Introduction to the Forex Trading Platform and Its Features

XTB is essentially a forex and CFD broker incorporated as X-Trade in 2002. In 2004, X-Trade merged into XTB, adhering to the new Polish market regulations. It is the first leveraged forex brokerage in the Polish market, with its headquarters in Warsaw.

As of today, XTB operates in more than 12 countries, which include the UK, Poland, Spain, Chile, France, Germany, and Turkey and is one of the highly competitive forex trading players on the market. Traders can trade forex, CFDs on indices, commodities, shares, ETFs, and cryptocurrencies using the XTB forex trading platform.

The XTB broker’s proprietary web-based xStation 5 platform provides access to more than 1,500 financial instruments, including demo account options. The customer support of this broker is its USP. It is important to note that XTB International offers Islamic trading accounts without any swap fees and hidden costs.

- 1,500 financial instruments

- 50% bonus of your first deposit

- No swap fees

- No hidden costs

- Native mobile app

- Educational content

What Did We Cover in This XTB Broker’s Review?

All the information that is provided in the following XTB broker review is entirely factual, unbiased, and reliable. Here, we have attempted to compile everything a trader should know about the broker and the services they provide. A wide range of topics is covered in this XTB forex review.

Review Summary

XTB can be considered one of the most reliable brokers in the market. It is highly regulated by many credible financial institutions in many countries. The XTB’s trading platform, xStation 5, is user-friendly for novice traders. Experienced traders can also be satisfied with multiple asset types to trade.

Licenses

XTB Int. Ltd. is regulated and authorized by numerous credible regulators. Some of them include the UK’s FCA, Germany’s BaFIN, Poland’s KNF, France’s AMF, Spain’s CNMV, etc. In addition, the new branches opened by this broker have cross-border licenses in Austria, Sweden, Greece, Bulgaria, the Netherlands, etc.

Plarforms

XTB provides two trading platforms: xStation 5 and MT4. xStation 5 is the proprietary trading platform of XTB with a simple UI and excellent execution speeds. This platform has won the “Best Trading Platform 2016” award given by the prestigious Online Personal Wealth Awards.

Privacy and Security

With XTB being regulated by so many recognized financial institutions such as the FCA, BaFIN, KNF, AMF, and CNMV, we can say that trading with the XTB broker is extremely safe. Hence, users don’t have to worry about safeguarding their funds while trading with this broker.

Spreads/Fees

If you are one of their premium account users, the fees are very low. The minimum deposit is of €/$/£ 250/- In addition, XTB doesn’t charge any fee for being inactive, unlike other major brokers. The minimum spread provided for standard account holders is 0.35 and for pro account holders 0.28.

Mobile

XTB’s “xStation” is a great mobile application with brilliant UI and UX. It is also one of the most popular products of XTB, with more than 50% of its customers using it for their trading activities. Traders and investors can access the most recent market news, educational content, and trading statistics right from the app.

Customer Care

Customer service has been top-rated by the users of XTB. Users can talk to the customer support team right from the website and application using their live chat feature. Also, the phone and email support team are friendly while resolving issues quickly.

XTB Regulation Policy

In 2016, XTB was listed on the Warsaw Stock Exchange after its successful IPO with a valuation of ~$350 million. A listed company is typically more transparent, with all its financials disclosed regularly.

Also, the XTB broker is authorized and regulated by several credible regulators. Below is more detailed information on this.

- XTB Int. Ltd. is regulated by Belize IFSC (license number IFSC/60/413/TS/17).

- In the UK, XTB is regulated by the FCA (license number 522157).

- CySEC governs XTB in Europe (license number 169/12).

- XTB Spain is regulated by the Comisión Nacional del Mercado de Valores.

Trading Forex (FX) and Contracts for Differences (CFDs) with XTB carries a high level of risk and may not be suitable for all investors. Please note that the percentages of losses currently and for the period 1st of May 2024 until 31st of July are the following: XTB Limited (CySEC): 80%; XTB S.A. (KNF): 77%; XTB Limited (FCA): 76%. Trade carefully.

Trade Options with the XTB Broker

XTB provides access to a wide range of markets, such as foreign exchange, shares, metals, commodities, indices, and cryptocurrencies. Traders get to trade and invest in all of these financial instruments using this platform.

Currently, XTB allows trading of 48 currency pairs with micro lot–size contracts. There is no minimum initial deposit, and traders can avail spreads from 0.1 pips. Some of the major pairs include EUR/USD, AUD/CAD, EUR/CAD, CHF/JPY, and EUR/NZD.

