LISTEN TO THIS ARTICLE:

If there’s one trading platform almost all retail traders instantly recognize, that’s the MetaTrader. Used by retail foreign exchange speculative traders, it has been on the market since 2005.

Naturally, different versions of it have appeared since its inception. Currently, MetaTrader 4 and MetaTrader 5 dominate retail trading, with MetaTrader 4 outpacing the later version.

This article will look at everything there is to know about both trading platforms. As you’re about to find out, the MetaTrader 5 version appeared as a response of the parent company, MetaQuotes Software, to the change in regulation in different jurisdictions, particularly in the United States.

The company licenses the two MetaTrader versions to any broker willing to pay for it. Moreover, branding possibilities exist because the broker offers the MetaTrader using its logo and name.

However, once logged in, the trading platform is the same at all brokerage houses. It makes it the perfect trading platform for the retail trader, fully customizable and easy to use.

It comes as no surprise that traders love it. But also, it says something about the type of trader you are. For instance, if someone asks you what trading platform you use and your answer is MetaTrader, it means you’re a retail trader.

As a reminder, a retail trader is the regular Joe, he or she that buys and sells currencies for fun, for a hobby, or even for a living. When the size of the trading account increases, brokerage houses approach traders with different offers and different trading platforms to use.

We’ll cover all the available options in this article. For now, the trader must know that there’s a logical process showing a trader’s progress.

The Road to Professional Trading via the Trading Platform Used

It is no secret now that MetaTrader is the platform for beginner traders. Or, to put it more correctly, when first starting trading as a retail trader, inevitably, the MetaTrader is the platform to use.

It works great up to the point where trading for a living is no longer a secret, and it fails to serve the same purpose by the time traders begin to swing large amounts of money. We’ll cover different options at the end of this article, only to pave the road to professional trading.

As a small introduction, a retail trader most likely uses the MetaTrader. All brokers offer it, even the ones who don’t want to.

Some brokers develop their own trading platforms. They have the financial resources and capabilities to do so, and the idea is that the trader becomes captive by learning to use one single trading platform.

But that comes at some substantial costs. Firstly, developing a performant trading platform requires a lot of time, energy, and financial resources.

Secondly, the broker must train the traders to use the platform for actual trading. If the trading platform is new and different from the MetaTrader, educating the trader comes at additional costs, not to mention the costs of maintaining the trading platform and providing ongoing tech support.

Therefore, the road to professional trading begins with the MetaTrader. New regulation, especially in the Eurozone and the United Kingdom, limits the leverage to 1:30.

But as long as the trading ends up with a profit, things start to change. To begin with, the broker provides new trading conditions, new leverage, tighter spreads, and different conditions offered to the newbie trader.

Yet the road to professional trading starts with the MetaTrader, which is what this article is all about.

MT4 Competition

Other trading platforms for retail traders also exist. One is the cTrader, launched in the last years as an alternative to MetaTrader for brokerage houses. Another one is the JForex, an in-house trading platform developed by one of the largest brokers for the retail traders. While having new features and a new look, at the core, trading is similar to what the MetaTrader offers.

When retail traders make the leap to professional trading, the Bloomberg terminal dominates the market. It has been the destination to make the most from trading international financial markets for years.

It gives access to literally all the markets in the world and, in some cases, to markets that many traders didn’t know exist. But it all comes with a stiff price, a reason for retail traders to stick with the MT4 or MT5 platform.

Downloading the MT4 Trading Platform

The MT4, as MetaTrader 4 is also known, is mostly used by retail traders. Compared with MT5, it has some highly appreciated features that we’ll cover later in this article.

After opening a trading account, the first thing to do is download the MT4 trading platform. Depending on the operating system, the broker offers various links for downloading it.

Once downloaded, the MT4 trading platform adds a shortcut on your desktop to launch it. On launch, a tab appears, requiring the login data (username and password) and the server to choose from.

Typically, the broker already provides all this information in the e-mail received when opening the account. Logging in is easy and takes less than a few minutes.

The desktop option is the recommended solution when trading with the MetaTrader. Most brokers also offer a web-based solution, but the Internet connection may play tricks from time to time, and that might affect the prices when trading.

On top of the desktop and web-based solutions, there’s another one that increased in popularity recently–the mobile trading platform.

Trading on the go revolutionized the industry yet again. Forex traders were glued to the screens, especially those trading on lower time frames.

Nowadays, the MetaTrader app appears on both Android and iOS for downloading. To trade on the go, first, you need to download the MT4 app. Next, find your broker using the search box. Finally, use the same credentials to access the trading account.

