LISTEN TO THIS ARTICLE:

The Forex market is the largest in the world and it continues to grow. The more people are connected to the Internet, the more retail traders open accounts with brokerage houses.

But as this article will point out, retail traders or investors are one of the smallest categories of market participants. Instead of worrying about competition from the retail environment, traders should be more preoccupied with other Forex market players or participants.

Because of the large volume flowing in the FX market, it is impossible to use volume-based analyses such as VSA (Volume Spread Analysis). This makes it difficult to assess the volume behind a certain market move, in sharp contrast to the stock market.

New technological breakthroughs have made the trading environment even more competitive. High-frequency trading is responsible for sharp movements in prices, especially when important economic news is due.

These robots or trading algorithms also use deep learning to scan and read texts. As such, when, say, the Federal Reserve of the United States releases its FOMC statement every 6 weeks, the robots quickly scan the text in search of changes from the previous statement.

The scanning takes place in a blink of an eye, and the prices react in consequence. If the Fed is perceived to be more hawkish, the algorithms are instructed to buy the dollar. Just the opposite happens if the Fed is perceived to be dovish – the robots will sell the dollar in an instant.

It should be clear from the start that it is not the retail traders and investors that move the currency market. For this reason, a clear understanding of other Forex market players makes it easier to see the forces behind major market moves.

Categorizing the Forex Market Players

The categories of market players listed below do not represent a ranking. Or, if you want to view it as a ranking, think of their influence in moving the market prices.

The list will present, in descending order, the types of Forex market participants that are able to influence the volatility in the market. As you’re about to see, it is all about the volume traded and the influence over the price.

Before starting, we should also mention that technological advances did not improve only the conditions for retail traders. Sure enough, retail traders enjoy better conditions currently than they did a decade ago: 5-digit quotes, better regulation, segregated accounts, ECN (Electronic Communication Network) and STP (Straight-Through Processing) technologies, lower spreads, commissions, ease of funding, speed of execution, and so on.

But the same technological breakthroughs act in favor of other market players too. For instance, the trading algorithm industry, or the quants industry as it is also called, advanced to such a level that a robot opens and closes thousands of trades per second.

If we couple this with the fact that all other market players have more resources, knowledge, and access to research and extra funds than retail traders, we understand why the success rate in the retail Forex trading industry is so low.

It should be no secret by now that most retail traders lose their equity in the currency market. For this reason, some brokerage houses, especially market makers, trade against their customers – because the chances are that by taking the opposite side of a trade, the market maker stands to win.

Therefore, by the end of this article, traders will have a clearer idea of why successful trading is a combination of hard work and dedication, but also of understanding the market’s forces and dynamics.

Retail Accounts

The first category, retail accounts, is the simplest form of participating in the currency market. Think of the kiosks in airports, tempting tourists to exchange foreign currency before leaving the country.

Still in this category, we can introduce the entire retail trading community. As explained earlier, the electronic trading technologies made it easier for retail traders to access financial markets, with the FX market being one of the biggest beneficiaries.

Active traders of all sorts, willing to risk their accounts to speculate on the currency market, belong in this category. Think also of households as well that use electronic trading to move their savings into foreign currencies. Nowadays, the process is so simple that it can be done from a simple app on a smartphone.

All the categories that follow from this moment on are beyond retail trading both in resources and influence on prices. In other words, to be profitable trading the currency market, a retail trader has more chances by following market trends triggered by other currency market players, rather than fading them.

Brokers – Market Makers

We’ve hinted earlier that some brokers trade against their clients, instead of routing their clients’ orders to the market. This is true, but it is also legal. Some market makers in the world run huge businesses, well-established ones, and with solid reputations.

Yet, there is always an ethical issue, knowing that on the other side of a trade is not another market participant, but your own broker that wishes you to fail as a trader. This ethical issue is one of the reasons why the industry evolved, and nowadays, market makers rarely make it in the developed economies.

Some brokerage houses organized their businesses as a hybrid, a combination between market-making and routing the trades to the market. The key here is to decide which customers go to the market-making business, and which ones have their orders routed to the market. The former trade against the broker, the latter, in the actual market.