XTB allows access to more than 20 indices across the world, including those from the United States, Germany, and China. Low transaction costs, financial leverage, and the ability to go long or short are some of the most significant features. Also, there is no cost to hold a position overnight. UK100, US30, JAP225, CHNcomp, MEXcomp, and AUS200 are some of the notable indices that can be traded in XTB.

Apart from currency pairs and indices, traders can explore and speculate essential commodities such as oil, gold, silver, natgas, sugar, copper, coffee, etc.

XTB also supports CDFs on more than 1,500 equities and 60 ETFs with leverage as high as 10×. Ultra-fast executions and low commissions are the notable pros of XTB compared to other brokers in the market.

Apart from currency pairs and indices, traders can explore and speculate essential commodities such as oil, gold, silver, natgas, sugar, copper, coffee, etc.

XTB also supports CDFs on more than 1,500 equities and 60 ETFs with leverage as high as 10×. Ultra-fast executions and low commissions are the notable pros of XTB compared to other brokers in the market.

Types of Accounts

There are three types of accounts offered by the XTB broker. Let us discuss each one of them briefly and show their features.

Standard Account

This account includes about 1,500+ instruments for XTB trading. The available instruments include forex, commodities, indices, cryptos, stock CFDs, and ETF CDFs. These accounts have standard spreads, and there is no commission charged for trading stock indices, forex, and commodities. However, there is a commission of 0.08% (per lot) charged for trading stock CFDs and ETF CFDs. Moreover, it provides a feature of automated trading.

| Standard Account | |

|---|---|

| Maximum Leverage | 1:200 |

| Minimum spread | 0.35 |

| Swap | Yes |

| Trading platforms | xStation and MT4 |

| Commission (forex, indices, commodities) | Zero commission |

| Commission (Cryptocurrencies) | Zero commission |

Pro Account

This account also allows the client to trade in instruments such as forex, commodity, indices, cryptos, stock, and ETF CFDs. These accounts have tighter spreads, and they do charge commissions for trading equity indices, currency pairs, and commodities. The commission, again, is the same as that of a standard account. It provides two trading platforms: xStation and MT4, which can be accessed via the web, desktop, mobile, tablet, and smart watches.

| Pro Account | |

|---|---|

| Maximum Leverage | 1:200 |

| Minimum spread | 0.28 |

| Swap | Yes |

| Trading platforms | xStation and MT4 |

| Commission (forex, indices, commodities) | Starting from $4 per lot |

| Commission (Cryptocurrencies) | Starting from $4 |

Islamic Account

Another account type apart from standard and pro accounts is the Islamic account. This account is no different from the other above account types—that is, it contains 1,500+ instruments for traders to trade. However, the spread and commission vary from those of standard and pro accounts.

| Pro Account | |

|---|---|

| Maximum Leverage | 1:200 |

| Minimum spread | 0.28 |

| Swap | Swap Free |

| Trading platforms | xStation and MT4 |

| Commission (forex, indices, commodities) | Starting from $10 per lot |

| Commission (Cryptocurrencies) | Data unavailable |

Pricing for XTB Broker Services - Fees and Commissions

First, there are two types of accounts provided by the XTB broker: standard and pro. The only difference between the two is that in a standard account, you pay only spreads, while in a pro account, you pay commission above the spreads as well. This commission is basically the interbank spreads.

With this under consideration, let us understand the different kinds of fees and commissions levied by the XTB broker.

- Fee for Maintaining an Account

There is no fee charged for trading XTB and maintaining an account with this broker.

- Commission Charged Per Lot for Equity CFDs and ETFs

The commission per lot for CFDs and ETFs starts from 0.08%, whose minimum commission is 5 EUR (CFDs) and 8 USD (ETFs). However, the average turns out to be the same as the minimum value.

- Fees for All Other Markets

For standard accounts, no commission is charged, while for pro accounts, 2.50 GBP / 3.50 EUR / 4 USD / 1,100 HUF per closed lot and 2.50 GBP / 3.50 EUR / 4 USD / 1,100 HUF per open lot is charged.

Apart from this, there is a fee for e-wallet funding, debit/credit card funding, and small withdrawals, which shall be discussed in the next section.

Spreads

In the case of spreads, their value varies depending on the account type.

