee (FOMC).

The three entities have a crucial role in making sure the Federal Reserve System conducts the appropriate monetary policy, promotes consumer protection, and promotes the safety of individual financial institutions, among others.

As the governing body of the Federal Reserve System, the Federal Reserve Board makes sure the Federal Reserve System fulfills its responsibilities, purpose, and functions. All members of the Board are also members of the FOMC.

The FOMC is in charge of conducting monetary policy in the United States. Congress sets the mandate, and the FOMC does everything in its power to fulfill the mandate – that is, to reach maximum employment, stable prices, and moderate long-term interest rates.

The Federal Reserve Banks are the arms of the Fed in the United States territory. Twelve reserve banks operate independently from one another, and each is responsible for distinct parts of the United States, including commonwealths and other territories (e.g., Puerto Rico, U.S. Virgin Islands, Guam, American Samoa, Northern Mariana Islands).

When thinking of the central bank of the United States, imagine a well-designed system that covers all financial aspects in the country. It all starts with the Congress that oversees it, and the three entities make sure they do everything in their power to achieve the mandate given by Congress.

Federal Reserve Board

An article like this one, explaining the structure of a central bank, its mission, and mandate, is very important for the trader. As you’re about to find out, not all central bankers who are part of the Federal Reserve System are voting members in the FOMC. Because the FOMC is the body that sets the federal reserve rate, traders have a particular interest in hearing and interpreting what the FOMC members have to say about economic developments in the United States. If the one giving a speech is not part of the FOMC or does not have voting power at the time of the speech, the market will ignore the remarks.

Also called the Board of Governors, the Federal Reserve Board has seven members appointed by the President of the United States. It becomes obvious now why elections in the United States always create severe turbulence in the financial markets – the President of the United States has multiple roles in designating people to run key U.S. institutions.

After the President nominates the board members, the nominees must also win U.S. Senate approval. As mentioned earlier, all of the board members serve as members of the FOMC.

Board member terms last fourteen years, and members can’t be re-elected after their term expires. However, if a board member quits during their mandate and someone else fills the role, the new person serves the remainder of the term and may be appointed to serve a new, full 14-year term.

There are two exceptions to the 14-year term. The chair and the vice-chair of the Board only serve four years, but they may be reappointed for another four-year term. For traders, it is important that the seven members forming the Board of Governors are full members of the FOMC.

Federal Reserve Banks

Twelve federal reserve banks are spread throughout the United States. Each has at least one branch, and each branch has its own Board of Directors.

To set the monetary policy for the entire territory of the United States, the Federal Reserve must be aware of all of the particularities of a specific region. For this reason, the federal reserve banks act as the eyes in the territory, gathering knowledge and economic data that serve when interpreting the overall economic evolution of the United States.

Each of the twelve federal reserve banks has a direct role in supervising the commercial banks under its jurisdiction. Furthermore, they provide financial services in the territory, like clearing checks or distributing coins. The Beige Book report, released to the public prior to every FOMC meeting, contains detailed economic activity data gathered by federal reserve banks. It is viewed as third-tier data from market participants, but it often gives clues about the overall economic strength in the United States.

Federal Open Market Committee (FOMC)

The Federal Open Market Committee is the board that sets the monetary policy. It has twelve voting members, but the Committee’s attendance is much bigger.

Of the twelve members that do have a vote, there’s one permanent voting right – that of the president of the Federal Reserve Bank of New York. No matter what, the rotating voting rights do not affect the New York Fed, whose president will always have voting power in any FOMC meeting.

Besides the New York Fed’s president, the seven members of the Board of Governors also have voting rights on the FOMC. As the board’s components change over time, the FOMC sees some variation in the board voting members, too.

Of the remaining eleven federal reserve banks, four of them serve as members with voting rights on the FOMC. Each term is one year long and, on a rotating basis, the components of the FOMC change constantly.

If we calculate six-week periods in the course of a year, the FOMC meets about eight times a year in regular meetings. Sometimes, though, in extraordinary circumstances, the FOMC acts quickly and decisively between two scheduled meetings.

The supervision of open market operations is the main task of the FOMC. In plain English, this is the tool to set and control the monetary policy. The FOMC is also in charge of credit conditions throughout the United States, of swap lines with other central banks around the world, and with the overall interpretation of aggregate demand and money supply.

FOMC Meetings

Every six weeks, the FOMC looks at the economic evolution in the United States and decides the monetary policy for the period ahead. This effectively means that eight times a year, the FOMC meets and discusses economic developments in the United States.