Many traders use the desktop version only for technical analysis purposes, and trading takes place on the app. Also, the app makes it easier to stay up-to-date with the latest market moves, something mandatory for the currency trader.

MetaTrader 4 General Characteristics

The MetaTrader 4 platform has the same interface on all brokers. Because it looks the same and has the same functions, traders find it easy to switch to a different broker that offers better trading conditions.

This is how the MT4 looks like the first time the trader opens the platform. On the top left of the picture above, there’s the broker’s name and the account number, but we edited it for privacy reasons.

From the very start, the forex dashboard (the list with the currency pairs and other markets offered) catches the eye. This is the market and represents the bread and butter of every trader.

Not all currency pairs and markets are listed initially. To find out the entire broker’s offering, right-click on any currency pair and select the “Show All” option. This way, all financial products will be listed in the Market Watch window. The clock on the market watch belongs to the time zone where the server is.

The MetaTrader 4 platform has the most significant part of it dedicated to the charting area. It is one of the reasons why MT4 is so popular among traders, as there are over fifty technical indicators pre-installed in the platform.

In any case, if there’s a custom indicator to import, that’s easy to do by following a few simple steps. Later in the article, we’ll cover this aspect too.

The platform offers nine different time frames and a strategy tester to automatically backtest any strategy. Furthermore, it has a MetaEditor connected so one can code an Expert Advisor (i.e., trading robot) or indicator and use them on the MT4 platform.

Trading with the MT4 Platform

Intuitive trading allows traders to set up the strategy quickly. Like any other trading platform, the MT4 allows trade at the market or to use pending orders.

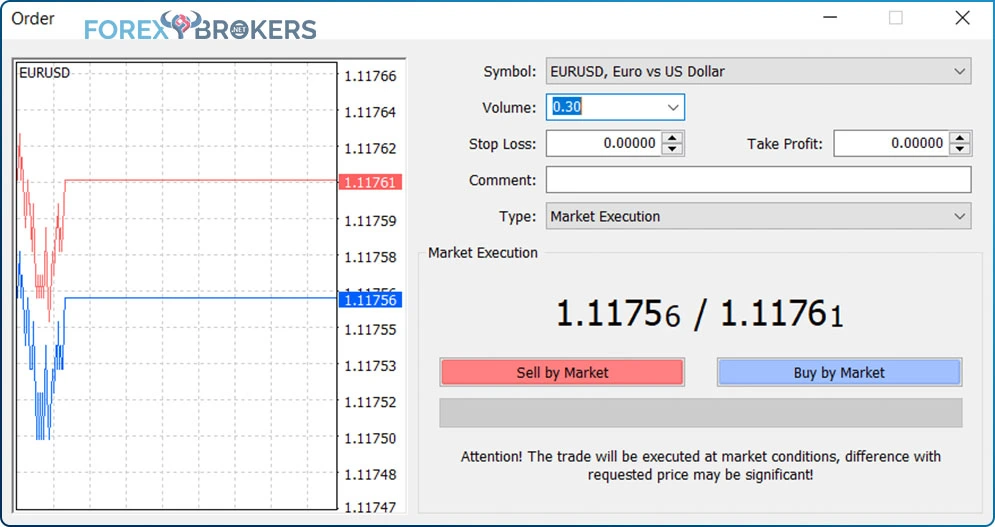

Trading at market means that the entry occurs precisely when the trader clicks the Buy or Sell button. Just pick a currency pair from the market watch, and double-click on it. The following pop-up window appears:

From top to bottom, let’s have a detailed look at it. First, the Symbol tab shows the currency pair to trade—in this case, the EURUSD.

However, traders can change it by simply opening the tab and selecting a new currency pair (or market) from the list that appears. The quotes will change accordingly.

The Volume shows how much the trader buys and sells. Volume is an essential component of the trading strategy because it gives the value of a pip.

For you to have an idea about the value of a pip, imagine that 0.1 in volume for the EURUSD pair represents about $1/pip (fourth digit) the EURUSD pair moves. In this case, the volume shows 0.3 lots, meaning that every pip has a value of $3 in a USD account. The volume traded also matters as it determines the size of the commissions paid as well as the positive or negative swap to receive or pay for the positions kept open overnight.

Stop-Loss and Take-Profit Orders

If there’s one thing to keep in mind after reading this article, it’s that every trade must have a stop-loss and a take-profit order. Ideally, the take-profit level exceeds the stop-loss level by a factor of a minimum two to one, giving traders proper risk–reward ratios.