Because these brokerage houses have many individual clients, they need to hedge positions and are involved in all kinds of trading strategies to minimize their losses. They do so by running a fully-equipped trading department that runs vast amounts of money, far bigger than the pool of funds their clients trade with them. As such, the brokerage houses (not all of them) are active market players, much bigger than individual traders.

Family Offices

A family office is a private wealth management firm that caters to high-net-worth individuals. They are an important pillar of the investment community with plenty of influence on financial market prices.

In the first half of 2021, the world learned that one family office company, Archegos Capital Management, was responsible for billions of dollars in losses for major investment banks through the use of leverage.

The AUM by family offices continue to rise, with the industry following the growth in the global investment industry. Family office managers have exposure to various markets and use long and short strategies on the currency market too.

Leveraged Accounts

The best way to refer to these market participants is to just call them representatives for the professional trading community. In this category we can include hedge funds, high-frequency trading (HFT) companies, and commodity trading advisers, but also any active trading account that uses leverage. Even the retail trading accounts available to Forex traders use leverage, and in most parts of the world the leverage is limited by financial regulators.

The Forex leveraged accounts take both short and long-term positions in the currency market. Because of their size and different strategies used, they are responsible for a big chunk of the currency market trading activity.

Institutional Investors

Institutional investors are pooled investment vehicles, usually with a long-term investment horizon. In this category we can include endowments, pension funds, real estate investment trusts (REITs), and mutual or hedge funds.

Because of their long-term horizon investments, institutional investors may move the market through the size of their orders. Credit unions, investment advisors, banks, insurance companies – they all have a department that executes either their client’s orders or their own orders in the currency market.

Endowments

Endowments are a sort of mutual funds and are typically investment vehicles of universities. They pool together donations from various sources and invest the funds to provide additional income for the future.

Some of the biggest endowments in the world are those belonging to renowned American universities (e.g., Harvard, Yale, Columbia, Stanford). They have a very long-term investing horizon and typically place a big chunk of the funds into commodities so as to protect themselves against inflation. In other words, they care the most about maintaining the value of their investments and the additional income generated is typically used for research, scholarships, and so on.

Besides university endowments, foundations act as endowments too, investing with a long-term horizon. Examples of foundation endowments in the United States are the Andrew W. Mellon Foundation, the Bill and Melinda Gates Foundation, and the Lilly Endowment.

- Harvard

Harvard is the most famous university in the world. It is funded, albeit partially, by an endowment. The funds in the endowment come mainly from philanthropic gifts, and they now are part of a permanent source of funding.

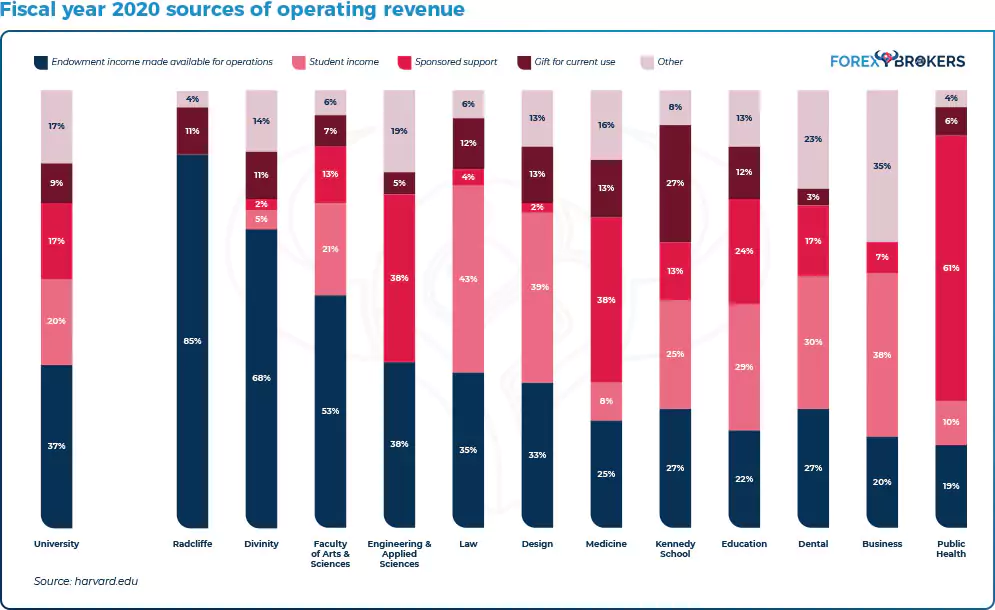

Harvard operates twelve different schools and each of them owns a share of the endowment. The endowment is managed by Harvard Management Company and has a target annual payout rate of 5.0% of market value.