Below is a table that shows the minimum and target spread values for some of the major currency pairs and commodities.

| Instrument | Minimum spreads Standard / PRO | Target spreads Standard / PRO |

|---|---|---|

| EURUSD | 0.00006 / 0.00002 | 0.00007 / 0.00003 |

| GBPUSD | 0.00009 / 0.00001 | 0.00014 / 0.00006 |

| USDJPY | 0.007 / 0.001 | 0.011 / 0.005 |

| AUDUSD | 0.00017 / 0.00003 | 0.00019 / 0.00005 |

| NZDUSD | 0.00022 / 0.00005 | 0.00025 / 0.00008 |

| USDCHF | 0.00014 / 0.00002 | 0.00019 / 0.00007 |

| EURJPY | 0.021 / 0.003 | 0.023 / 0.005 |

| GBPJPY | 0.049 / 0.012 | 0.055 / 0.018 |

| AUDJPY | 0.04 / 0.003 | 0.043 / 0.006 |

| EURGBP | 0.00009 / 0.00001 | 0.00013 / 0.00005 |

| EURCHF | 0.00021 / 0.00005 | 0.00023 / 0.00007 |

| Instrument | Minimum spreads Standard / PRO | Target spreads Standard / PRO |

|---|---|---|

| US 500 | 0.5 / 0.3 | 0.6 / 0.4 |

| UK 100 | 0.9 / 0.5 | 1.1 / 0.7 |

| DE 30 | 0.9 / 0.7 | 1 / 0.8 |

| FRA 40 | 0.00017 / 0.00003 | 0.00019 / 0.00005 |

| JAP225 | 21 / 13 | 25 / 17 |

| Instrument | Minimum spreads Standard / PRO | Target spreads Standard / PRO |

|---|---|---|

| GOLD | 0.3 / 0.1 | 0.35 / 0.15 |

| SILVER | 0.04 / 0.007 | 0.041 / 0.008 |

| OIL | 0.04 / 0.03 | 0.04 / 0.03 |

Slippage

XTB is one of those very few brokers with an ultra-fast trading platform and zero requotes. So traders don’t have to worry about any slippage. Their trades won’t be ordered at a different price compared to what they have executed them at.

Opening an Account in XTB

In this XTB forex demo, we have provided detailed snippets that act as a step-by-step guide for you while opening an account with this broker.

Opening an account is completely digitalized with the XTB broker. The process is simple, fast, and straightforward. The account opening procedure can be finished within 30 minutes. During this process, the broker will reach out several times by either phone or email.

Deposit and Withdrawal Options

The deposit and withdrawal process in the XTB broker is user-friendly, cost-effective, and swift. Deposits are typically processed instantly, while withdrawals can take up to 3-5 business days.

Deposit

The XTB forex broker provides several options to transfer funds into your trading account.

The transfer options are as follows:

- Bank Transfer: Accepted currencies include EUR, USD, GBP, and HUF.

- Credit/Debit Card: Accepted currencies are EUR, USD, and GBP. The accepted cards are Mastercard, Maestro, and Visa.

- Electronic Wallets: Accepted e-wallets include PayPal and Paysafe (Skrill).

Fee Charged for E-Wallet Funding

- PayPal – A 2% flat rate of the account to be deposited will be charged.

- Paysafe (formerly Skrill) – A 2% flat rate of the amount to be deposited will be charged.

Withdrawal

Unlike deposits, the only way to withdraw funds is through bank transfers. The withdrawal time typically does not exceed more than 2 working days.

Below is a table that represents different types of withdrawals with their processing times.

| Deposit Method | Deposit Processing Times | Min Deposit | Withdrawal Procesing Times | Min Withdrawal |

|---|---|---|---|---|

| Credit / Debit cards | 3-5 business days | $250 | Up to 24-48 hours | $50 |

| eWallets | 3-5 business days | $250 | Up to 24-48 hours | $50 |

| Bank Wire | 3-5 business days | $250 | Up to 24-48 hours | $10 |

The minimum withdrawal varies from currency to currency. Moreover, a fee is levied if the withdrawal amount is less than the threshold. You can refer to the table below to get an idea of the withdrawal fee.

| Currency | Threshold | Withdrawal fee on amounts lesser than the threshold |

|---|---|---|

| USD | 100 USD | 20 USD |

| EUR | 80 EUR | 16 EUR |

| GBP | 60 GBP | 12 GBP |

| HUF | 12,000 HUF | 3,00 HUF |

However, if the withdrawal amount is greater than the threshold, no charges are imposed on it.

How Secure Is the XTB Forex Broker?

The XTB website is heavily secured and protected using industry-standard security measures. The personal information (mobile number, passport number, tax identification number) submitted by the customers as they create their accounts goes through an SSL connection that is heavily secured. This prevents hackers from accessing the customers’ sensitive data. Also, as discussed, XTB is authorized by many world-class financial institutions and regulators such as FCA and CySec.