The MetaTrader 4 executes the two orders automatically. Only the opening of a trade is manual, and the rest takes place automatically, even if the trading platform is closed.

In other words, the MT4 is just an interface the trader uses to give orders to the broker, and the broker places the orders on the market. When the market executes the orders, the outcome appears in the trading account.

As the name suggests, the stop-loss order limits the potential loss. Placing such an order indicates a trading plan exists. Many traders, especially rookies or newbies to currency trading, prefer to change the stop-loss level by the time the price threatens to reach it.

While sometimes it may seem like a good idea, remember that a reason existed for placing the order in the first place. Conservative traders like to tighten the stop-loss order by the time the market goes in their favor. For instance, one of the most used strategies is to book partial profits as the trade advances in the right direction and move the stop-loss order to break even for the remaining of the position. More about such money management strategies comes later in the trading academy.

Types of Pending Orders

Market execution, once again, means the trade gets executed at the current market rate. A few years back, when trading accounts used to have four digits instead of five like today, often the broker gave requotes when trading at a market. The market moved too fast, and the broker couldn’t guarantee the bid and ask prices. Nowadays, that’s not the case; the trader usually gets the desired price.

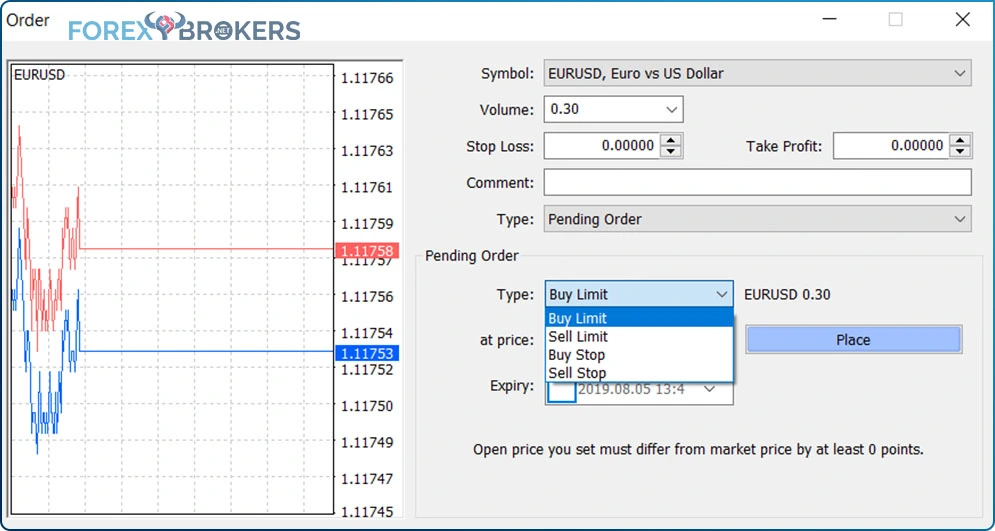

By clicking on the Type of the trade as shown in the previous image, a new tab appears with the possible pending orders to use:

- Buy stop

- Buy limit

- Sell stop

- Sell limit

- Pending Buy Limit

Traders use a pending buy limit when buying from lower levels. It means that the trading plan requires that the market drops a bit before going long.

- Pending Sell Limit

The opposite is true when traders want to sell from higher levels. Mostly used in bearish trends to sell spikes, the pending sell limit order waits for the market to rise before entering short.

- Pending Buy Stop

Typically used when trading continuation patterns (e.g., ascending triangles, pennants, bullish flags), pending buy stop orders, make sure buying takes place from higher values. Traders that use trending strategies like to buy a new higher high; the pending buy stop order is perfect for that.

- Pending Sell Stop

The pending sell stop order gets activated when traders wait for bearish continuation patterns to end. Mostly used to trade the end of a descending triangle or bearish flag, the pending sell stop order waits for the price to fall before entering short.

Charting with the MT4 Platform

Perhaps the number 1 reason traders favor the MT4 platform is the simplicity of using its most important feature: charting. Charting is easy and intuitive and, in the MT4 platform, fully customizable.

From the main menu, traders can find trend indicators, oscillators, and volume indicators. Also, all technical tools needed to chart exist too:

- Fibonacci tools

- Retracement

- Expansion

- Time zones

- Arcs

- Gann tools

- Fan

- Line

- Grid

- Channels

- Fibonacci

- Linear regression

- Equidistant

- Standard deviation

- Andrew’s Pitchfork

- Cycle lines

- Text to write on charts

- Trendlines and channels to use for marking support and resistance as well as defining trends

All of them are used on the charting window to forecast future prices. Simply put, they all help to build a technical analysis scenario, and we’ll start discussing the topic in the very next article part of this trading academy.