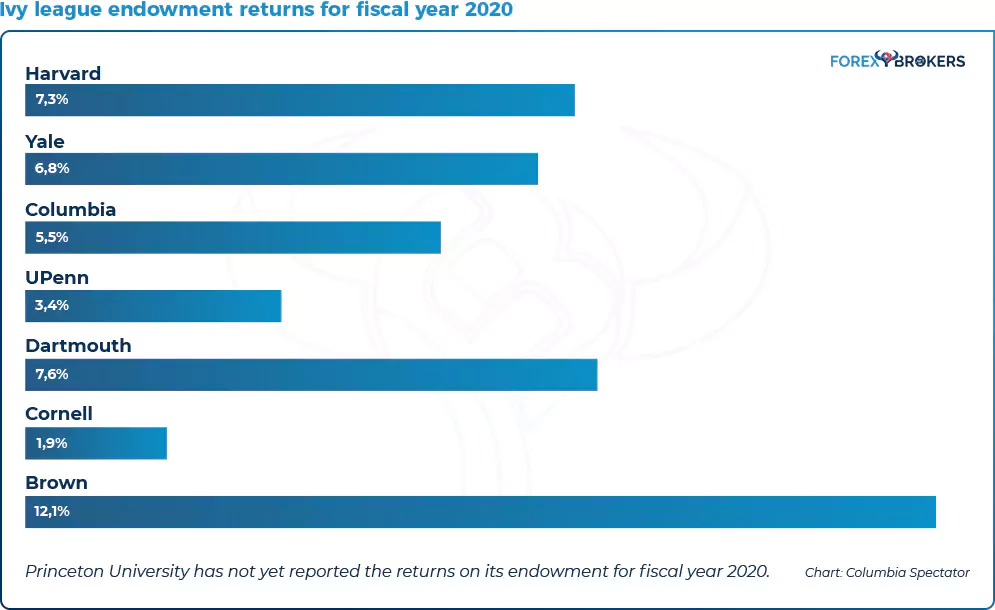

For the fiscal year ended June 30, 2020, the AUM of Harvard’s endowment exceeded $41.9 billion, generating a 7.3% annualized return.

- Yale

Yale’s endowment is famous for its outstanding performance over the years. It delivered over 12% in annualized returns over the past thirty years, mostly by using long-term investment policies and diversification.

The targets for the fiscal year 2021 are an absolute return of 23.5%, balancing investments over different areas such as venture capital, leveraged buyouts, and foreign and domestic equity, but also real estate and bonds and cash. Note that most of these investments are alternative ones, known as being less liquid than traditional long-only investments.

- Columbia

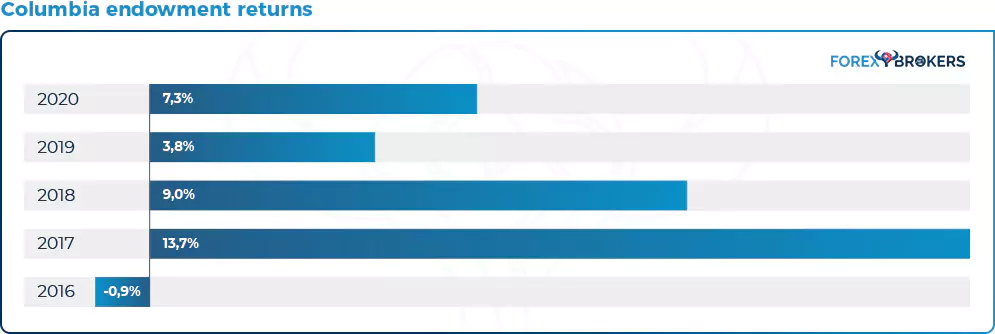

Columbia’s endowment reported a $310 million increase during the pandemic and 2020 does not stand out as a special year in terms of its historical returns. The graph below reflects the full diversification of endowments, choosing to spread investments on various asset classes instead of going with long-only stocks.