For traders, the FOMC meeting sits on the top of the agenda. No other economic event or data is as important as the outcome of the FOMC meeting.

Sometimes, depending on the situation, the financial world looks at different events. For instance, during the Eurozone sovereign debt crisis following the great financial crisis in 2008, the financial world focused more on the news out of Europe than on what was coming out of the United States.

As a rule of thumb, when the Fed is scheduled to speak, everyone with a stake in financial markets listens. The FOMC meetings show what the Fed intends to do next, and traders know that this is the time to form an educated guess about the future path for the federal funds rate.

The FOMC Meeting is one of the most expected and anticipated events of all the events to potentially influence the value of the USD. Because of this, the Monday and Tuesday before the outcome of the meeting is made public, ranges on the USD pairs are often shown. Naturally, everything changes the moment the outcome of the meeting is made public, and the trading algorithms start acting.

FOMC Statement

The outcome of any FOMC meeting is the FOMC statement. Its release creates tremendous volatility in the financial markets – opportunities for speculators.

The statement comes in the form of a text released at the top of the hour during the afternoon trading session in the United States. Because London is already closed for business, liquidity is not as high as normal, but all investment banks and other interested market participants have skin in the game and open offices to monitor the FOMC statement.

The text follows a script similar to the one from six weeks before. Central bankers have a tough job communicating the changes in the monetary policy or any decisions they may take because the market reacts quickly to everything they say. Hence, the FOMC statement, while a text, still has a tremendous impact on market prices.

At this point, it is worth mentioning what the “market” is. By market participants, we refer to any individual, entity, or algorithm that triggers an action of buy or sell on any financial security – currency pair, stock index, bond, etc. By market, we refer to the entire spectrum of financial products – currency pairs, stocks, indices, bonds, etc.

The FOMC statement has an impact on all those parties described above. Traders or market participants will buy or sell based on the FOMC statement’s outcome – some faster (i.e., algorithms) than others (manual traders).

The key for every market participant is to spot and understand potential changes in the FOMC statement. Namely, market participants look for nuances in the document’s wording. It can be one word (e.g., keep the monetary policy stance unchanged for an unlimited time vs. keep the monetary policy stance unchanged for twelve months), or some lines from the previous statement could disappear, or some new ones might appear.

FOMC Press Conference

The press conference follows thirty minutes after the FOMC statement’s release. By the time the Fed’s chair begins to speak, the currency market has already had half an hour to digest the changes, if any, in the Fed’s statement.

It isn’t necessary for the Fed to make a change in the statement for the market to move. Sometimes the market participants expect a change in language or in the federal funds level, and if the Fed does not deliver, a knee-jerk reaction follows.

The first part of the press conference is when the Fed’s chair reads the statement. The second half belongs to financial journalists to ask the Fed’s chair questions about the future path of interest rates and the overall economic stance.

Of the two, the questions and answers session is the one that creates the most volatility in the market. After all, no one knows the questions that will be asked or, more importantly, the answers to them.

FOMC Staff Projections

Before giving any further details, there’s one thing worth mentioning. The most important meetings for investors are those followed by a press conference, where the public finds out the staff projections.

The economic projections provide information about Core PCE Inflation and Real GDP for the next two years and in the long run. Often the market and the USD move aggressively on details about the future expectations for the U.S. economy, regardless of what the FOMC meeting and statement showed prior to the staff projections.

Of the eight meetings the FOMC holds each year, those where the staff projections are released have a particular impact on the currency market. The entire world waits for the U.S. economic forecast before deciding to buy or sell USD.

Staff projections have deep implications for future expectations regarding the federal funds rate. The projections show where each member (i.e., FOMC member) stands when it comes to the actual funds rate. For instance, if the federal funds rate is 1%, the traders would like to know what all the members’ opinions are for future rates. The projections show their expectations for the period ahead, and traders divide the expectations into hawkish (bullish for the currency) or dovish (bearish for the currency).

If more than half of the members see the rate being above 1% in the future, the overall forward guidance message is hawkish, or bullish, for the USD. The market will react by buying USD, and usually, that’s done rapidly as trading algorithms quickly execute instructions.

In other words, one of the outcomes of the FOMC staff projections is that they reveal the ratio between hawks and doves on the FOMC Committee – the bigger the discrepancy, the bigger the impact on the USD.

FOMC Members’ Speeches

Sometimes the Fed’s message isn’t clearly understood by the markets. Because a press conference only follows every other Fed meeting, sometimes the market needs a bit of clarification.