Customizing a Chart in MT4

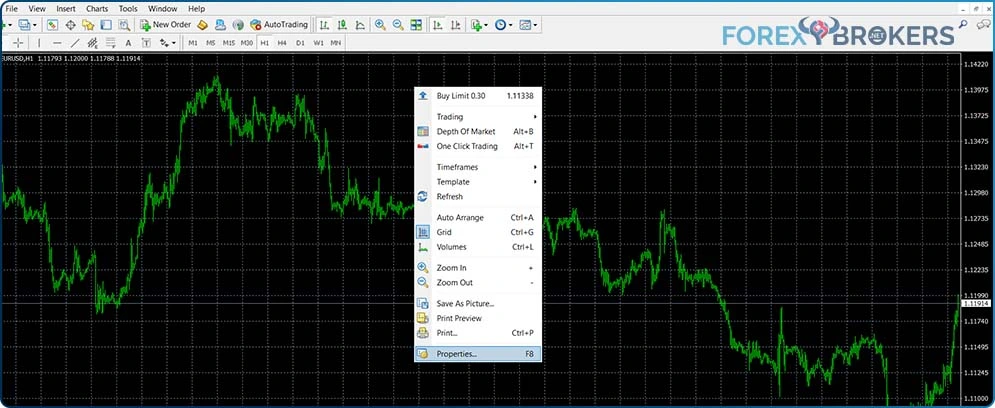

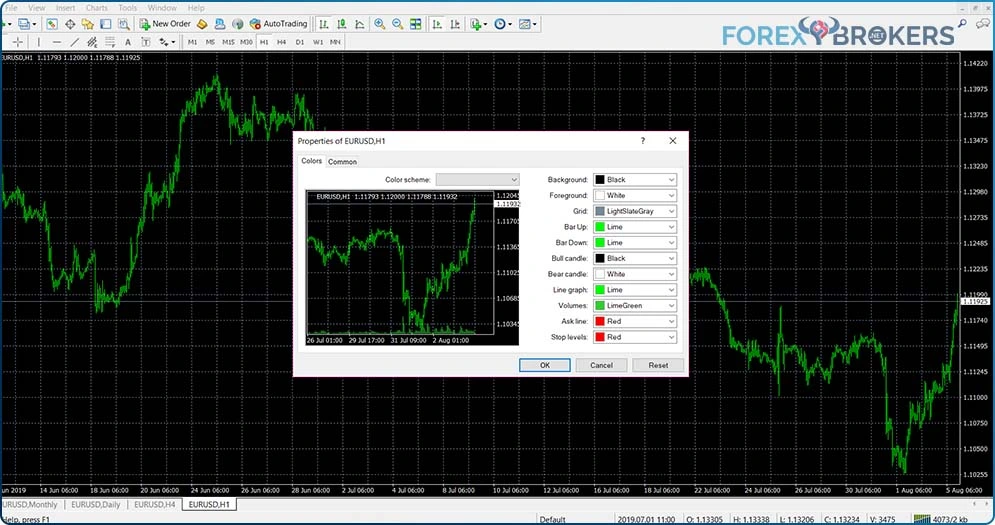

To start with, all charts come with a default setting that looks something like the one below. The intention here is to show step-by-step the process of customizing the MT4 chart to the details wanted and then saving the template for future use on other currency pairs and time frames.

With the current features, there’s not much we can do with this chart. If anything, we see that this is the H1 (hourly) EURUSD time frame. It means that every period on the chart represents one hour.

To customize it, we simply make right-click anywhere on the chart. Next, select the Properties tab, as indicated in the picture below.

A new pop-up window appears, allowing full customization of colors and other settings. Traders can choose the right color set with all options available.

For the sake of showing exactly how to customize the chart, here’s what we’ve changed:

- Background from black to white

- It makes charting more visible, as well as the trendlines.

- Foreground from white to black

- On a white background, the foreground must have a darker color to see the price on the screen.