It is the only explanation of why over the course of 2020 an endowment such as Columbia’s returned only 5.5%, when the stock market had a strong run from the pandemic’s lows. Also, the chart reflects the endowment’s long-term investing principles, mostly built around alternative investments.

- Dartmouth

Dartmouth’s endowment report for the year 2020 reveals a spending distribution of $273 million and 10.4% annualized returns in the last decade. The assets under management rose to $6 billion and the long-term pool of capital remained unchanged when compared to the previous year.

Dartmouth’s endowment doubled its AUM in the last ten years and in the last 5 years, it distributed over $200 million annually. The endowment’s asset allocation is mostly in alternative investments such as real estate, venture capital, private equity, and natural resources, but also fixed income and cash and global equity.

Pension Funds

Pension funds are one of the largest institutional investors in the world. Two types of pension funds exist – defined benefit and defined contributions pension plans, but only the first type belongs to institutional investors.

Under a defined benefit pension plan, an employer or government has an obligation to pay a certain amount to employees or population at retirement. The funds typically have a long-term investment horizon and high risk tolerance. Liquidity needs are also low.

A defined benefit pension plan has a long time horizon if it still admits new members, or a finite horizon if it no longer admits members. They are typically used by companies in the private sector, although the trend is for companies to move from defined benefit to defined contributions plans, where the investing responsibility is transferred to the individual investor.

One of the largest funds in this category is pension funds run by governments, such as the Government Pension Investment Fund in Japan, the National Pension Fund in South Korea, and the Federal Retirement Thrift in the United States.

- Government Pension Investment Plan – Japan

The Government Pension Investment Fund (GPIF) in Japan is the largest retirement savings fund in the world. It should be, given the demographics of the country. Founded in 2006, the fund manages over 162,000 billion yen or $1.6 trillion in AUM. An interesting aspect of this fund is that it hires external money managers selected and monitored by GIPF managers.

Insurance Companies Funds

Insurance companies have both short- and long-term liquidity needs. They invest in short-term marketable securities or securities that are liquid enough and can be easily converted to cash, and they also hold a significant cash balance so as to have enough working capital for the day-to-day business.

However, insurance companies do charge a premium for the policies they write. They invest this premium in financial markets, and have huge funds to divert in various assets.

Also, the time horizon for the investments depend on the type of the insurance company – life insurance or non-life insurance. The former have a longer time horizon and thus have different expectations from the funds invested in financial markets.

Most of these companies have a global presence and need to convert currencies on a daily basis. They also run complex hedging schemes to hedge against unexpected risks, using the derivatives market to find the best way of protecting their investments.

Representative names in the industry are Allianz, Prudential, Axxa, and Berkshire Hathaway.

The market players in this category are also known as real money accounts. They have restrictions in the way they use leverage, and thus differ from other market players.

Corporate Accounts

The best way to describe corporate accounts is by thinking of the mergers and acquisitions industry (M&A). That is particularly relevant in cross-border M&As.

When a company makes a cross-border acquisition (i.e., buys a company from a different country), it must pay for the transaction in the local currency. To exemplify, imagine a United Kingdom corporation that acquires a Spanish company.

To pay for the acquired company, the British one, the acquirer, must use euros – the local currency in Spain. Therefore, the company will instruct its treasury department to buy euros or to use some already bought previously and held for reserves. In other words, the corporate world or corporate accounts are big players in the currency market.

Another example is that of MicroStrategy. This is a software company based in the United States that decided in 2020 to invest most of its treasury into Bitcoin. The company’s management cited fears of inflation due to irrational acts from central banks, and it believed that Bitcoin offers a better hedge against inflation than the US dollar does.

Therefore, the company bought Bitcoin in the open market, but to do so, it needed to sell the US dollar, thus influencing the dollar rates. Tesla did the same, announcing in 2021 that it had bought $1.5 billion worth of Bitcoin in the first quarter of the year.

Sovereign Governments

Governments have incomes and expenses – incomes in the form of taxes from citizens, and expenses in the form of wages paid or pensions, for example. A government budget is more complex than a household’s budget, but we can use some analogies for the sake of explaining how governments function and how they impact the currency market.

Think of countries that run a large trade deficit – the United States is the best example. A trade deficit means that the country imports more than it exports.