To this end, the FOMC members hold regular speeches at various conferences, give interviews in financial publications, etc. They either reinforce the Fed’s message or clarify the Fed’s point of view and guide the market.

Fed speeches are important market-moving factors, especially if the one giving the speech is a voting member. Remember that there is a fine balance between the hawks and doves ratio on the FOMC, and if one Fed member is perceived as changing his/her stance, the market will react by selling or buying USD. In other words, the market will adapt.

FOMC Minutes

As mentioned earlier in the article, the FOMC meets every six weeks. At every meeting, the minutes are recorded and released three weeks from the moment the FOMC meeting ends.

In other words, the FOMC minutes release refers to the last FOMC meeting that took place three weeks earlier. For this reason, many market participants view these minutes as outdated or lagging. After all, what importance do they have if they refer to something that happened in the past, three weeks ago?

Well, this may or may not be true. Often, the minutes reveal interesting aspects of the FOMC meeting, aspects not known to the public until their release.

Just like the FOMC statement, the actual release is a text that causes market fluctuations in USD pairs. Trading algorithms sell and buy USD based on changes from the previous release and based on new hawkish or dovish details that the minutes reveal.

FOMC Emergency Rate Cuts

Sometimes the Fed is forced to cut the federal funds rate between two meetings. Not that it isn’t possible to hike the rate between meetings, but usually such a maneuver comes in unexpected, tense times. Almost always, in recent history, any Fed intervention between two meetings has turned out to be an emergency cut.

In 2008, right after the Lehman Brothers collapse, the Fed came out with a message delivering a rate cut. The last time this happened was in 2020, on the verge of the coronavirus outbreak around the world. The Fed cut fifty basis points in March 2020, between two ordinary meetings, in what was intended to be a message of trust and confidence – after all, the Fed is watching market developments and stands ready to intervene.

But the markets didn’t take it this way. The question on every investor’s mind was why didn’t the Fed wait two more weeks until its regular meeting? Could it be that the economic situation is so bad that two more weeks would cause even more damage to a weakening economy? Therefore, investors downplayed the Fed’s move and ask for even more cuts.

In theory, the Fed can intervene in the markets at any single time. It uses the FOMC meetings to assess each member’s opinion, to interpret the staff projections and the FOMC statement and press conference to communicate its decisions.

However, sometimes things move too quickly and decisive intervention is needed. The bigger the intervention, the more serious the problem is.

The norm among central banks is that when they begin a tightening or easing cycle, they move in incremental steps of a quarter of a basis point, or .25 basis points. The higher the rate cut, the deeper the feeling of emergency.

- Lehman Brothers Aftermath – The Fed’s Reaction

Over a decade ago, the Fed faced a crushing housing market that led to the collapse of one of the largest investment banks in the United States – Lehman Brothers. The volatility on the financial markets was so big and prices moved so fast that conventional market reactions no longer worked.

For instance, what was supposed to be bullish or hawkish for a currency no longer mattered. Also, economic data in times of uncertainty falls in second place. No one cares anymore what the unemployment rate or inflation is, because the market is driven by other factors.

Risk-off and risk-on sentiment dominates trading in such times. In other words, the world’s most important decision-makers for the financial industry (i.e., central banks) take measures that result in a risk-on or risk-off reaction. If the actions are perceived as positive, that’s risk-on, and traders buy equities. If not, equities fall, and risk-off triggers lower USDJPY, for instance.

The Fed intervened with an emergency rate cut in a similar way to 2020. The message was clear and sound, but it didn’t calm the markets. More was needed, and eventually the Fed lowered the federal funds rate almost to zero.

Like it or not, we live in societies connected by a central financial system. Central banks act not only unilaterally, but also under the Bank for International Settlement (BIS) umbrella. In difficult times, central banks extend credit and swap lines in different parts of the world via the BIS system, as needed.

The investors seeing the Fed’s reaction in 2008 didn’t sell USD, as it was normal – after all, the Fed slashed the rate, a move otherwise negative for USD. Instead, investors bought USD in anticipation that the other central banks around the world would follow the Fed’s steps and cut rates too.

- The Oil Price Shock and the Coronavirus – What Did the Fed Do?

So far, 2020 is no different. What started with the celebration of a new decade quickly turned into a nightmare.

The coronavirus spread from China to the rest of the world, prompting chain reactions from the world’s central banks. As it was not enough for any economy to weather, the oil price collapsed over thirty percent in the first weekend of March, creating massive gaps at Monday’s opening on almost all currency pairs.