- Bar up

- Lime

- Bar down

- Red

- Bull candle

- Lime

- Bear candle

- Red

By clicking the OK tab, here’s how the MT4 chart looks like after all the steps have been completed as mentioned above:

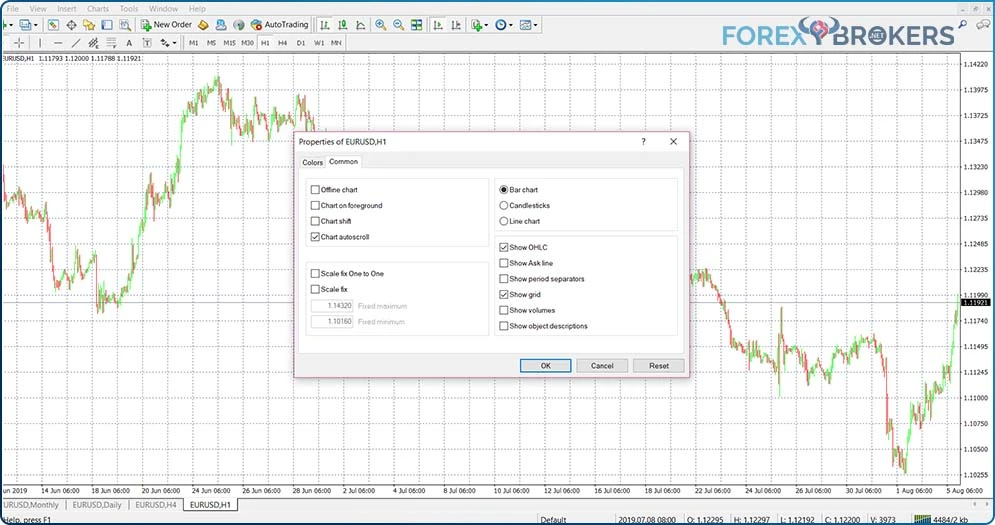

But that’s not all. On the left side of the pop-up window, there is another tab called Common.

- Customizing the Common Tab

The Common tab has some important features. With the default settings, it looks like below:

A quick look at the right side of the picture reveals the price sits very close to the screen’s edge. In other words, the current arrangement is useless as we can’t forecast any future prices on the right side of the screen.

For this, we need to select the “Chart shift” tab from the pop-up window and at the same time, deselect the “Chart autoscroll” option.

By doing that, the current market price shifts a bit on the left side of the screen. Also, traders can check historical prices without the autoscroll function to send the chart to the current price anymore.

There’s no need for OHLC (open-high-low-close) as the information already exists at the bottom right of every chart. The MT4 shows the OHLC if traders move the mouse on any chart candlestick.

Talking about candlesticks, the bar chart is the default setting, but candlestick charts are more popular. Therefore, most likely, you’ll want to switch from the bar chart to a candlestick chart. By clicking OK, here’s what we got:

Not good enough for your trading strategy? Need a more in-depth look at the recent price action? No problem. Just use the Zoom options on the top center of the MT4 platform to zoom in and see more details.

Or choose a different time frame to look at the bigger perspective, such as the monthly chart. To do that, merely push the MN tab on the top center of the MT4 platform (currently, the H1 tab is selected), and the MT4 displays the monthly time frame.

- Saving the Template

Obviously, you won’t like to repeat these steps every time you open a new chart. Fortunately, the MT4 platform allows you to save your work via a template.

First, right-click again on the chart. Second, from the pop-up window that appears, move the mouse to the Template tab. Finally, select Save Template from the options on the right side.

Another window opens, where you can give the template a name and save it on your desktop. One may have multiple templates.

To use it on any chart, first, you need to open it. Second, right-click on it. Finally, choose Load Template from the dropdown menu after selecting the Template option to use the chart as customized earlier.

Tricks When Using the MT4 Trading Platform

Now that customizing a chart is not a secret anymore, the time has come to reveal some tips and tricks when using the MT4 trading platform. There are many, but we’ve selected just the ones that will impact your trading, either saving time or making it easier to switch brokers.

The examples used in this article are just that—examples. It means that the trader can easily change the parameters to make the platform look like what they want.

Switch the Profile

The Profile is a great feature offered by the MT4 trading platform. It contains all the customizable elements and charts opened when the trader saves the profile.

For example, let’s use the previous image. It shows not only the monthly EURUSD chart but also the daily, 4h, and another monthly analysis on the same pair. More precisely, it shows four different charts that may belong to a swing trading strategy on the EURUSD pair.

If you look at the center bottom of the chart, the Default shows the name of the profile. All four charts belong to this profile.

Many traders do their technical analysis separately so that not too many charts are open at any given time. To do this, they save a different profile for each currency pair or each strategy.

To do this, go to the File tab on the main menu. Next, from the dropdown menu, select the Profiles tab, as shown below.