To make local products more attractive, one way to do so is to have a weaker currency. Thus, governments may put pressure on central banks, even though the central banks may be independent.

When Donald Trump took office in 2016, one of the first things to do was to put pressure on the Fed to ease the monetary policy. At that time, the Fed was running a contractionary policy, as inflation came close to the target and the economic growth diverged from the rest of the advanced economies. The constant pressure on the Fed led to aggressive moves in the FX market.

Also, governments may impose tariffs or quotas, directly affecting the flows into and out of a currency. A tariff of, say, 25% on imported goods from one country may discourage local businesses and households from importing anymore, and thus the FX market flows are influenced.

Furthermore, governments choose to keep a big part of their reserves in foreign currencies. The dominant currency in the world is the US dollar, because foreign governments choose to keep their reserves in this currency. Other reserve currencies are the euro, the British pound, and the Japanese yen, but their share is significantly lower.

Central Banks

Central banks are some of the largest players in the international financial markets. They do not necessarily need to act on the FX market for their actions to have an impact on the currency market. For example, consider the Swiss National Bank (SNB), which is a central bank with a huge portfolio of foreign securities.

More precisely, it invested heavily in US securities, having stakes in the big tech companies, among others. However, to buy equities on the US market, the SNB needed to use the local currency, the US dollar, to pay for them. To buy dollars, the SNB sold CHF in the open market and, with the proceeds, it purchased the dollars to pay for the equities.

Therefore, such operations have nothing to do with the day-to-day market operations that a regular central bank makes. Nevertheless, such actions have a big impact on the currency market, both on the Swiss franc and the US dollar.

Below are a few central banks as examples of how they influence the FX market. The idea here is not to focus on the monetary policy decisions with effect on the local economies, but how their decisions affected the global currency market.

Federal Reserve of the United States

The Federal Reserve of the United States (Fed) is the most influential central bank in the world. It sets the monetary policy for the US economy and thus has a direct influence on the value of the dollar.

The best way to illustrate how the Fed actions influenced the FX market is to think of the COVID-19 pandemic and the way the Fed reacted. At the start of the pandemic, in March 2020, it became obvious that the world was facing an unprecedented crisis.

As such, traders and investors dumped risk assets (i.e., stocks, currencies that usually outperform in a risk-on environment – AUD, GBP, EUR) and favored the US dollar. Therefore, the initial reaction was for the dollar to appreciate and the stock market to decline. This happened during the 2008–2009 Great Financial Crisis too, so it should come as no surprise that the market reacted the same to the next crisis.

In front of such adversity, the Fed opened USD swap lines with other central banks. First, they made the announcement. This alone was enough to trigger some reactions from other market players listed in this article, to start reducing their exposure on the dollar. Second, the Fed effectively printed more dollars digitally, by buying bonds issued by the US Treasury. This increased the money supply both in the US and in the international financial system.

Put simply, the Fed flooded the system with liquidity (i.e., newly printed dollars), and thus the FX market reacted by selling the dollar. In the course of a few months, the EURUSD pair rose from 1.06 to 1.20, and other major pairs did the same – all because of the Fed’s decisions and actions.

European Central Bank

The European Central Bank (ECB) is the second most important central bank in today’s financial markets. It has, perhaps, one of the most difficult jobs of all rival banks.

Because it is setting the monetary policy on different economies, with different strengths and weaknesses, the ECB must consider regional factors but act with the same voice. In other words, its decisions apply equally to the southern and northern countries. In Europe, southern countries always needed easier monetary conditions than the northern ones, so that is a big issue – how to set the right monetary policy for the entire block without getting it wrong in some countries?

To resolve this, the ECB uses the previous national banks in each country as its “eyes and ears” locally. In a way, if you want, the national banks in Europe act just like the regional federal banks in the United States. The difference between Europe and the United States is that in the United States there is also a common fiscal policy, in addition to the monetary one.

So, the ECB must set a common monetary policy, but it preserves the right to act locally. For instance, during the EU sovereign crisis in 2012, the ECB acted swiftly by supporting the Italian and Spanish bonds. In doing so, the ECB avoided an unnecessary increase in the credit spreads. Whenever the spreads widen, that is negative for the common currency, leading to a bearish move for the euro. The opposite is true as well – tighter spreads are positive for the currency, leading to a bullish euro.