The Fed intervened at the start of March, during the NFP week. In an emergency intervention, it delivered a fifty basis point rate cut, just like it did in the 2008 financial crisis. It didn’t have time to wait before the next meeting, so it cut the federal funds rate effective immediately.

In times of uncertainty, the Fed is viewed as the world’s most proactive central bank. When the Fed suddenly changes the course of its monetary policy, it does so for a reason. Therefore, when it delivers an emergency rate cut, the world’s central banks listen.

It came as no surprise that the Bank of England (BOE) also delivered a similar rate cut less than two weeks after the Fed surprised the markets. For the BOE to do something like this is surprising, because it is one of the most conservative banks in the world.

The point here is that when the Fed intervenes outside of its regular monetary policy decisions, traders and other central banks know that it is serious, and there’s no room for complacency anymore. When it’s time to act, the Fed is not shy to lead the way.

The Jackson Hole Symposium

Once a year in August, the Fed holds a symposium in Jackson Hole, Wyoming. With a history of almost forty years, the symposium is a closely-watched central banking gathering that often influences market prices.

It isn’t the Fed per se that holds the gathering, but the Federal Reserve Bank of Kansas City. Prominent central bankers gather to discuss the world’s economic issues and brainstorm solutions for solving them.

One of the longest-standing central banking conferences in the world, the Jackson Hole Symposium, is an open forum, a discussion among prominent members. Participation is not free – a fee is paid to cover the expenses, and only selected media have access to the event.

The ECB copied this model and began organizing a similar event in Sintra, Portugal. Such conferences often yield positive results in terms of better communicating to the public the central bank’s intentions and fostering transparency in a world of central banking that is often viewed as opaque.

A particularity of such events as Jackson Hole and Sintra is that they take place during the summer – end of June for Sintra and August for Jackson Hole. Often, summer trading conditions mean low volatility as people enjoy their annual vacations, giving central bankers the opportunity to meet at such events.

The news coming out of the Jackson Hole Symposium often moves markets. While the topics on the agenda may not be related to monetary policy, the reporters often interview participants on a wide range of topics. Hence, market-moving remarks are not unusual, and traders from all corners of the world monitor the Jackson Hole event closely.

What to Watch Between Two FOMC Meetings?

The currency market moves based on the perceived differences between the values of the two currencies that make up a currency pair. In turn, the currencies reflect the economic shape of a country or region. The stronger the economy, the quicker the central bank will tighten the monetary policy to avoid rising inflation.

Therefore, between two FOMC meetings, the traders focus on interpreting the economic indicators and putting the information together to get the overall picture of where the economy is heading next. Is there a recession or expansion ahead?

Some indicators are more important than others. Coincident and leading indicators have a different impact on the market than lagging indicators. For instance, building permits is a leading indicator and offers a better forecast of future economic growth than, say, the unemployment rate, which is a lagging indicator (i.e., it refers to past conditions).

The stock market, for instance, is a leading indicator too. It is responsible for the so-called wealth effect (i.e., a rising stock market is responsible for increased spending because investors perceive the rise in value as a confident sign of their wealth increase, and so spending will rise, positively affecting the economy).

Conclusion

The most prominent central bank in the world, the Federal Reserve, leads when it comes to other central banks’ actions. Because it is responsible for setting the interest rates on the world’s reserve currency, the Fed has a tremendous responsibility when it comes to global economic growth.

It can easily influence economic performance in other parts of the world by simply changing the way the USD is available worldwide. The coronavirus reaction from the Fed is a good example – it slashed the rates to zero in two emergency rate cuts and opened USD swap lines with major central banks around the world to make sure there was no USD scarcity in the system. That’s proactive behavior that goes far beyond the United States’ physical borders.

This is just an example, but throughout history, many exist. For retail currency traders, but not just them, the key takeaway of this article is that this is the one central bank to watch for at least as long as the USD remains the world’s reserve currency.

A clear understanding of how the Fed functions and how it delivers the monetary policy is very important for the currency trader. Armed with the economic calendar that shows the important economic events and releases for the period ahead, traders can filter what data is important and what isn’t so that they may make the appropriate trading decisions.

The Fed system may be a bit more complicated when compared with other central banks in the world. This trading academy covers the most important central banks, and it reveals the relevant differences between them. Some operate based on a simpler system, some on a more complex one – but they all aim at fostering economic growth by setting the right monetary policy.