From this moment on, you can save the profile under a new name or switch to a different existing profile.

Pack Up and Go

The Profiles function has a tremendous role in the MT4’s increasing popularity. Here’s why: Suppose you don’t want to trade with your broker anymore, and your trading style uses the Elliott Wave Theory to find entries and exits on the currency market.

As you’ll find out later in this trading academy, the Elliott Wave Theory is time-consuming. It assumes counting waves on various time frames using a top/down approach from the bigger to lower time frames.

In other words, you don’t want to leave your work and do it again on a different broker. If the new broker offers the MT4 platform (which most likely it will), the simple solution is to export the profiles from the old broker to the new one.

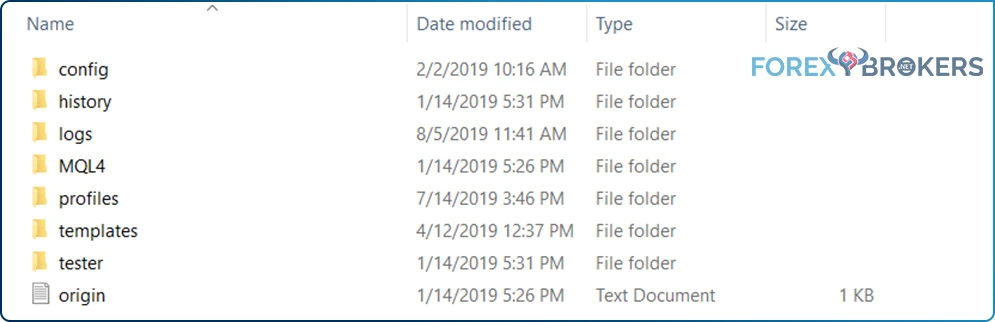

To do that, go to File and Open Data Folder. Find the Profiles folder, copy it, and save it on your desktop. On the new MT4 platform, go to Open Data Folder again and paste the Profiles folder into the new platform. Important: Close the MT4 to see the changes. On reopening, the Profiles appear on the new MT4 platform.