Even during the COVID-19 pandemic, the spreads narrowed, leading to the euro being supported on every dip. One of the reasons for the euro’s strength came from the constant bond-buying from the ECB in areas of Europe seen as riskier.

Bank of Japan

The Bank of Japan (BOJ) became famous in financial markets as the one central bank that did run a quantitative easing experiment bigger than the one in the United States. Because it could not bring inflation close to its target, the BOJ announced that it would engage in bond-buying to bring inflation up. At that time, in 2010–2011, the world was facing the aftermath of the Great Financial Crisis from 2008–2009 and the United States was experimenting with quantitative easing.

The BOJ went all in, and it announced a program much bigger than the one in the US. The USDJPY pair was trading around the 76 level at the time of the BOJ announcement. It started to aggressively grind higher, ending its rally at 125 after months of tripping stops and squeezing the short sellers.

But the BOJ did not stop there. It instituted yield curve control measures, as well as aggressive programs of buying ETFs on the local stock exchange. The idea was to ease the monetary policy as much as possible, and so to weaken the currency by creating inflation.

It did work for a while, but at some cost and with uncertain results in the long term. All in all, the BOJ did influence the FX market and was one of the key driving forces in the FX world for several years.

Swiss National Bank

We are not done yet with the Swiss National Bank – this is one of the most interesting central banks in the world because it has a slightly different status than other central banks. For example, it has common shares, publicly listed on the national stock exchange.

Also, this is a central bank that is not shy about letting the world know that the strength of the local currency, the Swiss franc, is weighing on Swiss exports and economic performance. Therefore, the SNB constantly intervened and still intervenes, directly or indirectly, in the currency market.

The most famous experiment happened in the first half of the 2010s, when the SNB pegged the EURCHF exchange rate at the 1.20 level. It vowed to protect the level by all means – and it succeeded, for several years.

During those years, the FX market was unnatural. Every time the EURCHF cross pair got closer to 1.20, the EURUSD and USDCHF inverse relationship got closer to -1, meaning 100% inverse correlation while the EURCHF was at 1.20. As such, traders needed to account for the next move from the SNB, and if it would be able to hold the pressure on the EURCHF floor.

It did not. At the start of 2015, the SNB let the floor go. It accounted for tens of billions of losses, those being the funds poured into the FX market to defend the exchange rate. By the time it ran out, it was too late for some brokerage houses and many retail traders as well.

Sovereign Wealth Funds

Countries that run a current account surplus must do something with the extra cash they got. Think here of oil-producing countries such as Norway or countries in the Middle East.

Instead of entrusting their national central banks with managing the funds they receive from exporting oil products, they poured the funds into Sovereign Wealth Funds (SWF). Representative names of such funds are the Norway Government Pension Fund Global, the Abu Dhabi Investment Authority, and the Kuwait Investment Authority.

These are ginormous funds that typically have a long-term horizon for their investments and a global market at their disposal. Typically, investors with a long-term horizon invest in the global fixed-income market, but also in alternative investments such as real estate or commodities.

Because they invest globally, they move the funds from one currency to another, and thus the flows affect the daily FX volatility.

Conclusion

This article was meant to illustrate the complexity of the financial markets, and, in particular, the complexity of the currency market. Retail traders, as mentioned earlier, are only a small part of this world. Therefore, to make it in this world, you’d better stick to the main trades and, if you hold a contrarian view, try to adapt as quickly as possible and have a tight money management system.

It becomes clear now why volume trading strategies, such as the VSA – Volume Spread Analysis, are of no use in the currency market. Because there is no way of knowing the exact volume traded at any one point in time, the information is useless – unlike in the equity markets.

Some other categories of Forex market participants exist, but we will treat them in a different article part of this academy. For example, a big part of the daily FX turnover is given by dealing desks, such as HSBC or Citigroup. Not everyone can be a dealing desk, as the costs of running such a business are prohibitively high.

All in all, the FX market is a complex market, full of the unexpected. Anything can turn the prices – from a sudden event in one part of the world, to an important piece of economic data. The forces involved in the FX market are so powerful that the retail trader must have a well-defined money management plan to profit from the market swings.