Any broker must follow a number of policies to get licenses from these regulators. One of the most crucial terms is to hold client funds and company funds in different accounts. By doing this, there is a lower probability for the broker to scam the client’s funds. Also, XTB is a member of the Investors Compensation Scheme (ICS) and the Financial Services Compensation Scheme (FSCS). These schemes provide insurance to the clients in any event of XTB getting bankrupt.

Trading Platforms in XTB

n the following XTB trading review, let’s discuss the three major platform services that this broker provides.

xStation 5

XTB is one of the most innovative brokers out there. This is reflected in the trading platform they have built for their traders. xStation 5 is the XTB broker’s preparatory custom trading application. It might look like a complex tool for novice traders in the beginning, but once they start trading on this platform, it becomes effortless to use.

Still, this doesn’t mean that this trading platform is for novice traders only. This platform has at least 26 premium technical analysis tools such as indicators and oscillators and no less than 25 drawing tools that every experienced trader would love to have. While doing this XTB online trading review, we experienced a lot of unique features that are embedded in the platform. This would greatly help experienced traders attain a seamless trading experience. Some of these features include sentiment analysis tools, heatmaps, screening tools, inbuilt calculators, position monitoring, etc.

With all these premium features built in, xStation 5 still launches with ultra-fast execution speed (~85 milliseconds) and with almost no requotes. Along with these premium features, xStation 5 has a built-in audio commentary feature. The best part is that this service is free in xStation 5, while other brokers in the market charge for it. However, there are a couple of drawbacks to this platform. Traders cannot add custom indicators on this platform like they do in the MT4 terminal.

Also, it doesn’t provide an option to save the current layout that any user creates. So it becomes difficult for the traders to develop their preferred layout every time they log in. At present, traders can use xStation 5 on multiple devices—the desktop, the web, tablets, and smartphones.

MT4

MetaTrader 4, a.k.a. “MT4,” is the most popular trading platform with industry standards. This platform is used by most experienced traders as it has numerous analytical tools built within the system. It has more than 80 indicators by default, with 9 time frames and 3 chart layouts. Traders get to add automatic strategies and custom indicators, which cannot be done in xStation 5.

The XTB broker offers a complete MT4 platform suite using which traders get to use XTB’s services on MT4. Since this trading software is universal, it is available in all versions—desktop, web, tablet, and smartphone.

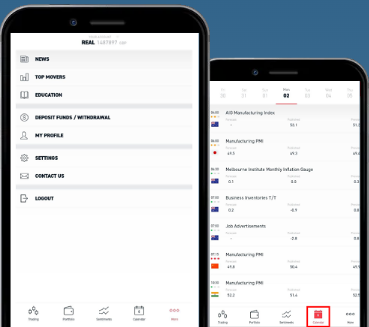

Mobile Trading

The XTB forex broker’s mobile application, xStation, is an excellent trading app with a sleek appearance and great design. This application is available for both Android and iOS devices. It provides traders with competitive trading experience and industry-standard design and working. xStation is simple to use with easy navigation and great UI and UX. Because of these features, this app is extremely popular, with more than 50% of XTB clients using it actively.

Some of the significant pros of xStation include “auto-update mode” to the charts, which updates the last candle automatically and shows real-time data without a manual refresh. Traders can also contact the XTB customer support team directly from the app.

- Android

- iOS

However, there are a few things that experienced traders would still love to see in the xStation app. Technical tools inside this app are restricted to 10 indicators and 10 drawing tools. This is less compared to the desktop version of xStation 5, with more than 26 indicators and drawing tools. This can be improved in the xStation mobile application.

Here are some notable snippets of the xStation mobile application to show you what it looks like:

Trading Features of XTB

As with most other trading platforms, the platform offered by the XTB broker has several features. As mentioned, the XTB broker offers two platforms for trading: xStation 5 and MetaTrader4. Both these platforms provide a user-friendly experience.

The xStation 5 platform is designed such that even a novice trader can use it with ease.

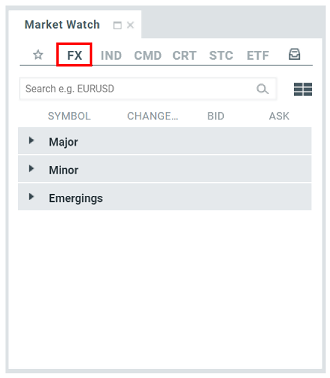

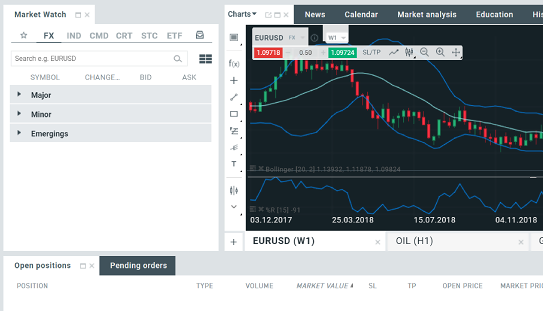

Below is an illustration of the main screen of the xStation 5 platform.