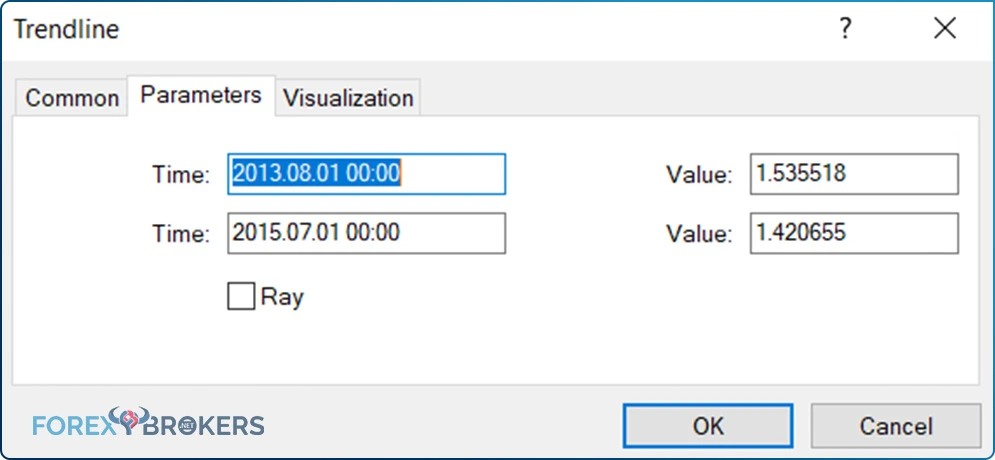

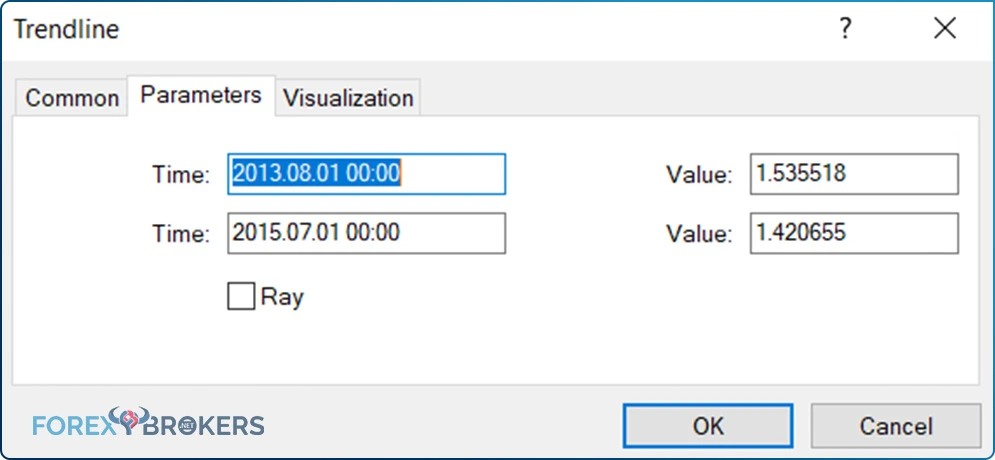

Customize a Trendline

Trendlines help define a trend. They connect two or more points in a downtrend or uptrend and contain the price action.

However, there’s a problem with trendlines when using the MT4 platform with the default setting. There’s a tick box to uncheck to make the most of it.

If not, the default state of a trendline has the characteristics of a ray (i.e., the platform projects it infinitely on the right side of the chart). But this would make the chart confusing and challenging to use.

To solve this issue, draw any trendline on any chart. Next, select and right-click on it. Finally, choose Trendline Properties. Under the Parameters tab, there’s a small box to uncheck.

From this moment on, every time you draw a trendline, it’ll have finite extremes. In other words, the trendline adapts now to the chartist’s needs.

Also, to copy a trendline from a chart (or any other object like a channel or text), there’s a shortcut offered by the MT4 platform. Simply select the object, press the CTRL tab, and then click on the object again. Finally, drag it wherever you want on the chart and use it as a copy of the original object.

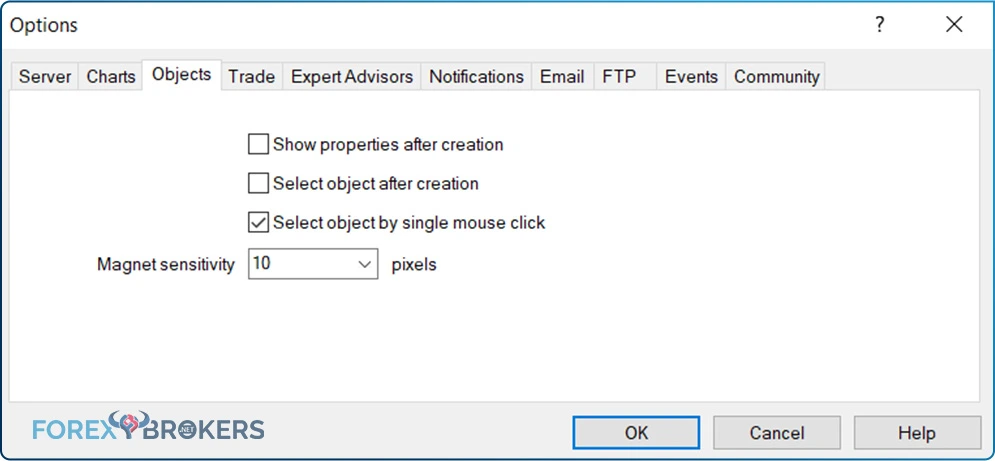

Activate the One-Click Selection

Another thing to consider is how to select the objects on a chart. Using the default settings, the chartist must click twice on every object to select it.

But if you use a charting-intensive trading theory like the Elliott Wave Theory, you’ll need plenty of objects like numbers and letters to count waves. For that, selecting each object with two mouse clicks takes a lot of time.

Luckily, the MT4 platform has a solution for this problem too. To solve it, go to the main menu and, from Tools, select the Options tab. From there, look for the Objects tab. Ensure the “Select object by single mouse click” option is activated, as it’ll save you a lot of time when charting with the MT4 platform.

Importing a Custom Indicator or Expert Advisor

As mentioned earlier in the article, the MT4 has about fifty indicators provided with the default settings. However, the trader may build a new one using the MetaEditor feature incorporated.

Or the trader may want to trade with a robot or Expert Advisor, as it is also called. Plenty of companies sell different indicators and trading algorithms customized to work on the MT4 platform too.

Nonetheless, before using a new indicator or trading algorithm, one must upload it to the platform. To do that, the first thing is to locate the indicator or Expert Advisor on your desktop.

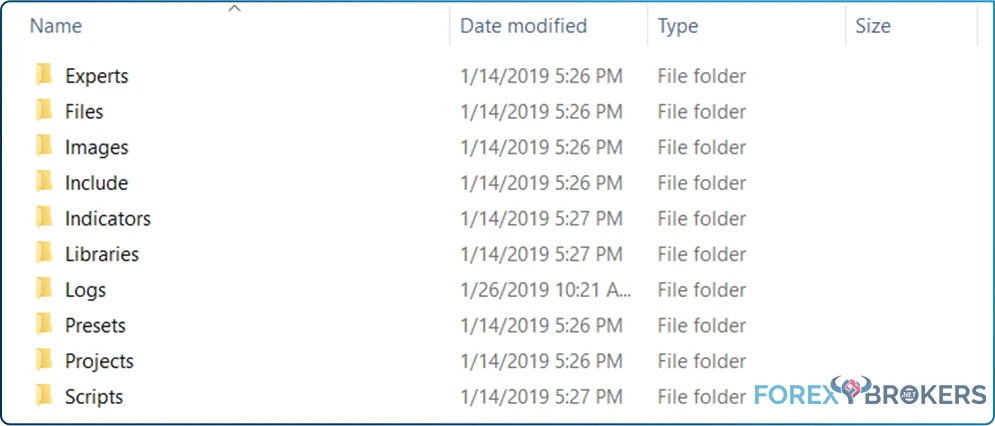

Next, use the Open Data Folder tab from the File on the main menu. By selecting it, a pop-up window appears, revealing the location and content of the MT4 platform. Moving forward, locate the folder called MQL4, as shown in the picture below.

By selecting it, you’ll gain access to its content. From this moment on, if you want to add a new indicator to use in the MT4 platform, paste it into the Indicators folder. Or, if you have a new trading robot, paste it into the Experts folder.

Very important! If the MT4 platform was open during this process, the changes made wouldn’t appear. To see them, close the trading platform and open it again. The new indicator and the trading algorithm will appear under the Indicators and Expert Advisors category on the Navigator tab.

Other MetaTrader 4 Features

A trader must know everything presented so far. As always, a bit of curiosity helps to discover more MT4 features, as many of them exist.

For instance, the History Center. Located under the tools tab, the History Center provides historical price data. All you have to do is to select the desired currency pair and the time frame. Next, click on the Download tab. Then the MT4 starts downloading the data, making it instantly available on the desired chart.

MT4 versus MT5: What Trading Platform to Use?

By now, you probably wonder why the developers came up with the MT5 platform. If the MT4 is so performant and preferred by traders, why the need for a new version of it?

The answer comes from regulations. In some parts of the world, specific trading rules exist that the MT4 platform can’t obey. For this, the MT5 appeared.

The MT5 offers many additional features when compared with the MT4. However, two main reasons for its development were hedging and FIFO.

Hedging with the MetaTrader

Hedging a position means opening a new trade on the same currency pair but in the opposite direction. For whatever the reason, in some parts of the world (e.g., the United States), hedging is considered a risky trading strategy responsible for many traders’ failure.

But the MT4 platform allows hedging. A trader can open a position on the same currency pair in two different directions. Why would they do that? The answer comes from the desire to make the most of all time frames. For instance, the EURUSD pair may be bullish on the five-minute chart and bearish on the 4h chart.

The trader may have a short position targeting a hundred pips lower and a long position targeting ten pips higher. If the EURUSD pair rises ten pips then falls one hundred, the hedging strategy gave one hundred and ten pips profit. The trader took advantage of both the long and the short. That’s not allowed in the United States, and the MT5 solves the issue only by not offering the possibility to hedge.

FIFO

The term comes from accounting, meaning first in, first out. It refers to the positions open on the same currency pair.

For instance, let’s assume the trader rides a bullish trend. For this, they wait for dips and place a stop-loss order at the previous higher low.

Strong trends may give plenty of new trades following such a simple trend trading strategy. But if the trader decides to book partial profits, they can do it only by closing the trades in the order of their opening.

Again, the regulators intervened to simplify the process and eliminate as much as possible from the risk. For some traders, this is a limitation of their trading style. Others don’t see it like this.

Conclusion

For years, the MetaTrader has been the number 1 trading platform for the retail trader. Because it comes with no cost, traders favor it. For this reason, we dedicated an entire article revealing its capabilities and features.

If a trader becomes consistently profitable in time, other trading platforms can be more suitable for the new needs. The ultimate one is the Bloomberg terminal, the final destination for a professional trader. But until consistent profitability exists, the MT4 and MT5 serve the retail trader just right.

The next topic of our trading academy introduces a concept where the trading platform plays an important role. We’ll use examples from this moment on, many of them from the MetaTrader 4, using the customized charts built here.