The xStation platform provides a wide range of features. Some of them are as follows.

Placing Orders

XTB allows their clients to place the following:

- Market (instant) and limit (pending) orders

- Stop-loss and take-profit orders

- Trailing stop-loss orders

Trading Alerts

A highly reliable feature provided by this broker is the notification function. One can set this feature up to receive email, SMS, or push notifications for important events such as margin calls, open/closed positions, deposits and withdrawals, etc.

An illustration for setting price alerts is given below.

Reports

This is an excellent feature for those who maintain trading journals as it provides complete reports on their trading activities. You can obtain these reports every day by email as well.

Apart from this, XTB’s xStation 5 trading platform provides feeds with timely updated market news.

Also, several chartings and indicators for fundamental and technical traders to analyze the market are embedded in XTB’s trading terminal.

Customer Support

The most unique selling proposition of the XTB broker, after xStation 5, is undoubtedly their customer support. Traders and investors can reach out to XTB’s customer support team via phone, email, and chat. They are available on all trading days—i.e., Sunday through Friday (24/5). This customer support team stands out from those of XTB’s competitors as the members are friendly with their responses, offer prompt services, and provide instantaneous resolutions.

By this, we can understand that this broker’s intention is to build a long-term relationship with its customers than to make a quick buck. Another significant feature of XTB’s customer support is its personalized service. Each of its customers gets a personal support manager of their own who takes care of his/her account.

Customers can reach the XTB broker’s support team instantaneously through the live chat option (highlighted).

XTB is available in the following languages

Arabic

English

Czech

French

German

Hungarian

Italian

Polish

Portuguese

Romanian

Slovak

Turkish

Vietnamese

Spainish

Additional Benefits

This XTB review also takes a look at some of the most notable benefits that the broker provides for its customers. These include online trading education, powerful research tools, and overall trading experience.

Education

XTB’s education is segregated into basic, intermediate, expert, and premium courses. This is an obvious path to take for any kind of trader. Their premium courses are charged, but the rest is free and available for everyone.

Research Tools

XTB’s powerful research tools—such as heatmaps, sentiment indicators, and screeners—can be easily accessed by the traders on the official website and even in the mobile application. This can be considered great added value because not many brokers provide these kinds of tools, especially for a non-premium account.

Market Analysis

XTB provides free valuable market analysis for its customers and other readers. This analysis includes market news, price tables, and market calendars.

Overall Trading Experience

The overall experience should be considered as an additional benefit. The XTB broker is suitable for novice, intermediate, and expert traders because of the services it offers. xStation 5 can be used by traders who are looking for excellent visualization and innovation, whereas MT4 can be used by more conventional and traditional traders.

What Else Should You Know about the XTB Broker?

XTB trading platform has won numerous prestigious awards for its great service. Some of the most notable awards include “Best Trading Platform 2016” and “Best Forex Broker 2013.” XTB has also received honors from CFD Broker and honors at the World Finance Exchange Brokers Awards for being a highly reliable forex broker.

FAQ

Yes, of course. You can connect XTB’s iOS mobile application to your Apple Watch and trade the markets in just a few taps. Android smart watches can also be synchronized with the XTB Android mobile application so that you can receive notifications and trade alerts.

Yes. In XTB, you can leverage trade indices, CDFs on equities, and ETFs as well as cryptocurrencies. A maximum of 200× leverage is provided, and the standard leverage is 30×.

Through XTB Education, this broker provides its customers with the most important and necessary information, such as industry overviews, trading instruments, etc. Intermediate-level content, such as fundamental and technical analyses, can also be found. For experienced traders, expert-level content is yet to be included on the website. In total, there are 27 lessons in the basic module and 15 lessons in the intermediate module. If you are interested, XTB provides premium education as well, but they charge for this content.

Conclusion

XTB is a great online trading platform for all kinds of traders. It is innovative and yet adheres to all the essential basics of a brokerage firm. That being said, it is not entirely perfect. In the above XTB broker review, we have discussed the cons of the broker, although its pros clearly overshadow these drawbacks.

We would definitely recommend this broker to you because of the security it provides to your funds, low transaction fees, and excellent customer support. We hope this review helped you decide whether XTB is the right broker for you.